MVP Pipedream Becomes Reality and Unlocks New Market for ETRN

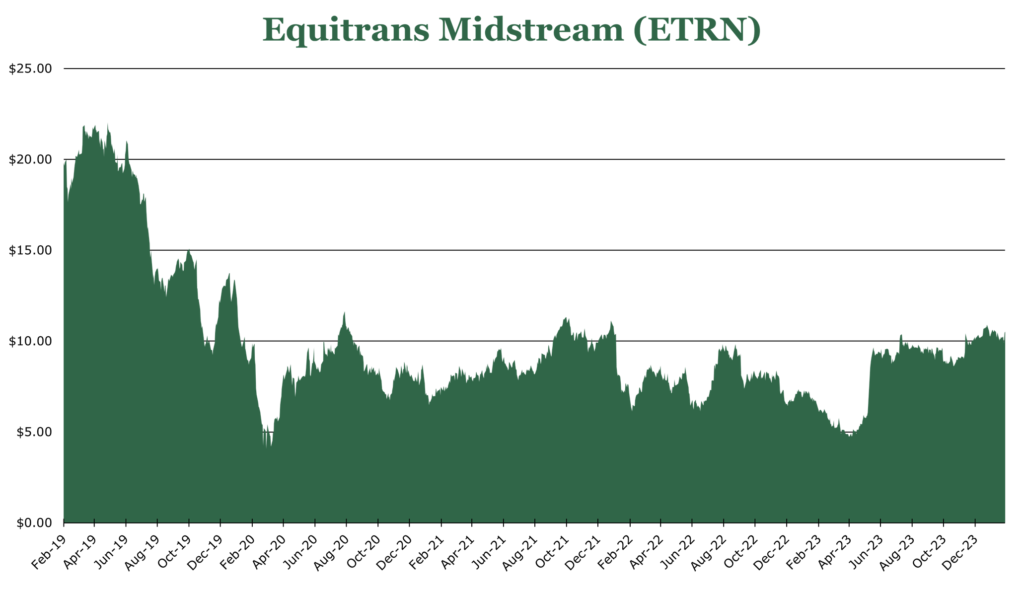

| Price $10.56 | Dividend Holding | February 26, 2024 |

- 5.7% dividend yield, with emphasis on maintaining dividend at the current level and using free cash to pay down debt.

- The Mountain Valley Pipeline is expected to be completed in mid-2024, providing access to Transco markets and Henry Hub and 2 Bcf/d in transit capacity.

- ETRN’s projected EBITDA for 2024 is $1.3 billion, representing an approximate 23% increase year over year.

- ETRN’s network includes 1,120 miles of gathering assets and 940 miles of transmission assets with a 12-year weighted average contract life.

Investment Thesis

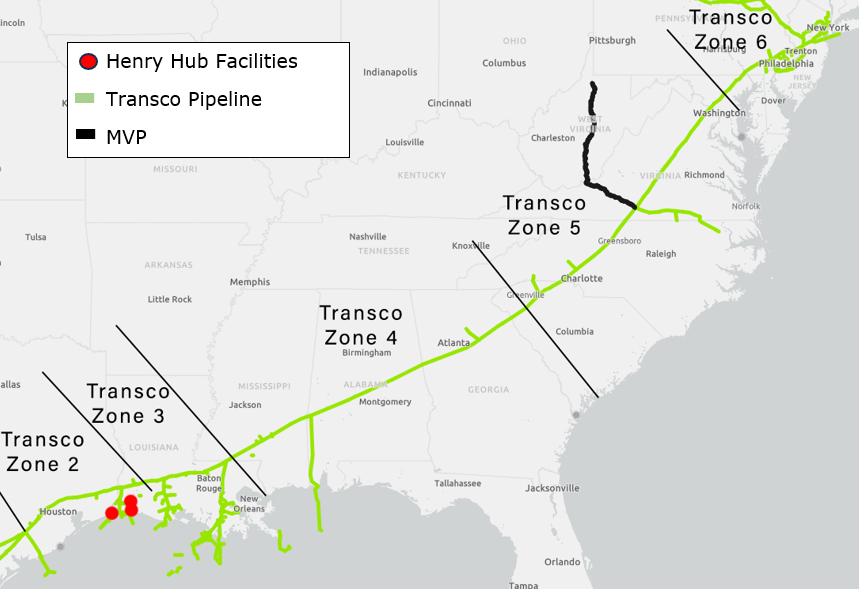

Equitrans Midstream (ETRN) is one of the largest natural gas gathering and midstream firms in the United States, focused on the Marcellus and Utica shale areas. The Mountain Valley Pipeline is expected to enter operational service in June 2024, as the Supreme Court and bipartisan lawmakers have taken an interest in the project’s success. The pipeline will connect the very cheap Utica and Marcellus natural gas basins to the Transco pipeline, which feeds into the entire East Coast and down to Henry hub.

