The Dollar’s Dilemma: BRICS, CIPS, and the Global Quest for Alternatives

| October 6, 2023 |

- Developing nations are increasingly interested in trading systems not tied to the USD (US Dollar).

- In response to the weaponization of the dollar SWIFT payment system, countries are developing alternatives like China’s CIPS, which are gaining traction.

- Confiscation of Russia’s dollar reserves as punishment for the invasion of Ukraine has accelerated the decline of the dollar as a reserve asset.

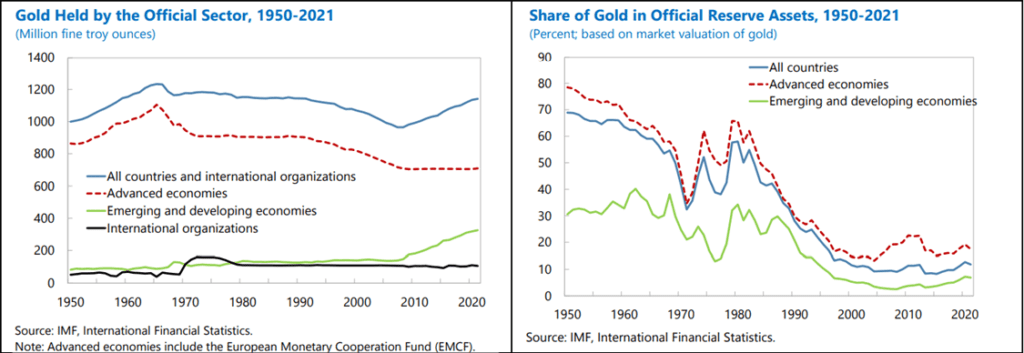

- Gold as a global central bank reserve asset is increasing with the developing world leading the way.

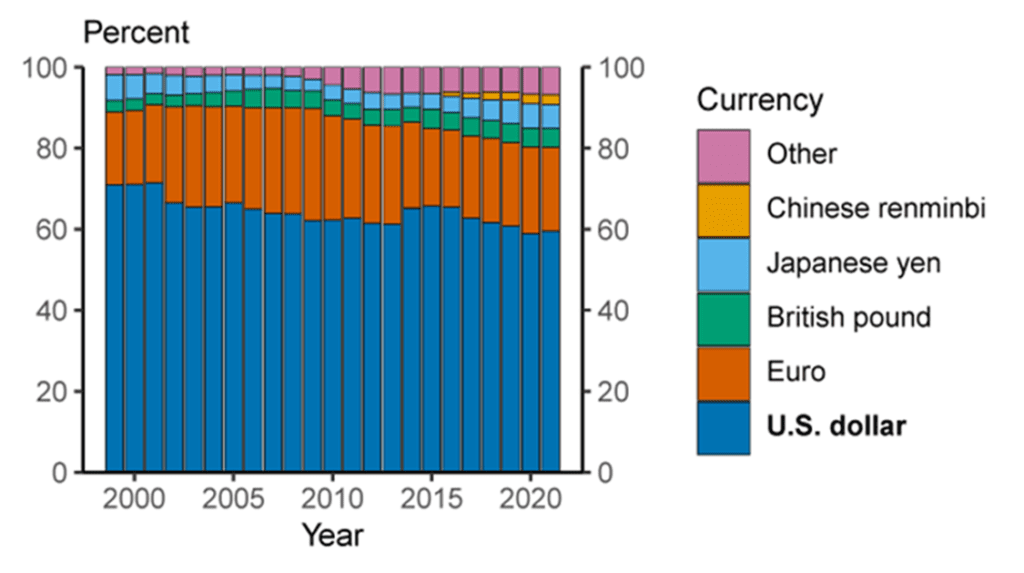

- Conversely, the USD is losing share.

Introduction

In our previous article regarding de-dollarization, we focused on the investment case for gold. In this article, we expand on the impacts of sanctions and a strong US dollar on developing nations.

Confiscation of Russia’s USD assets and the utilization of SWIFT as a sanctioning tool have prompted numerous developing nations to reconsider their dependence on the USD for trade settlement and as a reserve asset. SWIFT, originally designed as a neutral financial messaging system, has been used as a sanctioning instrument. This perceived weaponization is driving many developing nations to seek alternative financial systems actively.

A common aspiration among BRICS nations, which you can read more about here, is the quest for an economic system that operates independently of the US Dollar. Such an idea resonates strongly with developing economies.. While the political cohesion of BRICS remains a matter of debate among experts, the sheer number of countries expressing interest in de-dollarizing signals a movement that US policymakers may not be able to sideline.

