Barrick Taps into Existing Asset Base for Expansion

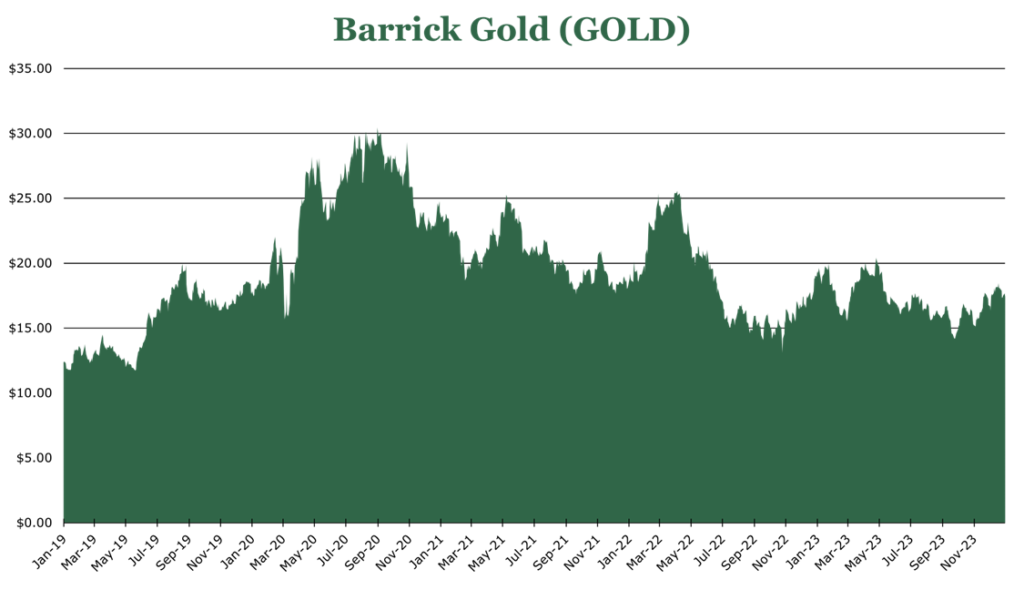

| Price $17.17 | Dividend Holding | January 11, 2023 |

- 2.3% dividend yield.

- Competitive cost profile, with $1,300/oz breakeven for gold and $3.2/lb for copper.

- Gold prices should benefit from economic instability, persistent inflation, deficit spending, high debt, and a global move away from the dollar.

- Copper prices should benefit significantly from the push toward a green economy and increased demand for electronics.

- Targeting 25% increase in gold equivalent production by the end of the decade, with a significant medium-term organic expansion strategy utilizing existing property.

- Virtually zero debt, with $4.2 billion in cash on hand for expansion, acquisition, or increasing dividends.

