US Deficit, Debt, and Interest Expense Begin to Spiral

| February 13, 2024 |

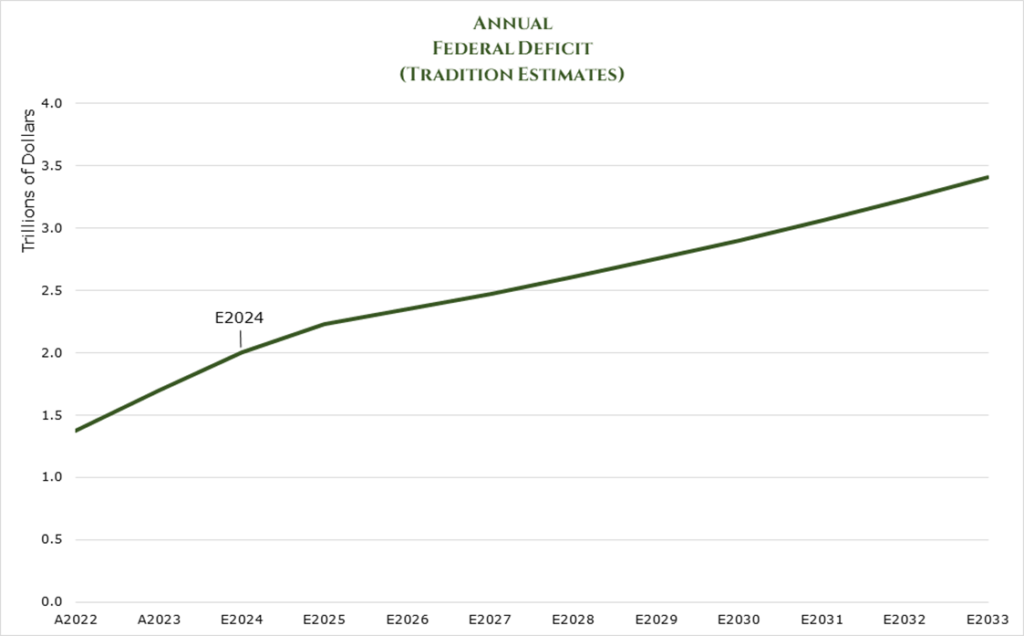

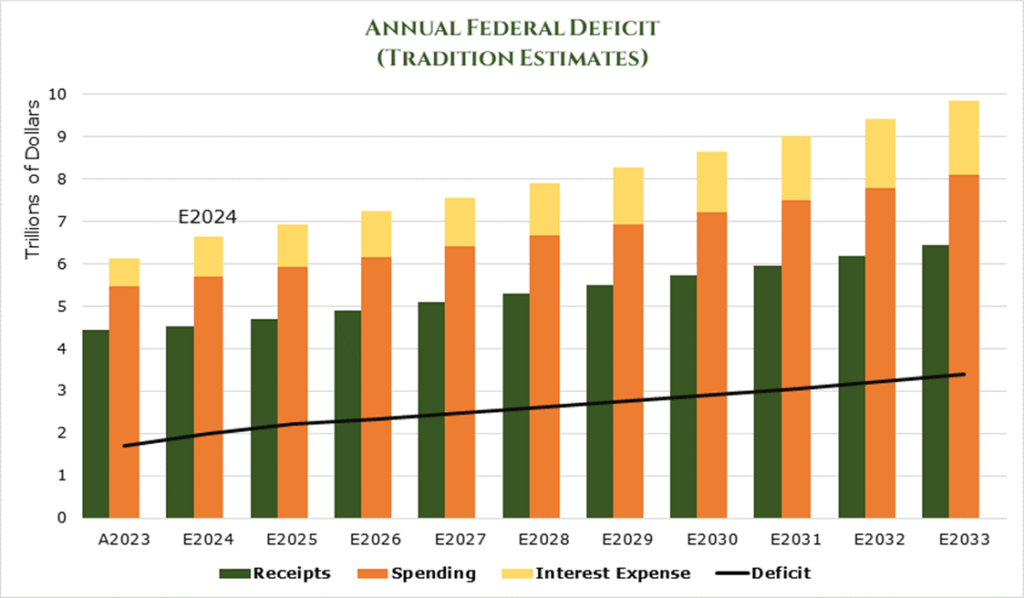

- Deficit accelerated to $500 billion in the December quarter, on pace for $2 trillion in the 2024 fiscal year ending September.

