Automotive Drives Solid Revenue Base for HIMX

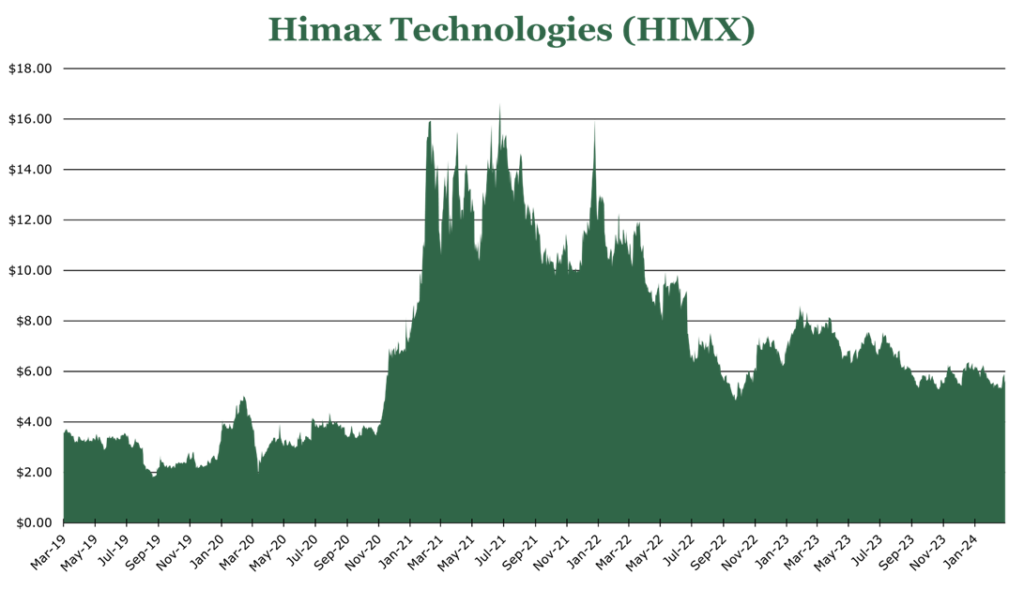

| Price $10.02 | Dividend Holding | March 6, 2025 |

- 3.0% Yield.

- HIMX’s automotive display-driver sales increase just under 20% year over year, now representing around 50% of global market share.

- Invested in partner FOCI, seeking to accelerate development of CPO (co-packaged optics) to improve efficiency in data transmission within datacenters.

- Continued partnership with “leading AR (augmented reality) partner” in creating new consumer AR wearables device.

- Computer vision partnership with NVDA (Nvidia), allowing HIMX’s technology to be plug-and-play with NVDA software.

Investment Thesis

Himax Technologies (HIMX) is a semi-fabless semiconductor design and manufacturing firm specializing in optical and driver components for displays and sensors. HIMX holds a significant market share in the display technology sector, holding 50% of the automotive display market share, and 7% of global display driver market share.

A key development during 2024 was the rapid acceleration of automotive display-driver sales, growing just under 20% year over year and becoming 50% of company-wide revenues. While much of the acceleration was due to Chinese stimulus, we believe HIMX has strong relationships with automotive OEMs that will allow it to continue to take market share once a broad global recovery occurs. HIMX also has highlighted its partnerships and advances within the CPO (co-packaged optics) to improve efficiency in server-to-server and chip-to-chip communications in AI-focused datacenters.

Despite a small 4.1% decline in company-wide revenues, continued cost-cutting measures and a better mix of high-margin automotive products boosted gross margin by 260bps. We expect a slight dividend increase given the improvement in margins. In the short term, we believe that HIMX is a strong dividend stock for those seeking more stable exposure to the EV (Electrical Vehicle) and AI markets. Over the long term, we believe that HIMX has several compelling avenues for growth.

Estimated Fair Value

The entire industry has been hard-hit by the contraction in consumer spending on durables and on a slow Chinese recovery. In our view, there is no reason why HIMX won’t see earnings recovery once the cycle turns over. Additionally, new product launches and accelerating domination in automotive will drive earnings growth over the medium term.

