Himax Positioned for Jump into AI and IoT

| Price $5.76 | Dividend Holding | March 11, 2024 |

- 4.2% Expected Dividend Yield for 2024.

- HIMX is expanding its product portfolio into non-display technologies, catering to emerging markets like AR/VR, AI, and IoT.

- HIMX’s strong partnerships with major automotive OEMs and its 40% market share in automotive displays position it well to capitalize on further digitization of car displays.

- While there are short-term challenges, the display and optical semiconductor market remains one with high margins and high barriers to entry.

Investment Thesis

Himax Technologies (HIMX) is a semi-fabless semiconductor design and manufacturing firm specializing in optical and driver components for displays and sensors. HIMX holds a significant market share in the display technology sector, holding some 40% of the automotive display market share and 8% of the total display driver market share.

Despite a decline in revenue and margins due to industry downturns, HIMX has maintained a strong free cash flow and a healthy dividend yield of 4.2%. The company’s efforts in inventory management and new agreements with fabs are expected to support its financial stability in the short term while waiting for the consumer upcycle. While short-term challenges persist, HIMX’s shift towards higher-margin products and potential growth in non-display technologies could lead to both a recovery and growth in earnings.

Estimated Fair Value

While HIMX has a lower margin than some peers, we believe that this is offset by better than peers’ EV/EBITDA and dividend yield. The entire industry has been hard-hit by the contraction in consumer spending, and in our view, there is no reason why HIMX won’t see earnings recovery once the cycle turns over. Additionally, new product launches and continued domination in automotive will drive earnings growth over the medium term.

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $0.49 X 13.8x = $6.76

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.09 | 0.96 | 0.94 |

| Price-to-Earnings | 33.8 | 13.8 | 10.4 |

Primary Business

The core of HIMX’s business is display driver chips for OEMs. These come in the form of DDIC (display driver integrated circuits) and TDDI (touch and display driver integration).

DDICs are used in everything with a screen. HIMX has a leading market share (#4 globally, 8%) in display driver electronics across OEMs. While this area is mature in innovation, the market has continued to grow at a steady pace with further consumer adoption of high-resolution TVs and auto OEM adoption of digitized dashboards. Growth in the DDIC area will be pushed forward by continued auto-growth and Chinese economic recovery. HIMX lists 8K and 4K display driver growth as a key item, as it provides high margins and has very high entry barriers for new competitors. Though, we feel that high consumer adoption of 8K and 4K TVs is still a few years off.

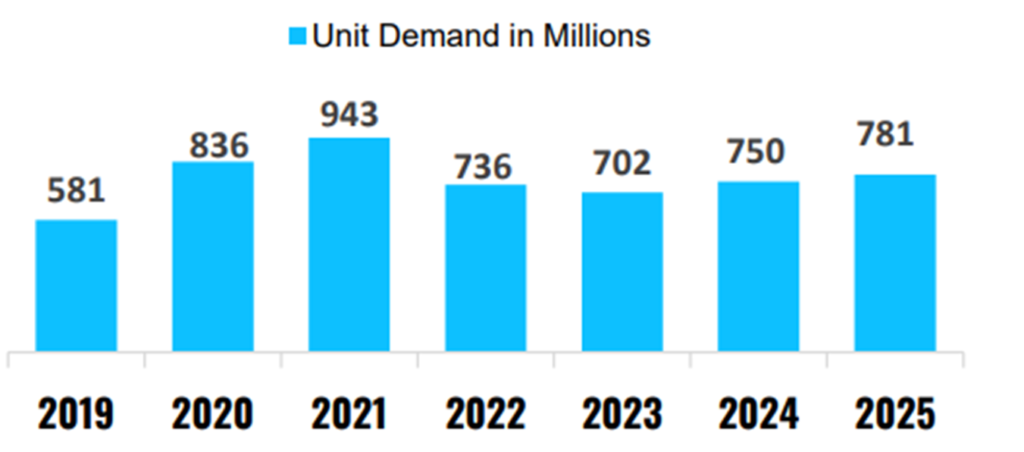

HIMX is a dominant provider of TDDI (touch and display driver integration), with a strong market share in the entry-to-mid-level smartphone and tablet market. TDDI has over 70% penetration in the entry-to-mid-level smartphone market and has rapidly replaced separate DDIC and touch drivers across touch-screen devices. TDDI demand in smartphones will likely decline going into 2024 and will be flat over the decade as existing TDDI drivers reach maturity.

However, we expect this decline to be made up by higher penetration in automotive and other consumer devices like laptops and appliances. HIMX states that it has collaborated with Chinese and Korean laptop screen makers, who are expecting a ramp-up in orders, with new generation device releases expected in the second half of 2024.

