Economic and Market Review

May 31, 2024

| Equity Indices | YTD Return |

| Dow Jones | 2.58% |

| S&P500 | 11.27% |

| NASDAQ | 13.34% |

| MSCI – Europe | 3.56% |

| MSCI–Emerging | 2.83% |

| Bonds | |

| 2yr Treasury | 4.87% |

| 10yr Treasury | 4.5% |

| 10yr Municipal | 3.11% |

| U.S. Corporate | 5.52% |

| Commodities | |

| Gold | $2,327.36/oz |

| Silver | $30.41/oz |

| Crude Oil (WTI) | $76.99/bbl |

| Natural Gas | $2.58/MMBtu |

| Currencies | |

| CAD/USD | $0.73 |

| GBP/USD | $1.27 |

| USD/JPY | ¥157.26 |

| EUR/USD | $1.09 |

Overview

GDP saw a substantial down revision, to just 1.3% quarter over quarter annualized compared to the previously reported 1.6%. Largely, this came due to a down revision in consumer spending, now reported as flat month over month.

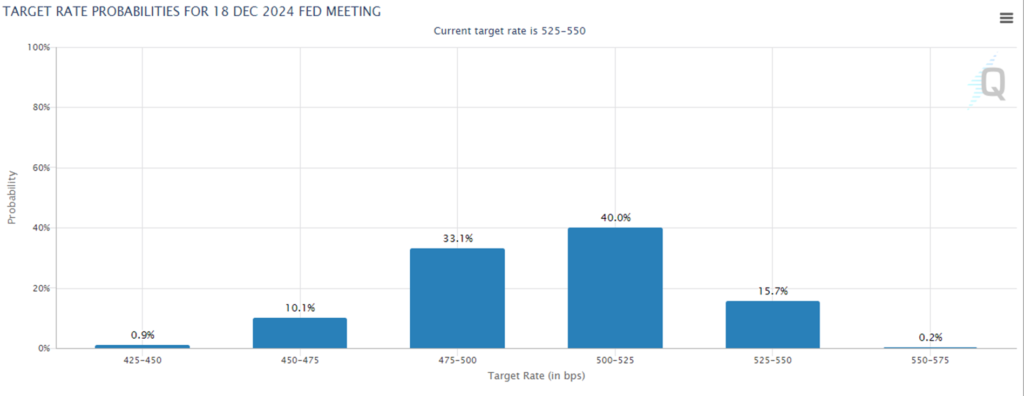

Treasury prices declined as the US Sold $70 billion in 5-year Treasuries at above stated yield after light buyer interest. The auctions have been weaker than expected due to new expectations that the Fed may raise rates before the end of the year or may not cut at all combined with an unrelenting supply caused by the deficit. The Minneapolis Fed President said that the Fed has not ruled out keeping rates the same, or even raising rates by the end of the year.

Stocks have had an incredible run thus far in 2024, with the S&P500 climbing 11.3% and the Dow Jones climbing a more modest 2.6%. However, the Dow Transport index has seen a 4.2% fall. The Transport Index represents 20 stocks, including major railroad operators, airlines, shipping companies, and trucking companies. The Transport Index is an important bellwether for economic activity, as low transportation activity is usually a leading indicator of economic slowdown.

