General Dynamics’ Diverse Defense Portfolio Key Part of Modernization

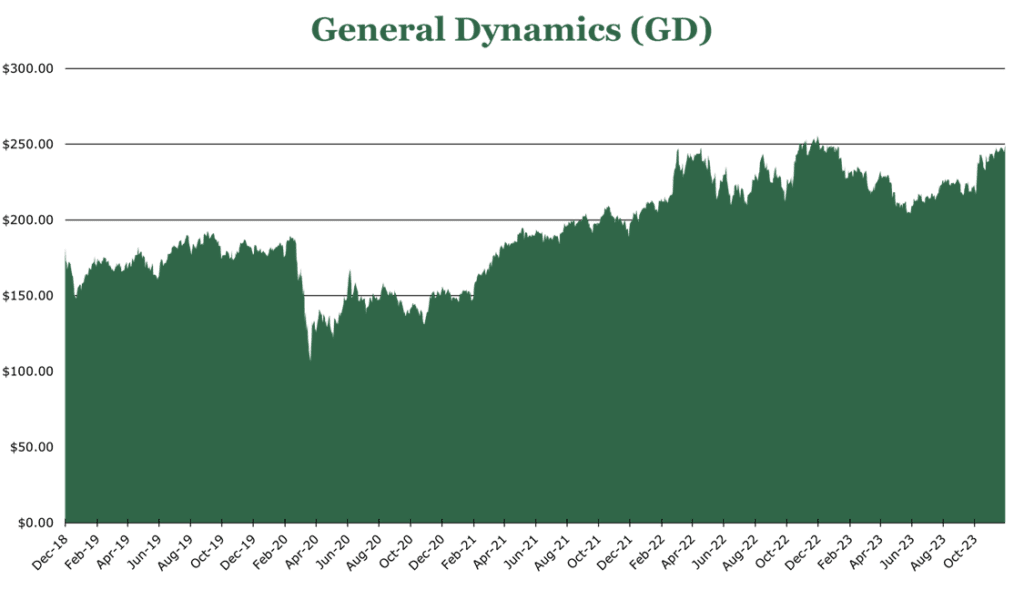

| Price $249.69 | Dividend Holding | December 6, 2023 |

- 2.16% Dividend Yield

- The Navy aims to procure 55 ships over the next five years, indicating sustained demand for maritime defense capabilities.

- Notable increase in ordnance production due to global conflicts, with plans for a 600% output increase as soon as 2025.

- Army and Navy are covering significant expansion expenses as part of an “industrial base modernization” program.

- Nearly $100 billion backlog, with a company-wide 1.4-to-1 book-to-bill.

Investment Thesis

General Dynamics (GD) is an American defense contractor with a global footprint. GD operates across diverse segments, including Aerospace, Marine, Mission Systems, and Combat Systems, catering to various industry needs from civilian aircraft to naval ships and combat vehicles.

Despite challenges posed by rising labor costs and materials shortages, GD is strategically positioned to benefit from increased military spending and government modernization efforts. Combining a strong order book, strategic positioning in key defense segments, and easing supply chain constraints make GD attractive for growth and dividend investors.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $16.40 X 16.1 = $264

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.6 | 1.5 | 1.4 |

| Price-to-Earnings | 16.8 | 15.2 | 14.0 |

Market Conditions

The Navy’s proposed 2024 budget includes $32.8 billion in shipbuilding funds for 9 new ships. Through 2028, the Navy’s plan includes procuring 11 ships per year, totaling 55 ships. We go into far more detail in our article on Huntington Ingalls here. Additionally, the Navy has released preliminary plans for its DDG(X) program to replace the aging Ticonderoga class cruisers and Arleigh Burkes. While specific details are still classified the CBO estimates that each ship will cost approximately $3.5 billion, or about 60% more than the Arleigh Burke. The first ship is expected to be procured in 2032.

COVID-19 and spiking labor costs have put stress on contractors who procure materials needed to supply the military. Numerous supply lines like artillery, missiles, and armored vehicles are seeing double or more demand. According to estimates, the entire Virginia class program is 410 months behind schedule.

