SuperVision Provides Future Vision for Mobileye

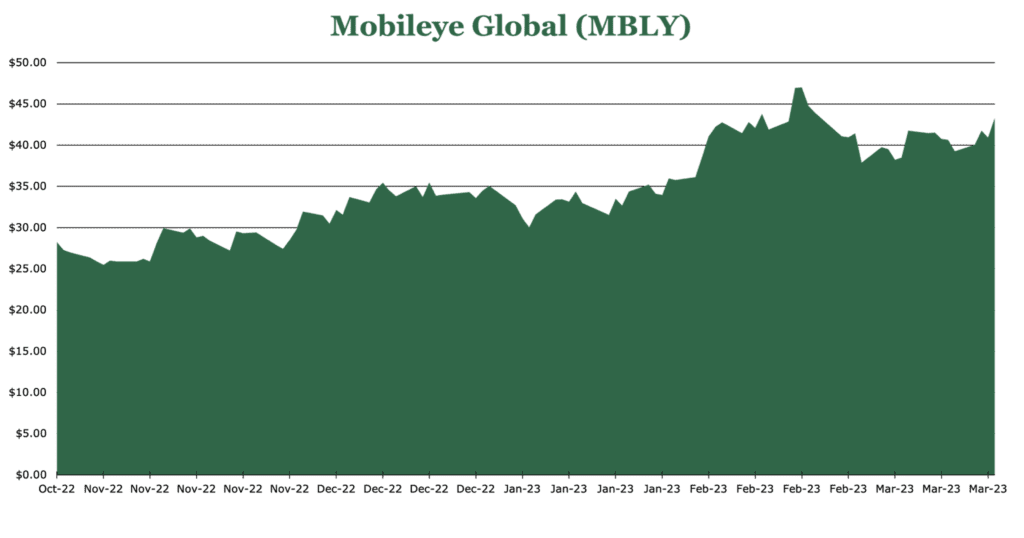

Price $42.30 Growth Holding March 21, 2023

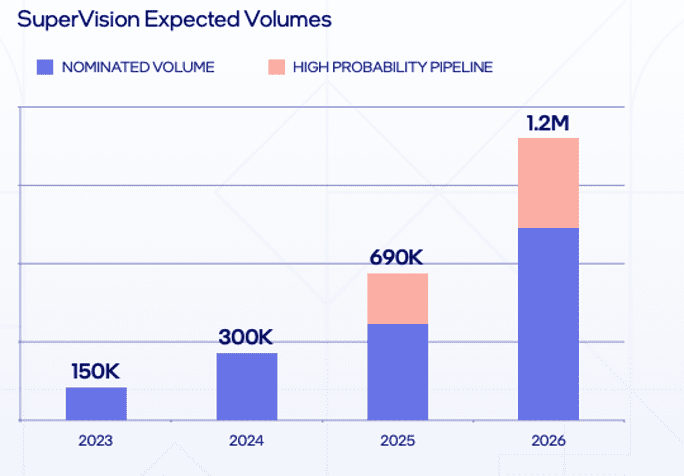

- Strong growth in advanced driver assistance systems, despite making up under 1% of volume, SuperVision makes up 33% of revenue growth.

