AHR Set to Grow 6.5% Yield with Demographic Tailwinds and Expansion

| Price $15.37 | Dividend Holding | July 8, 2024 |

- 6.5% Distribution Yield.

- Strong demographic tailwinds in the US, with the over 80 population increasing by more than 50% by the end of the decade.

- Occupancy rates are trending above pre-COVID average, with AHR reporting 91% weighted average occupancy.

- Seeking to offload an additional $50 million in non-core assets to fund expansion and purchasing the remaining interest in its largest operator.

- Strengthened balance sheet by going public. Debt now has a 4.89% weighted average interest and a 9.7-year average term.

Investment Thesis

American Healthcare REIT (AHR) is an REIT focused on nursing homes and other health infrastructure. AHR operates both traditional triple-net leases which provide stability, and RIDEA (REIT Investment Diversification and Empowerment Act) properties allowing it to take operational upside.

There are substantial demographic tailwinds that will provide long-term growth potential for AHR. Additionally, AHR is reporting both a return to pre-COVID occupancy rates at its facilities with contract travel nurse labor costs also returning to pre-COVID levels. We believe that the solid 6.5% yield coupled with cost improvements and demographic tailwinds make a strong long-term case for AHR.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 FFO (Funds from Operations) times P/FFO (Price/FFO)

EFV = E25 FFO X P/FFO = $1.30 X 15.0 = $19.50

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.0 | 0.9 | 0.8 |

| Price-to-FFO | 16.3 | 15.0 | 13.5 |

Market Conditions

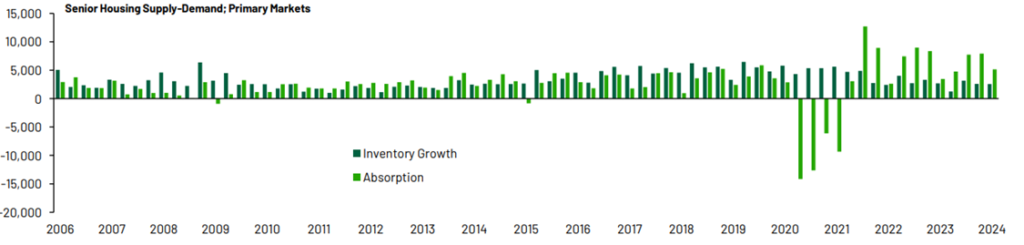

We have talked about demographic tailwinds in more detail in our article here. The overall population over 80 will increase by 50% over the next decade. Occupancy rates decreased to an average of 85% during COVID, compared to ~87-90% pre-COVID.

