Whirlpool’s 8.2% Dividend Powerhouse Spinning Through the Downcycle

| Price $85.27 | Dividend Holding | April 11, 2025 |

- 8.2% Dividend Yield

- Despite current headwinds in North American sales WHR’s high domestic manufacturing footprint (80% of US sales) provides insulation against potential tariff impacts.

- With a debt reduction target from 4.4x to 3.4x by end of 2025 and projected $550 million in free cash flow, WHR appears financially positioned to weather current housing market weakness.

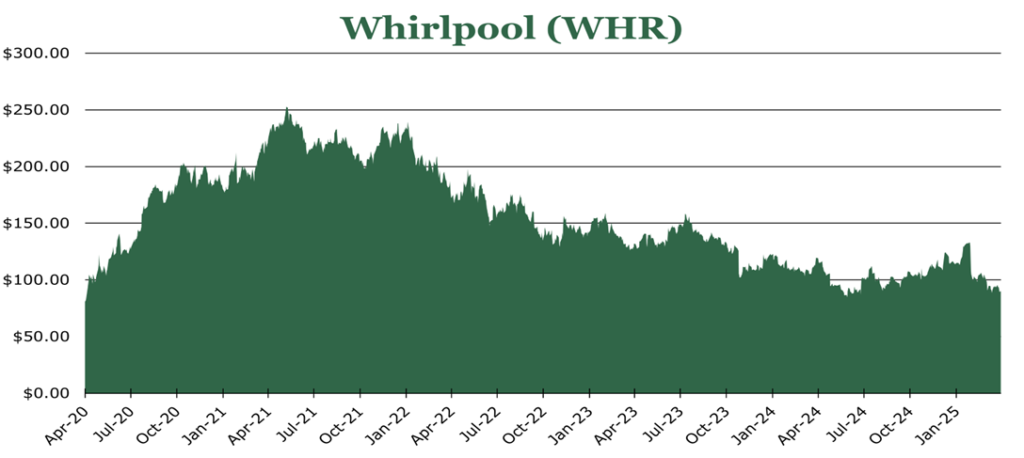

- The stock has declined 27.0% over the trailing twelve months, potentially creating an attractive entry point as worst-case scenarios appear priced in.

Investment Thesis

Whirlpool (WHR) is a US-based manufacturer of home appliances. Globally, WHR owns and operates 25 manufacturing facilities, with 11 in the United States. It owns 13 brands across small and large appliances, including KitchenAid, Maytag, and Whirlpool. In total, 93.6% of revenues come from large appliances, with 6.4% coming from small appliances.

As we discussed in our last coverage in 2023, WHR was in the process of undergoing a large restructuring that would reduce its direct holdings. This process continues, with WHR announcing it would reduce its share to 20% of Whirlpool India for $5-600 million in cash. While the debt load is elevated, management is guiding toward $550 million in free cash for 2025. Despite the slimming of operations and deleveraging, WHR has lost 27.0% over the trailing twelve months.

WHR has a strong 8.2% dividend yield, which is well covered by cashflows and has been uninterrupted since 1955. Despite economic indicators beginning to soften and consumer confidence dipping to decade lows, we believe that most of the worst-case scenarios are priced into the stock. WHR manufactures 80% of its North American sales domestically, which should allow it to be largely insulated from the worst of tariffs. Overall, we believe that WHR is a solid dividend income pick that is approaching the low of the cycle, marking an attractive entry point.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $11.27 X 13.37 = $150.70

