JCI Using Green-Dominance to Pivot to High-Value Services

| Price $52.38 | Dividend Holding | December 12, 2023 |

- 2.62% Dividend Yield.

- JCI’s focus on sustainable products, constituting about 55% of its revenue, aligns with global environmental goals and market trends.

- Building Solutions is shifting focus toward service-oriented business, allowing for predictable cycles and higher margins.

- Short-term weakness in the Global Products segment and Asia-Pacific installs, with secular tailwinds in sustainable product offerings and growth in the high-tech economy.

Investment Thesis

Johnson Controls International (JCI) is a building automation multinational based in the US. JCI traces its origin to the first-ever electric thermostat and has since grown to operate in over 150 countries with a wide breadth of service and product offerings.

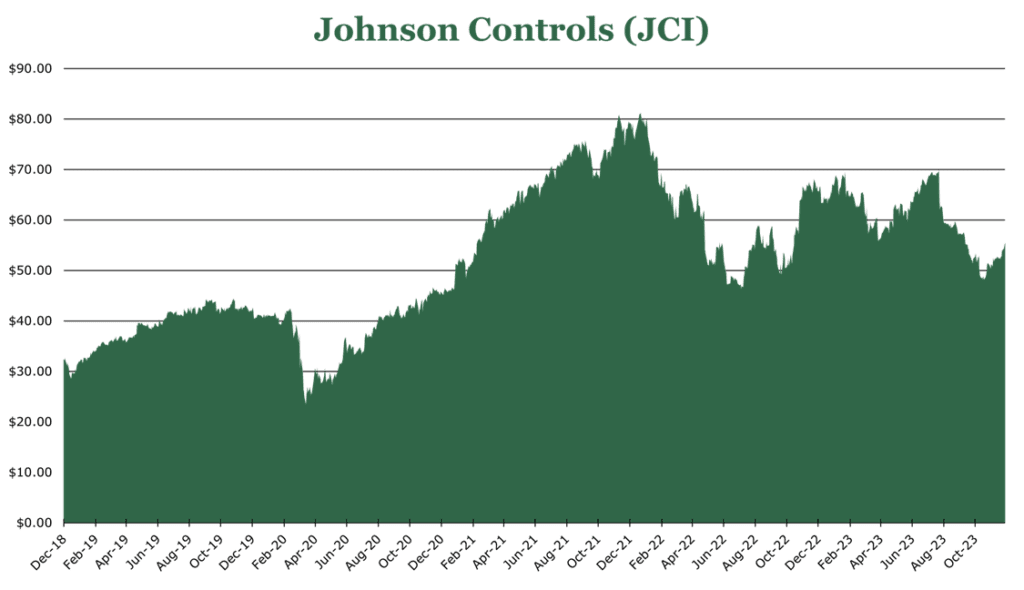

JCI is a leader in green buildings, pushing toward net zero and providing significant secular long-term value. Additionally, expanding semiconductor fabs and data centers with specialized cooling and ventilation needs could provide valuable tailwinds over the long term. Industry-wide pressures in the economy and short-term inventory pressures have pushed down expected results, resulting in a stock price decline of 18% in 2023. Given its leading position in the industry, we believe this is an attractive entry point.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $4.40 X 16.7 = $68 September FY (Fiscal Year)

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.3 | 1.3 | 1.2 |

| Price-to-Earnings | 14.1 | 12.6 | 11.2 |

Market Conditions

Green solutions are in high demand for heating and cooling, with 46% of energy consumption from climate control. Governments worldwide are offering significant incentives for retrofitting and new construction. JCI estimates that decarbonization represents a $240 billion opportunity by 2035. Several incentives exist, such as the EU Energy Performance of Building Directive and the US Inflation Reduction Act. Given the high percentage of energy consumption on climate control, it is an obvious place to start for companies and governments seeking net zero. The Inflation Reduction Act in the United States offers several income tax credits through 2032. For individuals, up to $3,200 is available for qualifying items like heat pumps. For new builds, it is $5,000 per unit. For commercial, it is up to $5 per square foot. In November 2023, JCI was awarded a $33 million Department of Energy grant to expand its heat pump manufacturing output by 200%.

Similarly, the high-tech economy has seen significant expansion through data centers and chip fabrication plants. Both of these could significantly boost the commercial business. Data centers require an immense amount of cooling, with the average data center utilizing the power equivalent of 80,000 homes – most of which goes toward cooling, requiring the equivalent of over 7,000 residential AC units. The story is much like semiconductor fabs, utilizing the same power as 50,000 homes and requiring specialized filtered-cooling equipment to ensure no contamination of wafers.

JCI has significant economies of scale, making it a lead player in the building-level decarbonization trend and the expansion of high-tech manufacturing and data centers. Currently, JCI sees about 55% of its revenue from sustainable products. Both of these trends provide significant tailwinds to the existing business.

JCI is split up into two main product areas: Global Products and Building Solutions. Global Products includes standalone units and products, while Building Solutions includes installation, maintenance, and engineering consulting.

| By Segment | as a % of Quarter Ending September Revenue | Segment EBITDA Margin | Reported Organic Sales Growth |

| North America Building Solutions | 40.2% | 15.4% | 8% |

| EMEA/LA* Building Solutions | 15.1% | 7.8% | 7% |

| Asia-Pacific Building Solutions | 10.1% | 13.5% | -7% |

| Global Products | 34.5% | 21.0% | -2% |

Global Products

Global Products includes all of the product businesses that JCI operates, including York, Hitachi HVAC, Tyco, and the in-house brand Johnson Controls. It also includes the software area. This area is generally shorter-cycled, manufacturing and selling products directly to consumers.

