Foot Locker Laces Up for Off-Mall Move

| Price $29.26 | Core Holding | February 8, 2023 |

- Foot Locker is shifting from mall-based to off-mall ‘new format’ stores to attract a broader customer base.

- It has started partnerships with leading brands like Puma and Reebok and a renewed Nike partnership.

- NBA sponsorship to boost brand loyalty and engagement, tapping into the massive global basketball fanbase.

- Eyeing growth in the Asia-Pacific region and India, targeting the burgeoning middle-class population and their increasing purchasing power.

- The current economic environment has decreased earnings and margins, but the foundation is set for recovery as the consumer spending upcycle takes hold.

Investment Thesis

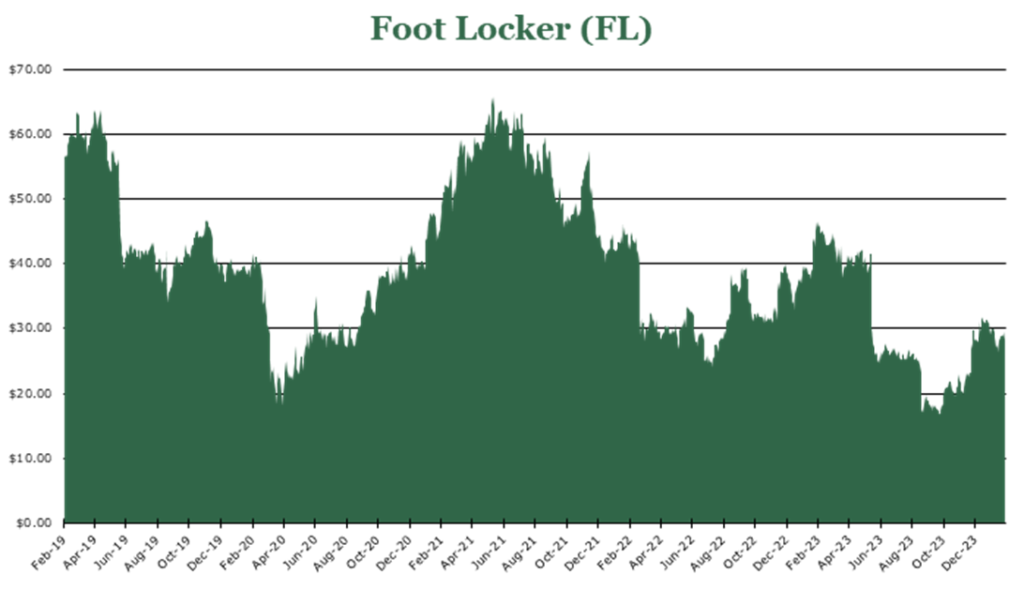

Foot Locker (FL) is a shoe and sportswear retailer. The current consumer spending downturn has hammered Foot Locker’s share price, falling almost 40% over the trailing twelve months.

Foot Locker has embarked on a strategic shift in the meantime. Through a pivot toward off-mall “new format” stores, more partnerships, and an expansion into Asia, Foot Locker hopes to establish brand loyalty and appeal to broader consumers. Additionally, Nike is set to launch an array of new shoes this year and potentially expand its footprint within Foot Locker stores. This could be a primary catalyst for earnings to rebound for Foot Locker.

Despite the challenges posed by the current consumer spending downcycle, particularly impacting its core customer base, Foot Locker’s expansion into Asia and history of capturing the consumer spending upcycle presents a good value case for capital appreciation and yield once the dividend resumes.

Estimated Fair Value

EFV (Estimated Fair Value) = EFYJan26 EPS (Earnings Per Share) X P/E (Price/EPS)

EFV = EFYJan26 EPS X P/E = $3.00 X 13 = $39.00 January Fiscal Year

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.39 | 0.39 | 0.38 |

| Price-to-Earnings | 20.2 | 13.5 | 9.4 |

Lace-Up Program

At the beginning of fiscal 2023, Foot Locker stated it would close 400 retail locations and open 300 “new format” locations. These new format locations are all non-mall and include more integration with its digital sales platform. Off-mall has become a burgeoning trend in traditionally in-mall retailers. Switching to off-mall offers a boost in brand loyalty among younger generations and a bottom-line boost from lower rents. This strategy has seen some success with other traditional mall retailers like The Gap. The decline of the mall has been well-reported, with larger malls more spread out becoming the norm. Likely, retail dynamics in malls will drastically change over the medium-term horizon, and going off-mall could avoid volatility in that area.

