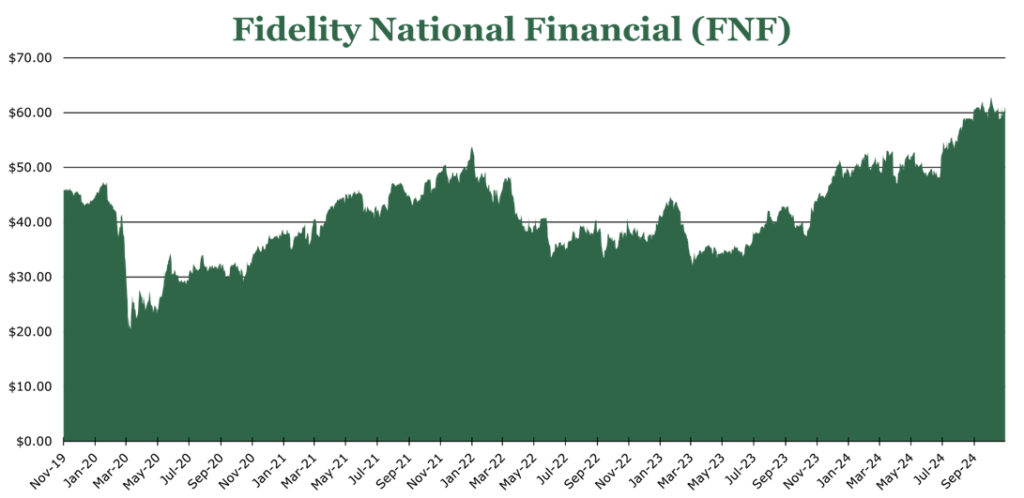

Fidelity National Financial has Strong and Safe Dividend Despite Housing Market

| Price $60.77 | Dividend Holding | November 17, 2024 |

- 3.3% Dividend Yield recently announced 4% dividend increase.

- Expects robust housing recovery in 2026, betting on a similar timeline for commercial real estate.

- #1 market share in the US for title insurance, in both agency and direct sales.

- F&G has secular tailwind in life and annuity from aging population.

- Despite downturn in housing market, FNF grew revenues by 8% over the first 9 months of 2024.

Investment Thesis

Fidelity National Financial (FNF) is a provider of title insurance and settlement services to the mortgage industry, and a provider of annuity and life insurance through F&G which owns approximately 85% of.

We believe we are at the cyclical bottom of the housing market, and at a long-term bottom for commercial real estate. As rates come down and the housing market sees a stronger recovery by 2026, FNF will be able to reap substantial benefits. In the F&G area we believe that the secular trend of the ageing population will continue to expand sales and premium income for life and annuity products.

We believe that FNF has strong secular tailwinds and has demonstrated strong shareholder returns through its 3.3% dividend and recent 4% dividend increase despite the weak housing and commercial real estate market.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/Earnings)

