6.5% Yield While Waiting for Whirlpool’s Recovery

| Price $107.25 | Dividend Holding | November 13, 2023 |

- 6.5% Yield. EPS should cover the dividend in the current year with a 43% payout ratio.

- Significant reduction in cost inflation, saving $800 million over 2023.

- Repositioning toward medium and long-term growth, shedding the breakeven European segment while retaining 25% ownership.

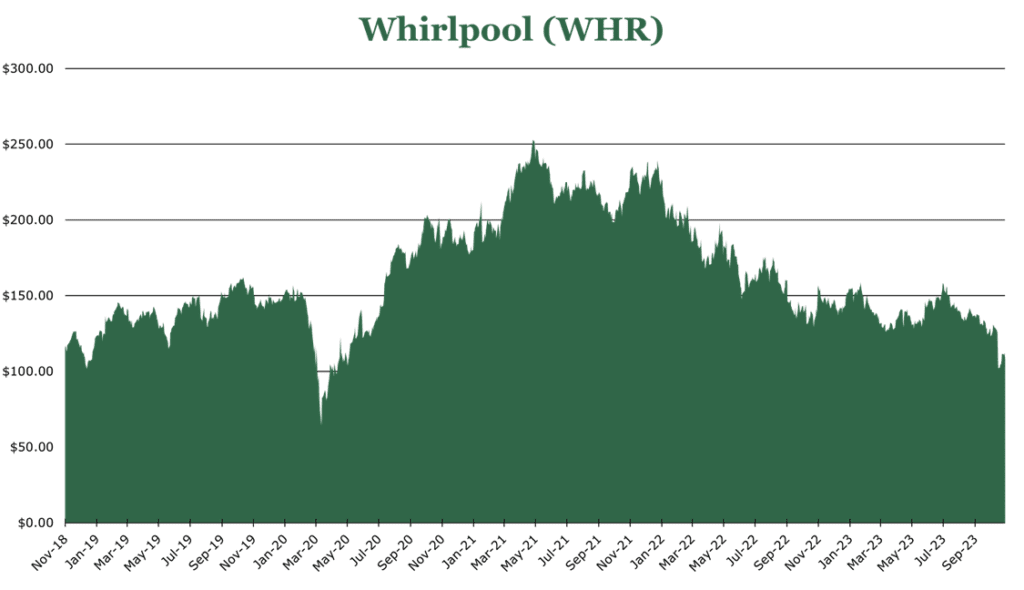

- Deep Value cyclical is currently losing money after restructuring charges but had a peak 4-quarter EPS of $31.26 in September 2021.

Investment Thesis

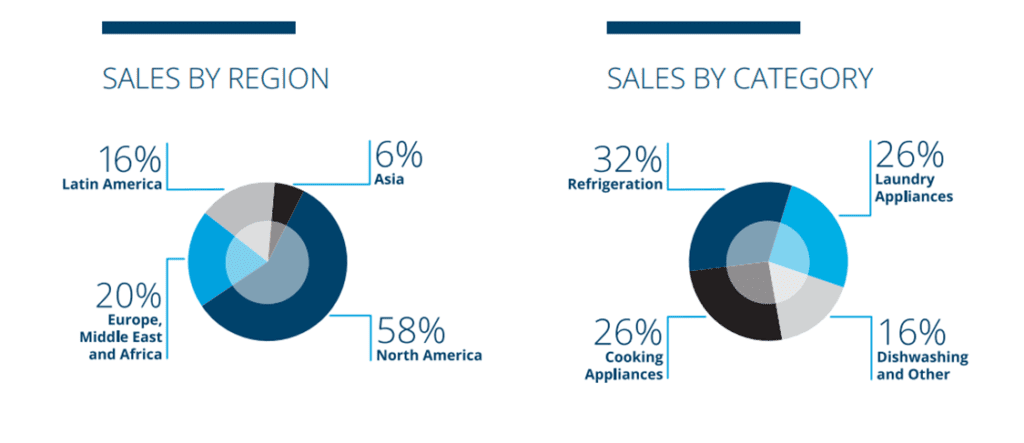

Whirlpool (WHR) is a global manufacturer of home appliances with a leading market share in North America. WHR has seen a reversal in cost inflation, which should save an estimated $800 million in 2023.

WHR is embarking on an aggressive campaign to “transform” the business into a high-growth, high-margin player in the face of stagnating sales growth and shrinking margins. This includes divesting from breakeven European business and focusing on more favorable areas like small-home appliances and DTC (direct-to-consumer) markets. With a strong dividend yielding 6.5% and actionable goals, the stock looks attractive for dividend investors with modest long-term growth in our opinion.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $16 X 9 = $144

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.3 | 0.3 | 0.3 |

| Price-to-Earnings | 6.7 | 6.9 | 7.4 |

Market Conditions and Overview

The major home appliances market is projected to grow at a 5 year CAGR (Compounded Annual Growth Rate) of nearly 5%, with particular strength in the Asia-Pacific region. The DTC (direct-to-consumer) market is a growth trend in North America, being WHR’s fastest-growing market segment. E-commerce market penetration is high, with many consumers now prefer purchasing directly from WHR rather than a reseller.

