Walgreens Boots Alliance Accelerates Healthcare Segment Despite Headwinds

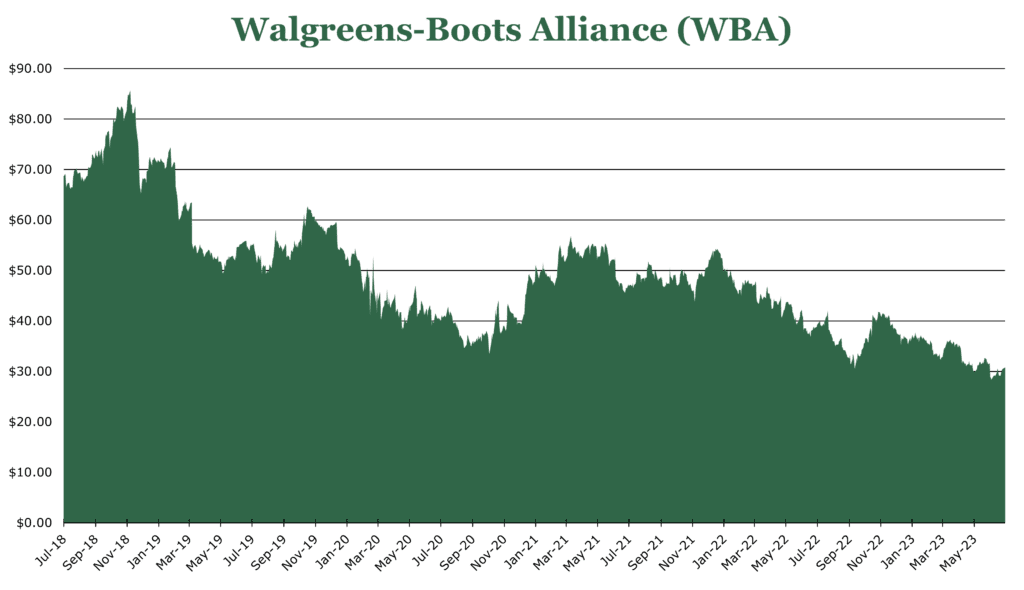

| Price $30.74 | Dividend Holding | July 27, 2023 |

- Current Dividend Yield 6.22%.

- WBA is scaling in the healthcare service sector and is expected to boost adjusted operating income in FY24, with sales growth increasing 22% to $2 billion in this segment.

- Growth in commitments from insurance payors, adding 2 million additional customers to the network.

- Significant cost savings program targeting $800 million for FY24, bringing the total to $4.1 billion in cost savings since FY19 This does not include the nearly $5 billion in divestitures since FY22.

- Continued commitment to dividend even amidst stronger-than-expected headwinds.

Investment Thesis

Walgreens Boots Alliance (WBA) is an American retail pharmacy chain expanding into a diversified healthcare provider. Through international divestitures and aggressive growth through M&A domestically, WBA hopes to become a significant competitor in the primary-care market without sacrificing its pharmacy brand.

WBA has a 6.22% yield, with an average net income payout ratio of 46%. This puts it far ahead of the sector, and despite a rougher than anticipated FY23 WBA management has stated they are still committed to expanding the dividend. Sales increased 8.9% year over year in 3Q23 but only translated to 3.6% EPS growth due to softening demand for COVID-related services and lower front-of-store sales volumes. However, adjusted operating income is expected to accelerate into 4Q23 and be reflected in results in FY24.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $4.48 X 11.7 = $52.42

| E2023 | E2024 | E2025 | |

| Price-to-Sales | 0.2 | 0.2 | 0.2 |

| Price-to-Earnings | 7.7 | 7.8 | 7.0 |

Strategic Shift

WBA is shifting from a traditional retail pharmacy to a more diversified healthcare brand. This includes acquisitions, reduction of retail floor space, and trimming holdings outside of the US.

