Economic and Market Review

June 30, 2023

Overview

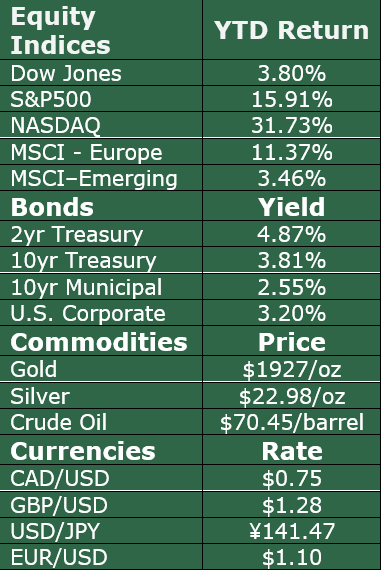

Equity markets reacted to uncertainty in June as major indices saw an increase in volatility. Earnings continue to be a critical focal point as companies struggle to maintain elevated prices while consumer confidence has begun to erode.

The Federal Reserve has essentially signaled that it is more concerned about combating inflation than the negative consequences of continued rising rates on the economy.

A growing discussion among economists is whether or not the economy will experience a soft landing, meaning that the recent Fed rate increases will not evolve into a recession. Should a recession result, economists view such an environment as a hard landing, which is when job expansion and economic growth are hindered.

Once each year, the Federal Reserve conducts a test to assess how large banks are likely to perform under hypothetical economic conditions. The results of the most recent tests revealed that all the major banking institutions passed this year’s stress test. The tests assumed a hypothetical 10% unemployment rate and a 40% drop in commercial real estate prices.

Yields on short-term bonds rose in June as the Fed indicated that it intends to raise rates at least two more instances this year. Longer-term bond yields remained below shorter-term bond yields as confidence in future economic growth faltered.

Inflation expectations among consumers continue to dissipate worldwide, as inflation expectations throughout European and Pacific Rim countries head downward. The Federal Reserve Bank of Atlanta projects a decrease in GDP growth in the U.S. as domestic economic growth recedes.

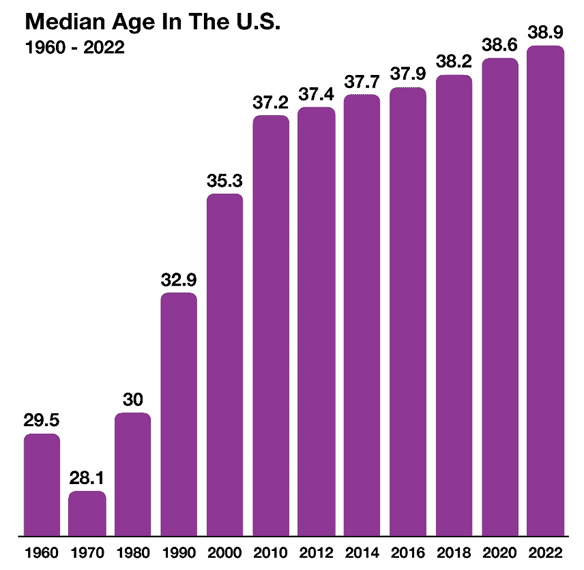

The average age in the U.S. increased to a historic high in 2022, reaching a median age of 38.9 years. The average age has steadily risen over the past decades, primarily due to declining birth rates coupled with longer life spans over the past 20 years.

