US Sportsbook Leaders Flutter and DraftKings Post Double-Digit Growth Guidance

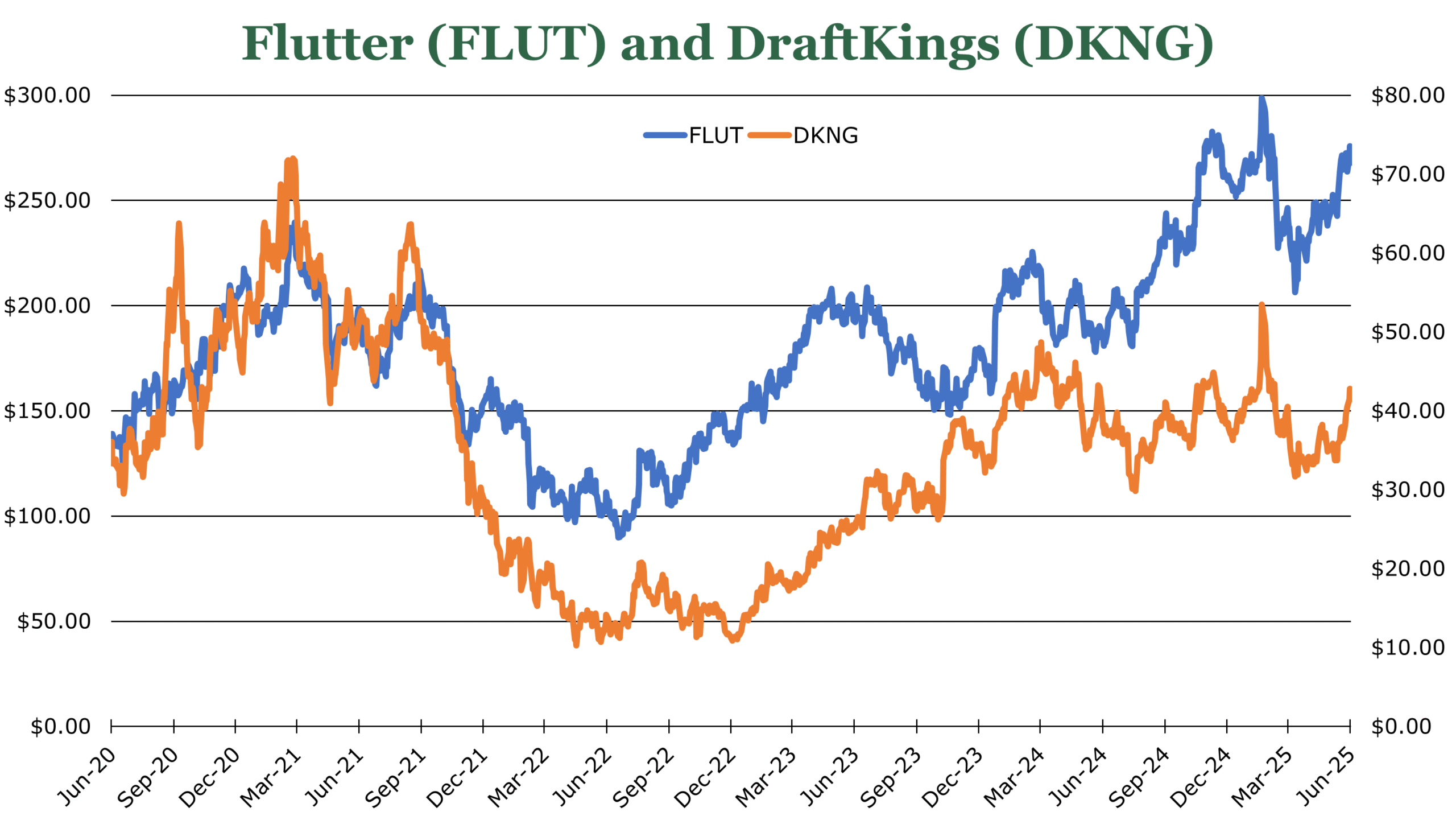

| DKNG $42.74 FLUT $267.98 | Growth Holdings | June 30, 2025 |

- Flutter’s FanDuel and DraftKings command a combined 66.1% market share in the $117 billion US sports betting market.

- DraftKings is guiding to 30% revenue growth for 2025, with adjusted EBITDA margins expanding from 3.8% to 13.5%.

- Flutter projects 28% US revenue growth for 2025, with adjusted EBITDA margins expanding to 15.2% from 8.7%.

- DraftKings expects net debt-to-adjusted EBITDA to decline below 1.5x by year-end 2025, with potential free cash flow positive achievement during the year.

- Flutter is already free cash positive, generating $805 million during 2024, with a net debt to adjusted EBITDA of 1.4x with $3.5 billion in cash on hand.

