Insuring Success Through $380 Million in Cost Savings

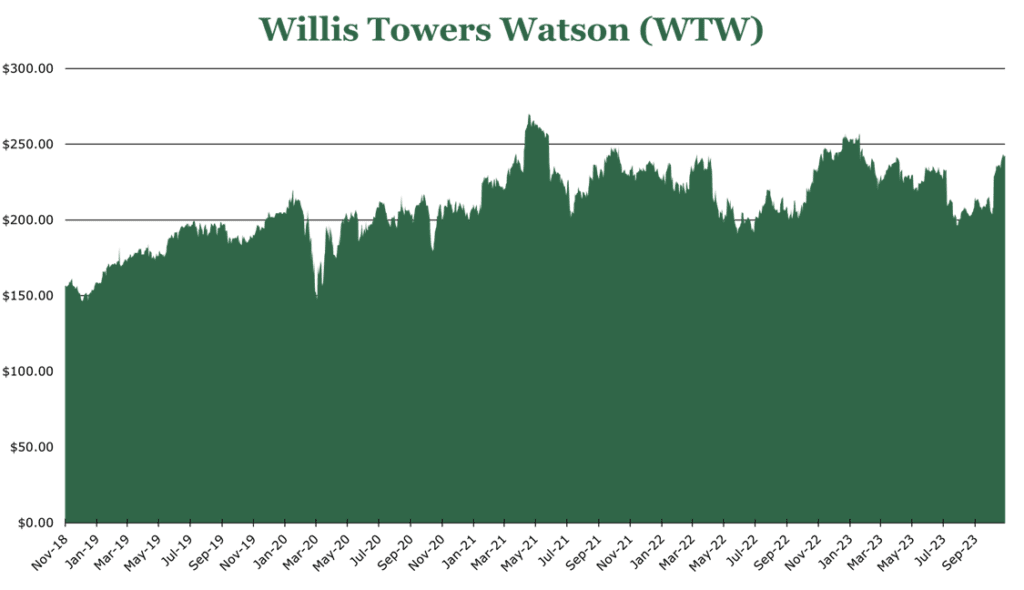

| Price $243.00 | Core Holding | November 21, 2023 |

- 1.38% Yield, $1 billion left on repurchase authorization.

- Expecting an increase in free cash flow in to $1 billion in 2024.

- WTW’s strategic cost-saving program aims to deliver $380 million in annualized savings by fiscal 2024.

- Strength in every business, with new clients and higher fees driving results.

- Demographic trends provide secular tailwinds.

Investment Thesis

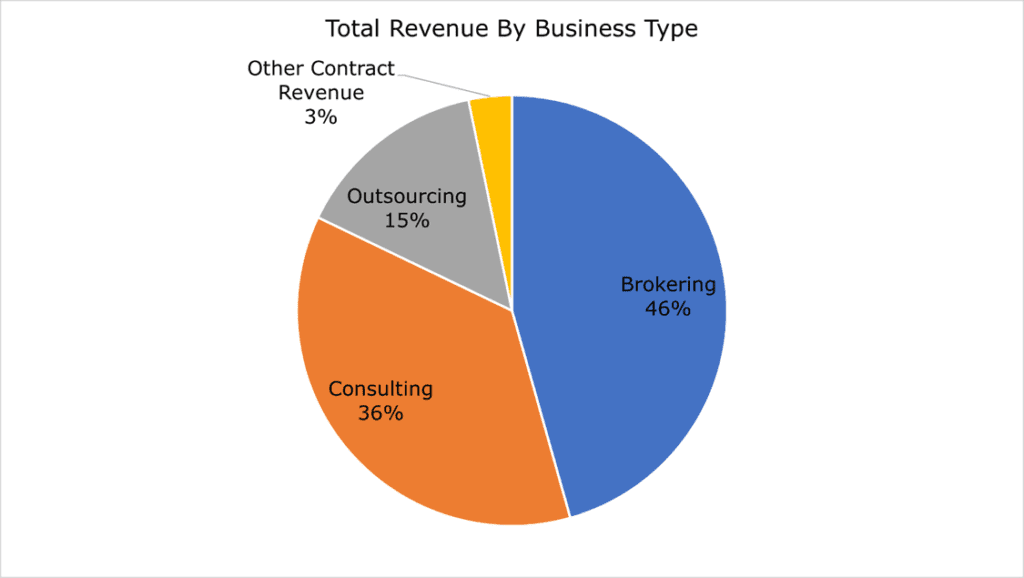

Willis Towers Watson (WTW) is a multinational consulting and insurance brokerage operating in 140 countries and is the 3rd largest insurance brokerage in the world. The company’s strategic cost-saving program, set to deliver $380 million in annualized savings by 2024, continues to improve margin despite the short-term increase in capital expenditures and operating expenses.

