Cheap Pureplay and Short Term Expansion Yields Long Term Cashflows for EQT

| Price $43.81 | Dividend Holding | September 5, 2023 |

- Earnings and Dividends are expected to ratchet higher with Mountain Valley Pipeline opening by 2024.

- Dividend Yield 1.36%, extensive share buyback regimen with $1.4 billion in repurchases left open.

- Pure player in one of the cheapest gas basins in the world. EQT produces 6% of total US natural gas output.

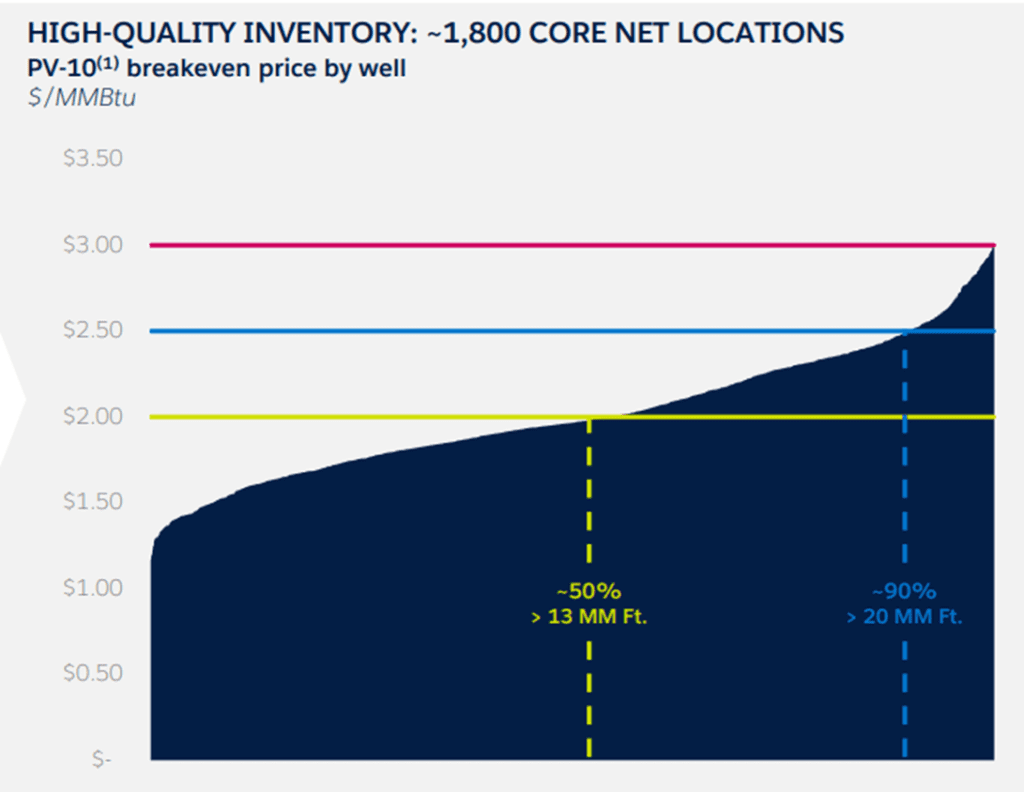

- Acquisition of Tug Hill, adding 800 MMcfe/d* in capacity while reducing firm-wide breakeven by $0.15/MMbtu*.

- Favorable natural gas conditions expect a shortfall in supply compared to demand. EIA expects 16% increase in global demand year over year.

Investment Thesis

EQT Corporation (EQT) is the largest natural gas producer in the Appalachian Basin. Producing an estimated 2,000 Bcfe per year (~5.5 Bcfe/d), EQT is the largest producer in the United States or about 6% of US nameplate output. EQT has an extensive development portfolio, with 1,800 low-breakeven locations averaging $1.34 per Mcfe in operating costs and an average realized price of $3.10 per Mcfe.