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.3 | 0.3 | 0.3 |

| Price-to-Earnings | 9.4 | 7.9 | 6.7 |

SeekingAlpha Analyst Consensus

Operations

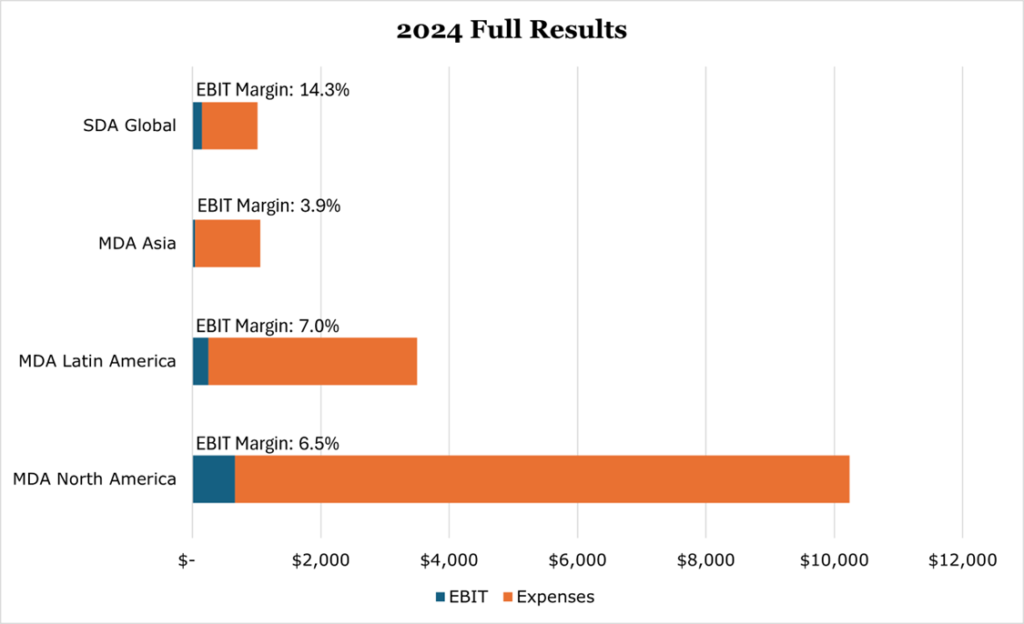

North American MDA (major domestic appliances) represents 62% of revenues, with a reported 80% of appliances sold in the United States being manufactured domestically. During 2024, sales fell 4.9% year over year due to unfavorable mix. EBIT margin contracted from 9.4% to 6.5% due to the unfavorable mix, though management did indicate that headwinds in raw material procurement are abating with cost of good sold decreasing by 1.6%. While we expect some headwinds in the segment due to slumping housing activity and a declining remodeling market, WHR still expects to expand EBIT margins by a full 100bps due to higher prices and cost-take out.

Latin America MDA saw sales increase 4.3% year over year, excluding the impact of currency, sales increased 9.7%. Over the same period margin expanded to 7.0% from 5.6% due to scale benefits. For 2025, WHR expects continued strength in Brazil and Mexico along with cost take-out actions that should boost EBIT margins by an additional 50bps.

Asia MDA sales increased 9.0% year over year, excluding currency effects sales increased 10.2%. EBIT margins expanded to 3.9% from 2.3%, due to scale benefits though the rise was muted due to a worse mix of products. During 2025, we expect Asia sales to continue to show strength particularly weighted to the second half of the year when most analysts expect to see the beginnings of a more organic Chinese consumer recovery. Although, the tariff drama could derail this recovery.

WHR has also pointed out that their Indian volumes have accelerated above the baseline. However, WHR is planning on reducing its share in Indian operations to 20% from 51% and has excluded India from guidance. With the exclusion of Indian operations from the full year 2025, WHR expects its EBIT margin in the Asia segment to increase to the 6% neighborhood.

SDA global sales increased 4.4% year over year, due to volume increases. Margins were flat overall, due to increased marketing spend. While WHR has modeled that demand will remain flat year over year, US consumer confidence has been at its lowest level since January 2021 and inflation expectations are at their highest level since December 2020. As a result, we expect a marginal decrease in volumes during 2025 which may be offset by price increases. However, we believe it is important to point out that spending data has remained strong and there is little sign that consumers are changing behavior thus far despite crashing confidence.

Risk

In November 2024, Fitch downgraded WHR’s debt to BBB- based on slower than expected margin expansion and the high debt load. The outlook is also negative, with Fitch projecting economic weakness putting higher-than-guidance strain on the top line.

