Growth Stock Thoughts

An Investment in Knowledge Pays the Best Interest

Benjamin Franklin

Video: CVS Offers Recession-Resistant Growth with Acquisitions, Single Digit P/E, 3.6% Dividend Yield

• 3.6% Dividend Yield, single digit P/E.

• M&A period over, now focusing on integrating new businesses and strengthening the balance sheet.

• Healthcare as a sector is recession-resistant.

• Cost recovery on the horizon, with the conclusion of a cost optimization program expected to yield $700-800 million in savings.

• The expected addition of $2 billion to EBITDA by FY26 from Oak Street and a significant internal referral network from Signify Health.

• This could grow earnings by 10% or more.

Video: Everest Group (EG) Raising Premiums and Profits with Compelling Low Valuation

• 1.9% dividend yield, EG is targeting over 13% shareholder return.

• Natural disasters are becoming more frequent and more intense, with primary insurers facing restrictions on premium hikes.

• Reinsurance rates have sustained tailwinds, with Everest realizing a 26.9% increase in premiums.

• Even in the face of increased catastrophe claims, the combined ratio in all segments of the company has improved. Reinsurance combined ratio dropped 340 bps to 88.2%, and primary insurance dropped 120 bps to 91.5%.

• International expansion effort in the primary insurance area resulting in premium growth of 13.5% year over year.

• Strong EPS growth to an expected $61 per share in 2024

• Compelling low valuation with a PE of 6

Civitas CIVI Permian Pivot Yields Massive 9% Dividend Yield

• 2.9% Base Yield, paying out 50% of average TTM quarterly Free Cash Flow as a variable dividend.

• 582k acres in low-cost basins in the US, expecting to have 280 Mboe/d in production by the end of 2023.

• Total 2024 production is expected to increase significantly, with quarterly production growing by at least 16% to 325 Mboe/d (thousands of barrels of oil equivalent per day).

• Entered the oil-rich Permian basin, significantly increasing its production targets by 101 Mboe/d in 2023 and 168 Mboe/d in 2024.

• These recent acquisitions are expected to surge earnings above $15/share in 2024, with 2024 guidance pointing to $1.8 billion in free cash flow.

• OPEC+ production cuts and Mideast uncertainty could put upward pressure on pricing, bringing WTI oil back to the $80/bbl area.

• Strong balance sheet, targeting a debt-to-EBITDA ratio of 0.9x by the end of fiscal 2024.

• 15.6% pullback from its $82.63 high is an attractive entry point in our opinion.

Video: Civitas CIVI Permian Pivot Yields Massive 9% Dividend Yield

• 2.9% Base Yield, paying out 50% of average TTM quarterly Free Cash Flow as a variable dividend bringing full yield to 9%.

• 582k acres in low-cost basins in the US, expecting to have 280 Mboe/d in production by the end of 2023.

• Total 2024 production is expected to increase significantly, with quarterly production growing by at least 16% to 325 Mboe/d (thousands of barrels of oil equivalent per day).

• Entered the oil-rich Permian basin, significantly increasing its production targets by 101 Mboe/d in 2023 and 168 Mboe/d in 2024.

• These recent acquisitions are expected to surge earnings above $15/share in 2024, with 2024 guidance pointing to $1.8 billion in free cash flow.

• OPEC+ production cuts and Mideast uncertainty could put upward pressure on pricing, bringing WTI oil back to the $80/bbl area.

• Strong balance sheet, targeting a debt-to-EBITDA ratio of 0.9x by the end of fiscal 2024.

• 15.6% pullback from its $82.63 high is an attractive entry point in our opinion.

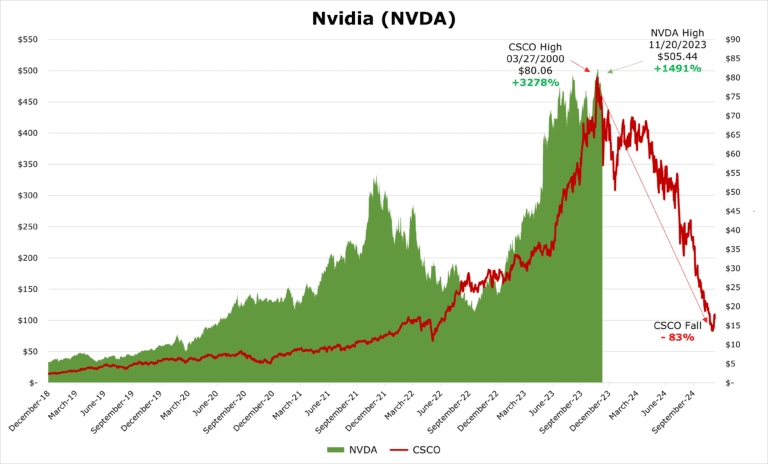

NVIDIA’s AI Boom and the Ghost of Cisco’s Internet Bust

• NVIDIA (NVDA) has established dominance in AI advancements, where it already had a foothold in the data center market. Prior to this, NVDA was a key player in the cryptocurrency mining and graphics card markets.