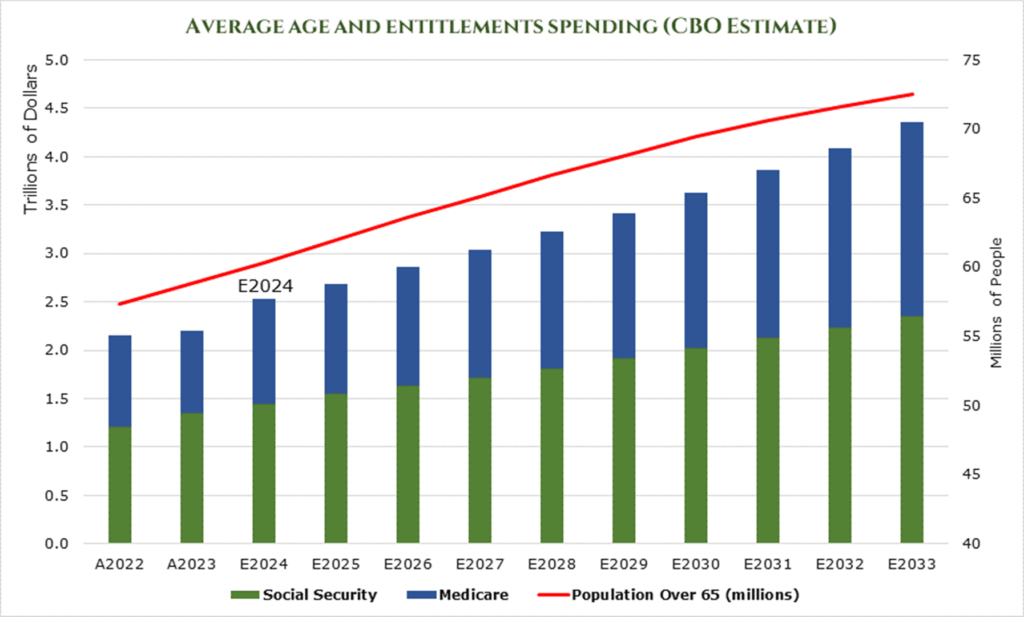

- Anticipated government debt of $36 trillion by December 2024, excluding significant unfunded Social Security and Medicare liabilities.

- Responses to the fiscal crisis are challenging. Resuming Quantitative Easing (QE) and debt monetization might lead to hyperinflation and discourage private investment.

- Options to mitigate the fiscal crisis, like cutting services or increasing taxes, are widely unpopular and politically unfeasible.

- Compounding Interest Expense requires the issuance of more bonds to cover higher interest expenses, driving rates even higher.

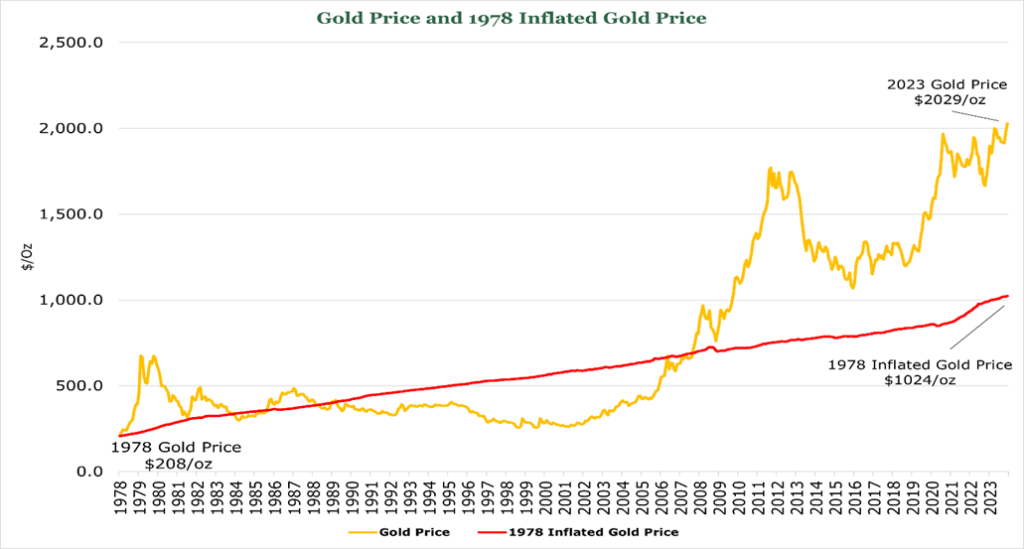

- If QE resumes, gold and stocks might benefit, although rapid QE and rising interest rates could initially depress stock price-to-earnings ratios before nominal prices recover.

- We are avoiding the long end of the yield curve, as the real purchasing power of long-term bonds will erode from persistent inflation even if nominal values are maintained.

- Short-term treasuries and cash look attractive as well as diversifying assets like reinsurance.

Overview

The US debt has surged to over $34 trillion, which will accelerate dramatically over the 2024 calendar year. The US is well on track to post a $2 trillion deficit by the end of the government fiscal year in September 2024, at which point the debt will have grown to $35 trillion. Of course, this does not include unfunded Social Security or Medicare liabilities, which exceed $66 trillion in total.