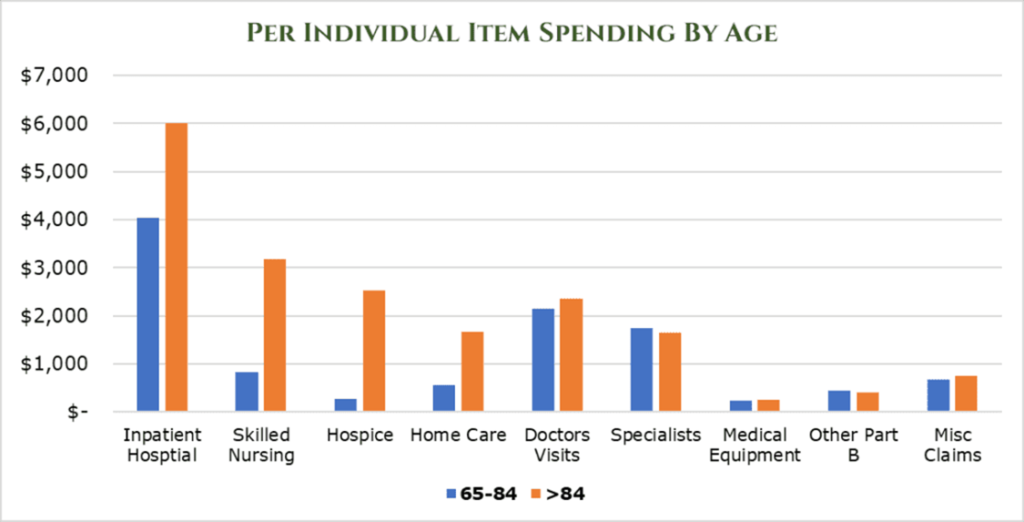

Additionally, new construction costs are up 36% since the start of 2020 with assisted living construction starting at their lowest level since 2010. Of those that are constructed, absorption has reached record high levels with AHR reporting occupancy is now trending above pre-COVID levels at 91%. Across the business, AHR also stands to benefit from future Medicare and Medicaid reimbursement level increases, which stood at a 4.4% year over year price increase in 2024 and a proposed 4.1% increase in 2025. Skilled Nursing and other forms of eldercare are some of the largest categories by spending for those over 84, with Medicare and Medicaid being payor agnostic toward care.

Primary Business

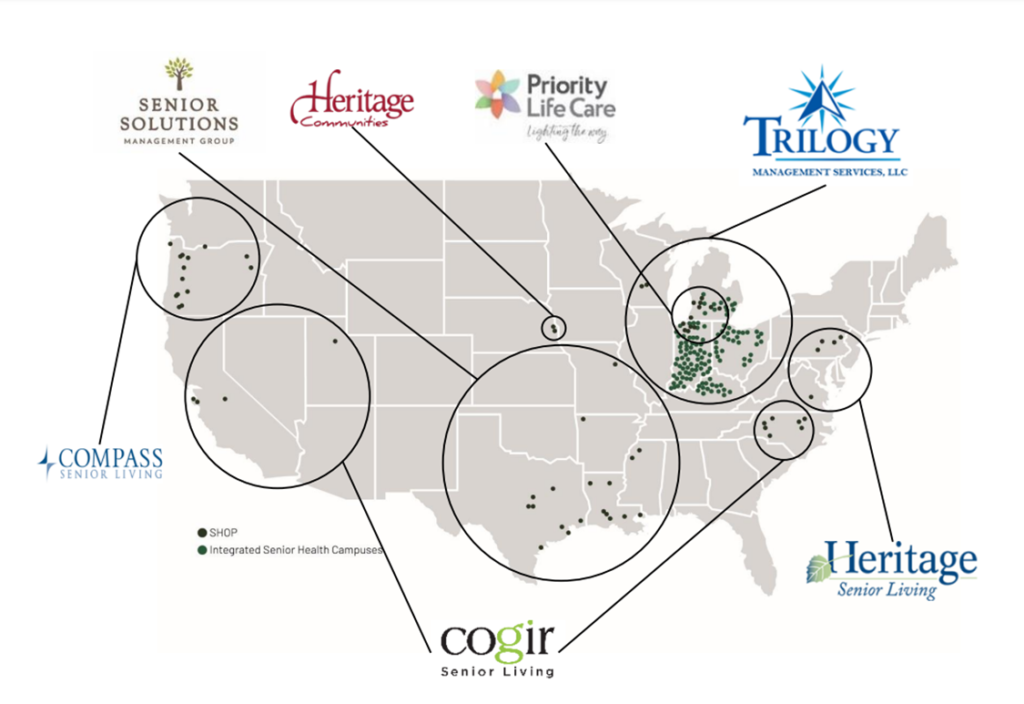

AHR operates 298 properties, 17,658 beds in total, across 36 states and the UK. Across these properties, AHR maintains 600 different tenants, concentrated in elder care.