Currently, HIMX has a 40% market share for automotive displays and ongoing partnerships with Mercedes, Jaguar, BMW, and Hyundai. In the quarter ending December 2023, HIMX began the first mass production of LTDI (large touch and display driver integration) for next-generation EVs. LTDI technology is based on the existing TDDI area and, in our view, represents significantly increased value for HIMX as LTDI integration requires 6 or more chips per panel, compared to just one for typical TDDI displays. This one-panel design allows for a larger display without sacrificing resolution or interactivity.

In our view, the automotive area will likely be the strongest driver of growth in the display business area, with HIMX being well-equipped to capture the megatrend of bigger and more complicated displays in vehicles. Currently, displays make up 85.1% of total revenue, with automotive customers making up 45% of total revenue. Revenue from large displays declined 33.5% year over year, driven by the consumer downcycle and inventory control measures implemented by customers. The story was similar in small and medium displays, with year-over-year revenue declines reaching 19.2%. However, there was an over 50% surge in auto OEM uptake for TDDIs, which we expect to continue to accelerate over the medium term and replace declining DDIC demand in automotive.

For 2024, large drivers are expected to continue to decline, albeit at a slower pace. HIMX has stated that display OEMs have begun to reduce utilization in an effort to preserve profitability, which will reduce demand for HIMX DDICs. However, small and medium displays for both TDDI are expected to see a jump in results from an expected increase in premium laptop sales. Additionally, over the 2024-2025 timeframe, we expect there to be marginal increases in both DDIC and TDDI laptop displays as the replacement cycle from 2020 begins to reach maturity.

Non-Display Technology

WLO (wafer-level optics) are at the forefront of 3D sensing. Current products are largely centered around biometrics, infrared sensing, and use cases where cameras need to be tiny, such as medicine. The most prominent new use has been AR/VR (augmented reality / virtual reality) devices, where HIMX has secured a contract for 3D gesture control to a “leading North American customer for their next-generation VR Device.”

HIMX’s WiseEye and Ultralow Power CMOS image sensor (CIS) could be breakout products with the advent of AI and IoT computer vision. In a product called “endpoint AI,” the CIS (image sensor) and WiseEye (processor) work in tandem to provide a variety of novel use cases, including body, gesture, or eye tracking. WiseEye was developed through “continuous collaboration with tech giants,” including Google’s TensorFlow AI and Microsoft Azure. To extend the addressable market of the WiseEye system, HIMX has integrated development tools that allow a high level of plug-and-play capabilities for OEMs, which is being marketed as a quick-to-market low-barrier entry point for IoT developers into AI.

Finally, LCoS (liquid crystal on silicon) microdisplays have already been supplied to Google and other OEMs for experimental AR/VR purposes. LCoS is a key for lightweight AR, which is able to track an image onto a plane in front of a user. HIMX has been a key partner since day 1 with Google, including the proof-of-concept Google Glass device. LCoS Technology has come a very long way since then, but demand is still lacking. In our view, this is a timing issue. HIMX is one of the few companies capable of a mass-market run of LCoS displays. If the first generation of mass-market AR/VR devices like Apple Vision Pro ends up with high uptake levels with consumers, then it could signal other firms to start creating their own mass-market devices.

As for IoT and AI, HIMX already dominates this area in China, where facial recognition for payment and keyless entry are becoming more common. A breakout into Western markets in this area could be huge, especially considering HIMX’s existing relationships with automotive OEMs and innovators like Google and Microsoft.

Non-Display Technology currently represents 14.9% of total revenue. Further penetration of AI into IoT and VR/AR could represent a significant growth area for HIMX, with WiseEye leading the charge. Additionally, LCoS and WLO are the only areas in which HIMX is not fabless. Even if it does not take market share with its own products in these areas, it has the facilities for two manufacturing lines, amounting to 34,000 8″ wafers per month.

While putting a secular growth number on the non-display area is challenging, given the novel nature of much of the technology and HIMX-owned manufacturing facilities for optical components, we expect the percentage of revenue derived from non-display to secularly increase over the decade as newer product lines reach mass-market production levels.

Risk

A significant portion of HIMX products is manufactured in China, with 75% of revenue realized in China. In the next few years, export admin regulations regarding Chinese-manufactured chips are likely going to be the next frontier in regulatory fighting. The DoC and DoD are aggressively posturing toward “legacy chips” – mature node semiconductors like HIMX’s DDICs, timing controllers, or LED drivers. These chips are presently used in a lot of US equipment, including in our weapons. With the war in Ukraine and China’s unrelenting assertion of reunification with Taiwan, these chips have become a “national security concern.” HIMX could reposition to US domestic or alternative manufacturing arrangements in Taiwan near its sole existing Fab. However, manufacturing semiconductors in the US is still 30-40% more expensive than in mainland China. Moving the rest of production to Taiwan or elsewhere could be problematic for certain chips, as any changes in export regulations regarding Chinese manufactured chips are going to cause an industry-wide shift, reducing the availability of fabs.