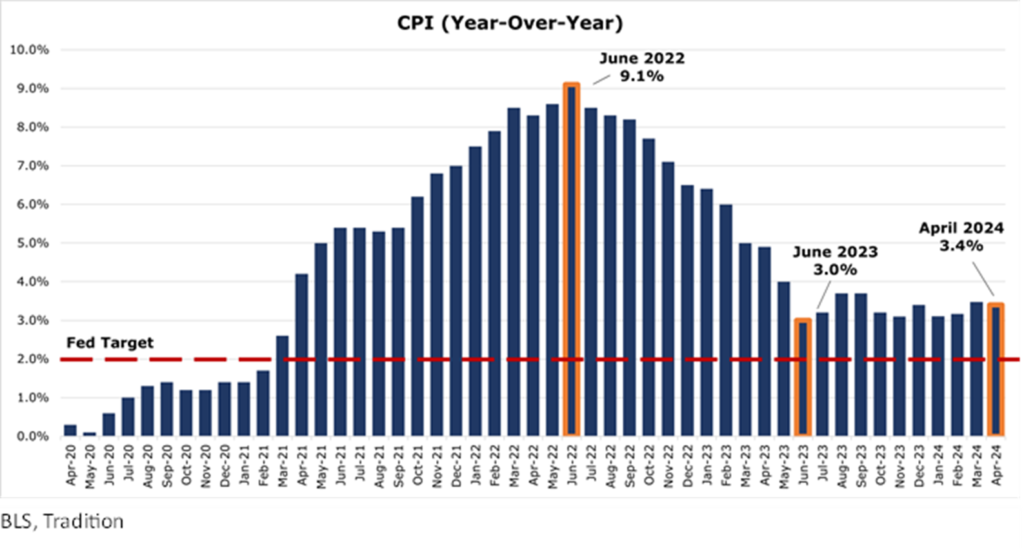

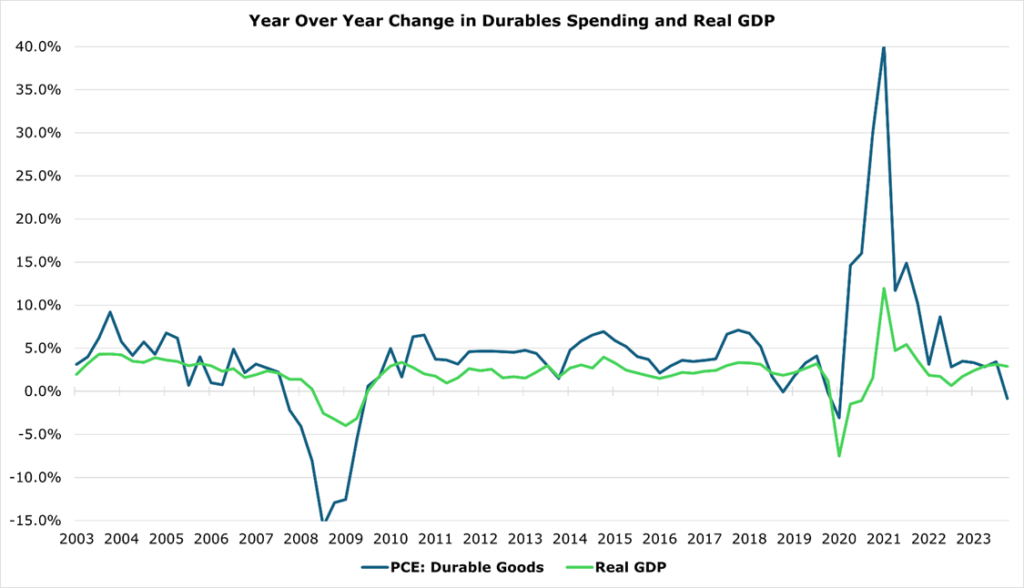

PCE in the consumer durable sector saw its weakest quarter since September 2021, contracting and renewing hard-landing fears. Compounding this was the April inflation release that showed prices still growing at 3.4% year over year, a mere 0.1% deceleration compared to March.

We’re Stuck – Downgrading Growth, but Steady Inflation

GDP in the first quarter saw a downgrade to 1.3% annualized from initially reported 1.6%, with the down revision contained in a far slower consumer spending than previously reported. While consumer spending has been a large driver of inflation, the 30bps down revision was not enough to budge inflation much.

Worryingly, consumer spending on durable goods has seen the weakest results since the quarter ending September 2021, and the first contraction since early 2020. Weak consumer spending on durables is a result of stretched and over leveraged balance sheets and lack of confidence that improvements in their finances will happen in the near future. Consumer spending on durable goods is often considered a leading indicator of recession, as consumers tend to cut out large durable purchases first.

