Civitas CIVI Permian Pivot Yields Massive 9% Dividend Yield

| Price $69.72 | Core Holding | December 20, 2023 |

- 2.9% Base Yield, paying out 50% of average TTM quarterly Free Cash Flow as a variable dividend.

- 582k acres in low-cost basins in the US, expecting to have 280 Mboe/d in production by the end of 2023.

- Total 2024 production is expected to increase significantly, with quarterly production growing by at least 16% to 325 Mboe/d (thousands of barrels of oil equivalent per day).

- Entered the oil-rich Permian basin, significantly increasing its production targets by 101 Mboe/d in 2023 and 168 Mboe/d in 2024.

- These recent acquisitions are expected to surge earnings above $15/share in 2024, with 2024 guidance pointing to $1.8 billion in free cash flow.

- OPEC+ production cuts and Mideast uncertainty could put upward pressure on pricing, bringing WTI oil back to the $80/bbl area.

- Strong balance sheet, targeting a debt-to-EBITDA ratio of 0.9x by the end of fiscal 2024.

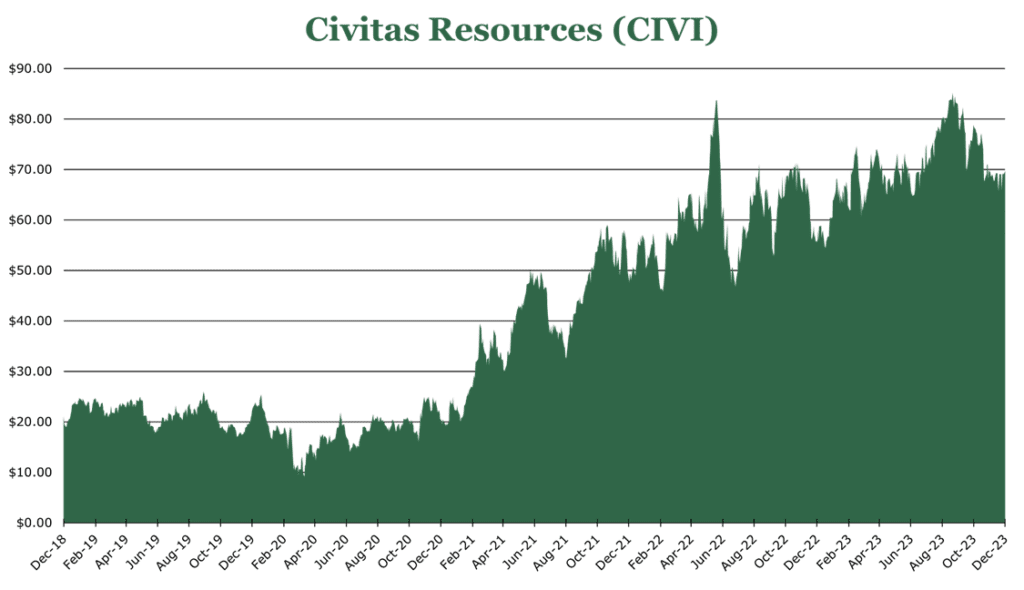

- 15.6% pullback from its $82.63 high is an attractive entry point in our opinion.

Investment Thesis

Civitas Resources (CIVI) was formed through the merger of Bonanza Creek and Extraction Oil and Gas. Operating 582k acres in some of the lowest-cost basins in the United States, CIVI has a strong financial position even with depressed pricing for oil and gas.

With a slew of accretive acquisitions under its belt for 2023, we expect earnings to surge north of $15/share in 2024. The stock pays out a very attractive dividend, with a base of 2.88% and 50% of the average trailing twelve-month quarterly FCF (free cash flow) as a variable, putting the full yield at 9.1%. On top of this, the stock has pulled back 15.6% from its $82.63 high, making it an attractive entry point.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $16.0 X 6.9 = $109.85

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.1 | 1.0 | 1.0 |

| Price-to-Earnings | 6.8 | 4.3 | 4.1 |

Market Conditions and Overview

Historically, oil and gas companies with high price realizations and lots of cash flow invested heavily in new development utilizing lots of leverage. The past down cycles bankrupted many and made the survivors more conservative. Hence, there is insufficient capital for development, meaning supply will not overshoot demand. In our view, this will result in more consistent pricing, which makes the industry less boom-bust. This has the added benefit of dividends being higher than historical payouts.

On a secular basis, Natural Gas consumption in all forms is expected to increase globally over 2023-2030 by around 15%. However, the magnitude of the change is highly dependent on several factors. The two primary factors are the price of low-carbon alternatives and current oil prices. If current oil prices stay low, the intermediate jump from oil to natural gas could be unfavorable. Additionally, if mineral pricing or production costs become cheaper for low-carbon alternatives, it could significantly change the economics of the energy transition.

