Cigna Delivering Growth at a Great Price

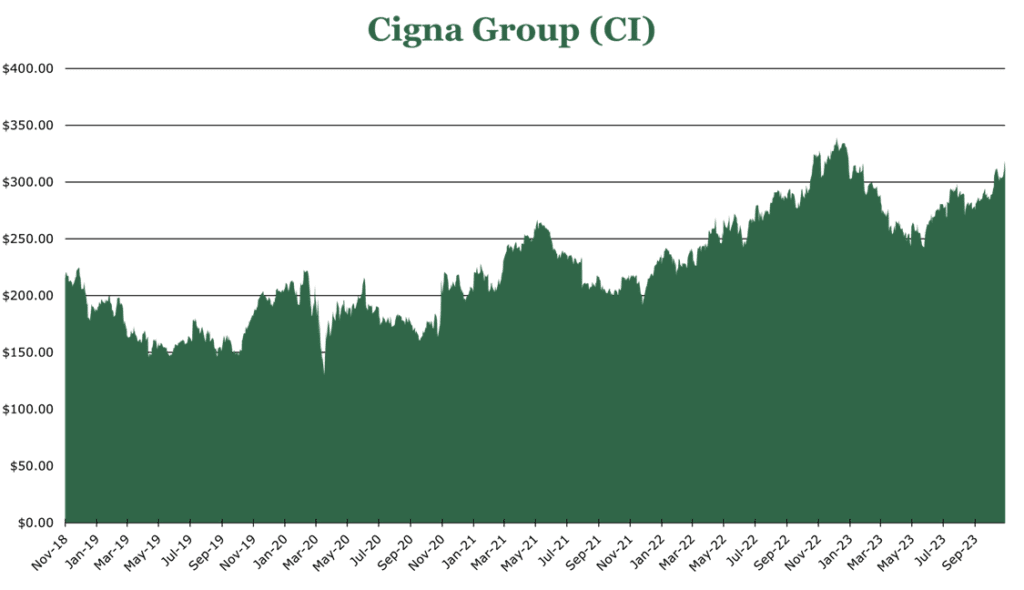

| Price $297.00 | Dividend Holding | November 8, 2023 |

- 1.58% Dividend Yield.

- Growing customers 9% to 165 million total relationships as of 3Q23.

- Diversified portfolio for sustained growth and resilience

Investment Thesis

Cigna Group (CI) is one of the largest health insurance and pharmacy benefits providers in the United States, with 165 million customer relationships across all segments. Year over year, Cigna has grown its customer base by 9%, with particular strength in the Government area.

Despite potential headwinds from a challenging economic environment and regulatory scrutiny, Cigna’s repositioning towards high-growth areas allows it the ability to capitalize on emerging healthcare trends. The company’s balanced approach to capital allocation supports a favorable outlook for both shareholder returns and business growth.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $28.25 X 13.65 = $385

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.4 | 0.4 | 0.4 |

| Price-to-Earnings | 11.0 | 9.8 | 8.8 |

Market Conditions and Overview

We extensively discussed the impacts of demographic changes in the United States in our article on HCA. To summarize, it’s anticipated that by 2026, Medicare Advantage, also known as Part C, will be the primary source of income for healthcare providers, with its enrollment increasing by roughly 8% annually. The number of older adults in the US is on track to double over the next four decades. As people grow older, there’s a sharp rise in how much each person spends on healthcare, especially for immediate and critical care needs. By the time someone reaches 85, they’re likely to spend an average of over $18,000 on healthcare annually. However, challenges like ongoing high inflation, a shortage of healthcare professionals, and surging demand from the growing number of elderly individuals are driving healthcare costs higher. McKinsey’s analysis suggests that healthcare spending in the US will climb at an annual growth rate of 7.1% over the next five years, which is projected to surpass the growth of the country’s GDP by a considerable margin.