The retail floorspace shift is something that WBA has been attempting to do since FY19, moving away from the traditional retail pharmacy market of prescriptions being filled on a per-store basis. WBA is consolidating pharmacy operations to micro fulfillment centers to concentrate pharmacy personnel for better economies of scale and either delivering the prescriptions to the patient’s home or in-store pickup. Already 40% of the Walgreen’s store footprint is covered by these fulfillment centers. Management has said this transformation could save as much as $1 billion in working capital per year, of which it claims $400 million has already been saved.

|  |  |  |

| • Private practice and specialists. • Outpatient services linked directly to Walgreens Retail • Saw 22% revenue growth in 3Q23 | • Post-acute care provider. • DME (durable medical equipment) vendor for home use. • Saw 15% revenue growth year over year, largely due to new partnerships. | • Software vendor. • Billing solutions and collaborations with third-party pharmacies. • 35% revenue growth largely due to major contract wins. | • In-store clinic and non-retail pharmacy services like vaccines. • 6.5% sales growth, slowing COVID-19 market. |

In FY21, WBA acquired a majority stake in VillageMD for $5.2 billion, a private practice manager and clinical service. VillageMD subsequently went on to acquire Summit Health in January of FY23, a multi-specialty medical practice manager, for $9 billion. This is part of an underlying strategy to grow and improve profitability within the primary care area.

WBA is completing its “transformational cost management program,” targeting $4.1 billion in total savings from FY19-FY24. This is done through organizational restructuring, divesting from international business, closing low-performance stores, and adjusting operating hours.

Trimming the portfolio has involved divestitures from most international business units and business units that no longer align with goals. These divestitures include Farmacias Ahumada, Option Healthcare, and AmerisourceBergen. Farmacias Ahumada in Chile, while specific details have not been announced, WBA purchased the chain in 2014 for $500 million. WBA also recently began to exit from Option Health Care, a transfusion clinic, for $1.2 billion. WBA has downsized its position in Amerisource Bergen (ABC) by $4.1 billion, though it still holds $5 billion in ABC stock. The stated purpose of the ABC sell-off was debt paydown and to increase liquidity, though WBA does estimate the reduction in holdings will be dilutive.

Risk

WBA settled a class action over the opioid crisis for $4.95 billion in remediation over 15 years, though it admitted no liability. WBA has chosen to realize all $5.5 billion in costs related to this settlement in FY23, adversely affecting results.

The string of acquisitions has undoubtedly put pressure on the balance sheet. WBA has $37.4 billion in debt, which it pays approximately $173 million per quarter – amounting to an average interest rate of approximately 3.2%. While this is below the market rate for similarly rated corporate debt, it is still a large quarterly expense that cannot be mitigated without significant capital drain. If WBA fails to monetize its healthcare business significantly, it could make the debt difficult to service. However, when writing, the lease-adjusted net debt to EBITDA ratio is 3.8x, which aligns with the sector.

Outlook

The acceleration of healthcare segment revenues is beginning to be realized. WBA has 4 payor partners: Horizon, Clover Heath, Blue Cross Blue Shield California, and Buckeye Health. This raises the customer base by 2 million individuals, with the total addressable market for primary care estimated to be close to $1 trillion. Additionally, WBA has signed 8 clinical trial agreements for Walgreens Health locations, allowing WBA to recruit participants. The Clinical trial market in the US was $25 billion in FY22 and is traditionally underserved by primary healthcare providers. Additionally, pharmacy volume has gone up and this trend is expected to continue, with new script growth increasing 2.8% year over year.

WBA’s healthcare segment is expected to have significant adjusted operating income growth post-integration of Summit Health in 4Q23, coupled with the maturity of the VillageMD business. The integration of new acquisitions will be accretive, providing tailwinds into FY24. The run-rate for healthcare sector sales in FY24 is expected to be $8 billion, with growth coming in at 25% year over year. Thus far in FY23, the adjusted operating income for the healthcare segment is a net loss of $600 million. But, in FY24, it is expected to contribute significantly to the low-to-mid single-digit growth to the company’s adjusted operating income.

An important metric for measuring the profitability of healthcare operations is the MLR (medical loss ratio). The MLR is what % of the paid amount is spent on providing healthcare rather than administrative expenses and profit. Because of the rapid scaling of VillageMD and the new Summit Health acquisition, the MLR has fallen by 500bps in FY23, to around 72%. This is a 5% 3-year CAGR decrease in healthcare provider costs.

The transformation toward a diversified healthcare company is one that WBA has committed significant resources toward. We believe this transformation will successfully capture a significant share of the $1 trillion in addressable primary healthcare and associated services market. Due to the recent stock price decline, WBA is currently near a good entry point for dividend investors in our opinion.

Competitive Comparisons