The strongest growth area within the Global Products segment has been the Industrial Refrigeration (includes compressors, food items, and heat exchangers) and Small Commercial Building area, each growing at over 20% year over year. The large HVAC, Controls, and Building Management System area also grew in the mid-teens. We expect that these areas will continue to be the hottest growth items for JCI with the growth of US domestic manufacturing and data-center growth.

OneBlue is JCI’s flagship IoT software suite, integrating various building systems into a single point. The software includes basic management up to AI-enabled energy optimization. Across 1,200 customers, OpenBlue reports 2.5 million active users. In July, JCI acquired the facility management software firm FM:Systems. This adds several new workspace management solutions to OpenBlue, including remote access control and building information modeling.

In the quarter ending September, Global Products saw a total sales decrease by 2% year over year, pushed down by volume headwinds in residential and a reduction in overall inventory.

Headwinds in residential are mostly macroeconomic and are being felt industry-wide. Consumers are stretched with limited savings, facing high interest rates and a credit crunch. Consumers are thinking harder about home upgrades. Additionally, new home starts are slowing down compared to what they have historically been over the last 5 years. On a company-specific basis, lead times from order to delivery have improved immensely since 2021. This means that JCI no longer has to keep excess inventory on hand.

Despite some headwinds, JCI expects new product launches and price/mix actions in fiscal 2024 to offset some of these. In the quarter ending September, the backlog for the segment is up 8% year over year to $2.5 billion. JCI expects revenue in the Global Products area to be sequentially flat over the short term in both revenue and EBITDA margin, which is currently at 21%.

Building Solutions

Building Solutions is a longer-cycle business encompassing designing and installing building control systems, including HVAC, refrigeration, security, and fire systems. The design and installation of systems represent the largest portion of the business. It also provides technical services, including inspection, engineering consulting, maintenance, repair, and system replacement. Building Solutions’ momentum going into fiscal 2024 is most felt in the service area. This shift is in response to the growing demand for more client-goal-oriented services like energy consulting rather than the typical “inspect-and-fix” business. This shift also adds value to existing client relationships, allowing for a longer revenue tail and acting as a funnel for new installations or other value-added sales. JCI estimates that this shift represents a $160 billion opportunity. Additionally, the business will experience a more predictable cycle and higher margins through this transformation.

| As of Quarter Ending September | Backlog (year over year growth) | Sales (year over year) | EBITDA Margin |

| North America | 10% | 8% | 15.4% |

| EMEA/LA | 10% | 7% | 7.8% |

| Asia-Pacific | -2% | -7% | 13.5% |

The overall backlog for the segment grew by 9% year over year, split evenly between service and installations, to $12.1 billion.

Typically, the overall backlog is made up of 20% service and 80% installs. There is acceleration in the service area, with volume growth for the service area being 11% and installations being around 6%.

| As of Quarter Ending September | Installs Quarterly Organic Growth | Service Quarterly Organic Growth |

| North America | 9% | 7% |

| EMEA/LA | -5% | 14% |

| Asia-Pacific | -11% | 11% |

While the core of the business will likely continue to be installs and sales of controls, the service business is undoubtedly in demand even in areas with weak install results like Asia-Pacific.

Risk

The largest risk affecting JCI over the medium term is continued difficulties in the new construction area. New construction has been on the decline with rising interest rates and a shortage of labor in the construction area. The previously discussed weaknesses in the residential area have partially offset the recovering commercial office area. These factors make the execution of the shift toward a higher-margin service offering more critical.

Recovery in China has been sluggish, causing depressed results for the Asia-Pacific segment, which relies on install revenue. While the timing for a full Chinese recovery is unknown, we believe that the growth in the services area will be able to offset any continued lag in install growth by the end of fiscal 2024.

Outlook

Building Solutions is expected to maintain momentum into fiscal 2024, offsetting any downside to the under-pressure Global Products business early in the year. For Fiscal 2024, JCI expects mid-single-digit growth to top-line revenue, with margin improvements in the 25bps neighborhood. We expect this to be more weighted toward the year’s second half, with the quarter ending December to be flat sequentially.

JCI has a 1.9x debt-to-EBITDA, with a 3.12% weighted average interest rate. Of the debt, 94.5% of debt is fixed rate. JCI reported 91% free cash flow conversion for the fiscal year ending September, largely attributed to the previously discussed inventory destocking and lagging install recovery. JCI expects that during fiscal 2024, it will return to 100% free cash flow conversion as headwinds alleviate.

On a shareholder return basis, JCI has approximately $3 billion in repurchases available. Repurchase activity decreased for the fiscal year ending September, falling by 56%. However, M&A activity has filled the gap, with JCI increasing M&A expenses by 170% over the same time frame. JCI has a $1.1 billion cash position that we believe will go toward M&A and improving the balance sheet. JCI has recently been active in acquiring industrial refrigeration firms and building automation IoT firms to help expand its offerings. The current dividend yields 2.62% or $1.48 annually per share.

JCI is in a strong position to execute dominance in green buildings and shift toward higher-margin service offerings. The company’s alignment with governmental incentives for eco-friendly construction and retrofitting, combined with the global push for net zero, demonstrates its potential for growth in its existing business. Moreover, the pivot to service promises higher margins and less reliance on market cycles in construction and renovation. Both of these combined make the company an attractive value at its current price.

Competitive Comparisons