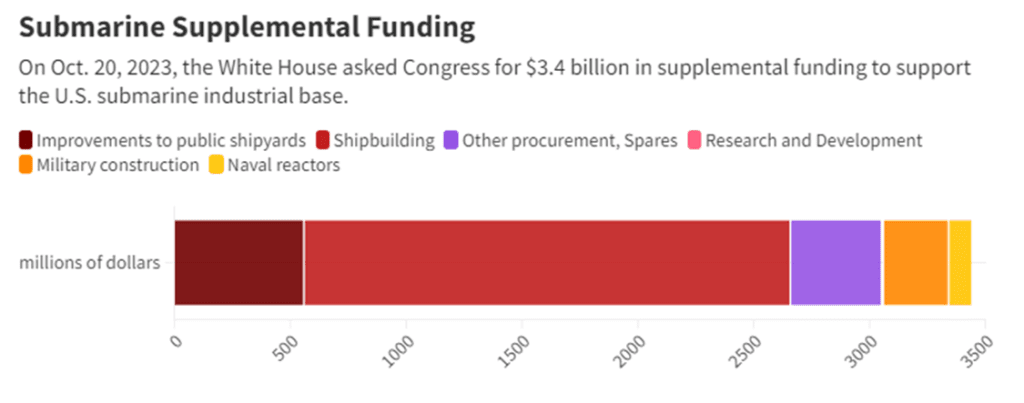

The Navy is investing $3.4 billion in industrial base funding for the submarine and DDG(X) program. This is part of a broader $8.7 billion push (with a proposed $3 billion from the Australians) to modernize procurement and repair for the Navy’s current needs. While the amount GD would receive is not specified, this investment should help grapple with the significant material procurement issues that GD says are compressing its margins.

In a similar move to the Navy’s submarine and surface spending, the Army is putting forward $18 billion over 15 years for procurement and strengthening the industrial base, with $2.5 billion expected to be injected for fiscal 2023.

Breakdown by Segment

GD operates 3 segments, broken down into much smaller parts. GD operates a multidisciplinary business with significant exposure to public and private sector clients.

| Backlog as of September 2023 | % Funded | Total Backlog ($ Millions) | Estimated Potential Contract Value ($ millions) |

| Aerospace | 98.0% | 20,059 | 785 |

| Marine Systems | 63.8% | 47,722 | 3,113 |

| Combat Systems | 95.2% | 15,094 | 6098 |

| Technologies | 77.5% | 12,685 | 27,302 |

In contracts, particularly those with the government, a “funded backlog” refers to orders with funding set aside, even if payment has not been made yet. The estimated potential contract value represents options for additional purchases at the original contract price, IDIQ contracts (indefinite duration, indefinite quantity), or potential long-term service agreements that are paid as needed.

| September Quarter 2023 | Revenue as a % of Total | Operating Margin |

| Aerospace | 19.2% | 13.2% |

| Marine Systems | 21.0% | 13.5% |

| Combat Systems | 28.4% | 7.0% |

| Technologies | 31.3% | 9.5% |

Aerospace

GD owns and operates Gulfstream, a manufacturer of small business aircraft, and Jet Aviation, a full-service aviation manager.

Jet Aviation is a Swiss full-service aircraft manager acquired in 2008. Since then, GD has significantly expanded Jet Aviation’s operations, including 55 charter aircraft in the US and a new hub in New Jersey.

Gulfstream’s backlog has grown 70% since 2020, the pandemic. However, material shortages have significantly reduced the amount of airframes that can be completed per quarter. This shortage has resulted in a reduction in expected deliveries by around 10%. The G700 model has a significantly longer range than the other products currently in the Gulfstream portfolio and is expected to be certified for sale by the FAA late in 2023. First deliveries are expected to be made immediately after approval, with several already pre-built for customers.

| As of September 31, 2023 | Revenue as a % of Total | Year-over-Year Growth |

| Manufacturing | 66.3% | -21.3% |

| Services | 33.7% | 7.7% |

The Aerospace segment had a book-to-bill of 1.4-to-1 for the September quarter, driven by Gulfstream which had a 1.5-to-1. While top-line revenue across the Aerospace segment decreased by 13.4%, this was largely driven by the previously mentioned material shortages in the Gulfstream area rather than a decrease in volume. GD expects these pressures to alleviate with time and bring the operating margin currently at 13.5%, back to the 15-18% neighborhood.