Our Outsized Currency is having Outsized Impacts

The Federal Reserve’s shift to a tighter monetary stance after prolonged Quantitative Easing has inadvertently had knock-on effects in developing economies. Almost all currencies from these countries have seen a stark devaluation against the USD.

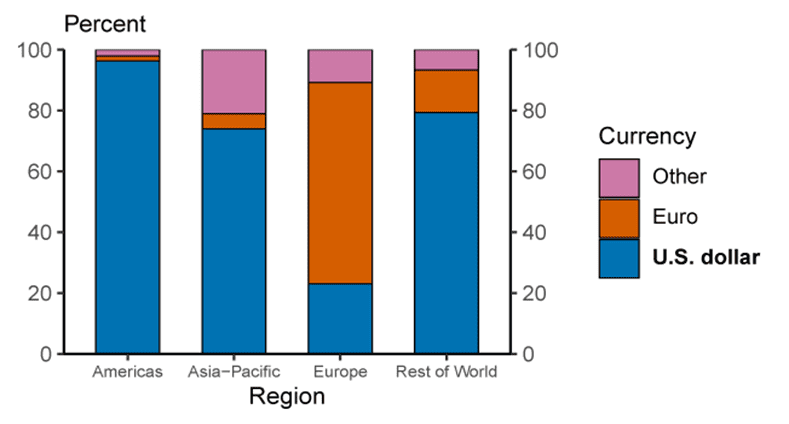

Around 88% of Forex transactions on a yearly basis are conducted in US Dollars. Everywhere except Europe, the US Dollar has a dominant share in export invoicing. This means that countries need to exchange their local currency to or from USD. US Dollars account for roughly 51% of central bank reserves and roughly 60% of all global banking deposits and loans. But this is trending down.

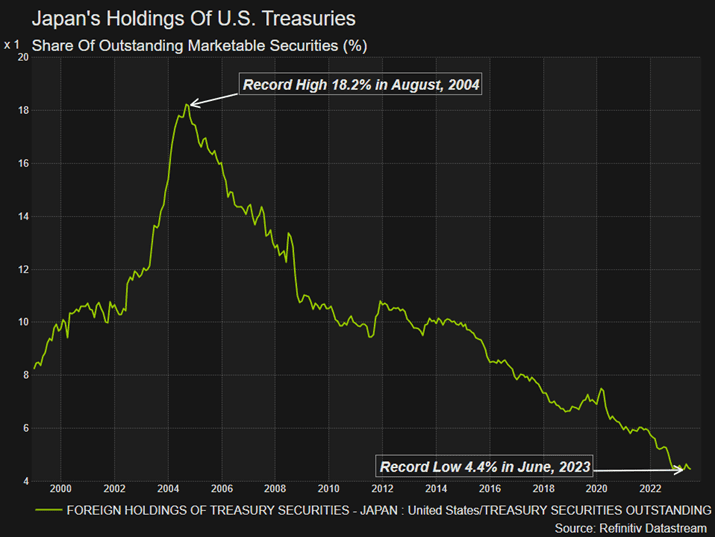

There is evidence to suggest that for every 100bps the US increases interest rates, there is a 1% decrease in GDP in the developing world. In an environment with high American interest rates, there is little benefit to being an “open middle-income” country like Brazil, Mexico, and South Africa – all of which are export economies conducting the majority of business in US Dollars. This has driven them to seek alternative arrangements in different currencies, with Brazil and South Africa having a bilateral agreement in RMB with China. Even in our advanced allies, like Japan, the impact of the US Dollar on investment and foreign trade has had serious consequences. Japan historically has been the largest foreign buyer of treasuries. Currently, it holds 4.4% of all treasuries, which is down dramatically over the past two decades, as shown below.

SWIFT and the Infancy of CIPS

SWIFT (the Society for Worldwide Interbank Financial Telecommunications) was initially designed to facilitate easy messaging between banks to verify transactions. SWIFT does not actually handle any money. It is simply a standardized system with a standardized ruleset that allows banks to automatically process transactions internationally. Roughly half of all cross-border transactions utilize SWIFT in some format, acting as an important intermediary across 4 billion global accounts.

SWIFT has only ever disconnected countries on two occasions: Iran in 2012 and in 2022 after Russia invaded Ukraine. Not only could Russian firms not utilize SWIFT for international transactions, but many Russian assets held abroad were frozen or seized.

