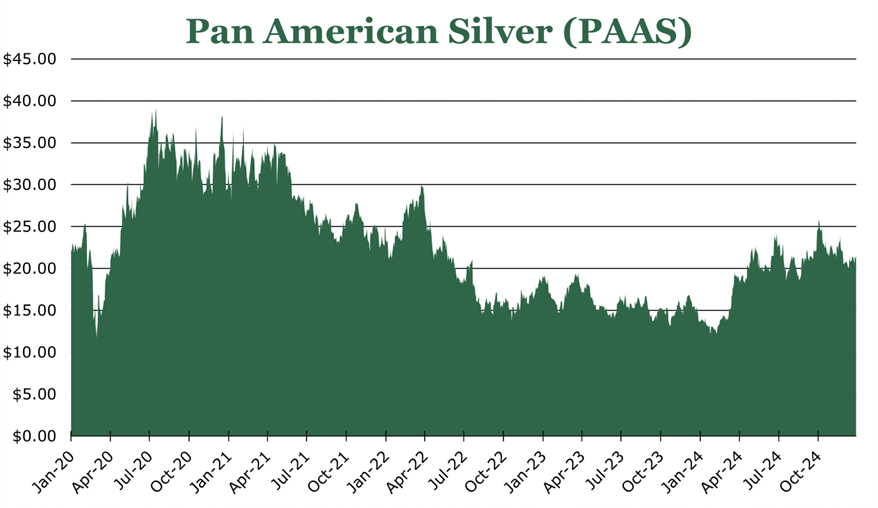

Secular Silver Shortfall Could Keep Prices Higher for Longer for Pan American Silver

| Price $21.45 | Dividend Holding | January 17, 2025 |

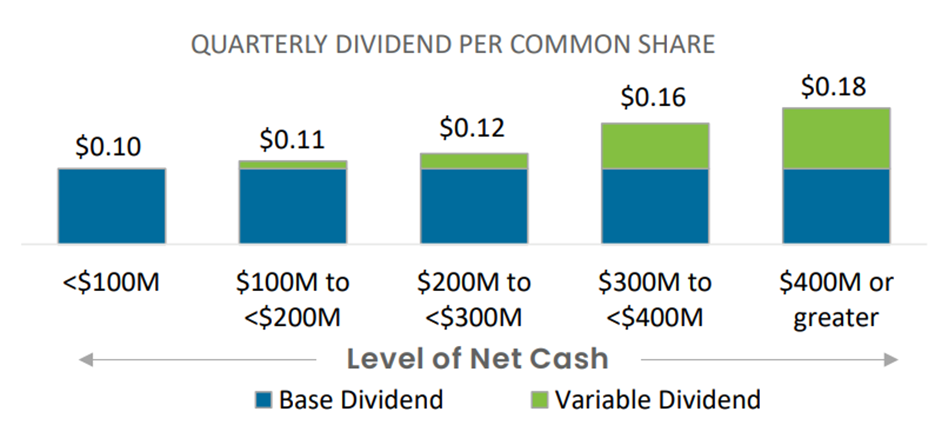

- $0.40 annual base dividend, yielding 1.89%.

- Variable dividend program linked to gross debt, paying up to $0.72 annually or yielding 3.3%.

- Demand projected to continue to outstrip supply in silver markets, with PAAS estimating an annual shortfall of 150 Moz to 2028.