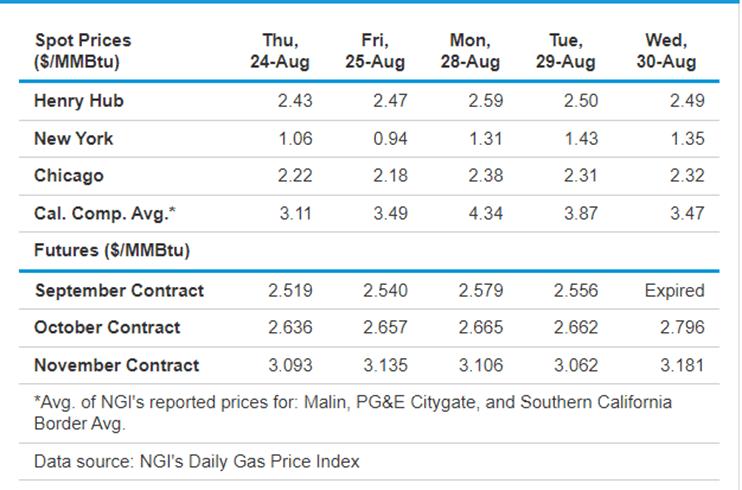

Between the Russian invasion of Ukraine, natural gas replacing coal fired generators, and significant demand growth in the developing world — global conditions favor significant upward pressure on natural gas prices. The EIA expects an average spot price of $3.22/MMBtu. While EQT has some short-term impacts on its bottom line through acquisition and deleveraging, a lean, high-margin producer has a significant long-term opportunity.

Estimated Fair Value

EFV (Estimated Fair Value) = E25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $7.0 X 10.8 = $75.60

| E2023 | E2024 | E2025 | |

| Price-to-Sales | 2.95 | 2.48 | 2.21 |

| Price-to-Earnings | 20.55 | 10.11 | 6.3 |

Operations

| Basin Operation Name | Output |

| NEPA Marcellus, PA | 0.9 Bcf/d |

| OH Utica, OH | 0.3 Bcfe/d |

| SWPA Marcellus, PA | 3.2 Bcfe/d |

| WV Marcellus, WV | 0.9 Bcfe/d |

In a “combo development” program, EQT utilizes a standard well-plate design across 18-25 wells. This immediate scaling allows EQT to set world records for footage drilled in 48 hours consistently. This long drilling distance in a short time, nearly double its peers, allows EQT to lead the pack in time to extraction from first drill.

$2.4 billion in cash and 49.6 million shares for a total value of $4.5 billion. Additional debt was raised to provide half the needed cash. The acquisition will add 11 years of 800 MMcfe/d production, lowering the firm-wide breakeven by $0.15/MMbtu. The acquisition will be accretive in FY24 or FY25.

EQT has the lowest emission intensity among its peers and aims to be net zero by FY25. Roughly 60% of this reduction will come from infrastructure improvements that will reduce carbon intensity. The remaining amount will be purchased through offsets.

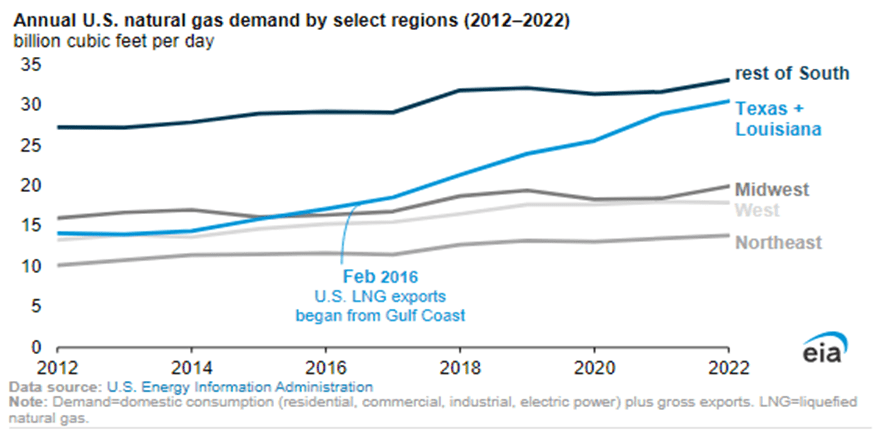

The MVP (Mountain View Pipeline) is expected to enter service in FY24, with full capacity to reach around FY27. The MVP would link gas directly to demand in the Southeast United States, allowing for better price realization and higher FCF (Free Cash Flow). Across the entire Appalachian Basin, natural gas storage is up 22.7% year over year. Natural gas companies choose to store gas and wait for more favorable pricing, while oil companies – with natural gas as a byproduct – are generally price takers. EIA estimates that roughly 12% of US natural gas output comes from byproducts of oil drilling. EQT states that once MVP pipeline’s initial capacity comes online, it will be able to offload the excess gas storage with more favorable pricing at Henry Hub. MVP will significantly reduce the negative basis for Appalachian gas compared to Henry Hub, as it will increase the basin’s potential market.