EFV = E25 EPS X P/E = $5.88 x 12.6x = $74.09

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.3 | 1.2 | 1.1 |

| Price-to-Earnings | 13.6 | 10.2 | 8.8 |

Market Conditions

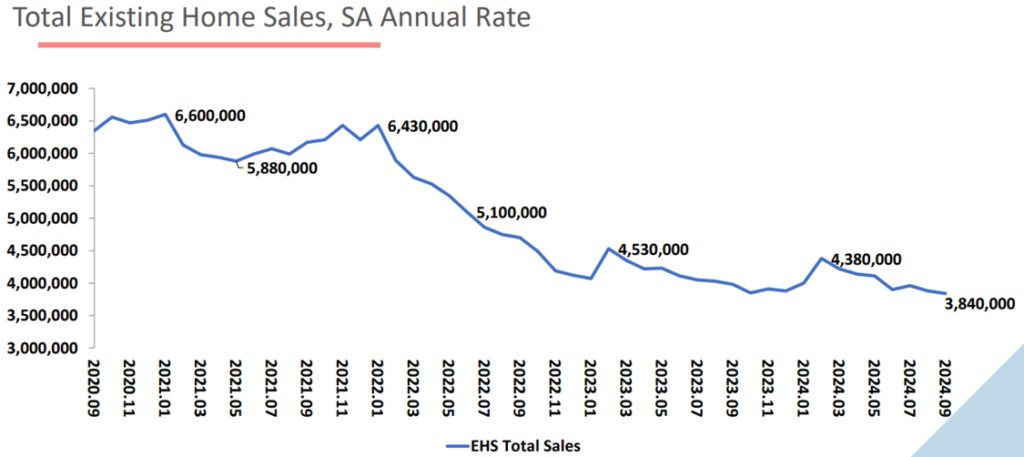

High interest rates and strained finances have driven a record low in mortgage originations. Existing home sales have decreased 3.5% year over year for the quarter ending September 2024, while home values increased 3% over the same time frame.

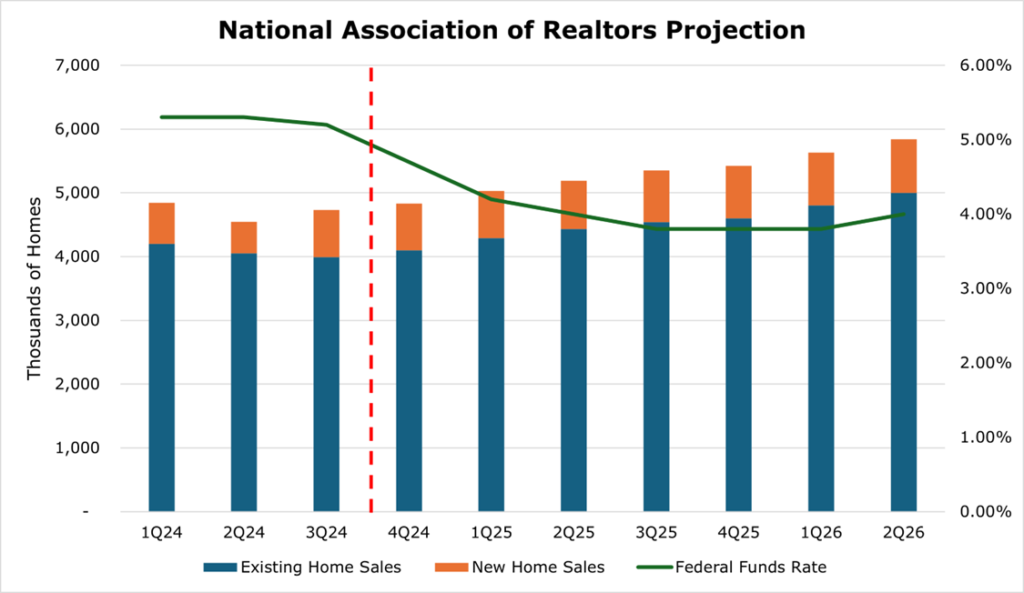

New single-family homes have seen some recovery, with the Census reporting a 6.3% year over year increase, though new construction typically makes up under 20% of the market. Despite some rate cuts by the Federal Reserve, the 30-year fixed mortgage increased to an average of 6.79% as of the week ending November 7, 2024. Mortgage rates are typically linked to the 10-year treasury, which has seen yields increase as bond markets have begun to expect long-term deficit spending by the Federal Government and renewed inflation.

Still, the National Association of Realtors projects renewed buying interest in homes going into the latter part of 2025 and 2026, with the Mortgage Bankers Association estimating mortgage and refinancing originations to full recovery by 2026. We believe that housing is still undersupplied in the United States. The US is still short more than 4.5 million housing units despite around 1.5 million new units built in 2023. According to Realtor.com, there were 1.7 million new renter/owner aged households created in 2023.

