BTG’s Golden Horizons with Growth Footing

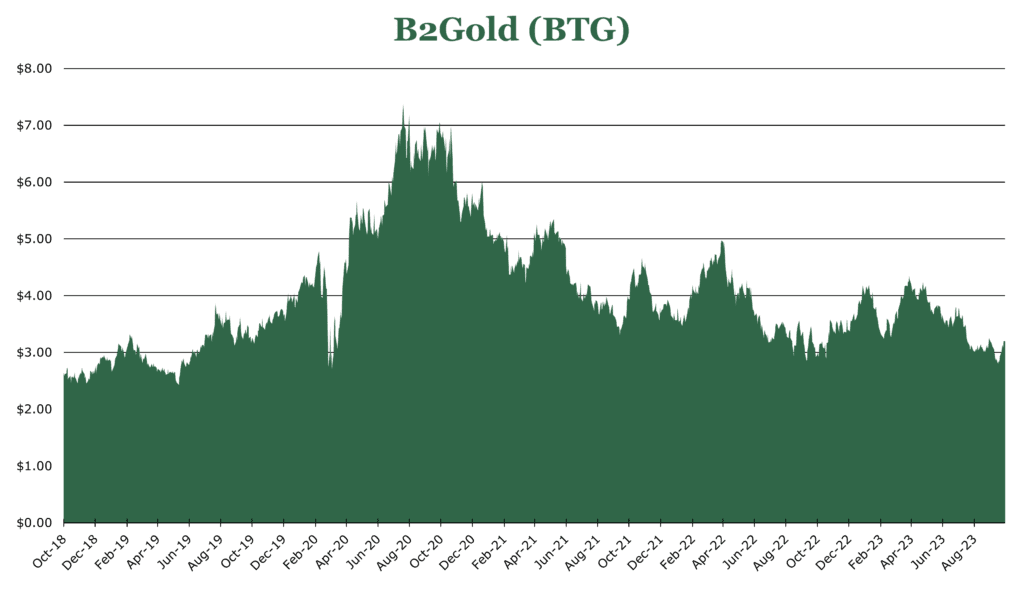

| Price $3.30 | Dividend Holding | October 18, 2023 |

- 5.0% dividend yield, strong cash position with significant investments in expansion.

- Major international events are unfolding, putting upward pressure on gold prices.

- Back River mine nearing completion, with first production expected in 1Q25.

- Potential small development in Gramalote, with BTG acquiring 100% interest. Greenfield exploration is underway in Finland with positive results.

- BTG telegraphing ongoing negotiations with the Malian government are going positively, with no expected impact on operations despite new laws

Investment Thesis

Buy2Gold (BTG) is a globalized gold-mining company, operating several low-cost mines and several exploratory digs on almost every continent. BTG is a cash-rich power player in the low AISC (All In Sustaining Cost) mining world and still maintains an attractive valuation.

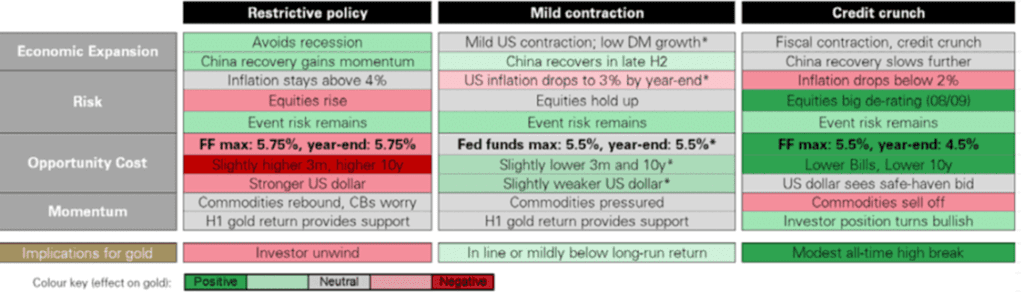

You can read more about the broader macro forces on gold in our overview article here. Gold is a finite resource and a historically solid hedge against inflation. It holds high intrinsic value across economies and cultures. The current global situation is uncertain, but gold has a strong potential to surpass its all-time high price of $2074.88/oz.

With the Back River mine expecting initial production on schedule in 1Q25, repositioning toward growth, and a stronger-than-ever financial position, the stock remains an attractive value at its current price.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $0.34 X 17.1 = $5.81

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 2.3 | 2.0 | 2.3 |

| Price-to-Earnings | 11.1 | 8.0 | 14.7 |

Operations

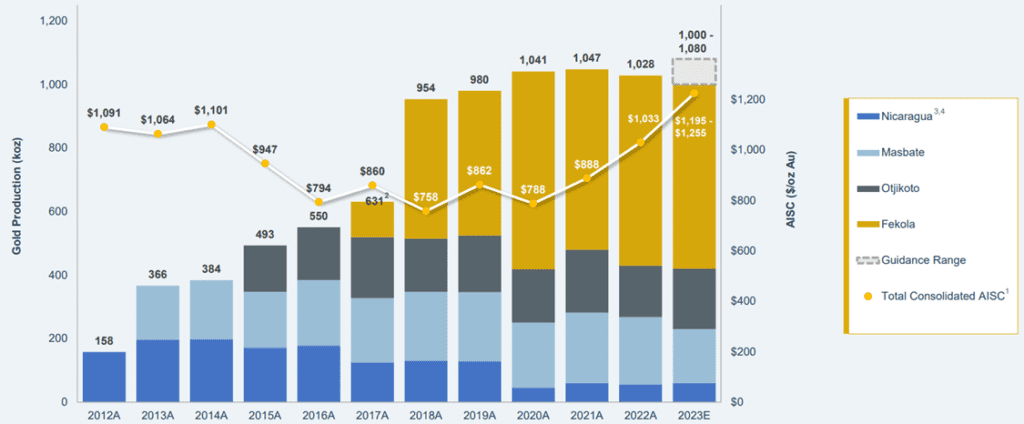

58% of output is from the Fekola Mine in Mali, 19% from the Otjikoto Mine in Namibia, 17% from Masbate in the Philippines, and 6% from royalties from the Calibre project.

