NVIDIA’s AI Boom and the Ghost of Cisco’s Internet Bust

| Price $489.00 | Sell | December 15, 2023 |

- NVIDIA (NVDA) has established dominance in AI advancements, where it already had a foothold in the data center market. Prior to this, NVDA was a key player in the cryptocurrency mining and graphics card markets.

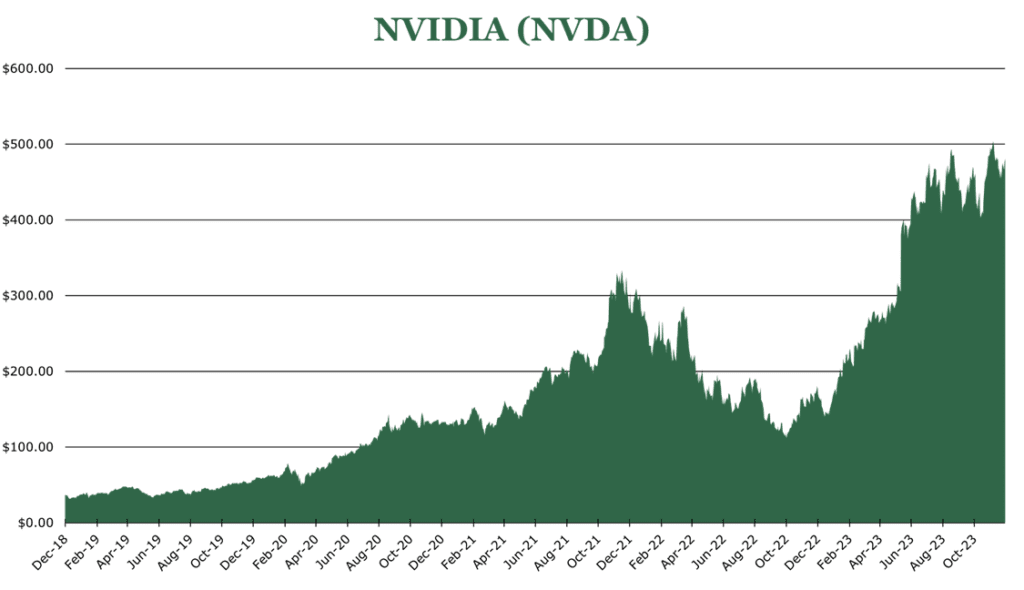

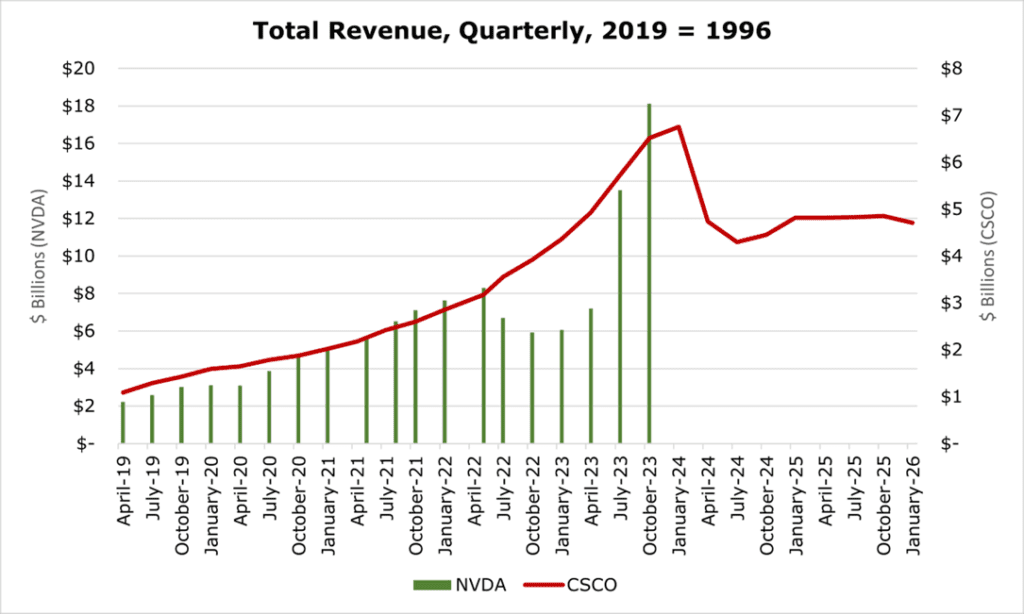

- Since 2019, NVDA has continued its upward trajectory with a remarkable 716% revenue growth. The share price during this time also saw an increase of 1,491%