Compared to the relative slump in the housing market, FNF has been able to maintain its leadership in the market, growing revenues by 8% for the over the first 9 months of 2024. We have no reason to believe that this won’t continue in the future. With rates coming down we expect some tailwinds in title insurance over the medium-term though we feel the short-term, especially for refinancing, is likely at a cyclical bottom.

Title Insurance

According to Fitch, FNF has a title insurance market share of 31%, making it #1 in the United States. There are two ways to acquire title insurance, through direct writing, or through an underwriting agent.

On the direct side, the underwriter issues the policy, conducts the due diligence on the title, and provides all ancillary services like escrow. In this market, FNF has 41% market share. FNF operates state-level subsidiaries rather than one single cohesive brand. In our view, the level of operating leverage offered by a single unified brand in title insurance is small. Equally, maintaining a regional brand as acquired would allow divestitures to be much quicker if market conditions in a geography were to deteriorate. Owning several state-level brands allows a high level of tailoring to local laws and demands, with FNF reporting that it holds the #1 or #2 market share in 38 states.

Agent operations are independent title agents who sell policies on behalf of an underwriter. Unlike other forms of insurance where agents act like marketplaces, title agents are far more involved; conducting due diligence for the underwriter and handle several other ancillary services like escrow. In this market, FNF has 26% market share.

FNF pre-tax margins in the title business are typically between 13-15%, ending the first 9 months of 2024 with 14.5%. Over the same period revenue increased 8% year over year.

| Segment | Revenue Growth | % Of Total Title Revenue |

| Direct | 5% | 42% |

| Agency | 9% | 58% |

FNF generally pays out around 77% of premiums from the agency originations as commission, which has remained stable over time. While no specific numbers have been released, FNF’s CFO indicated that contribution margin for direct is around 40%, compared to around 10% for agency. This is typical for the industry given the high commission for agency-based revenues.

Office and commercial real estate has begun a long and slow recovery after 3 years of negative growth. For the first time in two years in the quarter ending September 2024, the number of leased office space outpaced vacated space. According to the National Association of Realtors, the recovery in commercial real estate market is regionalized, with fast-growing metros like Philadelphia, Dallas, Austin, and Houston seeing much higher growth (>1 million sqft in net new leases) compared to the national average of 0.4 million square feet. We remain apprehensive about a recovery in commercial real estate at scale in the short-term, though FNF has seen consistent commercial volumes for the first 9 months of 2024. According to FNF a positive indicator for recovery in commercial title insurance is transaction sizes have seen an increase. Additionally, for the quarter ending September 2024 commercial revenues increased 10% year over year.

F&G

F&G primarily offers life insurance and annuities, with FNF owning 85% of outstanding shares. In our view F&G provides an important non-cyclical baseline for FNF, making up 42.8% of FNF’s total revenue. Typical life insurance products are not as cyclical as title insurance.