BTG expects Otijikoto’s results to be better in the second half of the year and Fekola’s results to be worse – evening out aggregate results. Expenses across the company increased during 1H23, up 34% year over year. BTG states that this was a culmination of upgrading the fleet, acquisition costs, increased fuel costs, and new stripping at Fekola to replace reserves. However, operating income increased by 50% year over year thanks to favorable gold pricing.

| Mine | Fekola | Otjikoto | Masbate |

| Location | Mali | Namibia | Philippines |

| Production (2023E, Koz) | 580-610 | 190-210 | 170-190 |

| All In Sustaining Cost (Upper Estimate, $/Oz) | $1,145 | $1,140 | $1,430 |

Shift to Growth Footing

The largest project, and the closest to completion, is the Back River Gold District in Nunavut, Canada. The total cost of the project is $600 million in capex in total, of which $400 million has already been invested. There is significant local support for the mine in a geographically stable region of the world. Initial production is expected to be in 1Q25, with an average annual production of 223 kOz and a 15-year asset life.

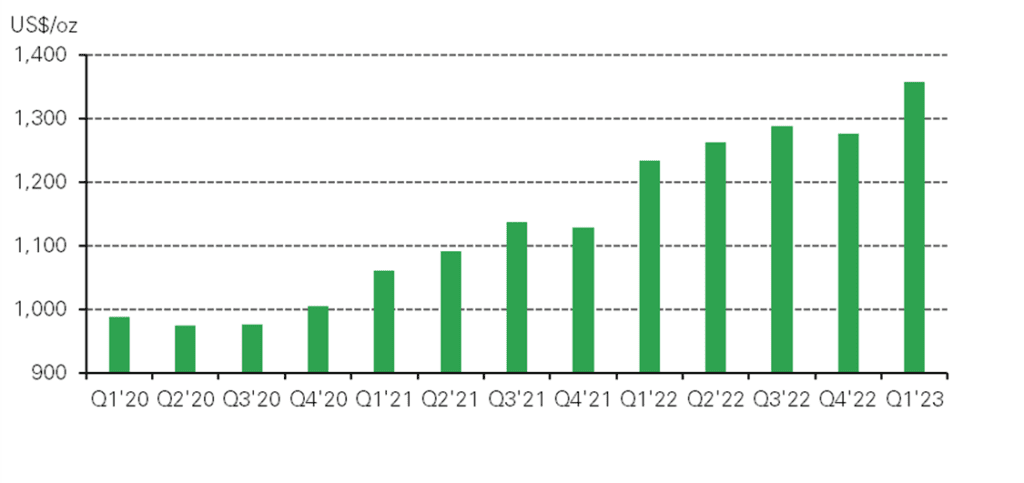

All-in-sustaining costs for the project are expected to be $775/oz, provided exchange rates stay similar to what they are now, and the IRR of the project is expected to be close to 30%. This would make the location far below the global average of around $1276/oz and continue with BTG’s strategy of high-quality, low-cost mines.

Outside of Back River, there is greenfield exploration underway in Finland. Early boreholes indicate high-gold grade, with additional testing to be done in 2H23. While it is too early to speculate on costs or output, BTG owns 70% operating interest in the land.

In September 2023, BTG acquired the full 100% interest in Gramalote. In 2022, BTG telegraphed that the JV between itself and AngloGold would be put up for sale, but it appears the course has been reversed. Originally, both companies stated that the return for the project at the scale it was initially envisioned was not worth the inputs required. As of October 2023, company materials still indicate that the development is paused pending review. BTG’s assessment of the project will be completed in 2Q24, and we expect a smaller project to come to fruition now that 100% interest from production can be realized.

Risk

The main risk facing BTG at the present moment is the ongoing coup and ECOWAS response in Niger. The Malian government has thrown its weight behind the Niger Junta, joining Burkina Faso. The Fekola mine in Mali makes up 58% of BTG production, and the closure of the mine, even for a short term amid ongoing conflict, would be devastating for BTG’s production. ECOWAS has previously sanctioned Mali, but BTG claimed no impact on production due to this.

Reuters reports that the current government of Mali is ramping up state share in mining in the country in an effort to boost GDP, which added to the geopolitical downdraft on price. BTG indicates that so far, negotiations are successful, and they have a good relationship with the government in Mali. The SVP stated that the Malian government considers BTG their success story, so we feel it is unlikely that relations between the two would sour in a way meaningful to production.

Outlook

BTG has a strong liquidity position with $506 million in cash on hand and no net debt. This cash on hand is to be used for expansion and dividends, which currently yield 5.0%. BTG has stated that it will utilize its free cash position for expansion and development while maintaining the current dividend level.

BTG expects to output 1,000koz in FY23, averaging an AISC of $1195-$1255/oz. According to the World Gold Council, AISC is trending upwards, with the global average now north of $1,300/oz with an average increase of 10% year over year.

This low AISC has driven BTG’s sector’s high EBITDA margin of 54.81%, allowing it to maintain its high dividend while also focusing on a more expansionary footing.

Over the short term, we do not expect operations to meaningfully change. However, the opening of new expansion in Canada in 2025 and indications that the Gramalote project may not be completely bust make the stock look attractive over the longer term, especially if negotiations in Mali continue on their current upward trend.

Competitive Comparisons