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E27 EPS X P/E = $1.50 X 12.0x = $18.00

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.8 | 1.5 | 1.2 |

| Price-to-Earnings | 22.4 | 11.2 | 10.0 |

Display Drivers

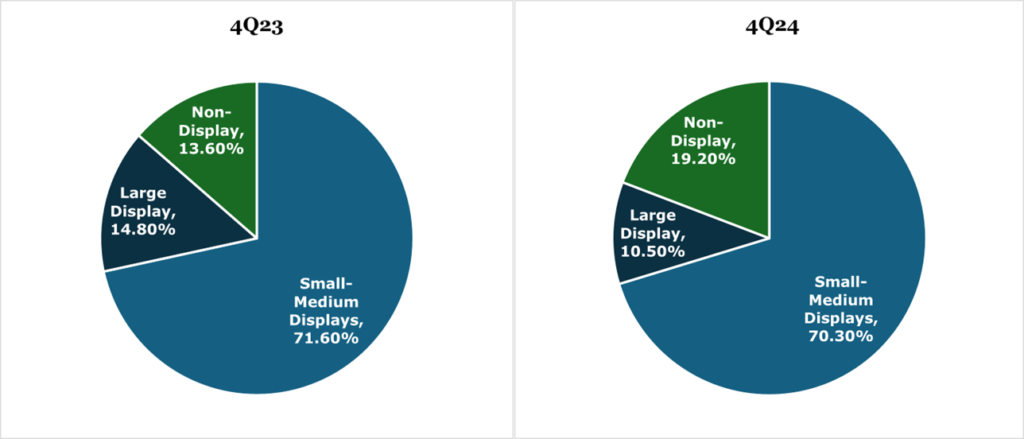

The core of HIMX’s business is display driver chips for OEMs. These come in the form of DDIC (display driver integrated circuits) and TDDI (touch and display driver integration). HIMX is a dominant provider of TDDI (touch and display driver integration), and outside of Apple devices it is the leading supplier globally. In our last coverage, we pointed out that TDDI demand within the smartphone market was likely to fall short of expectations, though alternative uses like automotive and touch-screen laptops would likely more than offset this. HIMX has revised its 2025 global smartphone demand expectation down by 9.4%. For the full year 2024, the company-wide TTDI and DDIC sales performed flat year- over year. However, the end-customer group shifted significantly toward automotive.

In 2024, automotive end use sales increased just short of 20% year over year, driven by TDDI adoption in new flagship vehicles, with continued DDIC demand. Despite TDDI replacing the more mature DDIC market in center consoles, HIMX reported it still had slight growth in the DDIC market and expects continued sales of DDIC drivers into the long-term given their place as gauge clusters, heads-up-display applications, or other vehicle panels that do not require touch capability.

Combined, automotive end customers now represent 50% of total revenues, a 500bps increase compared to our last coverage. Additionally, HIMX grew its automotive display market share by approximately 10%, reaching 50% in the quarter ending December 2024.

The sales surprise in the automotive area was driven by rush orders from Chinese customers, thanks to government incentive programs for trade-ins. We expect a more moderate, but still leading, growth profile for 2025. Outside of automotive, the push toward AI-integration in increasingly thin devices poses power draw complications that could provide a boost to HIMX’s OLED business, which draw less power than traditional TDDI or DDIC displays.

Large display driver sales, typically used in TVs, declined 28.3% year over year. While large displays underperformed, we do expect some recovery in 2025 thanks to continued Chinese consumer stimulus. If consumer electronics continue to be integrated with artificial intelligence, we expect some additional demand tailwinds for HIMX’s low-power-consumption display driver products. The recovery in the large display market will hinge on continued US-consumer strength and a moderate Chinese recovery beginning to materialize by the end of 2025.

Non-Display Driver Technology

Over the trailing twelve months, non-display driver sales grew 10.6%, driven by strength in local dimming timing controllers traditionally used in high-end TVs and computer monitors, thanks to the previously mentioned Chinese consumer stimulus.

WLO (wafer-level optics) are tiny optical components that can be placed directly onto semiconductor wafers, allowing high-precision small-footprint sensors. Last year, HIMX highlighted that it continued to see interest from OEMs in AR/VR (augmented reality / virtual reality) devices, as well as facial recognition.

We previously discussed WiseEye AI-sensing, Ultralow Power CMOS image sensor (CIS), as well as LCoS displays (liquid crystal on silicon) as potential breakout products within AR and VR applications. Despite HIMX’s leadership in the area, demand has not materialized in VR applications as expected. However, we believe that HIMX has excellent products in these areas but the market failed to develop.

Flagship firms are now launching AR wearables, with HIMX highlighting it is continuing to work with a ‘leading AR player’ for developing a wearable AR product. If AR products become mainstream in a way VR didn’t, HIMX could establish a dominant market presence in the area, given it is one of the few companies capable of a mass-market run of these specialized components.

Outside of AR, computer-vision products continue to develop and find a niche. In China, facial recognition for payment and keyless entry are already common. Outside of China, facial recognition for entry into personal electronics like laptops is becoming more common, with HIMX calling Dell a key partner in this area. As computer vision continues to develop, we expect some acceleration over the longer-term, with NVDA including WiseEye as a plug-and-play option for its TAO AI toolkit.

We believe that HIMX is well positioned to become a leader in N/CPO (near/co-packaged optics). With the rise of computing workloads that require ever higher bandwidth, like AI training, traditional copper interconnects have become a bottleneck because of their limited capacity for data transfer and the heat they generate.