North American demand is roughly 56 million annual units, typically split 50-50 on replacement and new. However, WHR reports that replacement demand is higher than normal, at around 60%. Increased home-appliance usage started during the pandemic but has not dissipated, which has shortened the replacement cycle of most household items. The downside of this is that despite the solid volume it provides, the mix is usually worse.

The new appliance market is highly correlated with consumer confidence and new home sales, which are at the same level as in 2010 – just after the recession. Secularly, the population is growing, and there is a cost-of-living crisis, with housing contributing to much of inflation over the last 30 years. WHR is #1 for new builds, so the push for more housing in North America could provide significant tailwinds.

European Merger

European business is roughly breakeven and supplies Europe, the Middle East, and Africa. WHR partnered with Turkish brand Arcelik to improve cost and scale to create a new European appliance maker. The EU has approved the merger, though the United Kingdom still has an open inquiry into the merger. WHR expects the merger to go through around April of 2024, with full benefits realized by 2025. WHR will retain the KitchenAid brand in Europe.

With 75% going to Arcelik and 25% to WHR, the new company is expected to generate $6.4 billion in revenue. The Arcelik merger in Europe would provide significant deleveraging and $250 million annually in additional free cash flow (the current expected free cash flow is $500 million for 2023). The Arcelik merger would also improve margins as the previously discussed European business is effectively breakeven, with an estimated 150bps in immediate improvement for EBIT margins.

Transformation

Shedding the European segment is part of a broader transformation in which WHR targets higher growth and margins. Margins for WHR have dropped into single digits, with the EBIT margin dropping to 7.25%, far below the sector median of 10.9% and below its 5-year average of 10.5%.

Full-year 2023 net sales growth is expected to be negative 1% despite pricing actions. Additionally, free cash flow was revised downward to $500 million, or 2.6% of net sales.

By management’s admission, many businesses within the portfolio reside in markets that are “structurally unattractive,” which includes Europe. Consistently, the Americas segments have been the strongest for consumer large appliances and B2B customers. We expect the focus in those areas to continue gaining market share while investing in Asian growth over the medium term.

On a category level, we expect renewed focus in the small-appliance area. Though WHR does not break out margins on a segment basis, it claims that the small-appliances area has an EBIT margin of >15%. To aid this, it acquired InSinkErator for an all-cash transaction of $3 billion in October 2022. While this was probably priced too steeply, InSinkErator has approximately 70% market share in North American garbage disposals and approximately $750 million in net sales.

Risk

WHR has a high debt load, largely due to the all-cash $3 billion acquisition of InSinkErator – paid for by $2.5 billion in credit and $500 million in cash on hand. Of the $6.3 billion in long-term debt, $1.3 billion is due in 2023. Free cash flow was revised to $500 million, of which $100 million will go toward the debt. WHR does have $1.2 billion in cash on hand, which will be used to pay debt maturities, which leaves very little wiggle room if economic conditions turn negative for appliances.

Consumer durables experience the greatest impact from decreases in discretionary spending brought on by the economic downturn. A significant portion of WHR’s North American demand growth is driven by replacement needs, which, while currently high, can fluctuate and decrease over time, especially as product lifecycles change or economic conditions change.

If the Arcelik transaction is rejected, it will significantly threaten WHR’s strategy. WHR will likely seek to offload its European business in the event of regulatory rejection, though the terms may not be as favorable. Already, WHR sold Arcelik its Russia segment in 2022, which included the manufacturing and marketing facility there.

Outlook

WHR reported a 3% increase in sales growth in 3Q23, with some limited market share growth boosted by high builder demand. Management’s target EBIT margin is 12%, with 5-6% target sales growth. 7-8% of net sales converted to free cash flow.

WHR has seen significant reductions in input inflation and expects to save some $800 million annually in input costs. Over the short term, we expect better results in 2024 if the Arcelik transaction is approved. This transaction will generate $ 250 million in free cash flow annually.

The dividend is currently paying out $7 per year, yielding 6.49%, representing 70 consecutive years of dividend payments. WHR does not include expected share repurchases in guidance, but it repurchased just shy of $1 billion in 2022. Given the expected operating difficulties remaining through 2023, we do not expect meaningful repurchases in the next couple of years.

In conclusion, WHR is entering the hard-reality phase of transformation. The Asia-Pacific region and the DTC market are key growth drivers, with increased replacement demand fueling sales in North America. The strategic merger with Arcelik in Europe has the potential to deliver significant cost savings and increased free cash flow. Despite challenges such as high debt from recent acquisitions and the impact of economic downturns on consumer spending, we are cautiously optimistic. We expect improved performance in 2024, especially if the Arcelik deal concludes successfully. Over the long term, WHR has the execution required for higher growth and higher-margin turnaround.

Competitive Comparisons