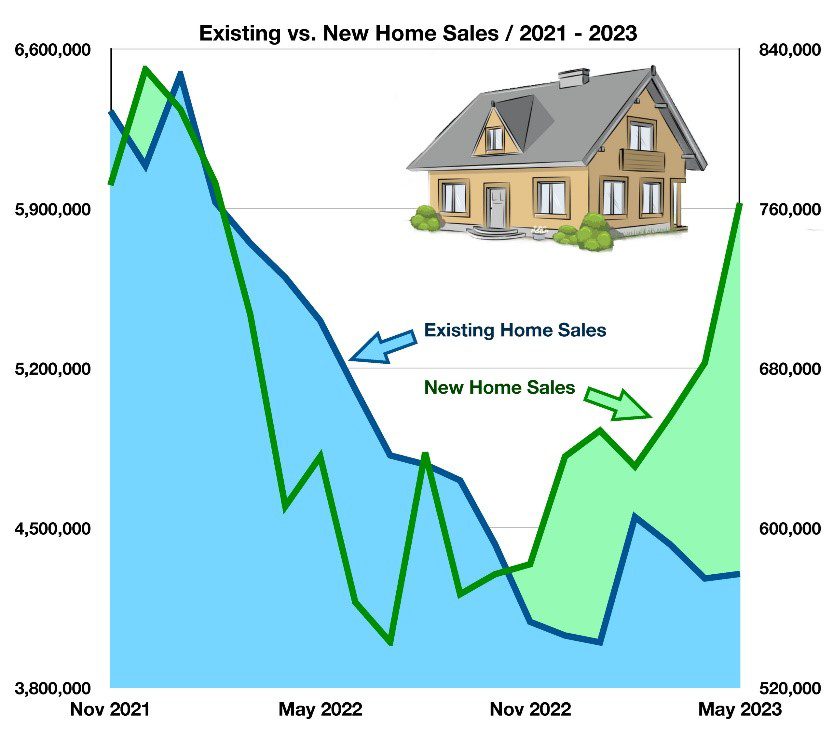

New Home Sales Grow, Existing Home Sales Drop

With hiking mortgage rates and historically high home prices, home sales have seen tumultuous recent months as the supply and demand for houses fluctuate. Recent data show that pending home sales are declining, as are existing home sales.

This trend reflects the lack of homeowners who wish to sell their homes, primarily due to not taking on a new mortgage at a higher rate. Many homeowners currently pay mortgages with rates between 2% and 4% due to low mortgage rates between 2019 and 2022. The 30-year fixed mortgage rate did not surpass 4% for 33 months during this period. Mortgage rates surpassed 7% in October 2022 and are currently at 6.8% for a 30-year fixed-conforming loan, scaring away many potential homebuyers who already own a property.

In March alone, pending home sales dropped 5.2%, their largest decrease last September. These trends can be seen in existing home sales, which have dropped by over 2 million monthly sales since January 2022. With fewer existing homes up for sale, many potential homebuyers are instead looking into new homes. This can be seen in new home sales, which increased by 40% since June 2022, reaching a 14-month high. While sales across the board are still down from the heights of the pandemic, existing homes are seeing stagnant sales and new homes are rising in popularity.

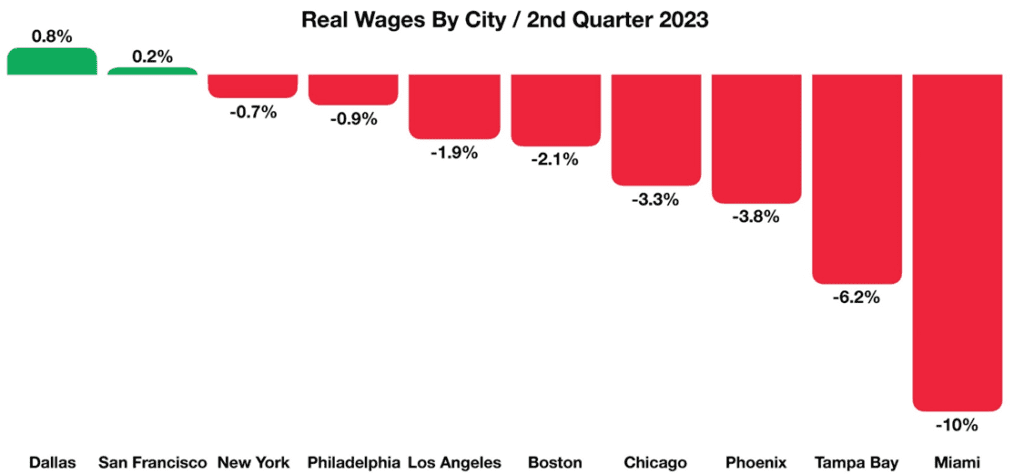

Wages Lag Behind Inflation in Nearly All US Cities

Real wages, or workers’ pay adjusted for inflation, have decreased for 26 consecutive months. Even when nominal wage growth has been significant, inflation has surpassed it and diminished workers’ purchasing power for over two years.