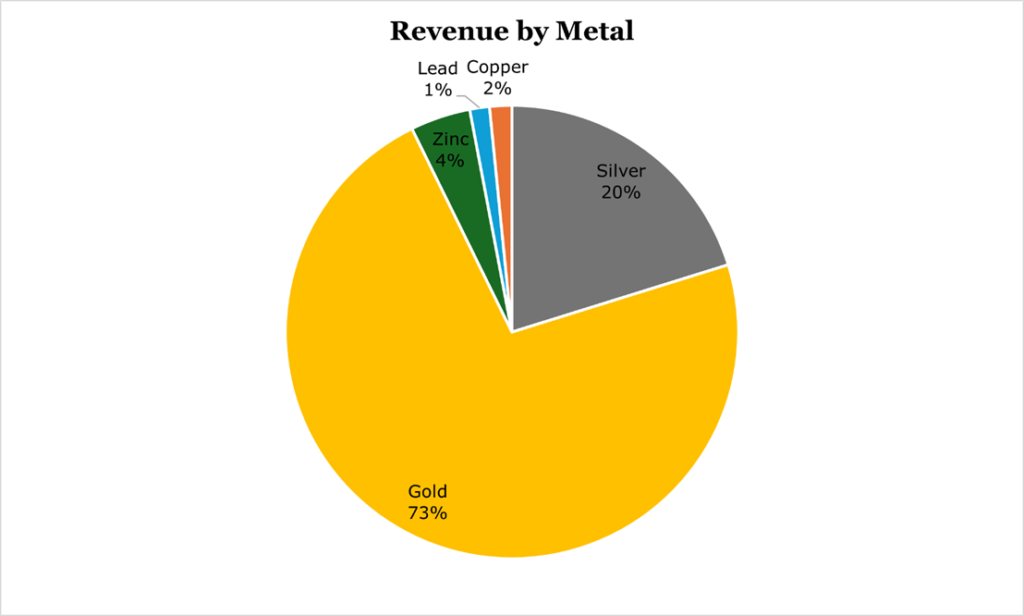

- Strong base of gold assets (73% of revenue) with high silver exposure (20% of revenue).

- Record high cash position of $887.3 million thanks to the sale of non-core assets, giving PAAS no net debt.

- For the year ending December 2024, PAAS had an output of 21.1 Moz of silver and 893 Koz of gold.

Investment Thesis

Pan American Silver (PAAS) is the second largest primary silver producer in the world, focused on developing primary deposits in the Americas. For the year ending December 2024, PAAS had an output of 21.1 Moz (millions of ounces) of silver and 893 Koz (thousands of ounces) of gold. Additionally, it has completed the sales of more non-core assets, giving it a record-high $887.3 million cash position.

With management focusing on deleveraging below 1.0x gross debt to EBTIDA and linking the variable dividend to gross debt we expect PAAS to continue aggressive deleveraging, while being able to maintain its $0.40 share base annual dividend at 1.89% yield. Since our last article, management has been authorized to repurchase up to 5% of outstanding shares. PAAS is a solid buy for income investors who want higher exposure to silver prices while still having the safety of an established gold producer.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $2.00 X 15.0 = $30.00

If higher prices continue for longer, reaching $2.00 by 2026 is more than possible. Additionally, given the potential for a variable dividend payment in the second half of 2025, a 15.0x P/E is fair in our view.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 2.7 | 2.8 | 2.8 |