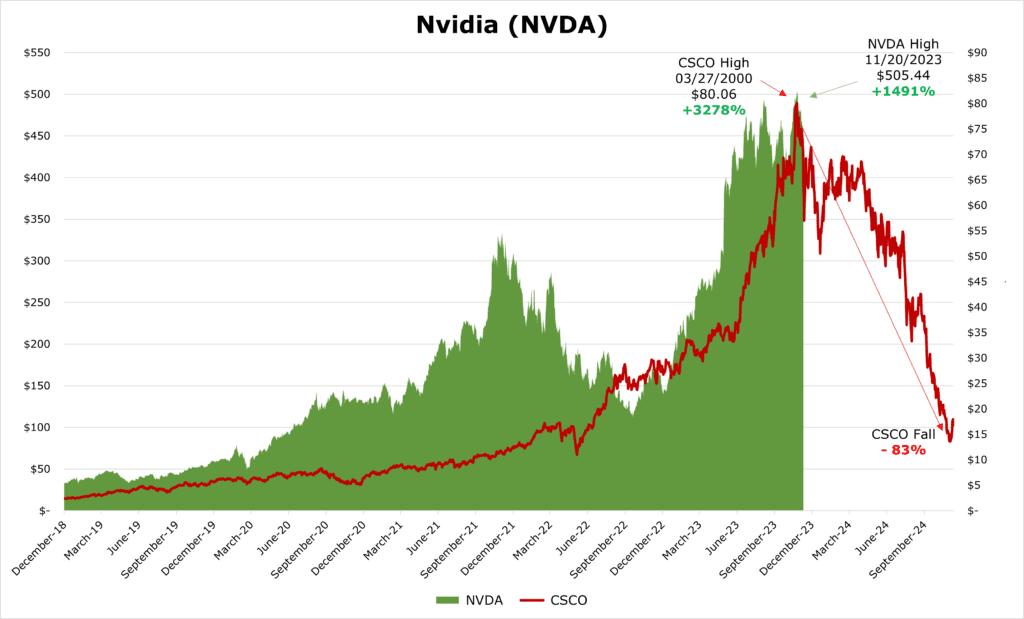

- Cisco Systems (CSCO) experienced a similar boom in the 1990s, becoming the leading infrastructure provider for the global internet buildout. From 1996 to its peak in 2000, Cisco’s revenue grew by 498%, while its share price dramatically increased by 3,278%. Eventually, it would collapse by 83%.

- Dominant players in capital goods markets, like NVIDIA’s chips and Cisco’s network routers, often experience significant pricing power during boom periods. However, this is typically followed by a bust characterized by over-buildout and a subsequent revenue decline.

- NVIDIA enjoyed a surge in purchases from Chinese companies just before export restrictions were implemented. This has led to significant overbuying and stockpiling of reserves in China, a market now mostly closed.

- High Growth and Great Margins during this surge often attract new competitors, leading to a saturated market, more competition, fewer sales, lower prices, and lower profits.

Investment Thesis

NVIDIA (NVDA) has been the best-performing stock in the entire S&P500 in calendar 2023. AI investment is driving the tech sector, with NVDA’s expertise and first-mover advantage propelling it to the top of the market.

While NVDA’s current market leadership and excellent product offerings are undisputed, the pattern resembles Cisco’s run-up in the late 1990s. The investment landscape in the capital goods sector is cyclical, with high entry barriers due to substantial startup costs. The initial phases of technology adoption with significant capital deployment and limited competition eventually leads to intense competition and resulting loss in pricing power. The company’s dominance faces threats from emerging competitors in both hardware and software realms. Additionally, US-China relations present significant uncertainties, with export restrictions changing frequently.

