Stock Thoughts

An Investment in Knowledge Pays the Best Interest

Benjamin Franklin

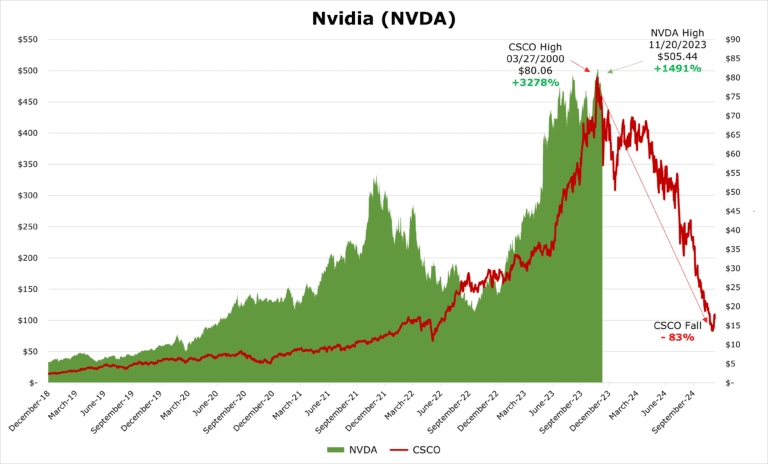

Video: NVIDIA’s AI Boom is Similar to Cisco’s Internet Boom. Will the Similarities Extend to the Bust?

• NVIDIA and Cisco have been leading players in their respective fields during periods of high capital expenditure and rapid industry expansion. However, they also share the likelihood of reaching a cyclical peak, which could lead to significant stock price corrections.

• Since 2019, NVDA has continued its upward trajectory with a remarkable 716% revenue growth. The share price during this time also saw an increase of 1,491%

• Cisco Systems (CSCO) experienced a similar boom in the 1990s, becoming the leading infrastructure provider for the global internet buildout. From 1996 to its peak in 2000, Cisco’s revenue grew by 498%, while its share price dramatically increased by 3,278%. Eventually, it would collapse by 83%.

• Given the historical patterns, we believe exercising caution with NVDA is the best action.

JCI Using Green-Dominance to Pivot to High-Value Services

• 2.62% Dividend Yield.

• JCI’s focus on sustainable products, constituting about 55% of its revenue, aligns with global environmental goals and market trends.

• Building Solutions is shifting focus toward service-oriented business, allowing for predictable cycles and higher margins.

• Short-term weakness in the Global Products segment and Asia-Pacific installs, with secular tailwinds in sustainable product offerings and growth in the high-tech economy.

Toyota (TM) Hybrid Dominance Continues: Hybrid Cars are Having a Moment Amid Electric Car Skepticism

•Hybrids — which get great gas mileage and average under $40,000 — are a happy medium for many.

•That has some carmakers rethinking their product offerings, at least in the short term.

•Toyota and its Lexus luxury brand now offer 26 “electrified” models — more than any other carmaker

•Toyota has long favored a mix of powertrain choices, and has stood apart from rivals for its reluctance to race too quickly into pure EVs.

General Dynamics’ Diverse Defense Portfolio Key Part of Modernization

• 2.16% Dividend Yield

• The Navy aims to procure 55 ships over the next five years, indicating sustained demand for maritime defense capabilities.

• Notable increase in ordnance production due to global conflicts, with plans for a 600% output increase as soon as 2025.

• Army and Navy are covering significant expansion expenses as part of an “industrial base modernization” program.

• Nearly $100 billion backlog, with a company-wide 1.4-to-1 book-to-bill.

Hasbro’s 6.1% Dividend Yield Pays as We Wait for Recovery

• 6.13% Dividend Yield.

• The company is undergoing major restructuring to focus on its core brands, offload the costly entertainment segment, and implement cost-saving measures.

• The company aims to save $220 million annually by the end of 2023, increasing to $300 million by 2024, by reducing its workforce and offloading non-core divisions.

• The Wizards of the Coast and Digital Gaming segment shows robust growth and high margins, now constituting 30% of Hasbro’s revenue.

• The Consumer Products segment faces challenges due to the macroeconomic environment but contains high-selling brands like Transformers.

Insuring Success Through $380 Million in Cost Savings

• 1.38% Yield, $1 billion left on repurchase authorization.

• Expecting an increase in free cash flow in to $1 billion in 2024.

• WTW’s strategic cost-saving program aims to deliver $380 million in annualized savings by fiscal 2024.

• Strength in every business, with new clients and higher fees driving results.

• Demographic trends provide secular tailwinds.

Video: Perrigo’s Pivot to OTC Products Produces a Bulwark Against Economic Uncertainty

• 3.63% dividend yield, we believe the company’s earnings will grow by 10% per year.

• Repositioning toward consumer-facing health brand progressing with divestitures and acquisitions. Power player in consumer staples.

• Opill prescription birth control approved for moving to OTC (Over The Counter) usage.

• Baby formula operation is undergoing expansion to allow for an additional 100 million units in volume per year, in the face of global shortages of baby formula.

HII Seas: Rearmament Continues to Propel Navy Spending and Improved Results

• 2.26% Dividend Yield.

• Total backlog of $49.5 billion up 5.7 % year over year. 5 years for shipbuilding and 2 years for Mission Technology.

• Naval shipbuilding is accelerating, with the Navy needing to build more than 55 ships to reach its 300-ship target.

• Mission Technology is an expansion area, with a segment book to bill of 2.4x.

• Largest military shipbuilder in the United States, benefiting significantly from naval rearmament.

6.5% Yield While Waiting for Whirlpool’s Recovery

• 6.5% Yield. EPS should cover the dividend in the current year with a 43% payout ratio.

• Significant reduction in cost inflation, saving $800 million over 2023.

• Repositioning toward medium and long-term growth, shedding the breakeven European segment while retaining 25% ownership.

• Deep Value cyclical is currently losing money after restructuring charges but had a peak 4-quarter EPS of $31.26 in September 2021.

Cigna Delivering Growth at a Great Price

• 1.58% Dividend Yield.

• Growing customers 9% to 165 million total relationships as of 3Q23.

• Diversified portfolio for sustained growth and resilience.

Diageo Targets Robust Market Share and Market Growth in Spirits

• 2.56% dividend yield

• $1 billion in share buyback program for fiscal 2024.

• Focusing on “Super-premium” brands as younger consumers shift toward quality over quantity.

• Dominant Spirits Portfolio makes up 80% of sales.

• Tequila is growing globally with European consumption doubling every year since 2021.

• The global alcoholic beverage market expected growth of 10.3% per year to 2028.

Pet and International Area Provide new Aisle for Growth for General Mills

• 3.6% dividend yield.

• A dominant force in the consumer-staples market, with a strong foothold in North America.

• Despite volume decreases in 1Q24, it recorded a net sales growth of 4%.

• As North American growth moderates, GIS’s pet and international segments present significant growth opportunities. Existing business is recession-resistant .