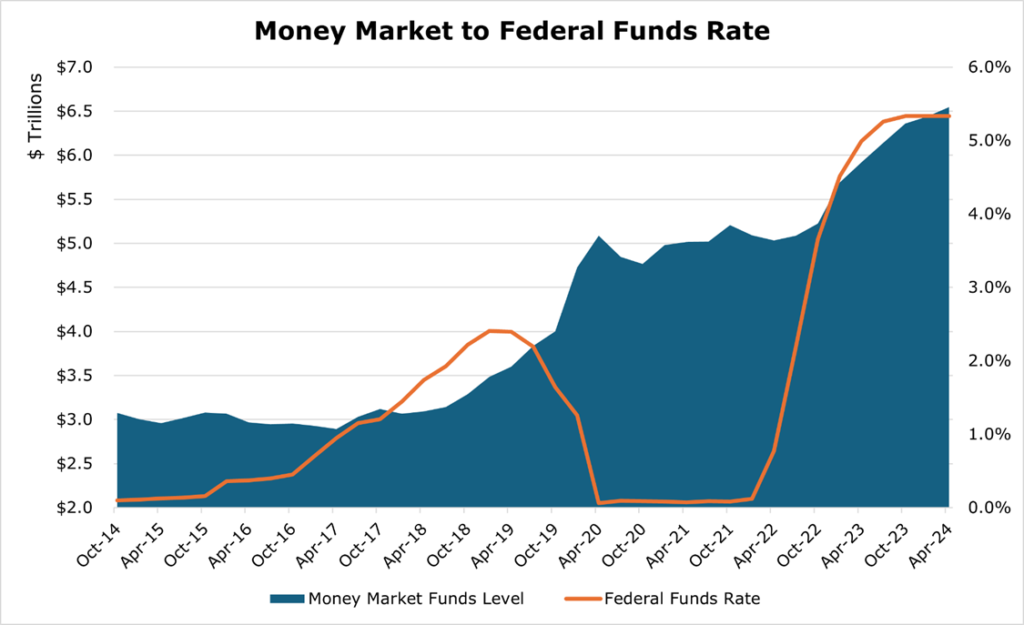

As we have discussed before, there is a secular shift in the US population, with more than 10,000 people per day turning 65 over the next 15 years which should provide a secular tailwind to F&G’s annuity and life business. The F&G segment has an additional tailwind in the form of aging American’s exposure to money market funds. Currently there are more than $6.5 trillion in money market funds and as rates begin to decline, FNF expects older consumers to elect alternative investments to lock in high rates utilizing annuity products.

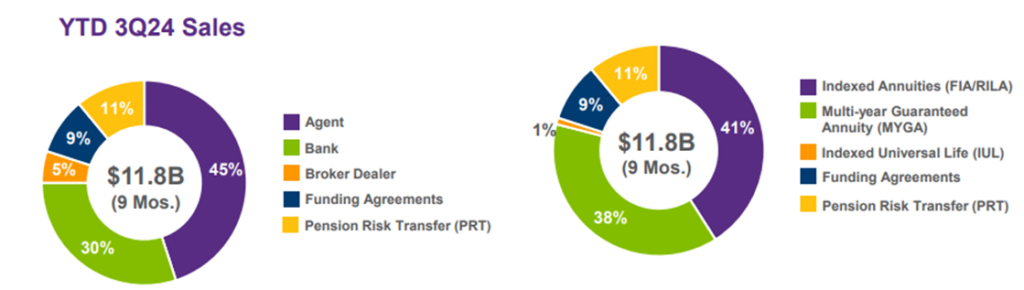

Given F&G’s horizontal expansion of sales locations to include banks, pension risk transfers, and funding agreements, we believe that F&G will continue to see strong secular growth and provide a strong non-cyclical base for FNF.

Since the 2020 acquisition of F&G, the number of sales channels and offerings has gradually expanded. The most substantial sales channel expansion has been offering products through banking institutions, which has grown to be 30% of origination compared to just 5% in 2020.

F&G’s investments are managed by Blackstone, and currently rated NAIC 1, an equivalent to at least an A rating. According to FNF, investment returns in the alternative categories have returned less than expected, which FNF expects to write down over the short term and cause a bottom-line impact of $35 million.