The overarching view is that Russia and its trading partners, like China, will seek the following:

- Find counterparties that do business through clearing houses that are not settled on SWIFT;

- Move away from the USD as a method of bilateral trade settlement;

- Creating a competitor for SWIFT.

- Reduce USD reserves

China has become a powerhouse of non-USD trade settlement thanks to its robust collection of government-supported banks and a cross-border clearing house in which SWIFT usage is optional. This clearing house, calling itself CIPS (Cross-Border Interbank Payment System), was initially created to shake the image of the RMB as a tightly controlled domestic-only currency.

CIPS is still in its infancy, but transaction volume increased by 50% between 2020 and 2021. More recent data on the post-Ukraine conflict has not been published. However, China is bolstering CIPS with intense foreign direct investment in the developing world, outpacing the United States. As a long-term investment, China is encouraging developing countries to make payments and borrow money in RMB as part of the belt-and-road scheme. For the first time ever in July of 2023, China utilized more RMB than USD for cross-border settlement.

The Impacts on Gold

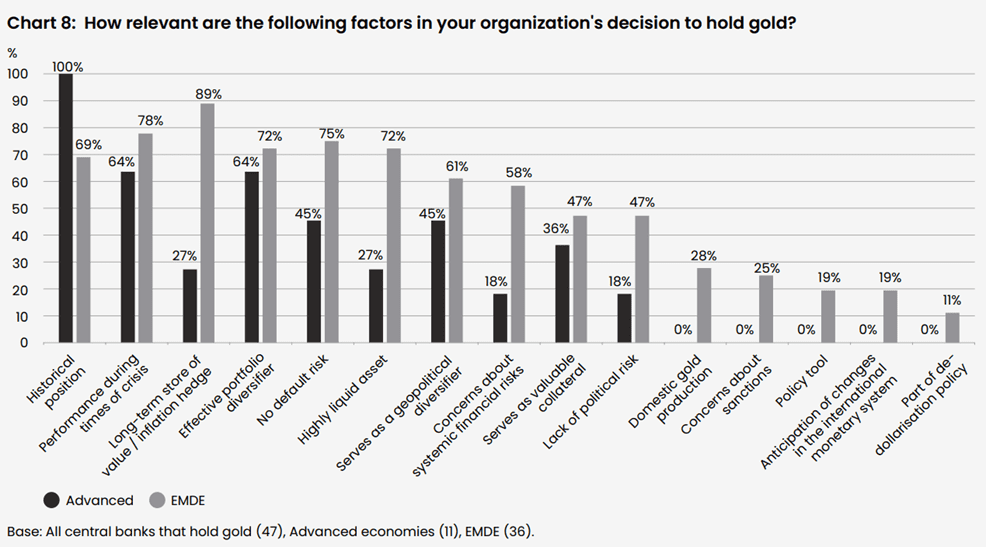

All of this has created a “gulf in thinking” between developing and advanced countries on reserves held. Of surveyed central banks, 68% of developing countries think in 5 years, gold will make up a more significant portion (>25%) of reserves, while only 38% of advanced economies share this thinking. Presently, gold makes up approximately 15% of reserves compared to 51% of US Dollars/Treasuries.

The difference in thinking is much more glaring when asked for the reasoning behind holding gold. Most advanced economies hold gold simply as a historical position. Developing countries are varied in their responses, but overall, the reasons are far more strategic.

Since 1999, gold officially held by developing nations has increased by 130%, compared to only 7% across the rest of the world. While a sizeable portion of this can be attributed to the previously discussed issues with a strong USD, of surveyed banks not currently under sanction, 25% responded that fear of sanctions was driving at least some of their desire to increase gold reserves.

Conclusion

Ultimately, it is dangerous to assume that US Treasury Bonds will be able to find enough buyers as the world moves away from the USD, and the US simultaneously runs two trillion dollar deficits that will create a surge in US debt outstanding. Now that previously price-insensitive buyers like the Federal Reserve, the developing world, and Japan have begun to reduce holdings and cease new purchases, the federal government may begin to struggle to finance itself with its out-of-control deficit spending.

Over the short term, the USD will remain unchallenged, but its dominance seems to be waning. Central banks, trade systems, and developing economies are all signaling a broader move towards diversification and away from a unipolar financial system. Developing economies are now being forced to explore alternatives due to the perceived weaponization of the USD financial system and the aftershocks of US monetary policy. The BRICS aspiration for economic autonomy, weakening currencies, and the increase in gold demand signal a significant shift in the status quo on the horizon.