Capital Goods and Cyclicality

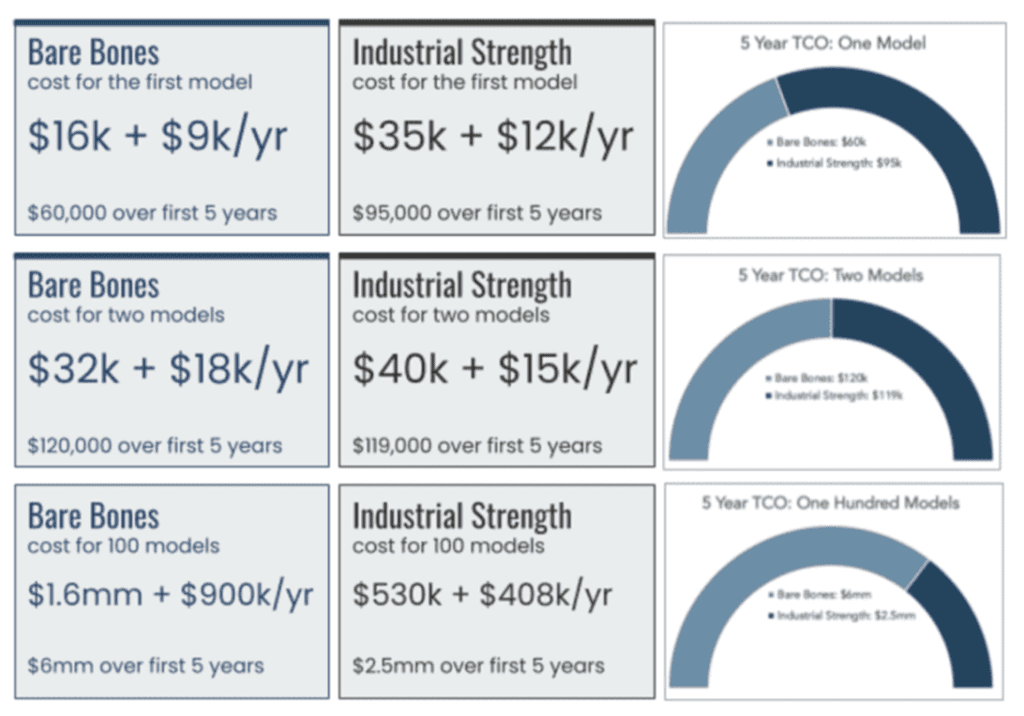

The capital goods market is cyclical, but how cyclical is the AI market? Signs point to a higher level than other high-capital spending industries, with the startup costs being unattainably high for those seeking an in-house approach. The most successful model, OpenAI’s ChatGPT, costs over $400 million annually in training alone. Utilizing a baseplate model that comes somewhat pre-trained or using a more limited training set will still be a capital-intensive investment before it becomes useful.

Innovation and technological advancement attract early adopters looking for a competitive advantage. During the first cycle of new technology, as businesses explore its potential, significant capital deployment is expended to find a footing and use cases. This stage is characterized by limited competition, granting huge pricing power to firms in the market. However, once competition begins, pricing power collapses as a saturated market means lower prices and fewer sales.

Over time, the novelty wears off, and efficient use cases are explored. This results in far more information for firms, with the cost-benefit of investing in AI being easier; firms that find themselves in a situation where AI has limited marginal utility will divest and move on. With other capital goods, this typically results in a bust characterized by a short-term revenue decline and then revenue stabilization for the capital good provider.

This trend in adoption can already be seen, with 2023 being the “year of generative AI.” However, there is already a significant gulf in thinking. Typical firms are struggling to find where AI fits into current strategic goals, seeing it more as a bolt-on product rather than something they wish to scale to a significant degree.

The History

The parallel to Cisco (CSCO) is obvious, with CSCO’s dominance in internet switching and routing propelling it to the top of its peers during the late 90s. This period was characterized by high capital expenditure and rapid internet infrastructure expansion. The competition was few and far between for CSCO, and everyone saw the internet as a huge revenue and economic growth catalyst. This allowed CSCO to exercise significant pricing power and gain a dominant market share globally. CSCO’s price grew dramatically from 1996 to its peak in March of 200 by almost 3,300%, with revenues increasing by 498% over the same period.

Eventually, though, the dot-com bubble burst. CSCO didn’t experience a catastrophic revenue loss or lose out on market share. However, a slowdown in new orders drove its 83% collapse as companies ceased buying at the pace they had been. This was enough to temper the massive revenue growth expected by investors, leading to a huge stock sell-off.

While NVDA differs from CSCO, it demonstrates the cyclical nature of capital goods and investment in new technology. The capital goods market is inherently cyclical. When a new product launches, a significant uptick in adoption occurs during the first cycle of a new technology as businesses explore its potential.