With inflation still untamed despite down revisions in consumer spending, overall market expectations of rate cuts have not budged since April with most expecting the year end rate for 2025 to still be over 5%, with some investors now expecting a mild rate increase.

Social Security Expected to Run Short of Funds in 2033

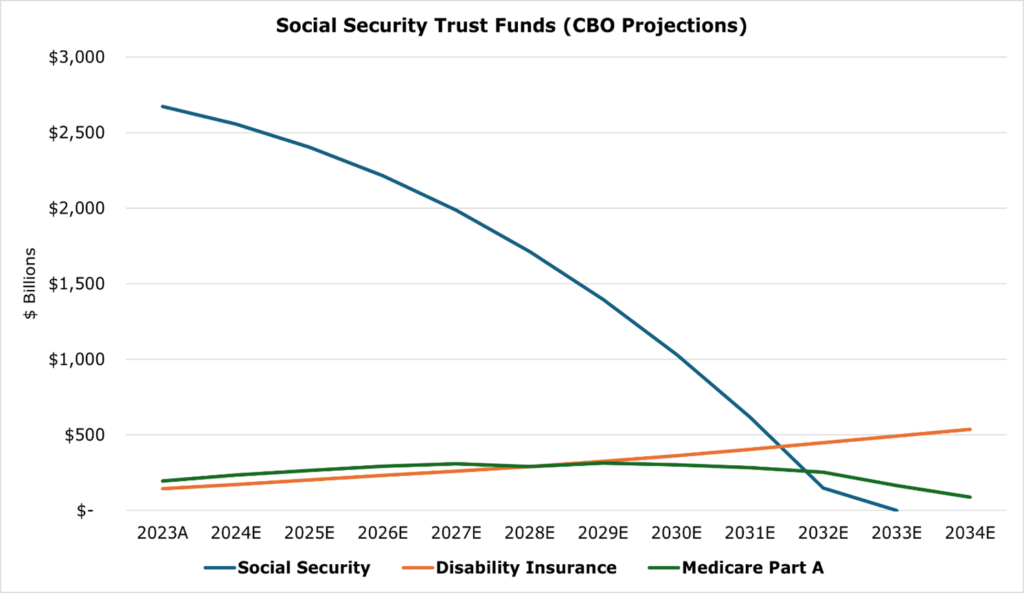

The Old Age and Survivors Insurance Trust Fund is the fund in which Social Security payroll taxes are invested now projected to last until 2033, a year earlier than the 2020 projections. In addition, the Medicare Part A fund is projected to run out some time in 2035.

Under current law, the Social Security Administration cannot pay benefits more than what is available in the trusts, meaning it cannot borrow money or receive transfers from other trusts to make up for the shortfall. When the time the trust fund runs out, payroll taxes are only expected to cover around 80% of the shortfall.

The solutions to this problem are immensely unpopular: cutting benefits, raising payroll taxes, raising the retirement age, or reducing cost of living adjustments. These are the only currently legal adjustments, all but basically politically impossible.