Market Condition

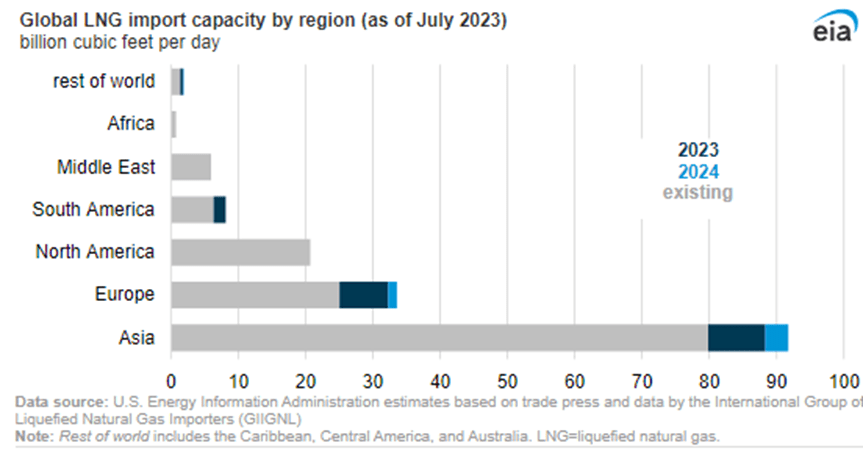

Part of mitigating risk for EQT has been seeking to expand sales locations to the Gulf Coast where the largest LNG terminals are located, and prices are more consistently favorable. This company currently delivers 1.2 Bcf/d to the Gulf Coast.

The Gulf Coast with its LNG facilities will continue to grow in importance for overall demand for US gas. the gulf coast increased by 116% compared to 43% for the whole United States over the past 10 years. The newest agreement is a 15-year tolling agreement that has already been signed with Lake Charles LNG. This agreement represents roughly 135 MMcf/d. EQT intends to pursue agreements with international buyers and additional tolling opportunities. International demand for US gas to grow by 16% by FY24. China could nearly double its demand, and Germany and the Philippines have begun importing LNGs for the first time. US LNG Export capacity will increase by 150% to FY27 while at the same time making up 35% of global production.