The Reality

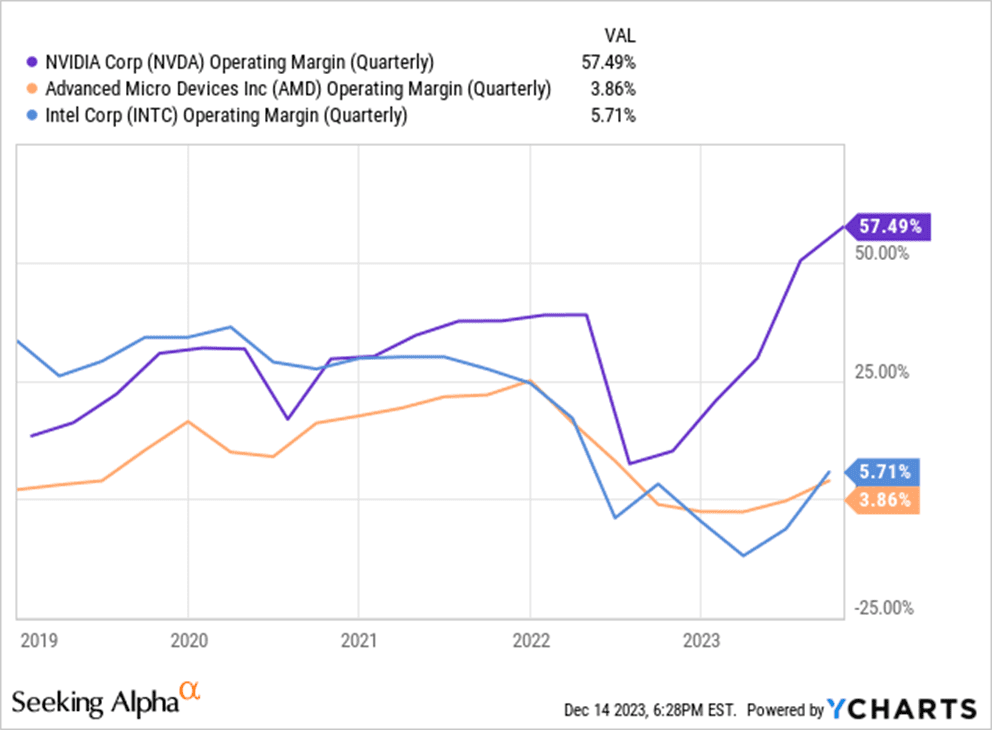

NVDA has had a huge first-mover advantage, with AMD restructuring for most of the last decade and INTC struggling to get out from under its huge OpEx budget. As a result, NVDA has dominated both hardware and software markets with CUDA and DGX Cloud software and the A100 and L40 chips. These products have made it the top data center player, with 91% of all enterprise GPU tasks done with NVDA products.

With massive margin expansion captured by NVDA and a total addressable market potentially seeing 47.5% CAGR to $1 trillion by 2030, the market is ripe for entry by competitors.

Advanced Micro Devices (AMD) continues to invest heavily into ROCm and HIP as software competitors, and the MIx series could be a cheaper competitor to the A100 chip. Intel (INTC) is still behind in hardware with its GPU Max series, but its OpenCL and XLA software have proven to be viable software competitors. We believe that AMD and INTC are still behind in the short term; the medium-term horizon is more uncertain, especially for hardware.

Outside of traditional competitors, Amazon has announced its in-house chip, Google has had one since 2016 in the form of its TPU, and Microsoft announced one just a week before Amazon. Since 80% of NVDA revenue comes from data centers, losing out on even part of the massive MAMAA (Meta, Amazon, Microsoft, Alphabet, Apple) customer base would seriously impact the top line.

The rapid technological advancements in software have allowed huge advancements in AI very quickly on the same hardware. The current focus of the hardware market is maximizing generalized chip production for a diverse range of workloads. Hardware specialization will inevitably be sought as the software process of model building is streamlined, which could significantly lower the barrier to entry for other, more specialized OEMs like Broadcom (AVGO).

A good company with good products can have its dominance eroded simply by no longer being the only player in the market.

