HII Seas: Rearmament Continues to Propel Navy Spending and Improved Results

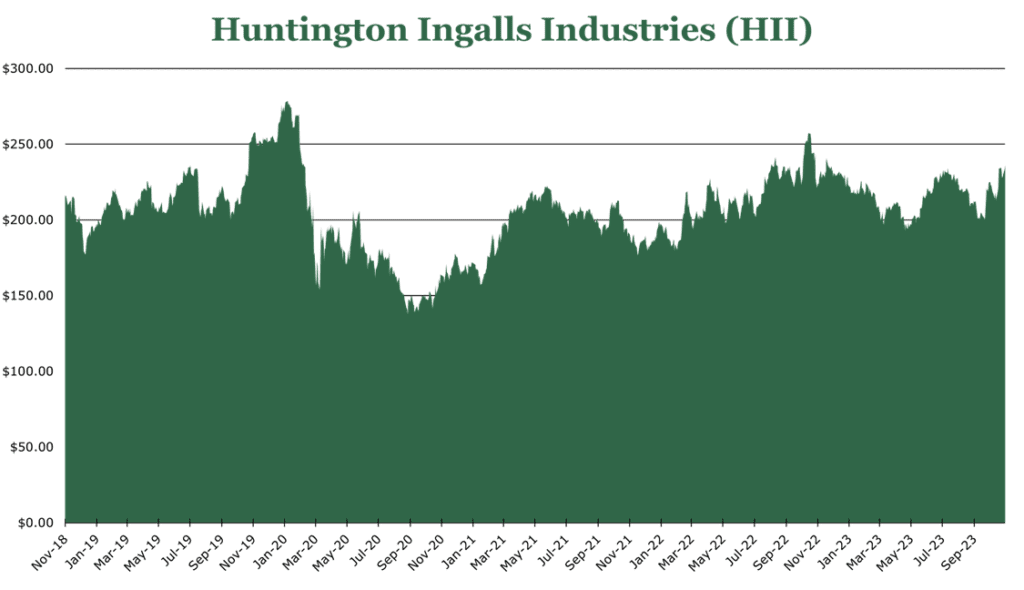

| Price $235.00 | Core Holding | November 17, 2023 |

- 2.26% Dividend Yield.

- Total backlog of $49.5 billion up 5.7 % year over year. 5 years for shipbuilding and 2 years for Mission Technology.

- Naval shipbuilding is accelerating, with the Navy needing to build more than 55 ships to reach its 300-ship target.

- Mission Technology is an expansion area, with a segment book to bill of 2.4x.

- Largest military shipbuilder in the United States, benefiting significantly from naval rearmament.

Investment Thesis

Huntington Ingalls Industries (HII) is the largest military shipbuilding company in the United States. Starting as a spin-off of Northrop-Grumman, HII has built more Navy ships than any other shipbuilder and is now branching into services through its Mission Technology segment.

The 2024 Navy budget, encompassing a strategy to reach 300 ships by the 2030s, presents a significant opportunity for HII. With current naval force attrition and the advent of the AUKUS submarine program, HII stands to continue to deliver solid growth within its existing business. The company’s expansion into the Mission Technologies segment is a major international growth area, with customers in 30 countries. HII has established itself as a keystone for naval procurement, giving it a significant competitive advantage in its operations.

Estimated Fair Value

EFV (Estimated Fair Value) = EMarFY24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E26 EPS X P/E = $19.00 X 15.6 = $296