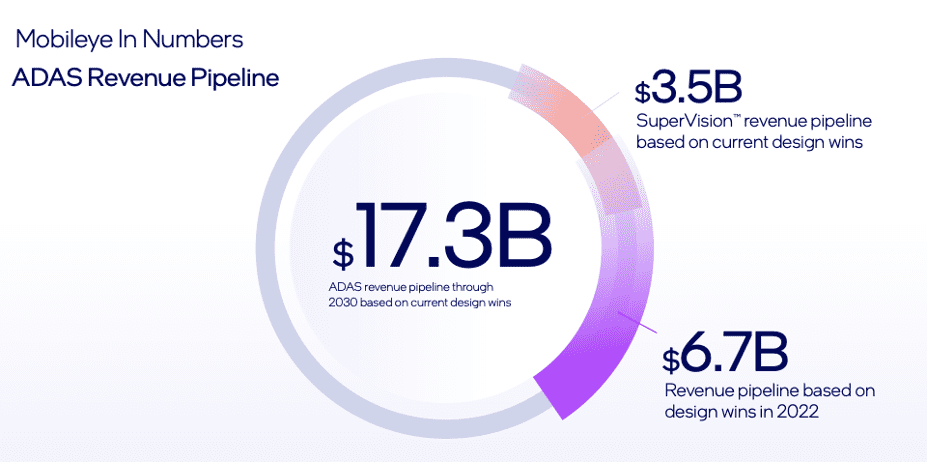

- $17 billion in contracted sales cumulatively through 2030, with an average system price of $105 expected compared to the current $56.2.

- Robust real-world implementation of SuperVision, with 96,000 units deployed in FY22. Expecting >100% growth in units shipped for FY23.

- Backed by strong consumer demand for more safety features and more fatigue-reducing driver features.