The ground is shifting under the feet of financial markets and average Americans. The sustainability of US deficit spending through Treasuries has become questionable, leaving very few options outside of default, monetization, or raising taxes and cutting entitlements.

The US Dollar

We’ve discussed this in two articles, one on gold and one on Dollarization.

The seizure of Russian USD assets and using the SWIFT payment system as a means of sanctions have led many developing countries to reevaluate their reliance on the USD for trading and as a reserve currency. Initially intended to be a neutral platform for financial communication, SWIFT has become a tool for sanctions, prompting these nations to look for other financial systems.

The US Dollar dominates global Forex transactions, making up 88% annually, and is the primary currency for export invoicing worldwide, except in Europe. This necessitates that nations convert their local currencies into or from USD. The US Dollar comprises about 51% of central bank reserves and 60% of all global banking transactions. However, this dominance is gradually declining.

Research indicates that a 1% increase in US interest rates leads to a 1% drop in GDP for developing countries. High US interest rates provide little advantage to “open middle-income” countries, such as Brazil, Mexico, and South Africa, which are export-driven and conduct most of their transactions in USD. These challenges have pushed such countries towards seeking alternatives in different currencies. For example, Brazil and South Africa have established bilateral agreements with China using the RMB. Developing countries are also turning toward gold, offering a politically neutral and generally more reliable store of value versus the Dollar which is a fiat currency.

What is there to do?

The sustainability of US Treasury Bonds as a borrowing mechanism faces increasing risks amidst growing $2 trillion-dollar deficits, leading to the national debt quickly spiraling out of control.

Economic growth hinges on a constant flow of capital to finance production, which includes labor and various input costs such as rent, equipment purchases, and research expenses. Over time, as capital assets depreciate and technologies evolve, there’s a perpetual need for investment to expand production capacities, conduct new research, and meet increasing demand. Capital expenditure is the linchpin of economic development. All of the options left to tackle the deficit affect this delicate ecosystem.

Cut Entitlements and Raise Taxes

One primary factor that diminishes the capital available for investment is taxation. Taxes can curtail investment since decisions are typically based on after-tax returns. A tax increase diverts cash flow from potential investments and shareholders, reallocating it towards tax obligations. While this effect is low relative to most other options, the political consequences are far-reaching. Fewer than 8% of Americans state they should pay more taxes, meaning both sides of the aisle feel little desire to step up to the plate and take action.

A Generation of short-sighted voters and politicians have backed the US into a corner. There is almost no political will to change fiscal policy, and voters do not yet seem to grasp the precarious situation the economy is in.

Monetization

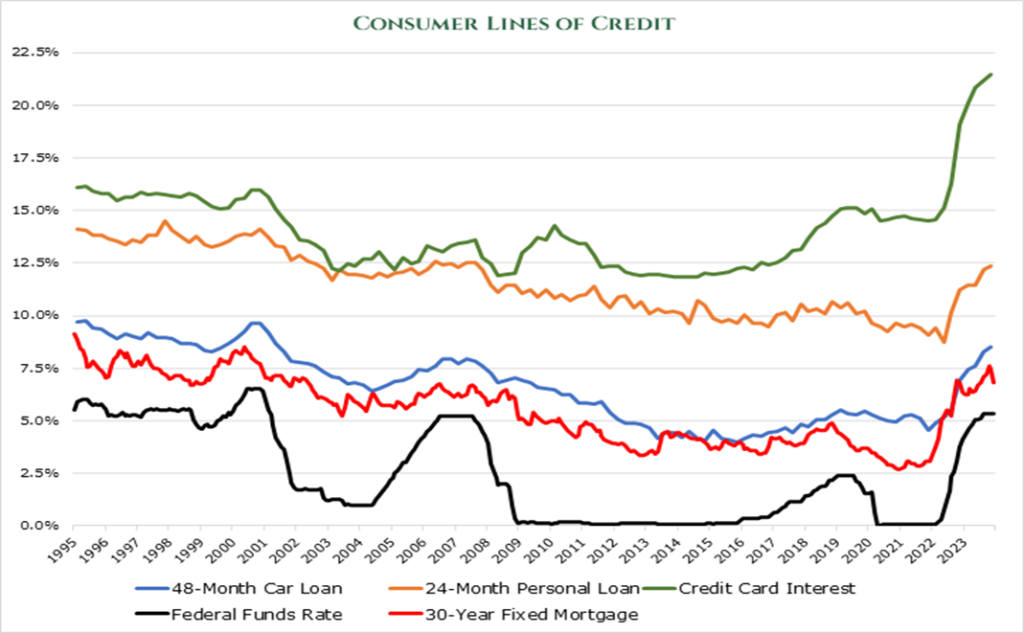

Debt monetization can lead to several immediate and long-term economic consequences as the government competes more aggressively for limited savings. Interest rates may increase, and private investment may become more costly. Already this can be seen with consumer credit. Consumer interest rates have shot up faster and further than ever before, which has put massive pressure on consumers.