Investment Thesis

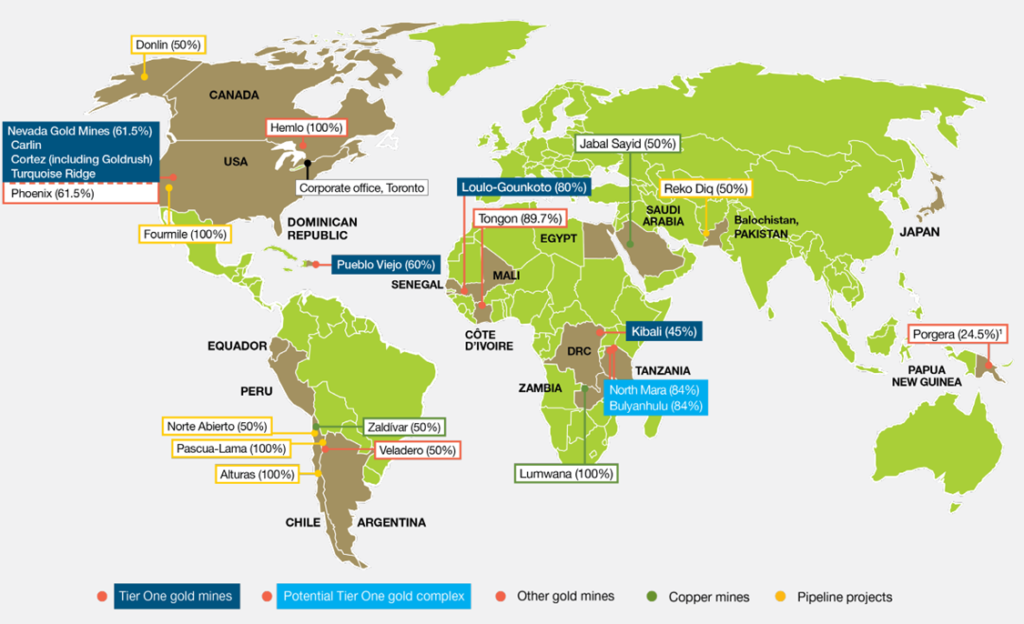

Barrick Gold (GOLD) is a gold and copper producer operating primarily in North America and Africa. Barrick has 4.4Moz of gold per year in output, with significant expansion into copper. All-in sustaining costs are $1300/oz for gold and $3.2/lb for copper.

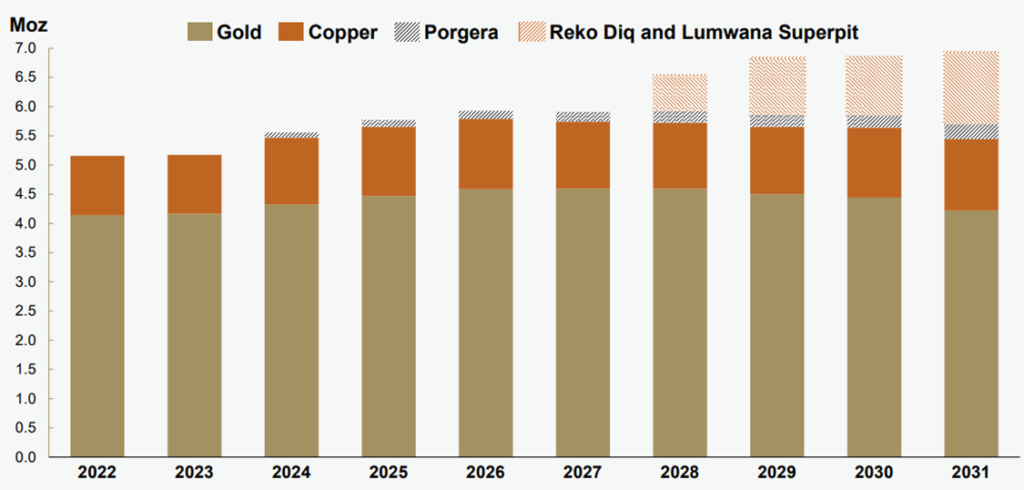

Barrick is investing heavily in finding its next tier 1 gold operation and expanding the efficiency and output of existing operations. Management targets a 25% gold equivalent ounce output growth by the decade’s end, equating to a 100% increase in copper production and a maintenance of current gold output.

Barrick stock declined 10.7% over the past year as financial results missed expectations. However, the pieces for a great value-based investment are organic production expansion on the horizon, gold prices being sustained at a high level, and increasing copper demand. In our opinion, Barrick represents a stock with dividend growth and capital appreciation potential.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = 1.43 X 15.0x = $21.45