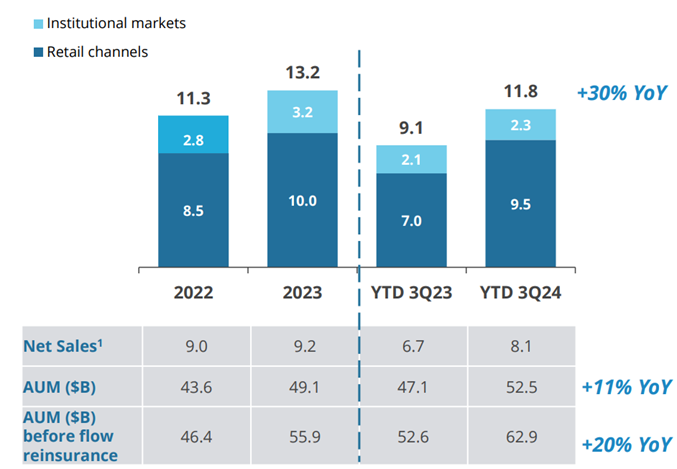

For the first 9 months of the year, total revenues grew 45% year over year. Drilling down over the same period, gross product sales were up 29.7% year over year, premium income was up 12.3% year over year and investment income up 24.0% year over year. The large increase in investment income was down to reaching a record retained AUM (assets under management after reinsurance) of $52.5 billion, an 11% year over year increase. For the first 9 months of the year, the F&G segment had a pretax margin of 8.7%. Over the medium term we do expect margins for F&G to expand given the focus on flow reinsurance to spread risk over time rather than traditional block reinsurance, meaning there are typically lower upfront costs.

Risk

The real estate market heavily determines FNF’s revenue outside of the F&G segment. In our view the real estate market is at a cyclical bottom, but the recovery timeline is unclear, especially for commercial. Industry consensus for residential appears to indicate a strong recovery being fully realized in 2026, though there is a more nebulous timeline for commercial.

On the refinancing side there has been a push by the Biden administration to waive certain title insurance requirements for refinancing. In our view the likelihood of any sort of sweeping action is low. The cost of title insurance has decreased consistently over the trailing 20 years, and most title insurance regulation is conducted on a state-level. According to a whitepaper by First American Financial, title insurance mitigates more than $900 billion in risk in the housing market annually, compared to an upfront premium of less than 0.5% of a home’s price.

In the F&G segment, high mortality events such as COVID-19 significantly impact life insurance claims for F&G. Additionally, a weak fixed-income market could pose risk for the investment profile – though FNF maintains that even the lowest rated (BBB) assets in F&G’s investment portfolio have a high (9.4%) default tolerance and long-term recovery rate of around 65% in the event of default.

Financials

FNF’s capital allocation is split between returning cash to shareholders, and growth-oriented M&A. Historically FNF has engaged in a M&A transactions in the title segment to expand technology offerings, including a 2022 blitz that saw the acquisitions of several automation, CRM, and settlement firms. Outside of technology, FNF appears to be betting on a more robust commercial recovery, acquired a NYC based commercial title insurance provider in October 2024.

FNF announced it will increase its dividend by 4%, representing $2.00 per year or a yield of 3.28%. FNF has been a dividend growth leader, with a trailing 5-year dividend CAGR of 10.2% and 12 years of consecutive dividend increases. Over the long term we believe that maintaining this is more than possible considering we are at the bottom of the cycle in housing and FNF is still raising the dividend. Since 2022 FNF has not embarked on a major purchase program due to ‘uncertainty in the market’. More likely in our view is that uses of capital like M&A have become more attractive in the title insurance segment given the cyclical low and will likely remain so until the housing market begins a more robust volume recovery in 2026.

On title claims for the first 9 months of 2024 FNF has seen a decrease in the loss ratio, down to 4.5% compared to 2023’s year ending 5.3%. Overall, we see little risk on the balance sheet, FNF has consistently held more than ample reserves on hand and currently has $822 million in non-required cash on hand. FNF targets a debt to total capital ratio of 20-30%, where it currently sits at 28.9%. This is slightly elevated compared to 2022, though we feel most of the debt increase is down to the previously mentioned attractive M&A valuations and will come down over time.

Conclusion

Despite being at a cyclical bottom in the housing market, FNF continues to raise the dividend and generate $7.4 billion in free cash flow over the trailing twelve months.

Over the medium term as rates come down, we believe that FNF will gain some tailwinds in both refinancing and home sales. While we remain apprehensive about a broad recovery in commercial FNF has been conducting M&A in the area and has stated that it sees signs of a recovery starting in 2025. In the F&G area we believe that the secular trend of an ageing population will continue to expand the top line, with cost savings from flow reinsurance also expanding the bottom line.

Overall, we believe that FNF is a good play for dividend investors seeking secular tailwinds.