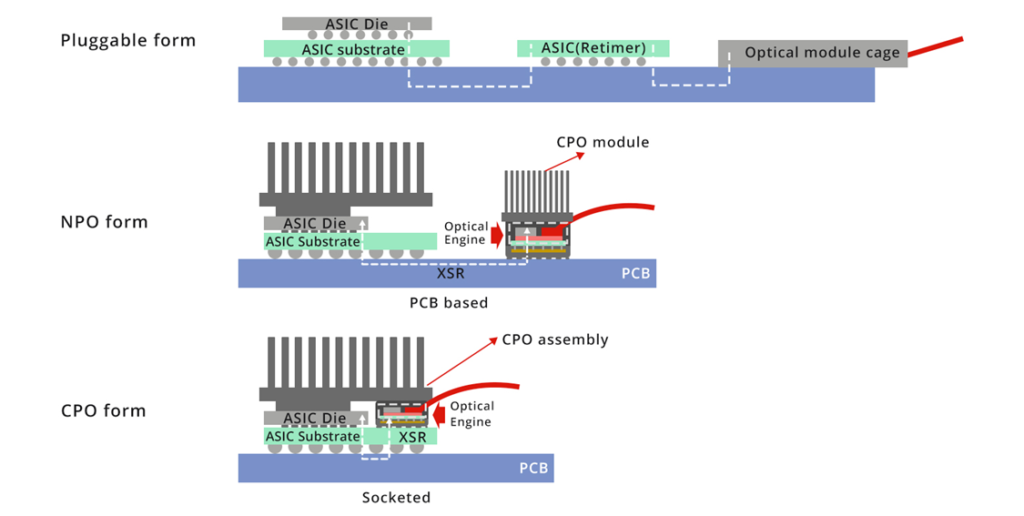

A temporary solution has been LPO (linear pluggable optics), where an optical module is plugged into a standard copper port. It converts the copper-carried electrical signals into light that travels through fiber optics. But this involves multiple signal conversions, which creates heat and can create data loss.

NPO and CPO put the optical engine and the chip together. This reduces the distance electrical signals must travel, which reduces heat generated, enhances speed, and reduces power requirements.

TSMC, NVDA, and MSFT are all confirmed to be actively pursuing CPO, with most large-scale data center providers like Amazon’s AWS offering pluggable form options to customers. During 2024, HIMX acquired a 5.3% stake in FOCI, a leading fiber-optic firm in order to continue developing a CPO solution with ‘leading AI semiconductor companies and foundry’. HIMX already has working relationships with TSMC and NVDA, and it is likely they will be major partners of HIMX’s CPO program. As of the year ending December 2024, the first CPO generation is in limited production, and management has indicated there is large OEM interest. For 2025, we expect that all CPO production during the year will be samples and validation, with management guiding toward mass production in 2026.

LCoS and WLO are the only areas in which HIMX is not fabless. Even if it does not take market share with its own products in these areas, it has the facilities for two manufacturing lines, amounting to 34,000 8″ wafers per month, or 50 million annual components for mobile imaging lenses. Though, given HIMX is ahead of the market in these areas, we expect it will be able to hold first mover advantage if these products become more mainstream.

Risk

A significant portion of HIMX products is manufactured in China, with 73% of revenue realized in China. The new administration has been hostile in trade policy toward China, with the current universal tariff on Chinese goods being 20%. With the Chinese economy already weak, the prospect of a strong Chinese consumer and industrial recovery by the end of 2025 is uncertain.

We believe that HIMX does operate within a market with high barriers for entry. High barriers for entry allow HIMX to take significant market share early and gain a first-mover advantage, which can provide high margins initially, with a long-tail from licensing revenues. A disadvantage is that HIMX has undergone periods of high R&D on products that are ahead of the market, such as AR and computer vision, or products that never hit the mainstream like VR.