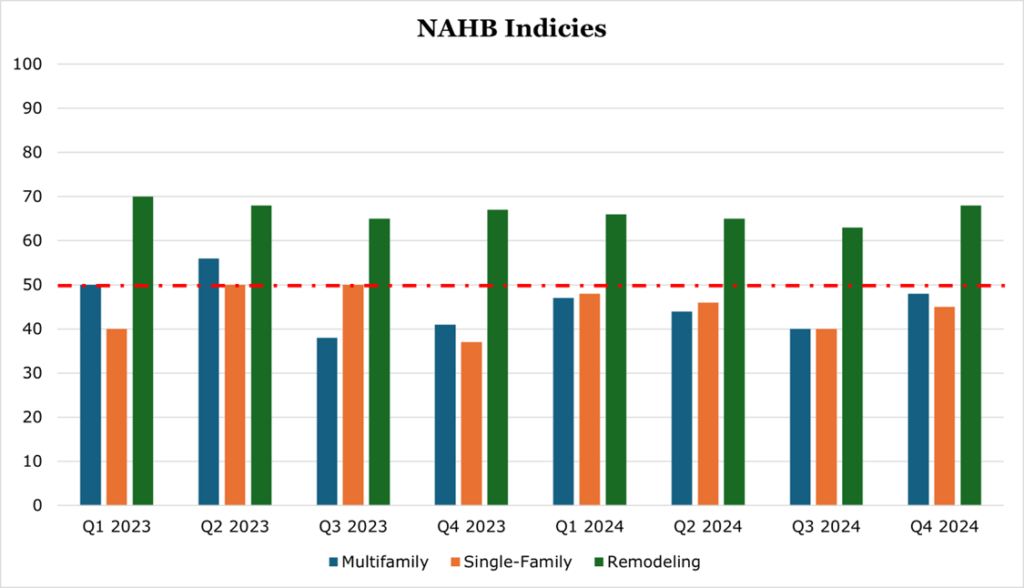

Based on the National Association of Homebuilders survey, the market has continued to be pessimistic. While remodeling activity has buoyed some areas of the market, new construction has slowed substantially. Based on March 2025 responses to single-family home builders, the confidence level is at its lowest level since August 2012. Of the housing units that are still being built, record numbers are going unsold. According to the US census bureau, the number of speculative new-builds unsold reached its highest level since 2005. As a percentage of total construction, the number of unsold units is at its highest level since record keeping began in 1963.

We believe this is largely due to persistently high mortgage and construction finance rates, with NAHB reporting an average of around 8.4% for single-family construction loans without a buyer, and around 8.0% for pre-sold construction loans. Mortgage rates are tracking lower at 6.7% — but still at their highest level since 2002.

While larger appliances are likely to continue to show weak results, SDAs (small domestic appliances) do show some continued activity. Though similar to 2018, we believe that even in a scenario where construction activity continues to slump, WHR will be largely insulated from tariffs which could provide an important buoy to results.

Historically, WHR has benefited from protectionist policies. In 2018 during a trade dispute with LG and Samsung over continuing anti-dumping in MDAs, WHR was able to have a boost to pricing power. WHR was able to raise its prices between 10-20% and expand operations in Ohio. Though, over the long-term, the market normalized as LG and Samsung opened plants in the United States and duties targeting aluminum and steel substantially increased WHR’s input prices.

Financials and Outlook

We expect headwinds to continue in the North American MDA segment through 2025. WHR more optimistically projects flat demand during 2025, though management stated that it did not include new tariffs or their impact on demand in its models. Under current conditions we expect discretionary demand to be muted, though replacement demand appears to be holding up, which is atypical considering the low consumer confidence.

| Location | WHR Projected Industry Demand | 2024 % of Revenue |

| MDA North America | Flat | 62% |

| MDA Latin America | 0-3% | 21% |

| MDA Asia | 3-5% | 6% |

| SDA Global (small domestic appliances) | Flat | 6% |

Outside of the US, given Chinese consumer stimulus continuing to emphasize replacing consumer appliances to stimulate economic activity, we believe that management’s 3-5% growth target is realistic.

Overall, we expect margin expansion to continue, with some raw material costs alleviating. As previously discussed, tariffs remain a wildcard, especially on raw materials though management did not indicate it was expecting a meaningful increase above the current baseline. WHR expects to realize $75 million in restructuring expenses which likely indicates further workforce reductions.

Management expects capital expenditures to remain at the same $450 million level for 2025, which is the top priority for allocation. The second priority is the debt level. During 2025 WHR has $1.85 billion in debt due, which it expects to pay off around $700 million of and refinance the remaining $1.1 billion. The long-term target is 2.0x currently at 4.4x. WHR expects to reduce its debt level to 3.4x by the end of 2025, which we believe could accelerate marginally given the cash position being bolstered by the sale of the majority of Whirlpool India.

The final priority is the dividend, which we expect will remain at the $1.75 per quarter payout. The dividend is around $400 million per year, and while operating results are weighed down by secular factors, we believe the dividend is safe at its current level given the cash position. The dividend has been uninterrupted since 1955.

WHR ended 2024 with a cash position of $1.3 billion, backed by $186 million in annual free cash. Free cash flow in 2024 was weighed down by $275 million in extra operating expenditures in the Arcelik Europe JV. For 2025, we expect free cash generation to return to the $500+ million neighborhood with the roll off of major European operating expenditures and some cost reduction actions. Management is guiding toward $550 million in free cash, and $1 billion in cash from operations which would represent a 20.0% increase from 2024.

During 2025 the cash position will also be bolstered by the sale of approximately 31% of Whirlpool India, with WHR reducing its ownership share from 51% to 20%. Expected to close by the end of 2025, the transaction will generate approximately $550 million in cash and will grant continued licensing revenues. We do not expect M&A activity in the short term, equally despite the $2.5 billion in remaining repurchase authorization we do not expect WHR to engage in repurchases given the priority of paying the dividend with free cash flow.

Conclusion

We are confident that management will be able to reach its deleveraging target of 3.4x by the end of 2025 and 2.0x target over the long term. Additionally, we expect the dividend to be covered through the downcycle. Over the long term, we expect strong margin expansion backed by the slimming of non-US operations. With its 8.2% yield, WHR is a strong dividend stock at an attractive price.

Peer Comparisons