| Price-to-Earnings | 13.0 | 12.1 | 12.0 |

Market Conditions

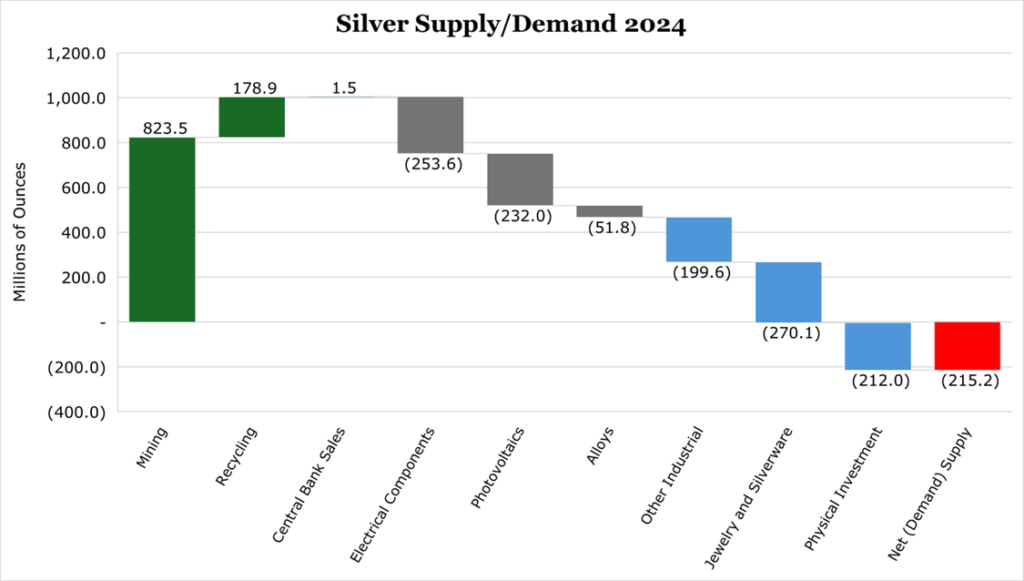

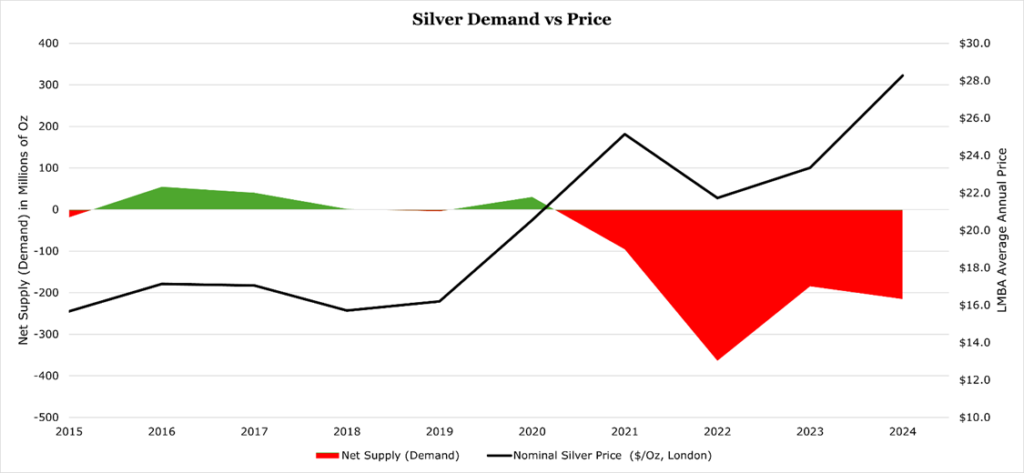

Since 2020, there has been a consistent shortfall in the supply of silver versus demand. On top of the typical hedging and inflationary pressures driving gold’s rise, 2024 was a year of huge growth for silver’s industrial demand, rising 9%. Silver’s price ended 2024 with an average of $28.27, rising 20.71% since the start of the year.

It is likely in our view that silver’s supply shortfall will continue to widen due to industrial growth and inflows into investment products. PAAS expects the shortfall to hover around 150Moz annually to 2028, largely driven by industrial demand growth. Industrial usage has been boosted to historical highs above 700Moz for the first time during 2024 due to 20% year over year growth in photovoltaics.

Outside of industrial uses, the latest Fed projections have US inflation higher for longer, with the ECB projecting lower than expected GDP growth across Europe. Combined, both could provide a short-term tailwind for investment inflows that could provide support for silver’s high price.