• Since 2019, NVDA has continued its upward trajectory with a remarkable 716% revenue growth. The share price during this time also saw an increase of 1,491%

• Cisco Systems (CSCO) experienced a similar boom in the 1990s, becoming the leading infrastructure provider for the global internet buildout. From 1996 to its peak in 2000, Cisco’s revenue grew by 498%, while its share price dramatically increased by 3,278%. Eventually, it would collapse by 83%.

• Dominant players in capital goods markets, like NVIDIA’s chips and Cisco’s network routers, often experience significant pricing power during boom periods. However, this is typically followed by a bust characterized by over-buildout and a subsequent revenue decline.

• NVIDIA enjoyed a surge in purchases from Chinese companies just before export restrictions were implemented. This has led to significant overbuying and stockpiling of reserves in China, a market now mostly closed.

• High Growth and Great Margins during this surge often attract new competitors, leading to a saturated market, more competition, fewer sales, lower prices, and lower profits.

Video: NVIDIA’s AI Boom is Similar to Cisco’s Internet Boom. Will the Similarities Extend to the Bust?

• NVIDIA and Cisco have been leading players in their respective fields during periods of high capital expenditure and rapid industry expansion. However, they also share the likelihood of reaching a cyclical peak, which could lead to significant stock price corrections.

• Since 2019, NVDA has continued its upward trajectory with a remarkable 716% revenue growth. The share price during this time also saw an increase of 1,491%

• Cisco Systems (CSCO) experienced a similar boom in the 1990s, becoming the leading infrastructure provider for the global internet buildout. From 1996 to its peak in 2000, Cisco’s revenue grew by 498%, while its share price dramatically increased by 3,278%. Eventually, it would collapse by 83%.

• Given the historical patterns, we believe exercising caution with NVDA is the best action.

Insuring Success Through $380 Million in Cost Savings

• 1.38% Yield, $1 billion left on repurchase authorization.

• Expecting an increase in free cash flow in to $1 billion in 2024.

• WTW’s strategic cost-saving program aims to deliver $380 million in annualized savings by fiscal 2024.

• Strength in every business, with new clients and higher fees driving results.

• Demographic trends provide secular tailwinds.

HII Seas: Rearmament Continues to Propel Navy Spending and Improved Results

• 2.26% Dividend Yield.

• Total backlog of $49.5 billion up 5.7 % year over year. 5 years for shipbuilding and 2 years for Mission Technology.

• Naval shipbuilding is accelerating, with the Navy needing to build more than 55 ships to reach its 300-ship target.

• Mission Technology is an expansion area, with a segment book to bill of 2.4x.

• Largest military shipbuilder in the United States, benefiting significantly from naval rearmament.

Video: Riley Exploration Permian (REPX) Looks Attractive for Dividend at 4.5% Yield

• $6 EPS for E2023, with earnings rising to $9 for E2024 if oil prices stay elevated.

• Acquisition did add leverage to the balance sheet, but the company has strong free cash flow.

• Mostly, 60%, oil, which is beneficial with crude prices holding up better than natural gas prices.

• Dividend increase, expecting to make regular dividend payments on a go forward basis.

Everest Reaches Peak Performance with Rising Premiums and Business Expansion

• 1.9% dividend yield, EG is targeting >13% shareholder return.

• Natural disasters are becoming more frequent and more intense, with primary insurers facing restrictions on premium hikes.

• Reinsurance rates have sustained tailwinds, with Everest realizing a 26.9% increase in premiums.

• Even in the face of increased catastrophe claims, the combined ratio in all segments of the company has improved. Reinsurance combined ratio dropped 340 bps to 88.2%, and primary insurance dropped 120 bps to 91.5%.

• International expansion effort in the primary insurance area resulting in premium growth of 13.5% year over year.

CVS Offers Recession-Resistant Growth with Transformation

• 3.5% Dividend Yield, $14.5 billion in stock repurchase remaining.

• M&A period over, now focusing on integrating new businesses and strengthening the balance sheet.

• Healthcare as a sector is recession-resistant.

• Sees cost recovery by 2H24, with the conclusion of a cost optimization program expected to yield $700-800 million in savings.

• Expected addition of $2 billion to EBITDA by FY26 from Oak Street and a significant internal referral network from Signify Health.

Qualcomm Drives into the Future with Apple Renewal and Auto Deals

• 2.8% Dividend Yield, $5.5 billion in stock repurchase remaining.

• QCOM’s renewed agreement with Apple to supply 5G chips through FY26.

• The company anticipates significant growth in the Automotive sector, underscored by recent partnerships with BMW and Mercedes to supply infotainment chip systems.

• QCOM holds 140,000 patents across over 18 billion devices, an estimated 38% market share in RF IoT technology.

• Nuvia SoC ARM chipset to launch in FY24 for Windows, competing with Apple’s M1 and M2.