Competition is fierce in the semiconductor market, and if HIMX’s products fall behind technologically or become commoditized, it will result in both secular revenue losses and margin contraction. However, in our view, this risk is minimized as HIMX operates in areas with high barriers to entry. High barriers for entry allow HIMX to take significant market share early and gain a first-mover advantage. As product lines mature, OEMs turn to in-house solutions, or low-to-mid-level devices switch to more generic options, HIMX still gets some licensing revenue, but these transitions are a net negative.

Financial Outlook

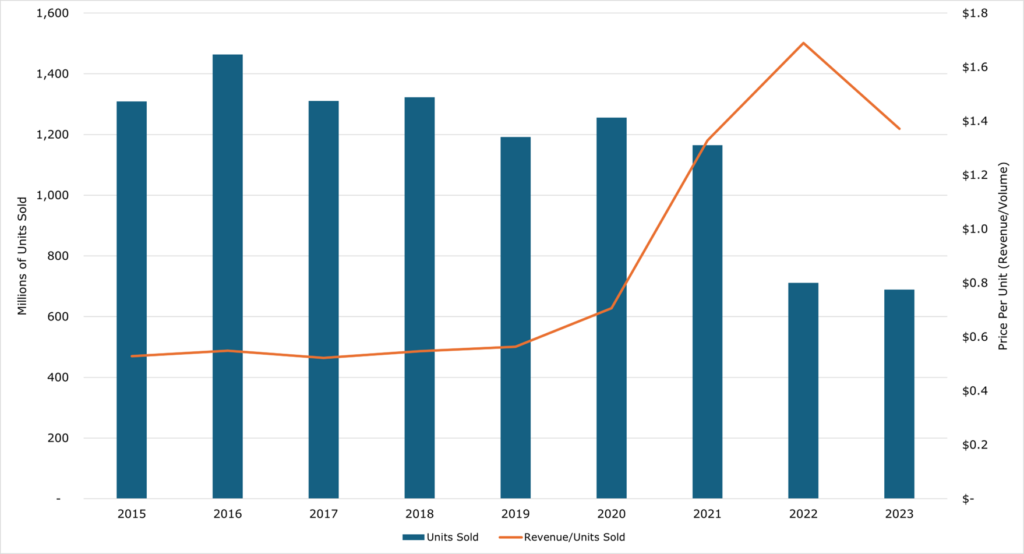

Overall, company revenue declined 21.3% year over year through year-end 2023. The persistent demand downturn has hammered both HIMX and the OEMs it supplies to. For 2024, HIMX expects this trend to continue, with a further decrease in revenue of 9-16%. Gross margins decreased to 27.9%, a significant collapse from 40.5% in 2022. Through 2023, HIMX practiced an aggressive inventory management campaign, which included sacrificing some short-term margins in exchange for normalizing inventory levels. The remaining stocks of wafers on hand are dedicated to customer design activities and products with longer life cycles.

Despite revenue declines, the average revenue per unit sold has dramatically increased since the pandemic. While this can partially be attributed to demand outpacing supply during the consumer upcycle in 2020-2022, HIMX has shifted toward higher-margin products like non-smartphone TDDIs and larger automobile panels. If this trend continues, HIMX should see improvements in margins coupled with higher sales.

As previously mentioned, display OEMs that are HIMX’s primary customers have begun to reduce utilization in an effort to preserve profitability, which has increased the demand for last-minute ordering. As a result, HIMX cut foundry capacity agreements that included minimum fulfillment constraints. In the short term, this heavily contributed to the compression of margins as volume discounts no longer applied. Still, it allowed for more small runs and lower operating expenses during the consumer downcycle. In our view, the 2024 margin will marginally increase with a better product mix, but it will likely stay at the same level until the consumer upcycle takes place.

Despite the downturn in results, HIMX had a strong free cash flow in the quarter ending in December of $84 million. This figure represents a return to form due to improved inventory levels and fewer capacity commitments. In our view, the cutting of inventory and minimum utilization deals with fabs will likely improve FCF in the short term while waiting for the consumer upcycle. The current dividend yield is 4.2%, which we expect to stay stable in the medium term until earnings see a recovery.

While short-term challenges remain abundant, HIMX’s internationally dominant market position has not meaningfully changed. Additionally, the advent of further digitization of car displays, further consumer VR/AR development, and AI integration into the ever-growing IoT market could potentially represent breakout markets for HIMX to dominate. In our view, once the consumer upcycle begins and market trends begin to be clearer, HIMX will be a solid pick for yield and capital appreciation.

Competitive Comparisons