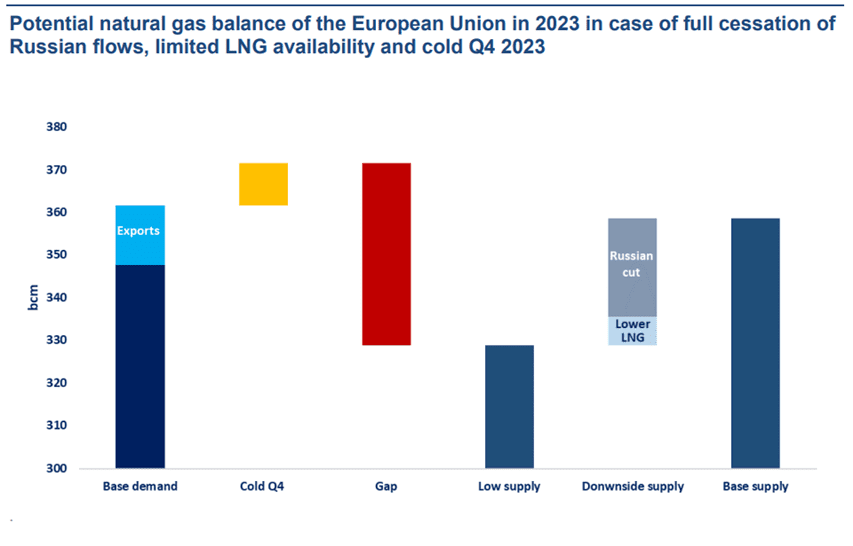

Global gas balances are impacted heavily by the war in Ukraine, with the EU reducing Russian imports of natural gas by around 35 Bcf/d. Currently, the EU still imports Russian gas to cover about 15% of its demand, but if either side suddenly ceased this supply, the EU gas supply would decrease by a further. If the Chinese economy recovers quicker than expected, EU importers would have to compete on a price basis with China. There is already a significant gap in supply, and global gas in storage has been trending down over the past 5 years. Globally, conditions are positive for upward pressure on Natural Gas prices.

Outlook on natural gas is very positive, with global demand expected to spike by 16% year over year in FY24 (middle guidance). Expected demand growth of 4-5 Bcfe/d by 2025 will strain supplies and potentially result in better pricing.

Risk

EQT is 30% hedged for FY24, with an average price floor of $3.64. With expectation of a gas price recovery hedging into 2024 is on the low side. However, 2Q22 saw an unfavorable gas price realization, averaging $2.2/MMbtu. This caused a reported loss of $-0.18 per share, though full year guidance is still expected to be $2.15 per share.

Before the acquisition of Tug Hill, EQT was expected to post $900 million in free cash for the year. Given the 1.0x debt to EBITDA target, much of the free cash flow may go toward that acquisition. In the short term, cashflow available to EQT shareholders will be constrained, but the company is guiding towards the acquisition being accretive in 2024. We believe the acquisition improves EQT’s underlying business over the intermediate and long term. Buying gas assets when pricing and asset values are down is a smart move in our opinion.