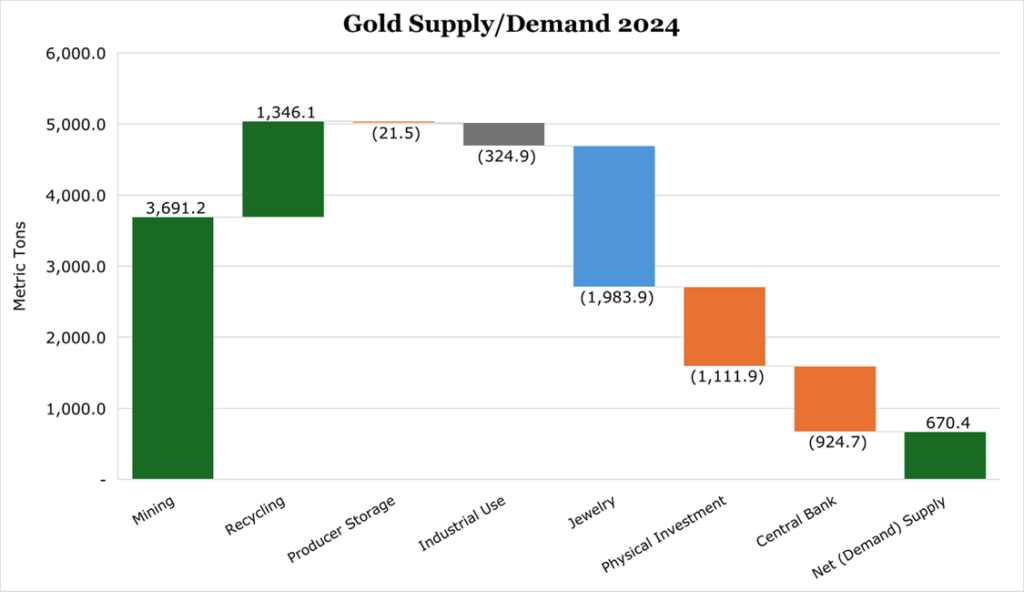

Gold saw a record-breaking year, up 26% driven by inflationary pressures sustaining globally even as central banks began their cutting cycles. Compounding this, there was global instability and a strong US dollar that pushed many emerging market central banks to bolster their bullion holdings. For a more detailed look into gold demand tailwinds, see our article on it here.

Existing Operations

For the full year 2024, PAAS had 20.8 Moz of silver produced, up 2.2% year over year, and 893 Koz of gold produced, flat year over year.

| Mine | Silver Production (Koz) | Gold Production (Koz) | AISC ($/oz) |

| La Colorada | 4,878 | 2.6 | $22.50 |

| Cerro Moro | 2,969 | 77.5 | $9.75 |

| Huaron | 3,519 | 0.1 | $16.25 |

| San Vincente | 3,109 | – | $17.80 |

| Silver Segment Total | 14,475 | 80 | $17.25 |

| Jacobina | 4 | 196.7 | $1300 |

| El Penon | 3,870 | 126.8 | $1380 |

| Timmins | 15 | 123.7 | $1905 |

| Shahuindo | 73 | 135.1 | $1600 |

| La Arena | 38 | 77.4 | $1725 |

| Minera Florida | 646 | 80.3 | $1738 |

| Dolores | 1735 | 72.3 | $1325 |

| Gold Segment | 6,381 | 812.3 | $1525 |

| PAAS-Consolidated | 20,856 | 893.0 |

La Colorada is the flagship silver mine, outputting a total of 4.9 Moz of silver during 2024. PAAS has operated this mine for over 20 years and estimates that the main mine will last until 2035. Over the last 4 years, ventilation limitations have consistently had the mine miss guidance and operate at a higher-than-expected AISC (all-in sustaining cost) due to shutdowns. After two years of construction, in July 2024 the new ventilation was commissioned. During the quarter ending September 2024, new ventilation has yielded a 32% year-over-year increase in production with a 26.6% decrease in AISC. Management stated during the Jeffries Industrial Conference that it expects 2025 to return the mine to form, outputting 6-7 Moz of silver per year.

On the gold side, the Jacobina mine remains the flagship focus for PAAS. In the resource update released in September 2024, PAAS discovered more than 1.2 Moz of gold in the existing Jacobina mine, extending its life at current production levels and AISC to 2048.

The resource update also included the results for the La Colorada Skarn project. Skarn is now believed to have the potential to add 17.2 Moz of annual silver production with 265 million tons of indicated reserves, up more than 53% since the last exploratory drill. This includes an estimated 309 Moz of silver, more than tripling the existing La Colorada reserves. Not only would La Colorada Skarn be the 5th largest silver mine in the world, it would become the 4th largest Zinc mine in the world, sitting near the bottom of the global cost curve for Zinc.