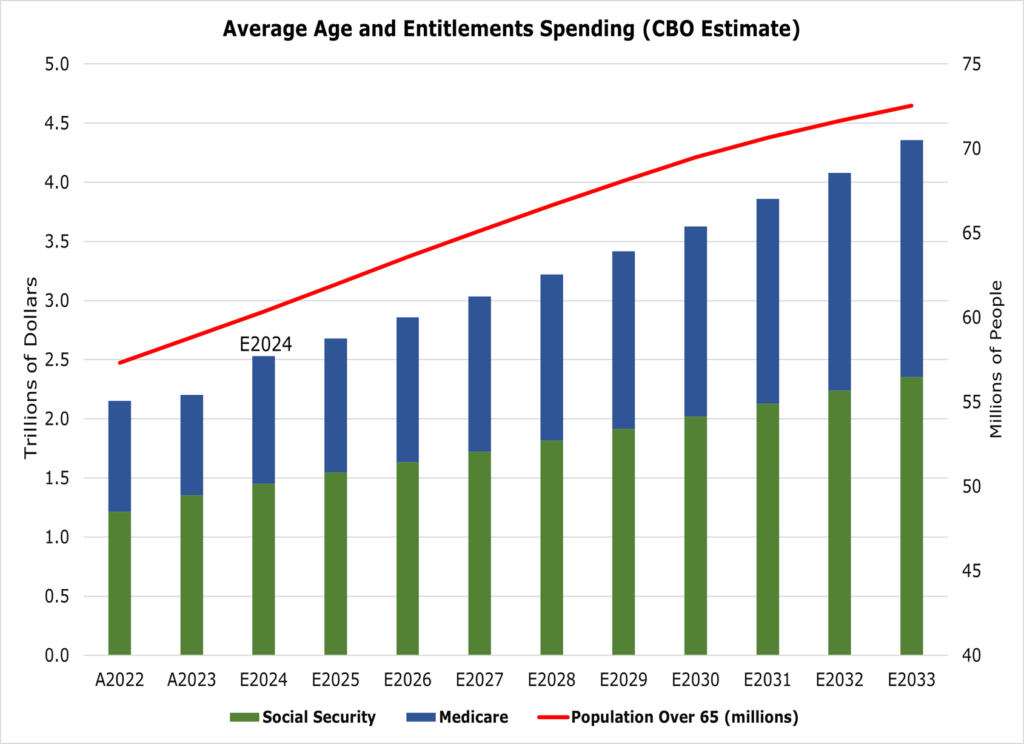

As we have discussed in our article on demographics, spending on entitlements will balloon by an extra $1.5 trillion per year by 2030, with a more drastic change over time as the number of Americans 65 and older will double by 2040.

Interest Goes Parabolic

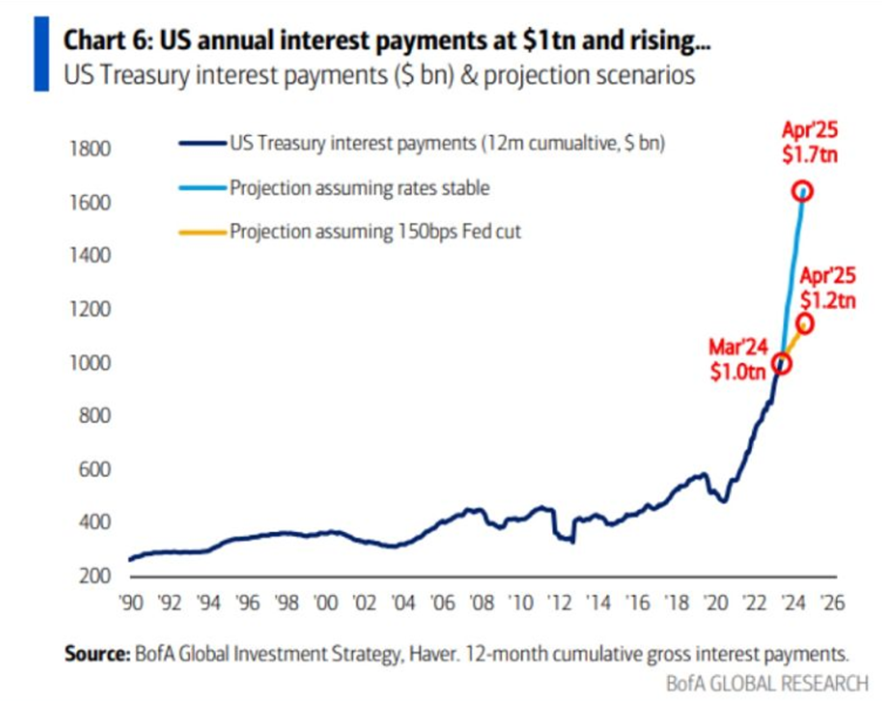

According to a new estimate by Bank of America, if interest rates stay stable for the remainder of the year, the US will pay a total of $1.7 trillion interest through April 2025.