Marine Systems

GD operates 3 sub-segments in the Naval area to construct and repair ships for the US Navy, civilians, and allies.

The Bath Iron Works in Maine is one of the primary builders of the Arleigh Burke class of destroyers and is the exclusive builder of the advanced Zumwalt class. While the Navy has no current plans to procure any more Zumwalt classes, the Flight III upgrade of the Arleigh Burke has a $2.2 billion price tag, and GD currently holds the contract to construct 6 of them. On a secular basis, Bath Iron Works has historically been the favored shipyard for new cutting-edge ships and will be the likely target for the first of the previously discussed DDG(X) program’s prototypes.

The Electric Boat shipyard in Connecticut is the primary builder of the Virginia-class submarine. The Electric Boat segment outputs approximately 1.2 boats per year, with the Navy and Congress stating it wants to see capacity built out to be at least 2 per year by 2028. The aforementioned industrial base supply program could significantly aid in this push for more output.

The NASSCO area contains 4 shipyards in San Diego, Norfolk, Bremerton, and Mayport. Compared to other shipyards, it specializes in Jones act-compliant shipping and military support vessels. In addition to shipbuilding, the yards are commonly contracted to refurbish and repair various civilian and Navy ships.

| As of September 31, 2023 | Revenue as a % of Total | Year-over-Year Growth |

| Submarines | 67.5% | 13.6% |

| Surface Ships | 23.2% | -0.6% |

| Repair and Services | 9.3% | 0.2% |

The previously mentioned supply chain and labor situation has impacted the Marine segment the hardest. Operating margin dropped 160bps year over year to 7.0% in the September quarter. This is attributable to a lack of materials, a downgrade of earned value at completion due to new liability requirements, and difficulty acquiring high-skill labor.

The Marine Systems segment had a massive 2.3-to-1 book-to-bill, leading the company. GD expects $4-500 million per year in top-line growth for the segment as labor and supply chain conditions improve.

Combat Systems

Combat Systems handles all GD development and procurement for military ground vehicles and ordnance.

European Land Systems encompass all European acquisitions GD has entered since 2003. Land Systems encompasses non-European design and construction of military equipment. These sub-segments are effectively the same in their operations; the difference is the location where revenue is realized. The confirmation of the M10 Booker new combat vehicle program and continued sales of the M1 Abrams main battle tank to US allies drove strength in the Land Systems area. An overall volume increase across the portfolio drove the European Land Systems area.

Ordnance and Tactical Systems is a catch-all for sub-businesses that don’t fit elsewhere. Not only is one of the largest manufacturers of munitions in the world, but it also includes composite metal working plants, military waste disposal services, and vehicle protection systems.

An area of note is the Ordnance area, which has had hypergrowth in demand. Before the war in Ukraine and Israel, GD was outputting 14,000 artillery rounds per month. It is now up to 20,000 per month and current production targets are shooting for 85,000 per month by 2028, depending on conflict conditions. The US Army is spending $218 million to bring GD’s capacity to 50,000 rounds per month. However, DoD acquisition head Bill LaPlante says that if Congress approves further supplemental assistance, it could be as high as 100,000 by 2025.

| As of September 31, 2023 | Revenue as a % of Total | Year-over-Year Growth |

| Military Vehicles | 57.6% | 12.9% |

| Ordnance | 33.2% | 54.0% |

| Services | 9.2% | 17.8% |

The Combat Systems segment had one of its best quarters ever, with a 24.4% year-over-year revenue increase in September. Net income was up, but operating margin was down by 170bps year over year to 13.5%. This drop in margin is expected to be a growing pain of building out capacity, with margins improving sequentially back to the 15% neighborhood. GD does not expect to see meaningful supply chain or labor issues in this area as it has with the marine area, which allowed it to reach a 1.0 book-to-bill in the September quarter and a 1.3-to-1 book-to-bill on a YTD basis.