Slides from the Investor Day 2024 indicate that the 6-year construction would take $2.8 billion, operate for 17 years and have a similar operating cost as the existing La Colorada mine.

Divestitures and Dormant Assets

PAAS has conducted some portfolio optimization actions, which has thus far yielded $988.4 million in cash plus 4 NSR (net smelter return) royalties. We previously discussed the silver and copper assets in our previous article on PAAS. La Arena is new on the divestment list and was acquired in 2019 with the purchase of Tahoe Resources, with production recently expanded the life of the mine to 2026. Management indicated that mines likely to be divested are those near their end-of-life, including Cero Moro and Dolores.

| Portfolio | PAAS Stake | Notes | Cash ($ Millions) | NSR Royalty |

| La Arena | 100% | Operating | $245 upfront, $50 on completion of expansion | 1.5% Gold |

| MARA Project | 56.25% | Operating | $475 | 0.75% Copper |

| Morococha | 92.3% | No longer operating | $25 | – |

| Agua de la Falda | 57.74% | In development stage | $45.6 | 1.25% Precious, 0.2% Base metals |

| Equity Interests | $47.1 |

In our last article, we covered two assets that are awaiting government approval. Over the last year there has been some minor updates on the Escobal side. Negotiations at Escobal have moved to stage 3 of 4, which based on how long phase 2 took, will be complete in 2026. The new minister of mining, Victor Ventura, has never publicly commented on the Escobal mine but is regarded as less friendly to business interests, but more by the book, than the former minister. The new vice minister and the one working on the case, Luis Pacheco, is an Indigenous activist who has previously worked on similar consultations. We expect any re-opening will include concessions and stringent environmental controls, which would increase AISC and reduce annual production. PAAS estimates that it will take roughly $100 million to restart the mine. Pre-shutdown it held a silver AISC of $10/oz, and more than 20Moz of annual silver production, making it the second largest silver mine in the world.

Risk

PAAS remains geographically diversified, with no one country representing more than 25% of revenue. As shown in Guatemala, there are still risks associated with local governance that can meaningfully impact the top line.

We do not believe that the Argentinian Navidad mine will ever pan out given the Federal governments RIGI (Régimen de Incentivo para-Grandes Inversiones) did not move the public support needle even amongst a failing Argentinian economy. PAAS has been sitting on the land since 2009, and its carrying value is quickly winding down to below $200 million.

In Mexico, the previous president Andrés Manuel López Obrador had pushed forward initiatives to ban open-pit mining in the country. However, the new president Claudia Sheinbaum has opposed the ban. La Colorada is a subterranean mine, and La Colorada Skarn would also be subterranean. In the short term there would be little impact if a measure was adopted, though it would set the stage for further environmental restrictions on mining.