The US is the global leader in LNG exports, accounting for 34% of all spot traffic. US LNG exports are estimated to increase to 10 tcf per year (Trillion cubic feet), or a 152% increase by 2050. US domestic consumption is expected to remain consistent at around 3.2 Tcf per year, depending on weather conditions and energy transition costs.

| International Energy Agency, Price projections | 2022 Actual Average Price ($/MMBtu) | E2030 Natural Gas Price, Currently Stated Policy Goals ($/MMBtu) | E2030 Natural Gas Price, Currently Implemented Policy ($/MMBtu) |

| United States | 5.1 | $3.2 | $4.0 |

| European Union | 32.3 | $6.5 | $6.9 |

| China | 13.7 | $7.8 | $8.4 |

| Japan | 15.9 | $8.3 | $9.4 |

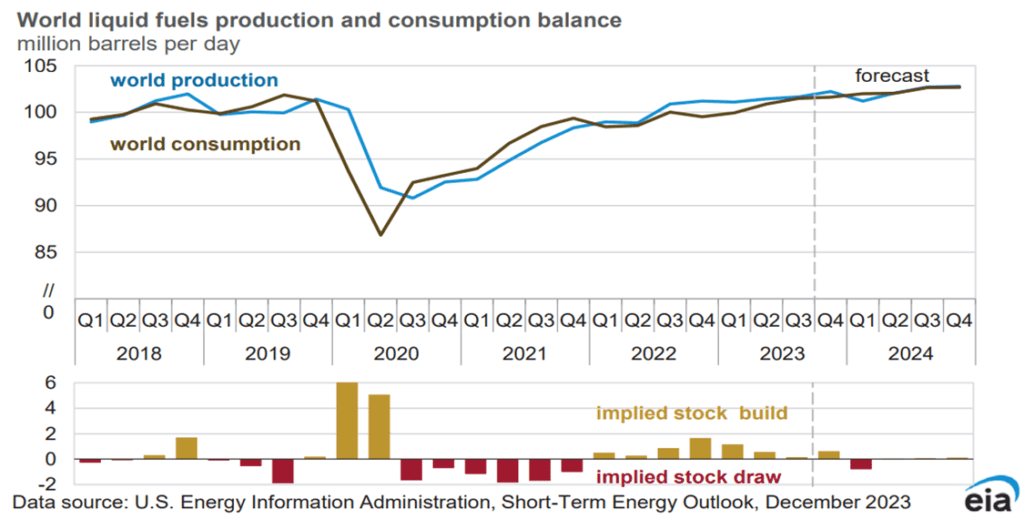

In the short term, the EIA predicts that 2024 will have one of the lowest production years for oil since before the pandemic, which should provide some upward pressure on prices. On a long-term secular basis, global oil consumption will likely peak by 2030, but supply constraints should in our opinion prevent a price collapse.

| International Energy Agency, Price projections | 2022 Actual Average Price ($/bbl) | E2030 Oil Price, Currently Stated Policy Goals ($/bbl) | E2030 Oil Price, Currently Implemented Policy ($/bbl) |

| Global | $98 | $74 | $85 |

While global pricing has come down significantly from its 2022 highs, the short-term reduction was largely due to a weak economic outlook and a lagging recovery in China. However, these factors are dissipating quickly, with Chinese GDP moving up quicker than expected, OPEC+ pledging further production cuts, and a “soft landing” looking possible.

Bolt-On Acquisition and Expansion in Permian

In June of 2023, Civitas entered the Permian basin for the first time by acquiring two companies from NGP Energy Capital Management for $4.7 billion. In October 2023, it added Vencer Energy’s $2.1 billion in assets to the portfolio, further expanding the Permian position going into fiscal 2024.

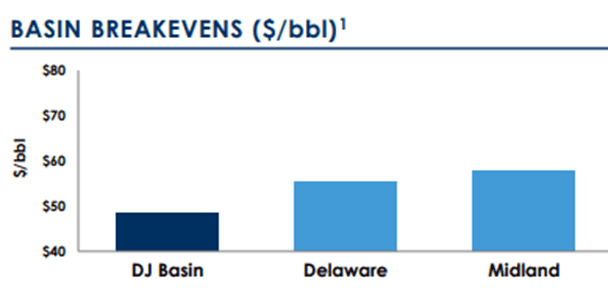

These acquisitions add 101 Mboe/d (Thousands of barrels of oils per day equivalent) at a 50% oil and 50% natural gas mix in 2023. This will grow to approximately 160 Mboe/d in 2024 once the Vencer transaction is closed on January 1st. The acquisitions include 1200 locations deemed economical to develop and 640 locations with an estimated IRR of >40% at $70/bbl and $3.5/MMBtu. This effectively doubles CIVI’s footprint. The average per-foot cost of the well is between $850-1000/ft, which is in line with competitors.

Both acquisitions are expected to be free cash accretive in fiscal 2024, adding approximately 40% to free cash flow per share if oil prices return to the $80/bbl neighborhood. This would bring full company free cash flow to around $1.8 billion.