Investment Thesis

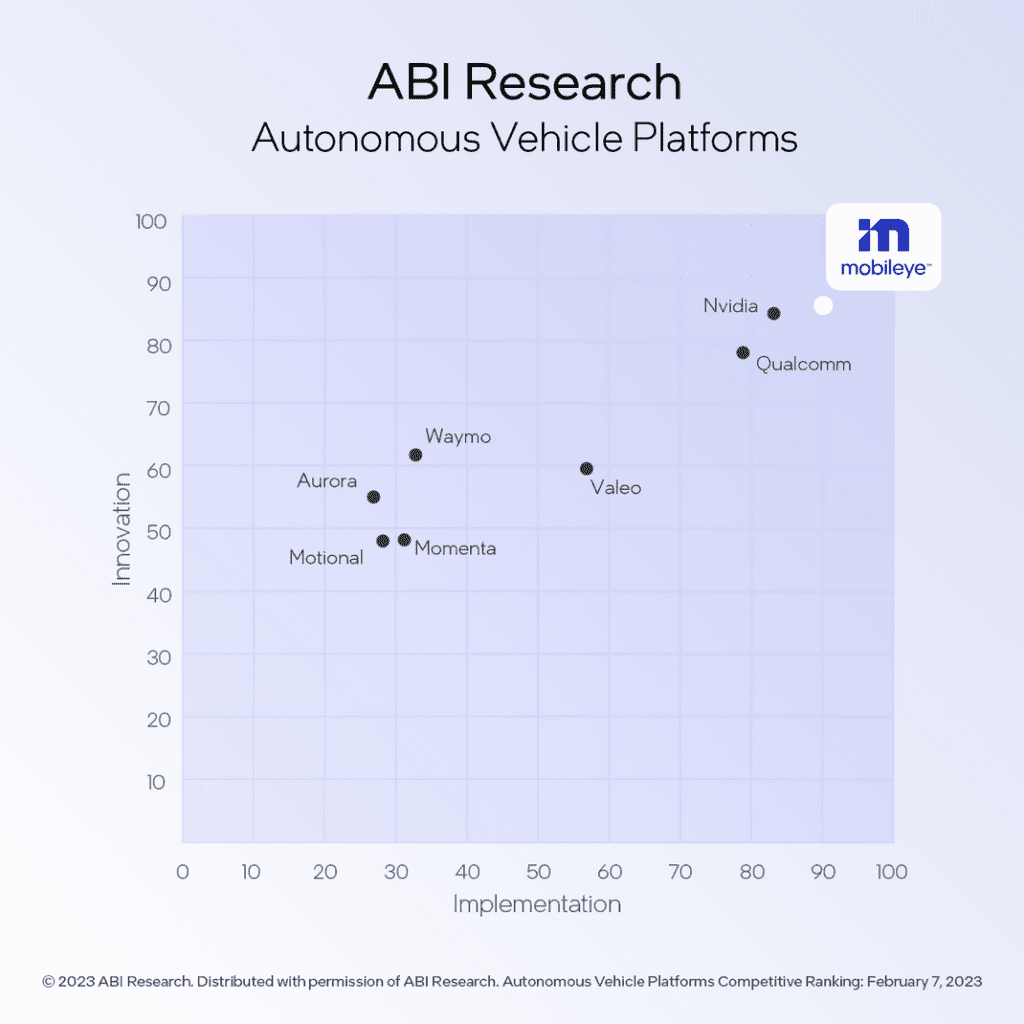

Mobileye (MBLY) is an autonomous and driver assistance systems technology firm spun off from Intel after its acquisition in 2017. MBLY is a market leader in both driver assistance technology and future autonomous driving technologies.

FY22 was the strongest year in MBLY’s history, with 4Q22 revenues up 59% year over year. The operating margin has also expanded by 1600bps, but MBLY is not yet profitable. However, as adoption surges in the middle of the decade MBLY could be top of the market.

We believe that MBLY is a good buy for growth. The autonomous driving market could hold $500 billion in the total addressable market by 2035. MBLY does not operate on platitudes and tech demos. It has an extensively deployed product portfolio across 30 OEMs and a strong path forward leveraging those relationships.

Estimated Fair Value

EFV (Estimated Fair Value) = E27 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E27 EPS X P/E = $4.00 X 14 = $56.00

Due to its first-mover advantage, leading market share in a hypergrowth sector, and significant margin expansion expected with the introduction of SuperVision, we believe that MBLY is poised for 35% CAGR (Compounded Annual Growth).

| Mobileye (MBLY) | E2023 | E2024 | E2025 |

|---|---|---|---|

| Price-to-Sales | 15.6 | 12.0 | 8.8 |

| Price-to-Earnings | 64.5 | 50.2 | 32.8 |

Introduction

The overarching ecosystem for machine vision in cars can be grouped into autonomous vehicles (AVs), and Advanced Driver Assistance Systems (ADAS).

The fully autonomous research primarily goes toward MaaS (Mobility as a Service). This takes the form of autonomous road transports and is actively being deployed globally. Consumer autonomous vehicles are further off, given the difficulty of non-highway driving. MBLY believes “the correct path is to scale Consumer AV incrementally rather than in a series of moonshots.”

The primary challenges facing the autonomous driving industry are consumer trust and scalability. It is not enough to build consumer trust with error rates at human levels. There must be demonstrated improvement over human decision-making for AVs to catch on meaningfully. McKinsey estimates that existing ADAS systems could reduce the number of accidents by 15%. Additionally, the difference between eyes-on autonomy versus eyes-off significantly shifts liability.

Products

The flagship EyeQ product is currently in 750 models and is used as a boilerplate for driver assistance systems. EyeQ is a system-on-chip solution for OEMs, used by 30 OEMs, including every single major auto manufacturer. It powers the systems for 100 million vehicles on the road. As a baseline, the system provides the ability for heads-up displays, driver monitoring systems, and infotainment systems.

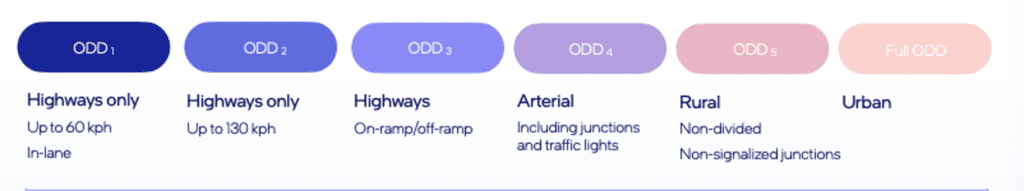

SuperVision is the machine vision driver assistance. SuperVision is intended as the next step in ADAS (advanced driver assistance systems). The intended goal for SuperVision is to be a full ODD system by the middle of the decade, but currently it is ODD2 capable.