| Total Customer Counts (in thousands) | |||

| 3Q23 | 3Q22 | Change | |

| Evernorth/Pharmacy | 98,325 | 94,846 | 3.7% |

| Commercial Healthcare | 16,009 | 14,761 | 8.5% |

| Government Healthcare | 1,970 | 1,381 | 42.7% |

| International | 1,628 | 1,812 | -10.2% |

| Behavioral Care | 25,100 | 44,522 | -43.6% |

| Dental | 18,593 | 18,380 | 1.2% |

| Medicare Drug (Part D) | 2,544 | 2,902 | -12.3% |

Cigna Healthcare is the health benefits segment, providing insurance services to commercial, government, and international customers. This is considered to be the “mature” segment of Cigna, accounting for about 41% of net income. Premiums have seen increases in this area, with premium revenue increasing 15% year over year in 3Q23. Cigna Healthcare did not experience a drastic uptick in utilization as was expected. There was some excess in inpatient care, but utilization stayed at typical levels of ~82%.

Evernorth offers behavioral care through the more novel Confide behavioral health portal, which provides high-touch engagement for matching patients to therapists. The need for mental health services has overwhelmed the available resources. According to the World Health Organization, mental health issues and substance abuse have risen by 13% to 25% since the onset of the pandemic. The estimated market value for clinical mental health services stands at $50 billion, with Cigna well poised to establish a significant share within this market. Cigna estimates that those without or with managed mental health concerns are significantly less likely to have high healthcare spend. The reduction in the behavioral care segment was related to the non-renewal of the New York Life contract, which, according to Cigna, was “insignificant to total revenues.” Excluding this, behavioral health increased by 2% year over year.

Evernorth and PBM

In 2020, Cigna created Evernorth. Evernorth is a pharmacy benefit and specialized care management segment, which has grown to be a large portion of the Cigna business. PBMs (Pharmacy Benefit Managers) are intermediaries that manage prescription drug benefits on behalf of health insurers, Medicare Part D drug plans, large employers, and other forms of large insurance plans like unions. They negotiate with drug manufacturers and pharmacies to establish fixed drug prices. Through Express Scripts, Evernorth is tasked with other duties like processing prescriptions and eligibility determination for specific drugs. Currently, Evernorth generates 58% of net income. Cigna expects that upscaling operations at Evernorth could create $10-20 billion in additional revenue.

A tailwind is the mainstream breakthrough of GLP-1 drugs, most famously Ozempic. Already, this area of business is seeing double-digit year-over-year revenue growth. There is block-busting consumer demand in this area, with Ozempic accounting for 65% of all diabetes- and obesity-related prescriptions in the US at the end of 2022. The GLP-1 sector alone could be worth more than $300 billion annually by the end of the decade. Cigna is launching InCircle RX to tackle this fast growth, a segment of Evernorth exclusively working in the GLP-1 drug area. InCircle RX will provide patient care management, marketing, as well as procurement. While specific program details are limited, Cigna expects this to be a growth item for 2024.

Additionally, gene therapies for previously untreatable chronic diseases like Alzheimer’s and novel biosimilar drugs significantly reduce costs for Evernorth and the consumer. An important win for Express Scripts is the $35 billion yearly spend of Centene’s 20 million customers starting in 2024. Cigna expects to spend $200 million in 2023 for onboarding, reaching breakeven by the end of 2024. 2025 is expected to be accretive, which could be significant if biosimilars gain market share. Currently, biosimilars are less than 10% of the specialty drug market.

Risk

Cigna targets a 40% long-term debt-to-capitalization ratio, currently at 40.5%. This is a significant rise year over year, compared to 38% at the start of the year, indicating an additional debt load. Currently, Cigna has a weighted average interest rate of 5.5%.

Cigna derives a significant portion of its bottom line from its PBM (Pharmacy Benefits Management) business. Recently, PBMs have come under intense regulatory scrutiny for rebates and spread pricing. When the PBM negotiates a lower price for a drug, it still pays the full price, but the manufacturer pays the difference to the PBM with a cash payment. Under current legislation, PBMs are permitted to keep a portion of the rebate. On average, PBMs retain about 9% of rebates. Spread pricing is similar. When a PBM negotiates with pharmacies to dispense the drug, the price difference between what the PBM pays and what the consumer pays is often pocketed by the PBM. Theoretically, this spread-pocketing allows PBMs to cover the administrative costs of negotiation and provides a hedge against price fluctuations. We have already seen introductory legislation on this issue, though it largely focuses on transparency in reporting rather than enforcement actions. While it is too early to see how this would impact the PBM business, the tailwinds provided by GLP-1 drugs and biosimilars may offset any potential rebates or spread pricing losses.