In recent months, US oil and gas has been undergoing significant consolidation. This appears to be companies looking for the best acreage now that prices are depressed and speculative money has dried up. Depressed prices have led to private operators and smaller public firms looking to leave an industry that increasingly relies on scale for profitability and efficiency. CIVI has not stated if it will continue to acquire in the Permian or elsewhere. Still, the two acquisitions it has engaged in will be accretive in year one and will not saddle debt onto the balance sheet, making further acquisitions of the same financial profile attractive.

DJ Basin

Previously, CIVI was a DJ basin pure player and the largest in the area. Current production is 168 Mboe/d, with a 48% oil mix. Per well drilling costs are around $700/ft, making it one of the lowest-cost basins in the United States.

The current DJ basin profile has become less attractive as prices have slumped, but half of CIVI’s 1000 locations still have an IRR of >40%. Part of the favorable economics of the basin is the higher concentrations of natural gas liquids than in other locations. NGLs (Natural Gas Liquids) include several high-value products for industrial use, like Ethane as a feedstock for plastics.

Full Profile

Current production numbers in the quarter ending September are 235 Mboe/d. Production expects a slight ramp to 280 Mboe/d toward the end of the year as $60 million in additional capital is deployed to finalize existing expansion before the Vencer acquisition is finalized.

Costs have been going down for CIVI at the wellhead, with new laterals coming in at 10% below the previous cost estimates, and company records are being set for speed. Current OpEx is $30.33/boe for the whole company or around $14.01/boe in sustaining costs (excludes depreciation, acquisitions, and exploration). The current realized price is $46.26/boe, including derivatives. This significant financial moat makes CIVI attractive, even with depressed oil and gas prices.

| September Quarter | Average Realized Price (Including Derivatives) | Year over Year % change in volume | As a % of sales volume (boe) |

| Oil ($/bbl) | $77.24 | 45% | 48% |

| Natural Gas ($/Mcf) | $2.13 | 28% | 30% |

| Natural Gas Liquids ($/bbl) | $22.85 | 20% | 22% |

Including acquisitions, around 30% of production is hedged through early 2025, allowing CIVI to take advantage of positive price fluctuations. Current estimates put an average realized price in fiscal 2024 at just below $80/bbl for WTI oil and $3.5 for NYMEX gas.

Risk

Given the mild start to winter, there has been a revision to pricing forecasts for natural gas. This has resulted in excess storage, with the EIA estimating the winter will end with storage being 22% higher than the 5-year average for natural gas. However, consumption is not expected to deviate from the 5-year average. A major concern with the high level of investment in the LNG area is a supply glut. The war in Ukraine has cut Russian gas to Europe, meaning Europe has to buy higher-priced LNG from the United States. A significant de-escalation in relations between Europe and Russia, coupled with the massive investment in LNGs in the US, could lead to a significant global supply glut.

As for oil, over the short term, a weak global economic outlook and higher US supply have depressed prices. OPEC+ has announced further production cuts of around 2.2 million barrels per day. Still, there is pessimism on whether or not the economies of constituent nations can afford to cut by the stated amount. Total inventories are on the bottom end of the 5-year average, and the Strategic Petroleum Reserve is still approximately 250 million barrels below its typical level.

Recent increases in attacks in the Gulf of Aden and the Red Sea have caused some shipping companies to take the drastic step of forbidding traffic in the region. Nearly 12% of all global maritime traffic flows through this area. While this may adversely impact US LNG exports to Asia as LNG loads shift from Europe to Asia, it should help with US LNG exports and put upward pressure on oil prices.

Outlook

Total 2024 production is expected to increase significantly, with quarterly production growing by at least 16% to 325 Mboe/d (thousands of barrels of oil equivalent per day). Drilling and completion costs will go up as operations in the Permian begin to ramp, with guidance pointing to about $2.1 billion for 2024 across the whole company. These costs will be about 55% for the Permian and 45% for the DJ Basin.

We expect earnings to come in north of $15/share for full 2024, or a 60% increase compared to 2023. The expected free cash flow for fiscal 2024 is $1.8 billion, implying an average realized price of $80/bbl and $3.5/MMbtu, which we believe is reachable. Free cash return priorities are attractive, with 50% of the average trailing twelve-month quarterly FCF paid out as a variable dividend. The base dividend pays out $0.50 per share or 2.9%. The variable dividend for the December quarter will be $1.09 per share, bringing the total yield to 9.1%. Management states they expect to increase the dividend by around 10% in 2024 with current pricing, leaving the door open for further increases if pricing recovers more favorably.

Even with the addition of Permian assets, by the end of fiscal 2024, CIVI projects it will be down to 0.9x debt-to-EBITDA. The current long-term leverage target is 0.75x. To strengthen the balance sheet, $300 million in non-core asset sales will be sold to pay off debt.

Civitas presents a compelling value case for the dividend-oriented investor in our opinion. Its acquisitions in the Permian basin position it for substantial growth in production and free cash flow. The company’s historically strong management, demonstrated by its low debt levels and strong dividend, add to the fundamentals and balance sheet.

Competitive Comparisons