Technology

The Technology segment includes two sub-segments.

The Mission Systems arm includes many hardware, software, and service solutions for the military. In particular, the cyber and cryptography portions of the business have seen significant strength with naval expansion and modernization spending. Compared to other areas, the supply chain issues driving material shortages are alleviating quicker in this area as the hardware is typically small.

GDIT (GD Information Technology) is a specialized IT provider for the military, civilian government, and commercial customers with special infrastructure needs. The most significant win came in early November, with GDIT winning the $710 million contract to modernize the infrastructure at the Department of Homeland Securities St. Elizabeth Campus.

The segment has increased investment with a technology accelerator investment program. This program has expanded internal labs for zero-trust cryptography and geospatial intelligence while partnering with large firms like Amazon and Cisco for 5G research.

| As of September 31, 2023 | Revenue as a % of Total | Year-over-Year Growth |

| Information Technology | 64.9% | 5.4% |

| C5ISR Solutions* | 35.1% | 12.7% |

Overall, the Technology segment grew top-line revenue by 8% year over year, with operating margin expansion being 20bps largely attributed to mix. The current operating margin is 9.3%, with expected margin expansion into the double digits for 2024. Given the segment is largely service-oriented, it maintained a book-to-bill of 1.0-to-1 on a YTD basis.

Risk

After a year-long dispute, GD has agreed to assume liability for accidents with the Tomahawk missile system at its yards. In 2018, an accident occurred with one of the missiles, for which the US Navy assumed liability. However, the high cost of the liability to the taxpayer had the Navy revise the contract for submarine procurement. Now, liability will be on the Electric Boat segment if an accident occurs. This impacted the entire project’s EAC (earned at completion) value, though no further balance sheet implications will occur unless an accident occurs.

Future defense programs, by their nature, are classified. Determining the result or lifetime of procurement programs like the DDG(X) or M10 Booker programs is difficult. On a broader level, GD derives 75% of its revenue from the US Government. While the United States Military isn’t going anywhere, there is still intense competition among contractors and technology providers to sell the most advanced technology possible at the lowest price, which poses a risk to operations.

FAS(Financial Accounting Standards – GAAP) and CAS(Cost Accounting Standards used by the Department of Defense) cause different results. FAS/CAS adjustments ensure the company reports correctly to investors and the government. This can cause volatility in results due to fluctuations in pension plans, government regulation, or defense budgetary changes.

Sequential decreases in financial performance are attributed to mix problems and some remaining supply chain growing pains, which time can fix. GD has had sustained problems with the labor force in the Marine segment and material issues across all production segments. However, it is seeing relief in labor, with retention numbers increasing faster than expected.

Outlook

On a secular basis, the United States is re-equipping for a peer conflict with China, and we expected continued modernization spending efforts. Even if there are slowdowns in the conflict in Ukraine or Israel, the military has significantly drawn down its equipment reserves in aiding these conflicts.

GD generally targets capex at 2.5% of sales, currently at around 2% on a YTD basis. There will likely be an uptick in capex in the year’s final quarter, trailing down to 2% of sales once expansion projects in the Electric Boat area are completed. As we previously discussed, significant expansion is paid for by the Navy and Army, with the potential for far more provided approval is received.

For the quarter ending September 2023, GD saw a reduced free cash flow of 11%. However, GD still converts cash flow at around 126% of net income. GD used $500 million to repay maturing debt, which brought net debt to EBITDA down to 1.6x. It pays out a 2.16% yield or $5.28 annually. GD focuses more on share buybacks, which repurchased about $1.1 billion on a YTD basis. Currently, it has around 1.7% of outstanding shares available for repurchase or about $1.1 billion at current prices.

GD presents a compelling investment for the defense sector, underscored by a robust 1.4-to-1 book-to-bill ratio and a total backlog of almost $100 billion. This impressive backlog and the company’s diversified portfolio across multiple civilian and military areas position GD to take advantage of secular geopolitical trends.

Competitive Comparisons