The aging population, particularly in developed countries, is expected to double by 2040, amplifying the demand for WTW’s health, wealth, and career consulting services. Additionally, the hard market in insurance provides substantial tailwinds to the value-added consulting business and premium commission income.

Estimated Fair Value

EFV (Estimated Fair Value) = E25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $18.70 X 16 = $299

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 2.5 | 2.4 | 2.4 |

| Price-to-Earnings | 14.9 | 12.9 | 12.9 |

Market Conditions and Overview

The global insurance marketplace is in a “hard market,” meaning higher premiums and stricter underwriting standards. This provides two tailwinds for WTW. As an insurance broker, WTW earns additional revenue on commission from higher premiums. As a secondary, the increased insurance cost will provide further value to the consulting component of WTW’s business. With stricter underwriting standards and higher premiums, benefits management and plan design value propositions are more attractive for firms.

Much of WTW’s business involves healthcare and retirement services. There are significant demographic tailwinds, which you can read about in our article here. By 2040, approximately 80 million Americans will be at retirement age – doubling in only 20 years. This effect is mirrored in developed nations, with similar expectations in major European economies.

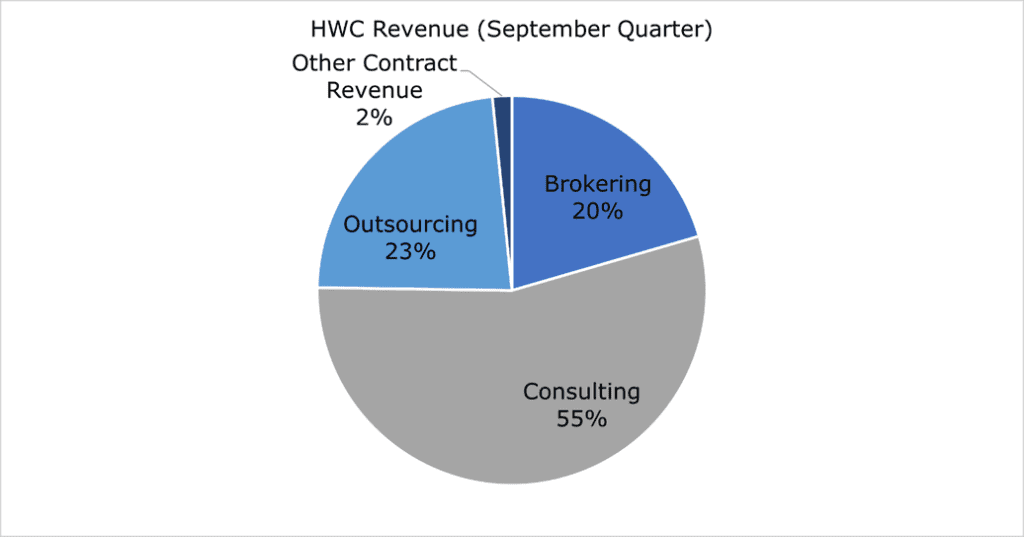

Health, Wealth, and Career

HWC provides various services across the back-of-house operations areas, like employee benefits and investment consulting.

| Sub-Segment | Organic Revenue Growth (Year over Year) |

| Health | 7% |

| Wealth | 7% |

| Career | 8% |

| Benefits and Outsourcing | 14% |

The Benefits and Outsourcing segment has a broad scope, providing administrative services for benefits plans of all types and outsourcing HR functions. Benefits and Outsourcing was by far the strongest segment, driven by new outsourcing clients and higher placements in the individual marketplace Medicare Advantage and Life. Benefits and Outsourcing sees around 50% of its individual marketplace revenue in the December quarter, and it expects year-over-year growth in the December quarter to align with the rest of the segment.