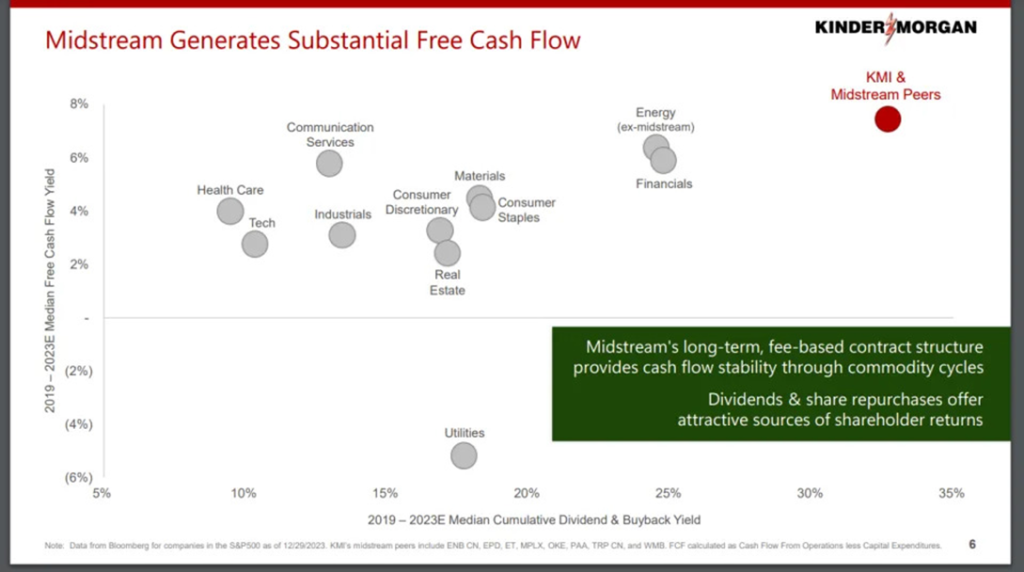

The company’s long-term contracts, with a weighted average life of 12 years, provide a stable revenue base. The MVP, once operational, is expected to significantly enhance ETRN’s access to Transco markets, further bolstering its earnings growth. For this reason, we believe that ETRN has strong potential for long-term total return through a strong dividend supported by long-term contracts and capital appreciation as earnings grow.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $1.30 X 11 = $14.30