The only thing that will mute this upward swing is a strong 150bps cut by the end of 2024. In our view, is becoming unlikely that the Fed will even be able to eke out any cut larger than 50bps during 2024 and maybe none at all.

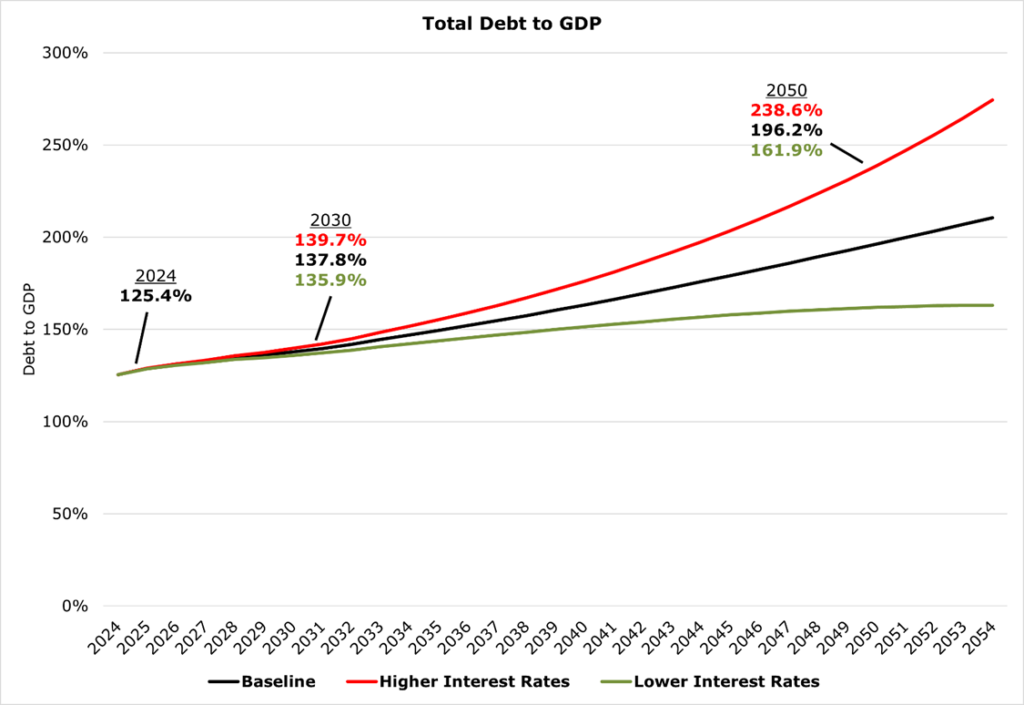

However, fiscal irresponsibility has left little choice but to start cutting. According to the CBO, if interest rates increased to a long-term average of 4.3%, the US Debt to GDP Rate would skyrocket to 238.6% in 2050. In contrast, if rates fell to an average of just 1.7%, US Debt to GDP would be only 161.9% in 2050.