The Health segment operates as an advisor on a B2B basis, negotiating on behalf of a company with insurance companies. The health segment also provides analytics for usage and compliance-related services to reduce costs. Health had similar tailwinds to Benefits and Outsourcing, with strength in new clients.

The Wealth segment provides investment consulting for employee retirement plans. As opposed to managing the money for clients, the Wealth segment assists in selecting money managers and other actuarial services for retirement plans. Wealth equally has tailwinds from an aging population. Higher levels of retirement consulting services and increases in portfolio de-risking activities provided the lion’s share of increases in organic revenue growth, with companies taking a more defensive footing with macroeconomic conditions remaining wobbly.

The Career segment is more specialized, consulting for labor force development and other broad organizational services. Career has been boosted by the hotter labor market in the United States, with increased compensation consulting services boosting results.

All in, HWC saw a 29% increase year over year in operating income. Additionally, it increased its adjusted operating margin by 350bps in the September quarter, reaching 23.8%.

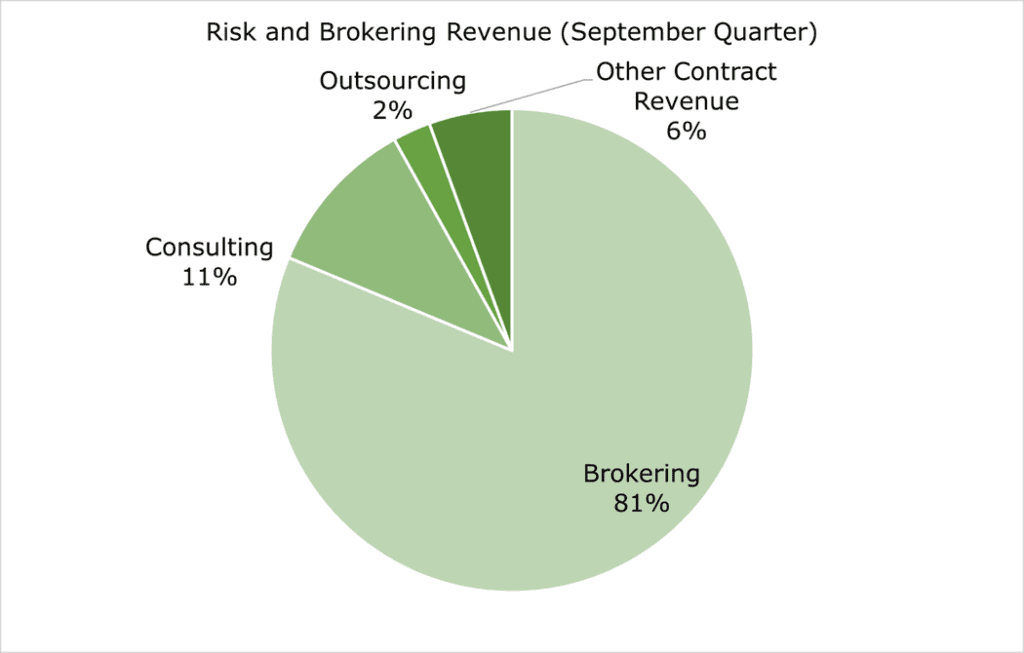

Risk and Brokering

R&B (Risk and Brokering) provides insurance and technology consulting and large-scale insurance brokering services for businesses. In the segment, 81% of revenue comes from brokering activities, meaning the increase in premiums will provide substantial tailwinds in this area.

| Sub-Segment | Organic Revenue Growth (Year over Year) |

| Corporate Risk and Brokering | 10% |

| Insurance Consulting and Technology | 9% |

Corporate Risk and Brokering provides risk management on a B2B basis, providing firms with specialized or industry-specific risk management recommendations and consulting services. Additionally, it operates as WTW’s primary B2B insurance brokerage, representing 81% of segment revenue.

Compared to other segments of WTW, ICT (Insurance Consulting and Technology) still benefits from the hard market but in a different way. During a hard market, insurers seek growth and cost management for existing operations. ICT provides regulatory compliance, product development consulting, and digitizing operations, among other back-of-house operations for insurance and financial companies. Risk and Brokering improved its adjusted operating margin by 200bps to 15.7% in the September quarter, increasing operating income by 28% year-over-year.