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.9 | 0.8 | 0.8 |

| Price-to-Earnings | 14.1 | 12.6 | 10.8 |

Market Conditions

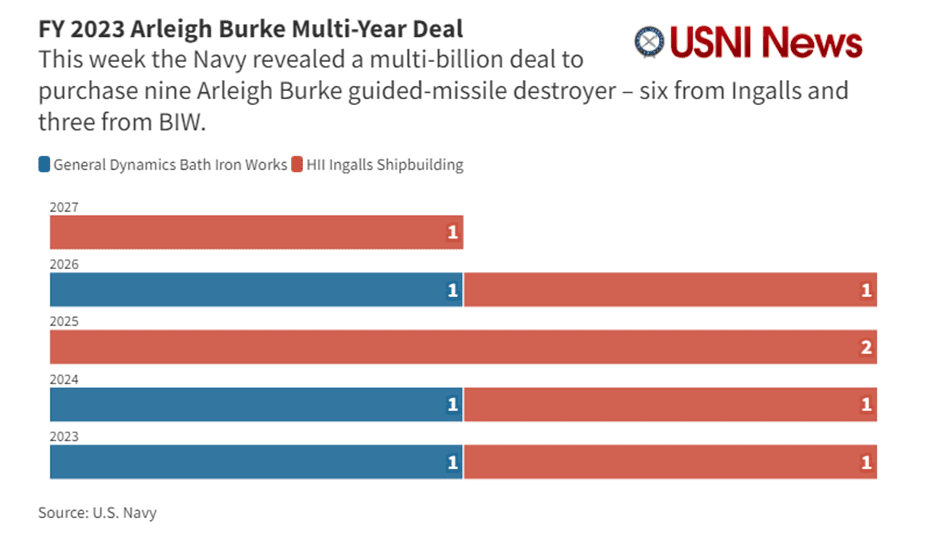

The Navy’s proposed 2024 budget includes $32.8 billion in shipbuilding funds for 9 new ships. Through 2028, the Navy’s plan includes procuring 11 ships per year, totaling 55 ships.

US Navy ships typically have a surface life of 35 years, with the Navy targeting 300 ships in force. However, recent procurement and design blunders have caused this to fall, with the current force being 295 ships and falling to 285 by 2026.

Additionally, the AUKUS submarine program will deliver 3 nuclear-powered submarines to the Australian Navy in the 2030s, with options to acquire an additional 2 more. This will turn into a program of a joint US-UK-Australia-developed submarine to succeed the Virginia class. This could be an important win for HII and offer an entry point into the UK and Australian defense markets. As early as fiscal 2024, HII expects to see limited fund distribution for developing the supply chains and labor force required for the program.

Breakdown by Segment

| % Of Revenue | Operating Margin | % Of Total Backlog | |

| Ingalls | 25.0% | 10.3% | 32.5% |

| Newport News | 51.0% | 6.2% | 56.5% |

| Mission Technologies | 24.0% | 3.5% | 11.0% |

Mission Technology

Mission technologies is the newest segment for HII. The Mission Technology segment provides technology solutions, fleet sustainment services, nuclear services, and electronic warfare solutions.

| Contract | Awarded Amount ($ millions) | Category |

| Joint Network Engineering and Emerging Operations | $1,400 | Support/Unmanned Systems |

| Lionfish Undersea Vehicle | $347 | Unmanned Systems |

| Minotaur Software | $244 | Software |

| Air Force Life Cycle Management | $138 | Support |

| Navy Training System | $134 | Software |

| Geospatial Agency Cloud Migration | $84 | Software |

| Missile Defense Support | $79 | Support |

According to HII, the currently funded backlog for mission technologies is $1.9 billion, with $3.5 billion in the unfunded backlog. The segment is the fastest growing of the three, with a 15.1% increase year over year in the quarter ending September. As the segment matures, we expect operating margins to increase from 3.5%. Mission Technologies’ unmanned systems have customers in more than 30 countries, far more than any other segment. A particular strength is the increased investment in unmanned systems and modernizing existing systems. The segment has a book-to-bill of 2.4x, representing a significant growth opportunity.

Ingalls and Newport News Shipbuilding

HII operates two primary shipyards comprising respective segments, Ingalls in Mississippi and Newport News in Virginia. Typically, Newport News handles larger displacement ships like Aircraft Carriers and Submarines, while Ingalls is a more generalized builder.