54% of AHR’s NAV (net asset value) comes from RIDEA properties, or 90.5% of revenue. These include all the ISHC (integrated senior health campuses) and SHOPs (senior housing operating properties). RIDEA properties are a classification that allows REITs to earn both rental income and a share of operational profits. The advantage of this is that it allows AHR to experience operational upside rather than just rental escalators. Though, the RIDEA structure means that AHR does assume some operational risk and non-rental profits are taxed at the same rate as the corporate tax before distribution.

| Segment Quarter ending March 2024 | % of Net Operating Income | Net Operating Income Growth (year over year) | Occupancy (% Leased) | Net Operating Income Margin |

| ISHC (integrated senior health campuses) | 51.1% | 25.7% | 86.7% | 10.7% |

| SHOP (senior housing operating properties) | 7.9% | 28.3% | 85.7% | 11.0% |

| OM (outpatient medical) | 25.5% | -9.1% | 88.1% | 61.6% |

| Other (triple-net leases) | 15.5% | 138.6% | 100% | 95.2% |

ISHC comprises 12,993 beds, with 57% of those beds being skilled nursing, and 43% being senior housing. Same-store net operating income grew by 20% year over year, driven by both rent growth and a 210bps increase in occupancy to 86.7% in May 2024. This sets up a positive trend for the year as occupancy and leasing rates are typically lowest in the first quarter of the year. Full year 2024 in the ISHC segment is expected to have 8-10% net operating income growth for 2024, with continued growth back up to and even exceeding the long-term average for occupancy. AHR has expressed interest in buying out the $247 million interest in Trilogy, who operates 75% of ISHC facilities. Currently, AHR owns 76% of Trilogy. The purchase option lasts until September 2025, with AHR expecting to execute by that time.

SHOP has 5,175 beds, with 79% of beds classed as assisted living or memory care. Same-store net operating income rose 30% year over year, with occupancy climbing 700bps to 85.7%. SHOP is expected to have 25-30% net operating income growth for full year 2024, thanks to new asset acquisition and strong occupancy growth. In February 2024 AHR acquired 856 SHOP beds across 14 properties in Oregon for a cost of $110,000 per bed. The acquisition has a RIDEA structure and utilizes a known operator. AHR estimates that over the longer term more transactions like this one will become available. As interest rates have stayed elevated, lenders are more averse to high LTV (loan-to-value) ratios, making it harder for existing owner/operators to refinance high-interest debt on the balance sheet. AHR expects these transactions to be funded by non-core asset disposal and some operational free cash.

In the OM area leasing activity has slowed down to normal levels after an explosion of growth in the second half of 2023. No one tenant in this area makes up more than 8% of rental space, with the full OM portfolio having a weighted average lease term of 5.2 years. These facilities are multi-tenant and multi-specialty allowing for same-location diversification. Finally, AHR operates a small portion of standard triple-net leases on single-tenant facilities, usually hospitals, skilled nursing facilities or other single-tenant medical facilities. Rental escalators in the non-RIDEA area are usually 2-3% per year.