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 3.0 | 2.8 | 2.6 |

| Price-to-Earnings | 15.3 | 10.6 | 9.2 |

Operations

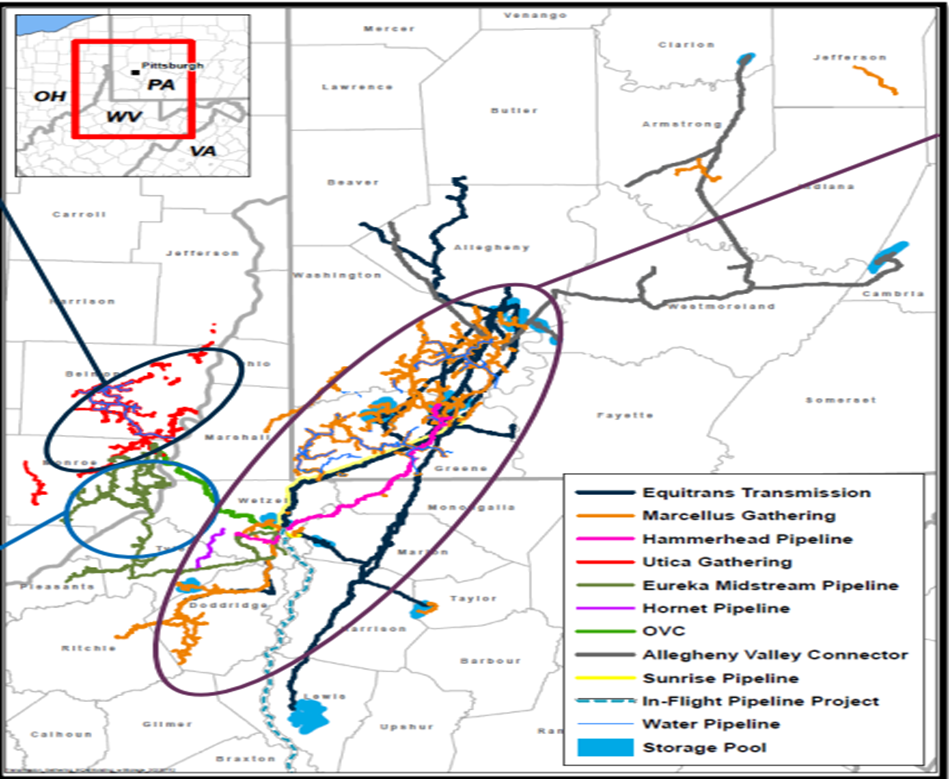

ETRN operates two forms of midstream infrastructure: gathering and transmission. Gathering is the use of smaller-diameter pipes that bring gas from the wellhead to compression or processing facilities. Transmission pipelines are long-length, large-diameter pipelines designed to move from production to consumption areas.

In PA and WV, ETRN operates 710 miles of gathering assets, with the primary customer being EQT, which we have discussed here. The current agreement with EQT covers 3 Bcf/d in gathering capacity, with an additional 1 Bcf/d once the Mountain Valley Pipeline comes online.

In Ohio, ETRN operates 220 miles of dry gas gathering lines, primarily in Belmont County, which produces approximately 500 MMcf in gas per year. ETRN typically runs these lines on interruptible service, meaning only in high-demand periods, with terms ranging from a month to a year or on an as-needed basis.

Eureka (60% ownership) and Hornet (100% ownership) gathering in OH and WV is 290 miles of pipe that cuts across both the Utica and Marcellus basins. Combined, the gathering capacity is 1 Bcf/d.

In 2024, ETRN expects the total capex in the gathering area to be between $210 million and $260 million, including potential expansion projects.

ETRN operates one of the largest storage assets in the region, with 18 storage pools across the region with a combined capacity of 43 Bcf. According to ETRN, these storage pools have a combined capacity to withdraw or deposit approximately 820 MMcf/d and are currently 69% subscribed.

Total ETRN transmission capacity is 4.4 Bcf/d across 940 miles, with connections to 7 major interstate pipelines, including Transco, once the MVP enters active service. Capex for the transmission area is expected to be $75-85 million, including the $40 million required for the OVCX project discussed later.

ETRN additionally has 53 miles of mixed-use water pipe in service, including a 10-year water supply commitment with EQT and another customer. ETRN will supply 350,000 barrels of water from its storage system across both Marcellus and Utica producers.

| Segment | % of 2023 Revenue | % of 2022 Revenue |

| Gathering | 62% | 66% |

| Transmission | 32% | 30% |

| Water | 6% | 4% |

Mountain Valley Pipeline and Extensions

The Mountain Valley Pipeline, often referred to as MVP, is a 300-mile pipeline designed to transport low-cost gas from the Northeast to Transco markets and to Henry Hub. ETRN will operate the pipeline and hold a 49% ownership stake.

MVP has a nameplate capacity of 2 Bcf/d in natural gas upon opening, which is expected in June. Currently, all 2 Bcf/d in capacity have been subscribed under 20-year contracts, with EQT being the largest customer with 1.2 Bcf/d in capacity reserved. The EQT gathering agreement includes shared costs for sustaining expenditures, projected to be $225 million in 2024.

The largest potential benefit of the MVP for ETRN is significantly expanded access to Transco markets. The Transco pipeline runs from Northern PA down to Texas and Henry Hub markets.

ETRN is well-positioned to capitalize on the growing demand for natural gas in the United States, particularly in the Northeast and Appalachian regions. According to Wood-Mackenzie, the Zone 5 Transco market could benefit the most from the MVP. The Zone 5 area has consistently added natural gas power capacity with consistently hot summers running current infrastructure to the limit. Over the short term, an estimated 1,000 MW in additional generation capacity will be added to the area by 2026. The EIA estimates that there are currently 6,373 MW of capacity proposed in the Zone 5 area alone, replacing many coal-fired power plants.

Southgate is a JV between ETRN and several local partners to extend the MVP 31 miles with 550 MMcf/d in carrying capacity. This is a significant trim from the original plan, though the cutback has alleviated significant local regulatory pressure. However, state lawmakers have been lobbying FERC to expedite the permitting process for Southgate. The targeted completion date is 2028 and will require $370 million of total capital. Expected ownership will be 47.2%, though ETRN will operate the pipeline.