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 2.4 | 2.3 | 2.5 |

| Price-to-Earnings | 14.9 | 13.2 | 12.0 |

Gold Overview

| Major Assets (quarter ending September) | AISC (all-in sustaining costs) ($/Oz) | Attributable production (kOz) | Production Growth (year over year) |

| Nevada Gold Mines (61.5%) | $1,286 | 478 | 12.5% |

| North America | $1,317 | 509 | 12.4% |

| Pueblo Viejo (60%) | $1,280 | 79 | -34.7% |

| Velandero (50%) | $1,314 | 55 | 34.2% |

| Central and South America | $1,304 | 134 | -17.3% |

| Loulo-Gounkoto (80%) | $1,068 | 142 | 9.2% |

| Kibali (45%) | $801 | 99 | 19.3% |

| North Mara (84%) | $1,429 | 62 | -12.3% |

| Bulyanhulu (84%) | $1,132 | 46 | -4.2% |

| Middle-East/Africa | $1,095 | 396 | 6.2% |

| Total Gold | $1,255 | 1,039 | 5.2% |

North American operations are anchored by the Nevada properties (61.5% ownership), with production being 509Koz quarterly, with around 15 years of prime mine life. The confirmation of inferred resources has added 12.8Moz of reserves to the mine, with an additional 20.9Moz unconfirmed inferred resources. However, despite these discoveries, the mine is showing its age with worse grades over time. Barrick is actively seeking to find North American replacement assets and has several planned expansions in Nevada to extend life and increase gold grade.

Central and South American production is anchored by Pueblo Viejo, which Barrick owns on a 60% basis. Previously, Pueblo Viejo was limited by limited tailings storage capacity and declining gold grade, which caused significant decreases in output and increased costs. Barrick recently completed a $2.2 billion expansion to extend mine life to the 2040s and significantly improve the short-term production profile. Production in 2024 could grow by 20% or more to 800kOz to 1Moz per year, with costs staying the same or decreasing over the long term.

African production is anchored by Mali, which experienced higher grade recovery, allowing for AISC to decrease by 12.2%. Some limited exploration around the site has been done for potential expansion, though the timeline is unknown and will likely occur after other planned mine expansions are completed.

The Porgera gold and silver mine in Papua New Guinea was previously the only Asian production profile asset. However, the mine halted production in April 2020 following the revocation of its mining license. The reason for the revocation was environmental impacts and social unrest, but at the time, the Barrick-Zijin Mining JV was unwilling to cede more ownership. After negotiations, the JV will own 49%, and the Papuan government will own 51%. The mine is set to re-open and begin production during the quarter ending March 2024. While this new ownership structure effectively reduces Barrick’s attributable share to 24%, the mine could turn into a tier 1 asset. Expected production is 700 Koz, at an AISC of $800/oz, requiring $1 billion in expansion capital.

Copper Overview

| Quarter ending September | AISC (all-in sustaining costs) ($/lb) | Attributable production (mlbs) | Production Growth (year over year) |

| Zaldivar (50%) | $3.39 | 22 | -4.3% |

| Lumwana | $3.41 | 72 | -12.2% |

| Jabal Sayid (50%) | $1.64 | 18 | – |

| Total Copper | $3.23 | 112 | -8.9% |

The largest copper production asset is the Lumwana mine in Zambia, which will begin to see sequential production improvements as expansion operations begin to contribute. Additionally, large-scale production expansion will begin construction in 2025. Other assets are not expected to change profiles meaningfully over the short term. Barrick targets 100% annual copper growth or approximately 1 billion lbs of copper production by the decade’s end.