Outlook

Cigna cites its high-growth businesses as specialty pharmacy, Evernorth, and US Government plans. These “high growth” items make up approximately 40% of revenue. Company-wide organic growth is targeted at 6-8%, with a 4-5% accretive contribution from capital deployment. To 2026, Cigna expects to spend 20% of free cash on the dividend, 10% on replaying debt, and 70% on M&A or buybacks. YTD, Cigna has repurchased roughly $2.2 billion in stock.

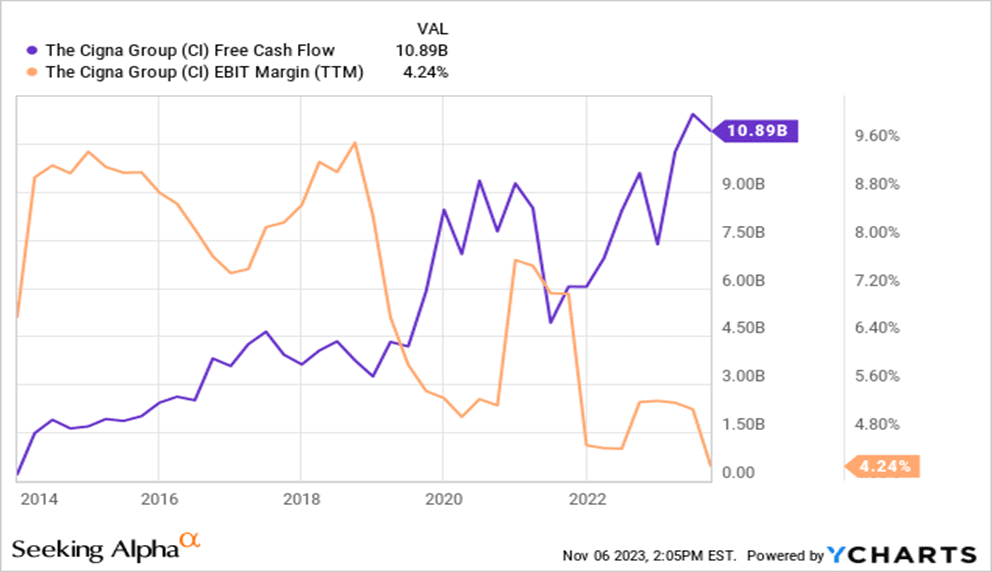

Cigna is heavily weighted toward PBM (Pharmacy benefits management) compared to its peers. According to Brookings, the average EBIT margin for PBMs is only 4%, with Cigna sitting at 4.39% for the entire business, including Cigna Healthcare. As Cigna has weighted operations toward Evernorth, it has become more in line with a PBM than a traditional health insurance company.

While this repositioning has put downward pressure on margins, the conversion to free cash flow has gone up. This has aided dividend growth which is up to $4.92 per year up from $4.00 in 2021.

Cigna projected some economic downturn in 2H23, which did not materialize. We believe it is still likely that some economic slowdown will hamper customer growth in 2024 and may cause minor attrition to customer numbers, depending on severity. However, this will also likely decrease utilization in the aggregate, which will at least partially offset losses.

Cigna, underpinned by its robust Evernorth segment and strategic focus on high-growth areas such as specialty pharmacy and US Government plans, presents a compelling investment case. The company’s proactive movement into the GLP-1 market positions it well within a high-growth market. Increasing demand from an aging population and M&A should enhance growth. This strategic response to market conditions suggests Cigna is well-positioned to capture tailwinds while maintaining the profitability of the existing business.

Competitive Comparisons