Ingalls has a $13.1 billion funded backlog and a $3.0 billion unfunded backlog. Ingalls has a wider operating margin of 10.3%, which increased 230bps year over year in the September quarter. This was largely due to favorable contract adjustments.

We do expect Ingall’s backlog to grow with new landing ship contracts and destroyer contracts, with the successor to the Arleigh Burke destroyers expected by 2032. While no contract has been awarded yet, General Dynamics Bath Iron Works is the only other Shipyard capable of producing military ships of this size. In our view, future procurement will likely be split in the same way it is now.

Over the medium term, we expect a small revenue decrease once the final Coast Guard cutter is completed.

Newport News has $11.9 billion in funded backlog and $16.0 billion in unfunded backlog. We don’t expect secular changes in the Newport News backlog, with the current backlog containing 2 more aircraft carriers and 5 more submarines.

Newport News’ operating margins decreased by 100bps to 6.2% in the September quarter. However, this is largely due to the relatively lower margin refueling and overhaul operations for the John C. Stennis carrier, expected to be complete by 2025. Management states it does not forecast meaningful improvements to Newport News margins at this time. However, labor costs have been decreasing and we expect some improvement in shipbuilding margins in Fiscal 2024 due to labor cost reductions.

Risk

The previously discussed 9 additional ships are part of a broader program. Titled the FYDP (Future Years Defense Program), which involves three parts. Phase one goes until 2028 and is the only one publicly disclosed currently. Annual shipbuilding costs from 2028-2034 are estimated to be approximately $29 billion, which is in line with the 2024-2028 phase of the program. However, shipbuilding funding will drop substantially under current programs after 2034, when the final ballistic missile submarine is completed. The lower-than-expected procurement numbers are already driving fiercer competition amongst shipbuilders, and substantial uncertainty exists beyond 2028.

On a broader level, the single-client model is high-risk. While the United States Navy isn’t going anywhere fast, there is still intense competition amongst shipbuilders and technology providers to sell the most advanced technology possible at the lowest price, which poses a risk to operations.

FAS(Financial Accounting Standards – GAAP) and CAS(Cost Accounting Standards used by the Department of Defense) cause different results. FAS/CAS adjustments ensure the company reports correctly to investors and the government. This can cause volatility in results due to fluctuations in pension plans, government regulation, or defense budgetary changes.

Outlook

The company’s revenues increased 7.2% year over year in the September quarter. Operating margin increased by 110bps to 6.1% over the same period.

Of the total backlog of $49.5 billion, $26.9 billion is funded, and $22.5 billion is unfunded. In the context of contracts, particularly those with the government, a “funded backlog” refers to orders with funding set aside, even if a payment has not been made yet. The $49.5 billion total backlog compares favorably to HII’s expected Fiscal 2023 revenues of $11 billion. This translates to roughly 5 years of backlog for the shipbuilding segments and just over 2 years for Mission Technology. The current book-to-bill is 1.2x on a YTD basis for the whole company. HII has an assumed opportunity pipeline of $70 billion in additional contracts.

Free cash flow in the September quarter was $293 million, with $50 million in dividends yielding 2.26% and $21 million in share repurchases. Management expects to increase the dividend at a low-to-mid single-digit growth rate. The total free cash flow is estimated to be $500 million for fiscal 2023, increasing by 33% in fiscal 2024 to $700 million. This substantial year-over-year increase in free cash flow will aid the $1 billion in repurchases left authorized and pay off the remaining debt to get below the <2x debt to EBITDA target.

HII’s portfolio, highlighted by a $49.5 billion 5-year backlog and a robust $70 billion opportunity pipeline, positions the company favorably in a competitive procurement market. The substantial growth in free cash flow, coupled with a favorable capital allocation strategy, further solidifies HII’s financial stability and growth prospects, making it a compelling investment for the growth-minded dividend investor.

Competitive Comparisons