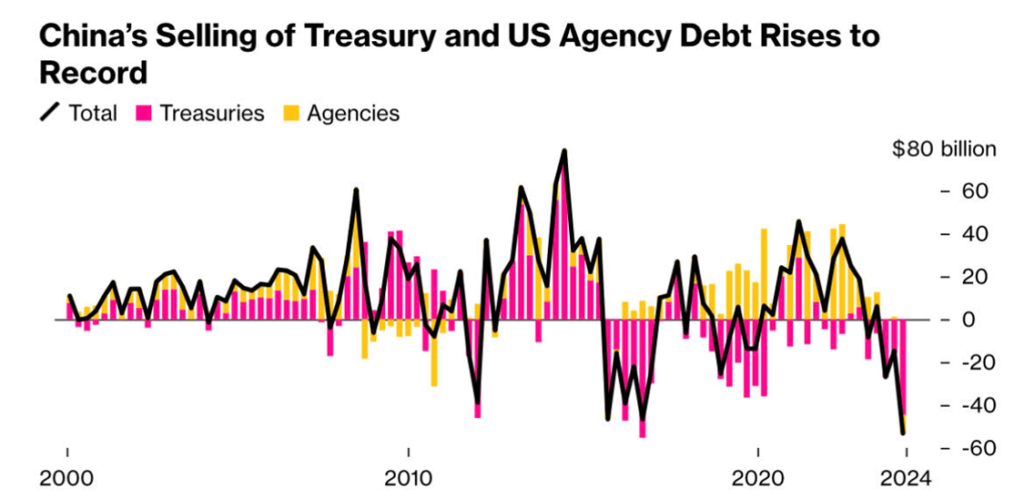

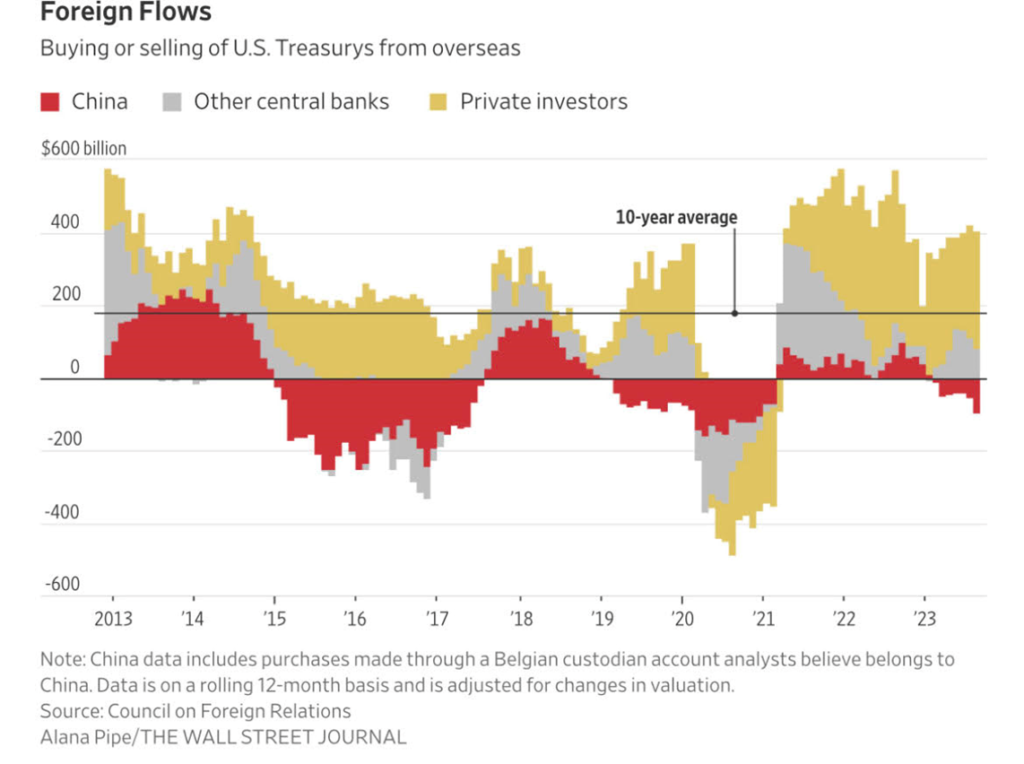

Chinese Offloading of US Debt Rises to Record Highs

We have discussed in the past the “price-insensitive” buyers of US Treasuries have historically made up a substantial portion of foreign Treasury buyers. These are generally economies that warehouse large amounts of central banking reserves in US Treasuries for stability. The weakness of their currencies against the USD, sanctions, and the desire for multiploarity had put downward pressure on the amount of US Treauries that the developing world – and even some allies like Japan – hold.

In total, China has offloaded $53.3 billion in US Debt since the year began, on pace for a record drawdown. China has been replacing these sales with gold, seeing the highest reserve level since 2015, making up 4.9% of Chinese reserves.