Financials

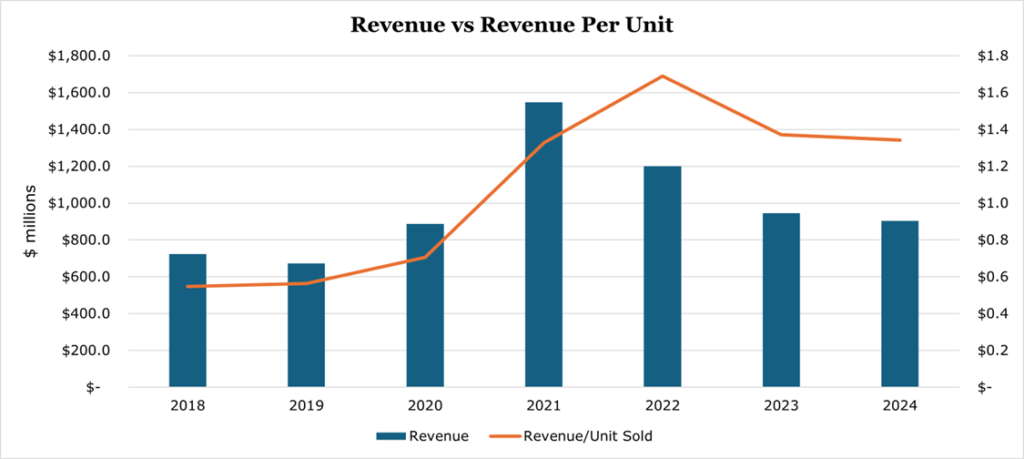

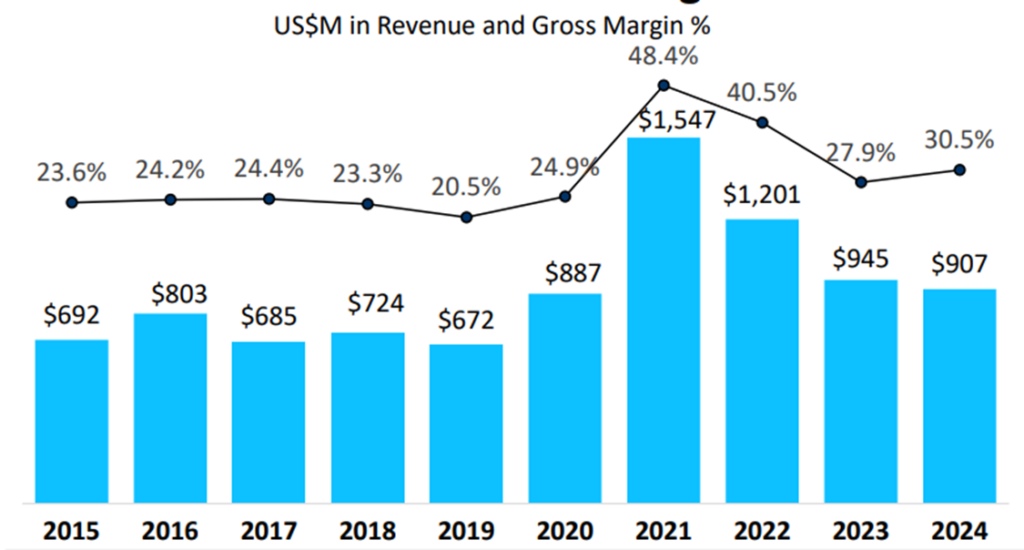

Overall, company revenue declined 4.1% year over year through year-end 2024, which was still ahead of guidance despite the decline. HIMX was buoyed by Chinese consumer stimulus, though management highlighted that their customers in the automotive area are geographically diversified. Since 2021, volume declines have outpaced ASP (average sales price). However, with a broad global market recovery, HIMX is well positioned to deliver high volumes of high-margin products.

Gross margins recovered slightly to 30.5% for the full year 2024, thanks to the continued cost-cutting campaign reducing operating expenses by 5.6%.

A critical component of the cost-cutting campaign was changing foundry agreements, including ‘diversifying’ sources. A long-term issue that could arise from a lack of committed volume is less discounting from foundries which could compress margins if availability is low like it was in 2021 and 2022. At this time, we believe that management’s conservatism surrounding the issue is likely for the best, given the unknown timeframe of Chinese consumer stimulus, tariffs, and the speed of uptake of new technologies. Over the medium-term, we expect the trend of margin recovery to continue, with management highlighting that automotive TDDIs have a higher per-unit margin than other more mature TDDIs and DDICs.

HIMX continues to deliver strong free cash flow, generating $102.9 million in 2024. Given the near-fabless nature of operations, we do not expect a meaningful increase in capital expenditure over the medium-term. HIMX currently pays out a dividend of 3.0%, paid once a year in July based on prior year profitability. In 2024, HIMX paid $0.29. Given 2024’s net income increased by 57.7% to $79.8 million, we expect a small increase in the dividend. HIMX has a net debt to EBITDA of 3.5x, which is on the high end of peers. However, given its strong free cash and $224.6 million cash position we do not see substantial balance sheet risk.

Conclusion

Despite a sales decline company wide, the automotive sector showed 10% growth in market share and 20% sales growth. We believe that high global new-auto inventories and consumers still apprehensive to buy durables has weighed down results. However, over the long-term, we believe that HIMX has planted itself within OEM’s value chain, which will provide a strong earnings boost once the cycle turns over. Outside of its typical display-driver space, HIMX has several potential growth opportunities in computer vision, AR, and in new data transfer technologies.

In our view, HIMX is a compelling dividend stock in the short term with a strong case for capital appreciation over the long term.

Peer Comparisons