The China Problem

Unlike its previous revenue boost from crypto mining, US regulators are more keen to pump the brakes on sales expansion to strategic adversaries. Currently, 65% of revenue comes from outside the United States, with 22% from China. The defense implications are obvious for AI, and NVDA now finds itself as a piece on the chessboard of US-China relations.

There was a surge in purchases from Chinese companies just before the Department of Commerce imposed export restrictions. Baidu, ByteDance, Tencent, and Alibaba have all made orders totaling $1 billion for the A800 chip, with $4 billion in orders for other GPU units in the months preceding export restrictions. This has led to significant overbuying and stockpiling of reserves in China, with Tencent stating that it has enough stockpiles for a few more generations of AI models – or about 18 months.

Initially, export restrictions were to take effect from 30 days past October 17, 2023. However, the timeline accelerated to October 20. As of the time of writing, it is unclear why the timeline sped up. Currently, the A100, H100, A800, H800, and L40S chips are affected – chips that make up the groundwork for most AI research. The A800 and H800 chips are export-specific designs purposefully built to comply with previous restrictions. Already, NVDA has submitted new designs for review by the Commerce Department. However, the Chinese development of an internal competitor will likely be accelerated on a secular basis.

This is not the first time – and it will not be the last – that NVDA has faced sudden export restrictions on its products. In August, NVDA was served with a similar letter of intent for restricting sales to certain unnamed Middle Eastern countries.

Despite its small size, Singapore makes up around 60% of Asian data center capacity and 15% of NVDA revenue. Singapore is the wild card, with a massive mix of companies worldwide operating 42 data centers. While specifics are difficult to nail down, some of these will undoubtedly fall under export restrictions for Chinese ownership.

Given that a large portion of revenue comes from outside the United States, this new position as a piece on the geopolitical chessboard is a bad place for a company with massive international growth prospects.

Outlook

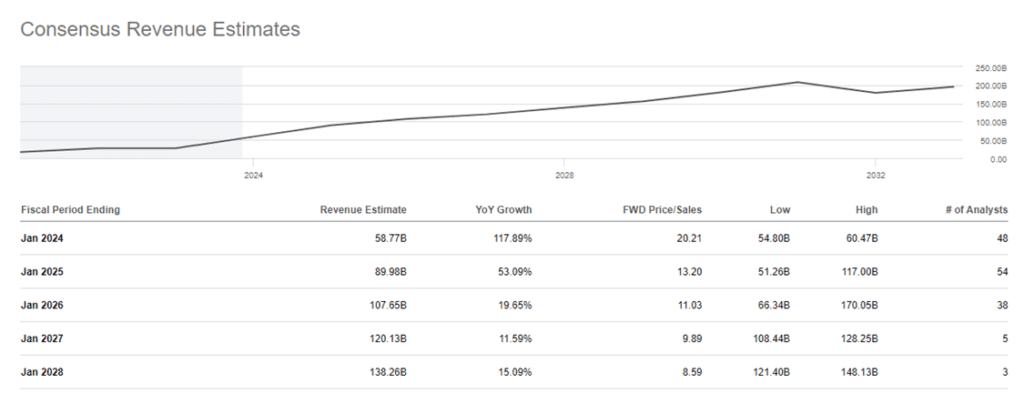

In conclusion, NVDA’s performance in calendar 2023 has been nothing short of stellar, driven by its dominance in the AI sector. The company’s success story is tempered by the inherent cyclicality of the capital goods market and the rapidly evolving regulatory landscape. NVDA’s current market position, bolstered by its first-mover advantage, faces potential challenges from both emerging competitors and the shifting sands of international trade regulations. Current SeekingAlpha consensus predicts continued revenue growth of 53% through calendar 2024, with indefinite mid-teens growth after that. We believe that this is overly optimistic. We expect revenues to peak sometime in 2024 followed by a modest decline into 2025 and then stabilization thereafter. Over the long-term, we expect continued cyclical growth. This would align it with typical technology build-out cycles.

Additionally, on a value basis, NVDA is currently much higher than its sector or its peers. Given NVDA’s dominance in the market thus far, trading at a premium is expected. However, it has surpassed what is reasonable for its secular cyclical growth.

NVDA is a great company with an excellent product line. However, the parallel to the dot-com era’s run-up, active export controls, and cyclicality of capital goods make us wary of calling it a worthwhile buy at this elevated price. We believe caution is the best way forward and we would be selling or trimming positions.

Competitive Comparisons