Most major American cities saw declines in post-inflation wages as of May 2023, other than minuscule increases in Dallas, San Francisco, and Houston. The worst metropolitan wage decrease is in Miami, whose workers saw a 10% drop in post-inflation pay due to 9% inflation and nominal wage contractions. Workers in Tampa Bay, San Diego, Phoenix, and Chicago are all seeing their inflation-adjusted wages fall by over 3% due to high inflation, despite all of these cities exhibiting nominal wage growth.

Stubborn inflation is weighing on workers, who are now also reportedly exhibiting historically high uncertainty in their year-ahead wages according to the New York Federal Reserve. Workers’ uncertainty in their future wages reflects their faith in the strength of the job market and the economy as a whole. With wages consistently losing purchasing power and prices increasing for many consumers, this uncertainty has a substantial influence on spending habits and personal financial decisions.

Consumers Are Still Spending, but Fears Continue

Consumer sentiment and spending have remained fairly consistent in recent months. Despite a dip in summer 2022, current consumer sentiment is at a similar level to its values before elevated inflation levels evolved. Inflation has steadily decreased for the past 11 months and reached 4% in May 2023, its lowest level since March 2021. Consumers’ inflation expectations have mellowed accordingly, dropping to a year-ahead expectation of 3.3% inflation as of June 2023. Consumers have not seen year-ahead prices rising this slowly since March 2021.

Despite a slowing economy, consumer spending and outlooks have remained resilient. Business investment and pullbacks in inventories have slowed growth, with investor sentiment remaining quite fragile. This has resulted in two consecutive quarterly decreases in GDP following the previous two-quarters of negative GDP growth.

Data such as this is extremely important to the Fed, which monitors spending and how it affects inflation. However, with aggressive monetary policies in place, deflationary pressures may also continue to grow, potentially negatively impacting asset prices.

The restaurant industry continues to experience turbulence that originated with the breakout of the COVID-19 pandemic and the ensuing lockdowns. In 2020, restaurant performance reached historic lows as people suddenly stopped ordering from restaurants due to unforeseen financial constraints and fears of disease. This completely reversed in 2021, as people flocked to restaurants at historically high rates after lockdowns ended.

However, the restaurant industry has seen demand die down immensely from these 2021 highs, with restaurant performance entering a period of contraction for the first time since January 2021. In May, restaurant performance fell 1.3% from its level in April and ended 28 months of expansion in the restaurant industry. Customer traffic in restaurants also slid below the cutoff for growth, reaching levels not seen since February 2021.

Spending on food services is also exhibiting a sharp decline, reaching 26-month lows as the surge in demand brought about by the end of COVID-19 lockdowns has evaporated. The peaks of 2021 spending growth, which reached as high as 88% yearly growth, have now mellowed to just 1% annual growth. This has led to many restaurants halting hiring, with job openings in food services falling 16% from last year.

Average Age in the US is Rising

The average age in the U.S. increased to a historic high in 2022, rising 0.2 years between 2021 and 2022 to reach a median of 38.9 years old. The average age has been steadily rising toward 40 years old, primarily due to declining birth rates coupled with people living longer over the past 20 years.

Americans’ median age reached 30 years old in 1980 and rose to 35 years old in 2000. In the past 22 years, the average age has risen by 3.6 years. America has been steadily aging over the past 50 years, with median age rising 10.8 years since 1970.

In 2022, 17 states had a median age of above 40, while no state experienced a decrease from their 2021 median age. Maine had the highest median age at 44.8, while Utah was the youngest state at 31.9 years. Florida had two of the nation’s six oldest counties, including the oldest county with a median age of 68.1 years old. Other key populations across Europe and Asia have seen similar trends and steady increases in age. The oldest median ages in nations across the world include Japan at 48.6, Monaco at 55.4, and Germany at 47.8 years. On the flip side, the youngest median ages include Niger at 14.8, Uganda at 15.7, and Angola at 15.9 years. The United States is the 61st oldest nation globally world, with a similar median age to China and Thailand.