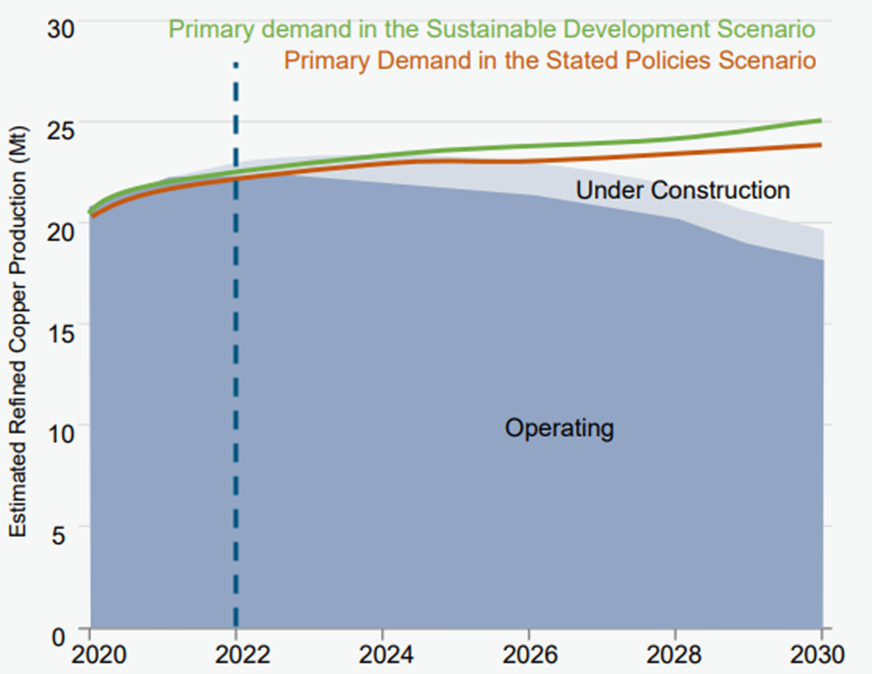

This hinges on two exploratory projects, the Lumwana super pit and Reko Diq. Copper is a key metal in the energy transition, providing significant tailwinds as the decade progresses. According to the IEA, copper production will fall far short of demand, even with short-term production growth from existing operations. Industry copper exploration budgets have historically been much smaller than gold exploration budgets, with copper budgets being 150% lower per S&P.

Expansion

Expansion is a mixture of brownfield and greenfield expansion. Barrick’s exploration at existing locations rather than seeking new mines distinguishes it from its peers and has helped keep costs down and free cash flow up. Since 2019, Barrick has been able to replace 125% of depletion through organic expansion. Barrick estimates that with the addition of Reko Diq and Lumwana expansion, production will peak at just under 7M GEO (millions of gold equivalent ounces) by 2029, or around 30% growth. With zero new assets, Barrick will maintain its current production levels well past 2031.

According to a Bloomberg report, Barrick approached First Quantum Mining regarding a potential takeover, a Canadian copper mining firm with around 1.5 billion lbs of copper and 250 koz of gold production per year. Quantum has been distressed by the closure of its flagship Panamanian mine due to its contract being ruled unconstitutional.

A smaller short-term expansion is the Goldrush property, which is building on the existing Nevada JV. Goldrush will add significant resources to the Cortez property and bring production to just over 1Moz per year at an ASIC of $800/oz. Costs are expected to be $1 billion on a 100% basis.

The top exploration asset is the Fourmile gold mine in Nevada, near the existing Cortez mine and Goldrush development. A 100% Barrick-owned property in the United States, the mine has the potential for significant geopolitically stable, high-margin production. Mine life is expected to be 15 years, with an average annual output of 350Koz, at an AISC (all-in sustaining cost) of $800/oz. Potentially, Fourmile is the highest-grade undeveloped gold asset in the Americas, costing an estimated $1 billion to open.

Lumwana is a brownfield expansion to the current open pit mine in Zambia. The expansion will increase the life to 36 years and increase copper production from 330 to 530 million lbs. It will not meaningfully change the AISC from its current $1.9/lb. With a target completion date of 2028, the project is expected to cost $2 billion, with initial construction beginning in 2025.

Reko Diq is in Pakistan and is a greenfield development. This development is located within one of the largest undeveloped copper-gold deposits in the world. The expected ownership structure is 50% Barrick and 50% various state-owned firms in Pakistan. Phase 1 of the mine, starting in 2028, will yield approximately 771 million lbs of copper and 300 koz of gold per year. Copper AISC for the project will be in the $1.2/lb area, making it significantly cheaper than the global average. The project is expected to have a life as long as 42 years and require $4 billion in initial capital.

Risk

Mining is unpredictable, with many surprises across a breadth of risks: labor, regulatory, costs, mine quality, pricing, and weather.