Risk

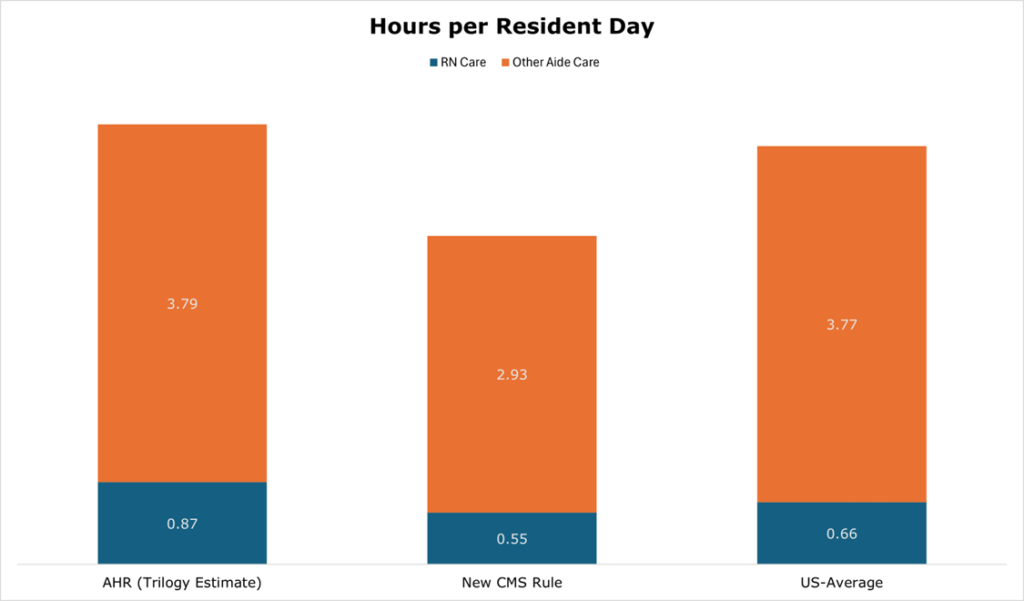

CMS has introduced new minimum staffing standards.

The CMS (Centers for Medicare and Medicaid Services) states that a majority of nursing homes would have to add some staff despite the average exceeding the rule. There is strong industry-wide opposition to the rule given its inflexibility, and AHR believes that the rule will be revised down before its implementation in 2028 at the latest. AHR believes that these rules, if they are implemented in their current form, will have only minor impacts on the business. As it stands, the Trilogy-operated facilities (74.7% of total AHR beds are operated by Trilogy) exceed the requirements by at least 10%. AHR did not disclose the stats on other operators but emphasized it will have minimal impact on operational costs.

AHR has a balance sheet increasing in quality, however it has expressed that it wishes to expand its footprint with purchase of distressed operators and buy out the remaining interest in Trilogy. While AHR has a strong liquidity position with low interest rates, increasing debt on the balance sheet in the current high interest rate environment could pose risk.

Financials

Contract and travel nursing has grown to be a huge expense to healthcare operators since the pandemic. According to the American Hospital Association, the share of nurse labor expenses from contract travel nurses went form 4.7% in 2019 to 38.6% in 2022. According to AHR, the labor situation in nursing has seen a stabilization and it has been able to shed “most” contact travel nurse labor costs, which is expected to continue through the end of 2024.

To achieve deleveraging and expansion goals, AHR is seeking to remove approximately $50 million in non-core assets during the remainder of 2024. Already over the trailing twelve months, AHR has unloaded approximately $110 million in non-core holdings, in the SHOP and OM segments. These divestitures have contributed to the strong $915 million liquidity position, with $90 million coming from cash on hand and the remaining from undrawn capacity on lines of credit. Advantageously, AHR has access to HUD (Housing and Urban Development) debt offered by the government, which has a fixed interest rate of 3.6% fixed over 30 years, provided the LTV ratio stays under 80%.

AHR has strengthened its balance sheet, paying off $721.5 million in debt over the trailing twelve months with a weighted average interest rate of 7.5%. This was financed by going public and brought total debt down to $1.75 billion with a 4.89% weighted average interest and 9.7 year weighted average term. The balance sheet is still at 7.4x net debt to EBITDA, which is high, but in line with other RIDEA healthcare REITs. By the end of 2024, AHR is targeting 6.0x net debt to EBITDA which would put it on the lower end of peers.

AHR has a current yield of 6.5%, paying out $0.25/share quarterly. For the full year 2024, net operating income growth is expected to be slower than seen in the quarter ending March 2024, expecting 5-7% same-store growth. AHR had operating results of $0.30/share in FFO in the quarter ending March 2024, with full year guidance of $1.18 to $1.24/share.

Conclusion

Over the short-term, AHR is targeting expanding its footprint with new facility growth while also capturing the remaining interest in Trilogy ISHC. Over the longer-term, there are substantial tailwinds in demographics that should provide a strong ramp for operational and rental growth. Coupled with a strong 6.5% yield and improving balance sheet, we believe that AHR is a buy for income investors seeking to capture part of the demographic tailwinds in the US

Competitive Comparisons