Risk

A strong US dollar impacts EPS as WTW operates in ~140 countries. WTW expects $0.07 per share yearly impact in headwinds at September quarter exchange rates.

Some of WTW’s business is weighted toward the year’s final quarter. The December quarter is the renewal season for the brokerage and is the typical enrollment window for marketplace plans like Medicare Advantage. However, results are not typically different in magnitude compared to the rest of the fiscal year.

While WTW does not hold risk in its books like a typical insurance company, it still sees fluctuations in business on insurance market conditions. However, insurance brokering and consulting services are typically more stable than underwriting, as even during an economic downturn, demand for brokerage and plan consulting remains relatively consistent. Insurance brokers are still the main channel through which insurance companies distribute their products. The byzantine nature of B2B insurance means that the market for brokers is resilient through economic contraction, and any reductions in business from a hard market are offset by price increases.

Outlook

For the remainder of fiscal 2023, WTW expects to maintain its current path of mid-single-digit revenue growth. In the September quarter, companywide organic revenue was up 9%. Companywide adjusted operating margins were up 170bps to 16.2%.

As part of efforts to improve the balance sheet, WTW embarked on a cost-savings program. The program is expected to deliver $380 million of annualized savings in fiscal 2024 and 380bps of margin improvement. WTW estimates it will spend another $150 million to finish the program in fiscal 2024, bringing the total program cost to approximately $750 million.

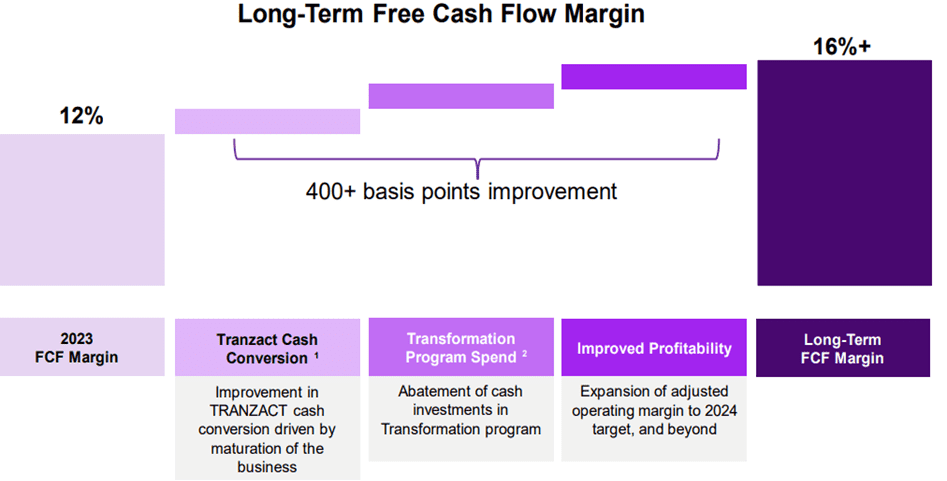

For fiscal 2023, WTW expects a 70.8% increase in FCF (free cash flow), though a lower revenue conversion due to the added expenses from the cost savings program. WTW expects an FCF margin of 12% for the full fiscal year. Long-term FCF margin targets are north of 16%. Given the debt to EBITDA is currently 2.2x with a target of <2.0x, this significant FCF improvement could all for a dividend boost.

The current shareholder return strategy is heavily weighted toward share repurchases, with $350 million repurchased during the September quarter. However, the 7-year dividend CAGR is 8%, paying out 1.38% or $3.36 per year. Approximately $1.5 billion remains in the current authorized repurchase agreement, with the first half of the fiscal year having $450 million in total repurchases.

With a diversified service portfolio aligned with key demographic trends, a hard market in insurance, and a strong focus on cost savings, WTW is well-positioned for sustained growth. WTW’s outlook appears robust, however, it has underperformed its peers, with its price being flat over the past couple of years. As the business improvement becomes evident, we believe this will begin to be reflected in the stock, especially once dividend increases kick in.

Competitive Comparisons