Part of the Lace-Up program is savings on the administrative side, which Foot Locker states is roughly $350 million. For fiscal 2024, it expects to capture $140 million of these savings through internal actions.

Consumer Position

In our article on the current consumer downcycle, we go far more in-depth. Roughly 50% of Foot Locker’s customer base has under $50,000 in household income. This bracket has been hardest hit by the consumer credit crunch and savings drawdown. This has reduced the average spending outside of even-driven purchases like Black Friday. However, as consumer retail recovers, so will Foot Locker.

As a marketing initiative, Foot Locker will become a sponsor of the NBA. The NBA has a massive global reach, second only to Soccer. In a 2018 Nielsen survey, 85% of basketball fans said they would consider a product if the product was a sponsor, and 76% stated they demonstrate more loyalty to sponsor brands.

Asia-Pacific and Brand Partnerships

Foot Locker has experienced a drawdown following Nike’s 2022 decision to focus on direct-to-consumer sales, which previously made up nearly 70% of Foot Locker’s total sales. Additionally, Nike’s lower expected guidance has further put downward pressure on Foot Locker. It seems like Nike wishes to maintain and even strengthen its strategic relationship with Foot Locker, as it is also experiencing an inventory glut with its direct-to-consumer shift. In our view, it is likely that Nike will continue to rebuild its relationship with Foot Locker to help bolster its 2024 release calendar and avoid an inventory glut.

Still, Foot Locker is moving forward with its plan to reduce its reliance on Nike. Foot Locker is targeting a reduction in Nike sales to under 60% of total sales by 2026, currently at 65% of total sales. Additionally, it has entered into agreements with Puma and Reebok for exclusive items. Exclusives currently make up around 15% of sales, which it hopes to grow to 25%. Exclusives can provide significant brand loyalty and drive traffic to non-mall locations.

The Asia-Pacific area was the strongest performer in the quarter ending September 2023, contracting only 0.5%. Nike Releases targeting this area, such as the Lunar New Year Collection, will likely provide tailwinds for the first quarter of 2024.

For Fiscal 2024, Foot Locker has planned expansion into India with both planned retail locations and partnerships with domestically recognized brands. The middle class in India has been growing at a 6.3% annual rate since 1995, with an estimated 31% of the population being middle class – or nearly 500 million people. A successful expansion into India could greatly increase the total addressable market.

Risk

Despite the downturn in results, Foot Locker has a modest long-term debt of $443.0 million. Previously, this would put its debt to EBITDA below 1.0x, though downturns in recent results have increased this to the 6.5x area. Most of these results can be directly attributed to the consumer spending downcycle and Nike shift. However, if the consumer downcycle extends far into the middle of the decade, it could be financially crippling for Foot Locker.

Outlook

Currently, consumers are pressed by inflation and increasing credit card rates, which have significantly shaken confidence. This has resulted in a fall in sales of 8.0% year over year. Inflation and bloated inventories continue to hurt the bottom line, with gross margin contracting 470 bps. However, Foot Locker does not expect its gross margin to fall below 27% for the full year FYJan2024. The contraction of sales has led to inventory being up 10.5% year over year, and Foot Locker expects to enter Fiscal 2025 with slightly lower inventory than the quarter ending September.

Foot Locker has paused its dividends to free up cash flow for repositioning projects, such as the new store formats.

Largely, the loss in earnings and margin can be attributed to the macroeconomic environment rather than a blunder. During the previous upcycle in 2021, Foot Locker posted record earnings and generated significant free cash. As consumer sentiment recovers, there is no reason why Foot Locker won’t return to form in both free cash output and dividend payouts. With a recovery in Nike sales and an important NBA sponsorship, Foot Locker is positioning itself to take advantage of the next consumer spending upcycle.

Competitive Comparisons