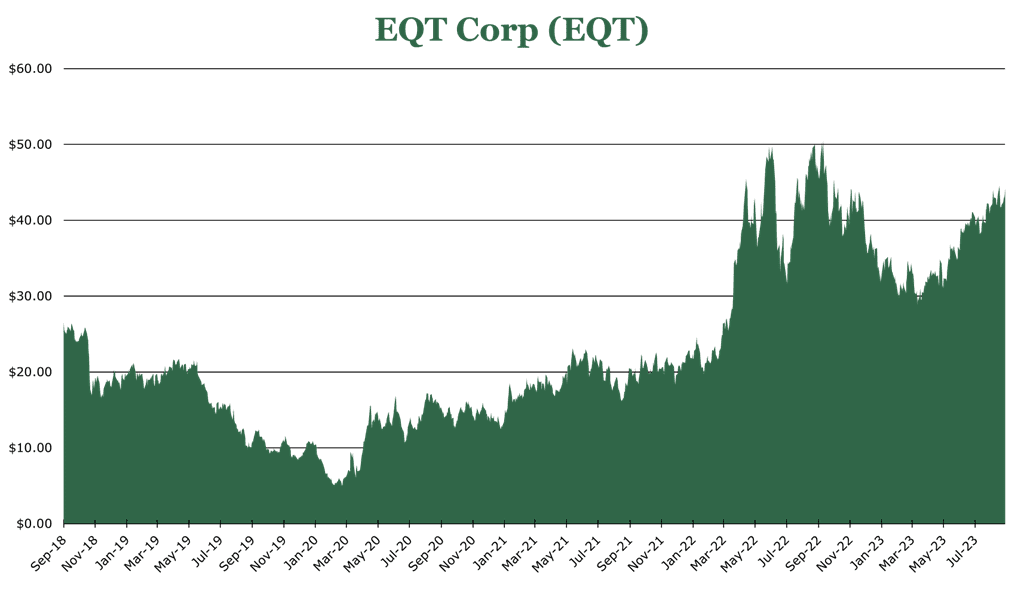

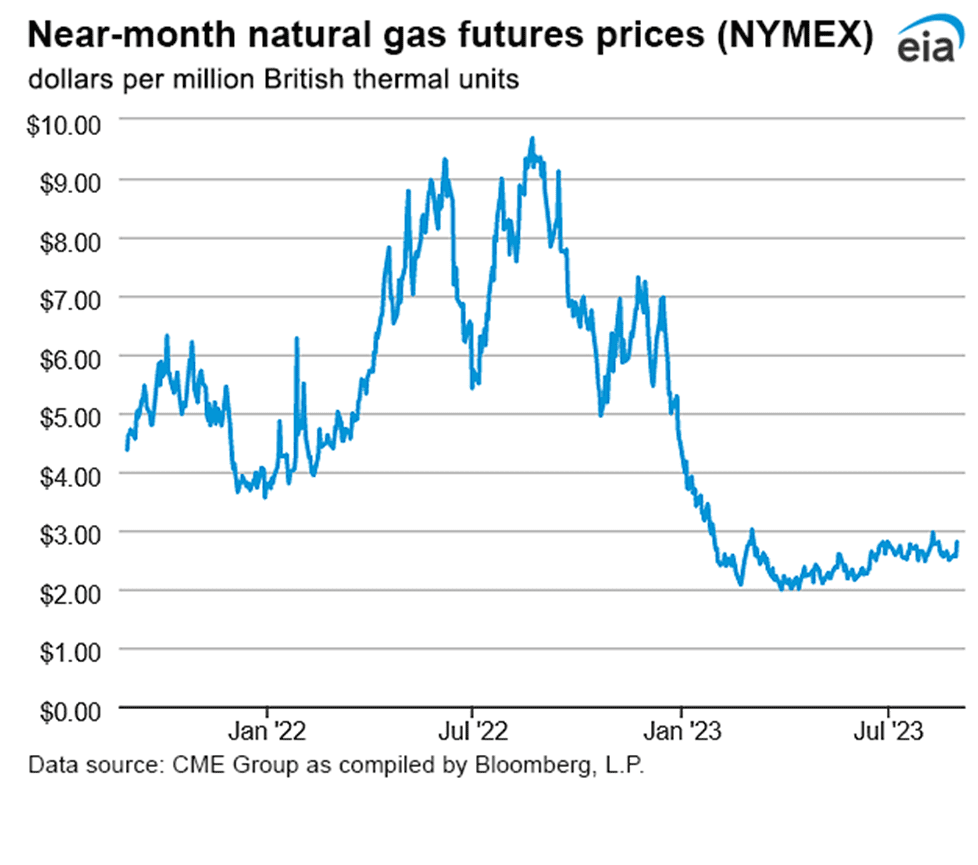

However, the largest risk facing EQT is cyclicality and volatility in the natural gas market. Natural gas has seen a downward slump as Russian exports were bigger than the West hoped and a warm European winter constrained demand. While these prices are expected to return to the $3-5 range for FY24, prices heavily depend on global conditions, temperature, economic activity and import/export capacity. Gas prices are extremely volatile and unpredictable. Part of the reason for this is 13% of gas in the US is a byproduct of drilling for the historically more lucrative crude oil. This means a lot of gas still comes to market even if the price drops. As you can see below, prices collapsed after the post-Russian invasion spike.

Outlook

EQT has a very strong free cash flow outlook, expecting to generate >50% of its enterprise value of $22 billion by FY27.

| Price Assumption ($/MMbtu) | Lower Bound ($M) | Upper Bound |

| $2.5 | $600 | $900 |

| $3.0 | $700 | $1000 |

| $3.5 | $900 | $1200 |

EQT targets 1.0x leverage at a $2.75/MMBtu natural gas price. In 2Q23, EQT retired $800 million in debt, further lowering the debt to 1.1x EBITDA. The 1.0x leverage target increases financial stability and lowers the risks of participating in the volatile gas market across the commodity cycle.

EQT currently has $1.4 billion left in repurchases and an annual dividend of $0.60, which currently yields 1.36%. While this is lower than the sector, management states that the current dividend level will grow as the cost structure improves: “Sustainable long-term base dividend growth will remain a key pillar of our shareholder return strategy moving forward.” This year’s dividend increase was 20%.

Despite adverse pricing affecting results, EQT remains a high-margin producer that will benefit from global conditions and its acquisitions as well as organic development projects.

Definitions

* MMbtu (Millions of British Thermal Units) is the standard unit for financial contracts and settlement, while Mcf (Thousands of cubic feet) is the standard for measuring supply and demand. 1 Mcf = 1.036 MMbtu.

Competitive Comparisons