Other Development Assets

Hammerhead gathering and transmission is a development project in southwestern PA designed to integrate PA gathering assets into the MVP. Hammerhead integrates an existing 63 miles of gathering infrastructure. The Hammerhead pipeline will be 40 miles of new pipe with 1.6 Bcf/d in carrying capacity. Currently, EQT has purchased 1.2 Bcf/d in capacity for a 20-year term. ETRN estimates that this will add $65 million of yearly EBITDA.

The OVCX (Ohio Valley Connector Expansion Project) is a series of compression stations and transmission assets spread across the Ohio Valley to add to the existing OVC pipeline operated by ETRN. Nameplate capacity is 350 MMcf/d, with 330 MMcf/d in commitments. Construction began in the quarter ending September 2023, with an in-service date expected in the quarter ending June 2024. ETRN expects to spend $40 million in 2024 on the project.

Additional expansion projects for both gathering and transmission are under the EEP (Equitrans Expansion Project), which are optional expansions to connect downstream users or upstream sellers of gas to the MVP. Currently, the EEP has 600 MMcf/d in capacity, with options to expand an additional 500 MMcf/d once MVP enters service.

Risk

ETRN has addressed most legal considerations with the MVP, as the Supreme Court lifted the block on completion, and federal lawmakers from both parties have shown interest in the pipeline’s completion. However, federal regulators have maintained environmental controls and required ETRN to conduct further tests on the pipeline to ensure no environmental concerns. Further delays could erode the favorable economics of the MVP.

The debt ladder is concentrated toward the end of the decade, with $6.3 billion in total outstanding debt. Additionally, once the MVP is in service, ETRN intends to open a $1.55 billion revolver to continue clearing the project backlog. With MVP’s in-service date now expected to be in the quarter ending June 2024, this extra revenue and borrowing facility will be critical in maintaining the debt-to-EBITDA target of under 4.0x and expansionary targets.

EQT is the largest single customer of ETRN, with current volume commitments of 3 Bcf/d – or around 61% of revenues. The contract will step up to 4 Bcf/d by 2026 with the MVP commissioning. There are some accounting considerations with volume commitments. Revenue recognition is done on an average basis over the life of the contract rather than as realized. This results in a stable revenue realization over time, with higher revenue periods deferred and lower revenue periods offset.

Outlook

The full-year 2023 financial results saw flat volumes overall but higher performance from the transmission business. In the gathering segment, full-year revenue was down 2.3% year over year due to a decrease in volumetric-based fees. In the transmission segment, full-year revenues were up 9.5% due to a large increase in volumetric-based fee volumes. The burgeoning water segment saw revenues increase 28.7% year over year.

The company’s guidance for 2024 projects an EBITDA of $1.3 billion, representing an approximate 23% increase year over year. ETRN expects volumes in existing assets to remain flat at 7.7 Bcf/d in volume, though once the MVP enters service, volume will increase.

| Project | Estimated Total ETRN Capital ($ Millions) | Annual EBITDA |

| Mountain Valley Pipeline | $3,970 | $220 |

| Hammerhead | $540 | $65 |

| EEP | $140 | $20 |

Access to Transco markets and significant long-term capacity agreements remain attractive draws despite cost and time overruns on the MVP. Additionally, with the full year 2024 release, ETRN released a statement stating that it has been engaged with at least one-third party regarding a “strategic transaction.” Whether the transaction is a full acquisition of ETRN or the buyout of ETRN’s 48.8% stake in MVP is unclear at this time.

Annual dividend yield is $0.60/share or a yield of around 5.7%. The current priority is reducing the debt load. According to ETRN, the dividend will stay the same in 2024 to aid in deleveraging efforts. Long-term leverage is targeted at a debt-to-EBITDA of under 4.0x, which is currently at 6.5x. This number is high among peers. However, with the addition of the MVP and other smaller development assets, this number could come down quickly, especially as the development queue finishes.

ETRN presents a compelling investment opportunity in the midstream sector, with its robust asset base, strategic expansion projects, and long-term revenue base. The company’s ability to navigate potential regulatory hurdles and execute its debt reduction targets will be key to realizing its full potential. Given the company’s strong contract portfolio with an average length of 12 years, expanding infrastructure, and focus on reducing debt, we are optimistic about its potential for long-term total return between modest capital appreciation and a strong dividend.

Competitive Comparisons