MBLY has $17.3 billion in ADAS contracts through 2030, including $3.5 billion for SuperVision. ADAS has 60% industry penetration in new vehicles, so there is still room to grow. Supervision is a high-revenue product deployed on 96,000 vehicles, expecting to expand into Europe in FY23. Despite SuperVision making up less than 1% of total unit output it represented over 1/3 of revenue growth in FY22. Currently, gross margins for SuperVision are around 35%. MBLY is targeting 50-60% gross margin in the long run once it becomes more hardware-light. In a 2021 survey, about 25% of respondents stated that they would be looking for ADAS in their next vehicle and would be willing to pay as much as $10,000 in additional cost for it.

Chauffeur is an experimental eyes-off autonomous vehicle platform based on the SuperVision system. While still in development, MBLY is projecting full production in 2026. Roughly 80% of Chauffeur will use the existing SuperVision system. Current production estimates put the cost per unit at $6,000 in additional costs for associated hardware to enable a vehicle to have Chauffeur support.

An under covered portion of the strengths of MBLY is the REM (Road Experience Management) tool which is a form of crowd-sourced data management. REM collects data from vehicles equipped with certain MBLY technologies in real time. Nearly 29 million miles of data are collected daily, with 12.1 billion miles in data stored worldwide. To enable this, 17 OEMs have partnered with MBLY.

MBLY currently has major partnerships through 2023 for the MaaS (mobility as a service) market. This represents $3.5 billion in revenue in the top 3 partnerships. MBLY has no intention of becoming its own brand and would rather stay capital light. The MaaS market is in its infancy, but of surveyed consumers 30% said that they would pay each time they use autonomous driving. The cost per mile for such a service is expected to be competitive with driving one’s own vehicle by 2035.

Guidance

As previously discussed, MBLY has $17.3 billion in contracted sales cumulatively to 2030. This represents about $105 per car and does not include the MaaS or Chauffeur system. Previous revenue was $53 per car in 2022, demonstrating the significant shift toward higher value-added products like SuperVision. FY23’s revenue per car is expected to be in the low $60 range depending on SuperVision supply. MBLY expects over 100% growth versus 2022 numbers in total units of SuperVision supplied but is still experiencing semiconductor supply constraints which might cause growth to miss targets. 2H23 is expected to have slightly accelerated revenue as a result. In addition, the introduction of SuperVision into European OEMs will bring the total deployed units to an estimated 150,000. By 2026, 9 cars across 6 brands will be equipped with SuperVision and will result in an estimated 1.2 million units being on the road.

Risk

As previously discussed, the liability ramp from hands-on driver assistance to full eyes-off autonomous driving is significant. Ongoing regulatory debate is key for the future of the segment, and whether it will stop at ADAS or be able to progress to full eyes-off self-driving. The USDOT has adjusted the Federal Motor Vehicle Safety Standards to be more friendly to automated vehicles, but only a few states have codified the ability for fully autonomous vehicles without a safety driver to operate on the roads. The EU has similar regulations on the books. China has continuously updated their laws regarding ADAS, though high-level autonomous driving is still controlled on a local basis.

Competitive Comparisons

| Mobileye (MBLY) | Aptiv (APTV) | Luminar Technologies (LAZR) | Tesla (TLSA) | Xpeng (XPEV) | |

|---|---|---|---|---|---|

| Price-to-Earnings (FWD) | 64.53 | 25.49 | Neg | 45.98 | Neg |

| Price-to-Sales (TTM) | 17.57 | 1.74 | 75.11 | 7.07 | 1.67 |

| Price-to-Book (TTM) | 2.35 | 3.45 | Neg | 13.03 | 1.29 |

| EV-to-EBITDA (FWD) | 51.73 | 13.11 | Neg | 27.71 | Neg |

| Gross Profit Margin | 49.33% | 15.13% | -148.13% | 25.60% | 12.23% |