As interest payments on Federal debt go up, the requirement to issue additional bonds to cover previous interest payments further increases the debt burden, necessitating even higher yields to attract investors. This essentially leaves only the Fed as a viable buyer of Federal debt at low interest rates.

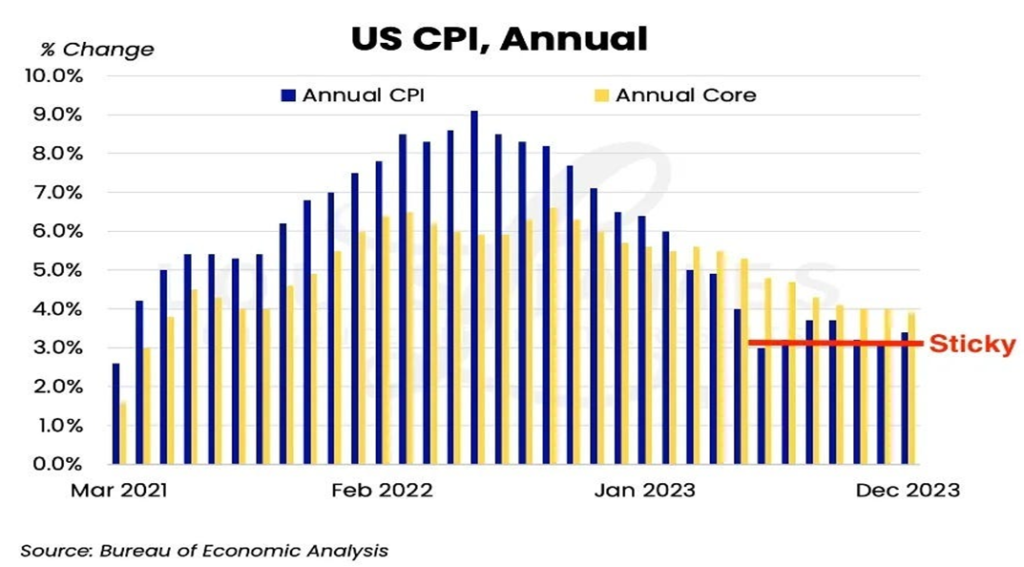

Over time, persistent government borrowing and debt monetization can undermine confidence in the currency and financial stability as investors and consumers grow concerned about the government’s ability to manage inflation and its debt burden. Already, inflation has become stuck at around 3%, even inching back up in the December quarter.

The dynamics of crowding out are complex, and its impact varies. In economies like the US’s now, where there is significant foreign investment, the effects can be somewhat mitigated, only decreasing private investment by an estimated 9% over 10 years with $10 trillion in additional deficit spending. However, once confidence in the US Government and the US Dollar is shaken and foreign money dries up, over those 10 years, the capital available for private investment will be reduced by 25%.

The long-term increase in the money supply and artificial depression of interest rates caused by monetization will be inflationary. As a result, consumer purchasing power will be significantly reduced as the currency undergoes long-term and persistent devaluation.

Default

The absolute worst case is default, which in our opinion, is unlikely. But with the politicization of the debt ceiling, it has already come close to default for shorter-term government debt. The politicization of the debt was one of the primary reasons the US Debt rating was downgraded to AA.

Estimates put the immediate effect of a default situation as a 10% decrease in real GDP, a global stock market crash, a liquidity crisis at banks, and more than 8% unemployment. No matter the impacts, they will be wide-sweeping and impossible to contain or predict; hence, in our view, this is unlikely.

Conclusion

Never have we had a situation in which the full faith and credit of the US government for the payment of future obligations has begun to erode.

Our guess is that the Federal Reserve will begin a program of monetization and resume QE (Quantitative Easing). Politically, it is the only choice that is viable and the only choice that doesn’t result in severe and immediate destruction of the financial system. Over the long term, as previously discussed, the dollar’s purchasing power will be destroyed. Thus, we are avoiding the long end of the yield curve, as the real purchasing power of long-term bonds will erode from persistent inflation even if nominal values are maintained. Gold and stocks will benefit, although rapid monetization and rising interest rates could initially depress stock price-to-earnings ratios before nominal prices recover.

Once it becomes clear that this issue is not going away, volatility is likely in the market. We are keeping short-term treasuries and cash and diversifying assets like reinsurance to minimize this volatility.