A major risk with the development projects is Reko Diq in Pakistan. Pakistan has had a history of sudden nationalization of assets. Barrick certainly has the expertise required to deal with the situation as they have in the past in Papua, and the Pakistani government has been cooperative thus far.

While Barrick controls 6 of the world’s top 10 producing gold mines, this does add an element of concentration risk. The loss of a single asset for an extended period would significantly impact financial results. Many of Barrick’s production assets are located in geopolitically unstable areas like Mali and the DRC (Democratic Republic of the Congo). Barrick strives to maintain cordial relations with the host governments and has been a key player in Mali over several governmental transitions.

Outlook

Gold production was higher and had lower costs year-over-year, largely due to increased production without meaningful changes in AISC. This momentum is expected to be carried into the final quarter of 2023 and into 2024. Copper production experienced some slowdowns, though Barrick does expect to deliver within the guidance range for full-year 2023 results.

| Quarter ending September | Year over Year Change |

| Gold Production | 5.2% |

| Gold AISC (all-in sustaining costs) | -1.1% |

| Copper Production | -8.9% |

| Copper AISC (all-in sustaining costs) | 3.2% |

| Revenue | 13.2% |

For 2024, we expect similar results with a more substantial boost toward the year’s second half as Pueblo Viejo gets over growing pains and Porgera re-initiates production after its 4-year hiatus.

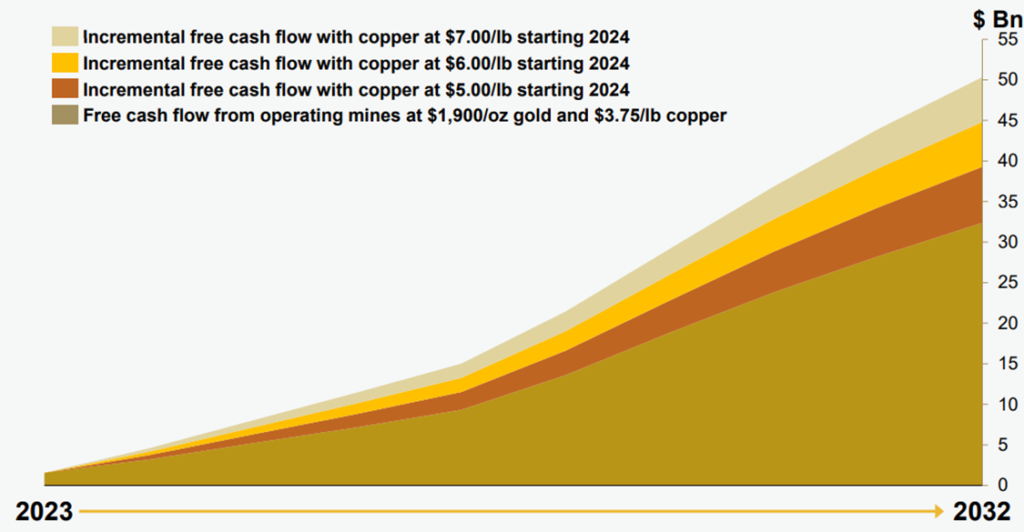

With copper prices potentially rising and a high gold price level potentially being sustained, Barrick expects significant free cash growth by the decade’s end. Current free cash is $1.1 billion for the quarter ending September, growing 35% year over year, though the quarterly dividend was maintained at $0.10/share or 2.3% yield.

Barrick has a net debt to EBITDA of effectively zero, rated at A3 by Moody’s. With $4.2 billion in cash, Barrick does not intend to utilize debt to fund organic expansionary activities. This leaves significant room for debt-financed acquisitions, like the previously discussed potential acquisition of First Quantum.

In summary, Barrick Gold presents a compelling investment opportunity with its strong production base, strategic expansion plans, excellent management, and fortress balance sheet. Couple this with a 10% price decrease over the previous year, and Barrick presents an excellent value case.

Competitive Comparisons