Financials

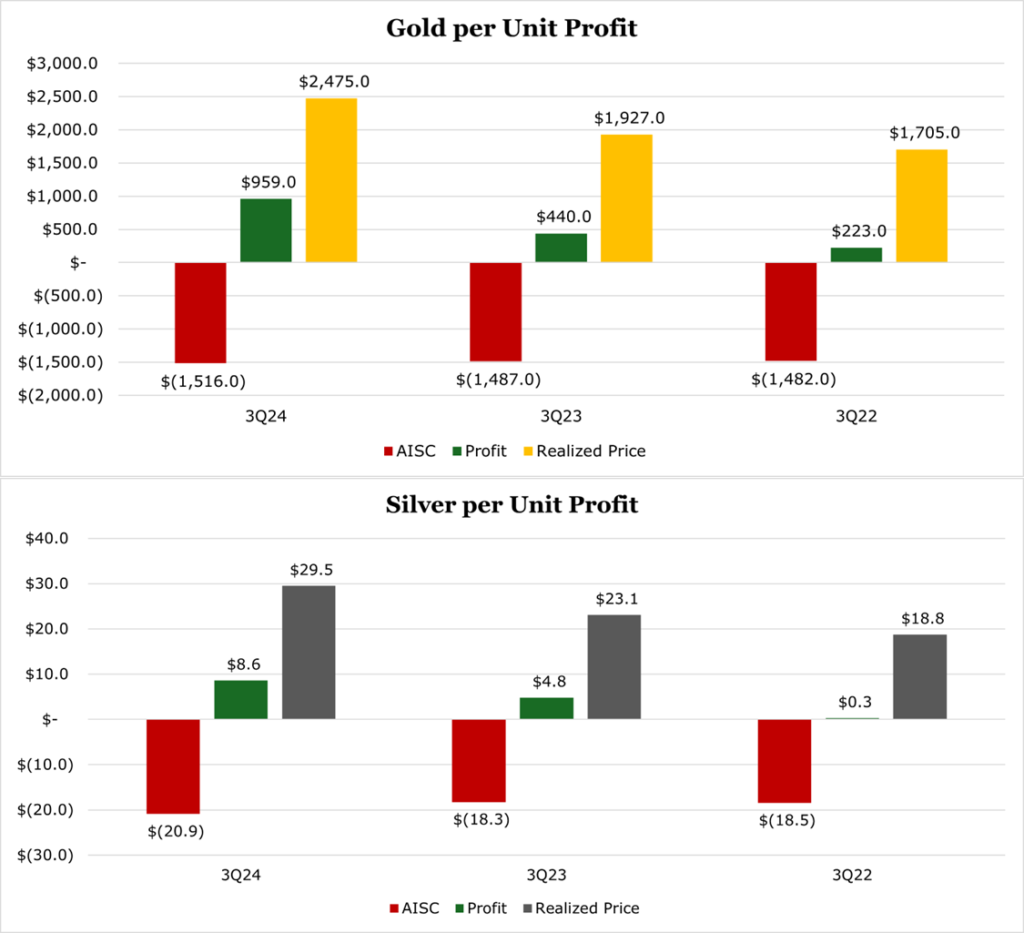

For the first 9 months of 2024, combined PAAS revenues grew 21.7% year over year with operating margin expanding 990bps to 13.8%. Most of the growth in revenue and margin outside of the silver segment’s 2.2% increase in production was due to record high realizations.

If prices return to more normalized levels, we expect that the La Colorada ventilation expansion should keep per unit profit up in the silver segment. For the full year 2024, PAAS expects sustaining capital to be $302.5 million at the midpoint, up 4.9% year over year, with expansion project capital to be $82.5 million, down 12.7%.

Currently, we do not expect management to engage in acquisitions over the short term. During the earnings call for the quarter ending September 2024, management stated that it is not interested in smaller scale operations and noted that valuations are at cyclical highs given the robust pricing environment. Based on the existing profile of divestitures, PAAS would likely only consider an acquisition in the gold space if it exceeded 80 Koz of production annually.

Capital allocation is primarily focused on keeping the debt below 1.0x gross debt to EBITDA. Currently, total debt is $839.2 million, or 1.2x. Thanks to the divestitures it has undertaken during the year, PAAS’s cash position for the year ending December 2024 was $887.3 million. The second capital priority is expansionary spending, which as previously discussed, will likely come in the form of mine improvements and organic development at La Colorada Skarn.

The final priority is the dividend and shareholder return. PAAS pays a base dividend of $0.10 per share quarterly, with a variable component based on cash net of debt. For the year ending December 2024, this figure was $48.1 million. On top of the dividend, management has been authorized to repurchase up to 5% of outstanding shares.

Conclusion

Record realizations have boosted cash position to fully net out debt, and thus it is possible that PAAS pays a variable dividend in the second part of 2025 providing high prices continue to prevail. We expect the continued supply shortfall in silver to provide a secular boost to the bottom line, along with improvements at the La Colorada mine giving company-level benefits. For gold, we believe that there are strong secular tailwinds driven by economic uncertainty that should keep realizations high.

Overall, PAAS is a good choice for investors seeking higher exposure to silver while maintaining the balance sheet stability of a gold miner.

Peer Comparisons