The lack of “price-insensitive” buyers has thusfar been more than made up for by an influx of “price-sensitive” private investors, as interest rates have increased. Though, as the name suggests, these “price-sensitive” investors will leave the Treasury market once rates go down. With nobody but the Fed to buy Treasuries once rates decrease, it feels all but inevitable that QE will restart.

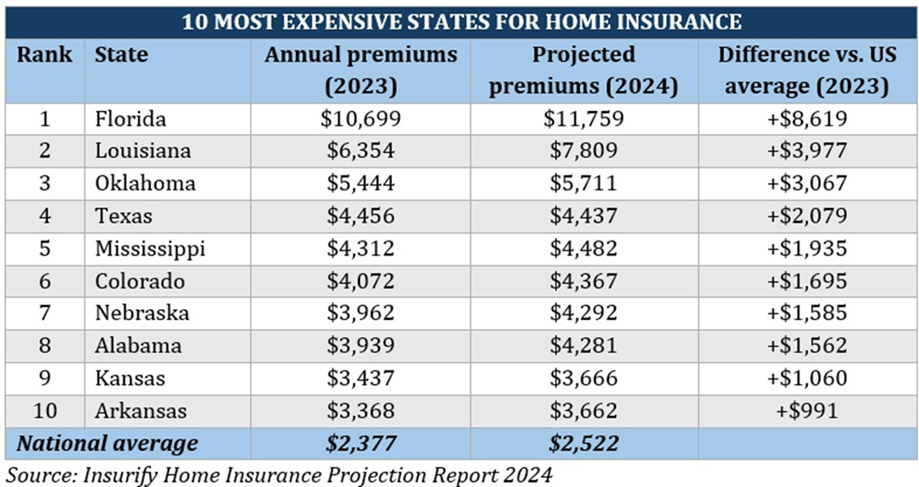

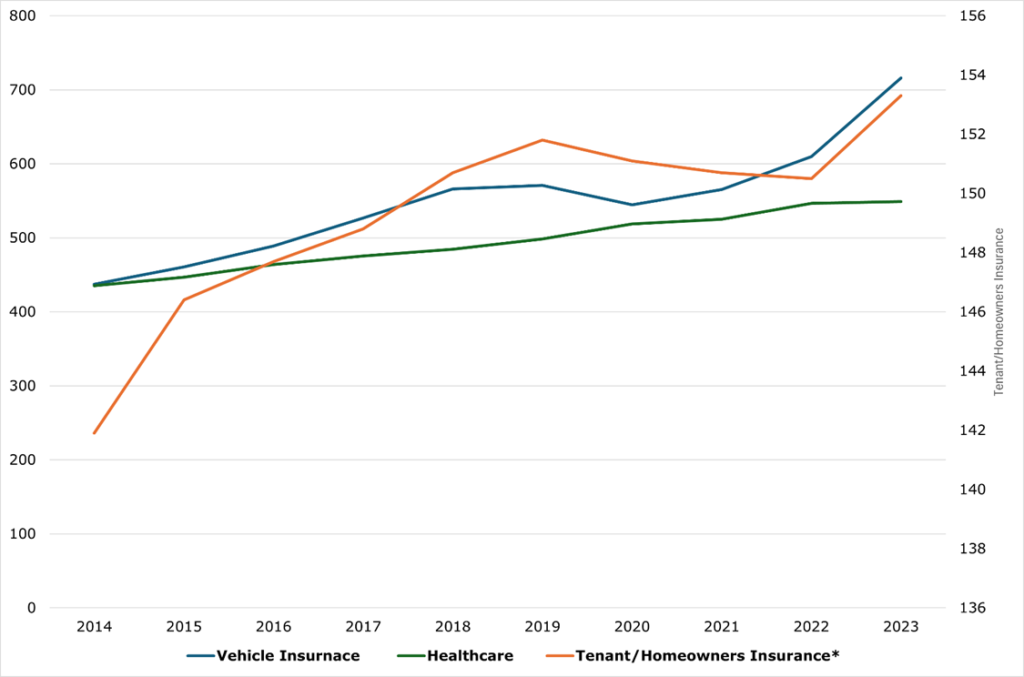

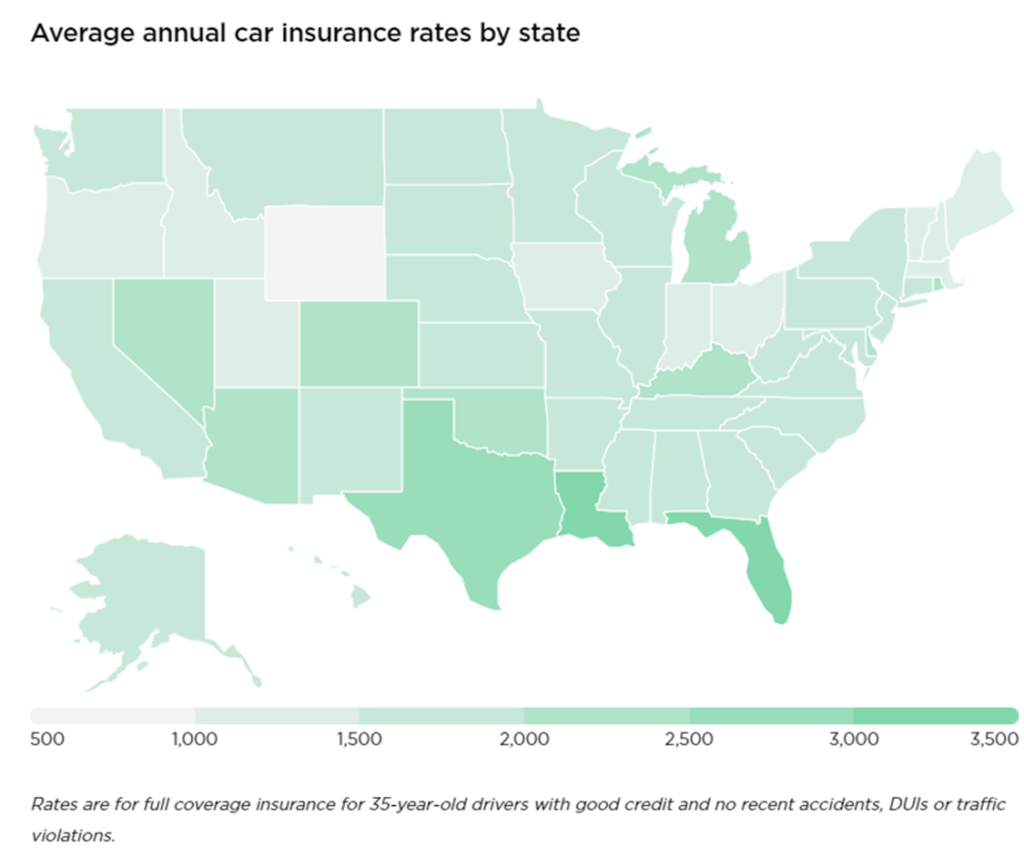

No Relief in Sight for Insurance Rates

While representing a small portion of inflation, insurance costs are one of the hardest-hitting areas for consumers. According to Bank of America, it has shown no signs of slowing. As of May 2024, car insurance costs are up 22.6% year over year, with Homeowners insurance jumping 19%, and Healthcare costs (includes insurance and prescriptions) increasing a more modest 7%.

For car insurance rates, the end is not in sight. Auto carriers are still seeing massive increases in vehicle repair costs when a claim is made, essentially at the same rate as premiums are increasing (20.9% year over year). This has caused a record number – an estimated 17% — of drivers on the road to drive uninsured.

The story is much the same in homeowners insurance, with Insurify estimating a further 6% increase in 2024 across the US, with more harsh increases concentrated around geographies like Florida. According to Deloitte, homeowners insurance firms are expected to end 2024 with a combined ratio of 105%, meaning they are paying out more than they are receiving in premiums – the 6th loss year in a row.