Investment Thesis

Flutter (FLUT) and DraftKings (DKNG) dominate the US sportsbooks industry. During the trailing twelve months ending March 2025, Flutter’s FanDuel holds a 34% gross gaming revenue share of all sports betting in the US, with DraftKings holding 32.1%. Flutter holds a 28.7% gross iGaming revenue market share in the United States followed by DraftKings at 24.3%.

The US sports betting market over the trailing twelve months ending May 2025 handled $117.9 billion in bets, translating to a GGR (gross gaming revenue) of $10.8 billion, or a hold rate of 9.14%. Online sports betting represents 60% of total industry revenues, and makes up 69.2% of Flutter’s US revenues, and 61.0% of DraftKing’s revenues. Just under half of US adults now live in locations where sports betting is legal and can bet online with a sportsbook owned by DraftKings or FanDuel. Thus we believe that the market is still far from maturity.

We expect there to be continued legislative momentum moving toward continued legalization in the United States, driven by tax revenue incentives. This creates natural expansion targets for both Flutter’s FanDuel and DraftKings. Additionally, we believe both firms have a natural cost advantage over potential competitors having massive marketing budgets and lower fees than smaller operators. The economies of scale and first mover advantage have created a near duopoly. Overall, we believe that both Flutter and DraftKings are buys for growth investors.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

DraftKings (DKNG)

EFV = E26 EPS X P/E = $1.50 X 33.2x = $49.80

We believe that DraftKing’s warrants a higher P/E ratio due to the fact that it is a less mature company on the verge of profitability. We believe that it still has room to expand its operating leverage and reduce its customer acquisition cost which should increase earnings power over the long-term.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 6.2 | 5.2 | 4.5 |

| Price-to-Earnings | 114.3 | 31.0 | 19.4 |

SeekingAlpha Analyst Consensus

Flutter (FLUT)

EFV = E26 EPS X P/E = $12.50 X 22.6x = $282.50

Flutter has a stable base with a mature international business, and still has room to grow with continued US legislative tailwinds. Flutter has demonstrated low customer acquisition costs and superior hold rates, which we believe gives it a long-term edge above potential entrants.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 5.4 | 4.7 | 4.2 |

| Price-to-Earnings | 33.3 | 22.8 | 17.3 |

SeekingAlpha Analyst Consensus

Legislative Landscape

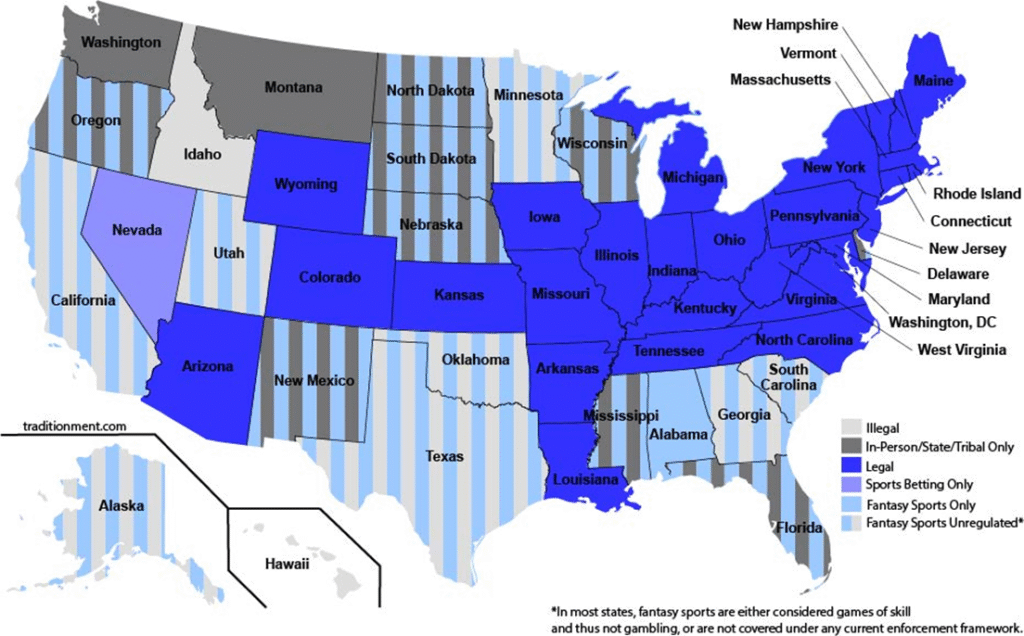

Federally, legislation regarding sports betting was struck down following the 2018 Supreme Court Decision Murphy v. NCAA. As of June 2025, 38 states, Washington DC and Puerto Rico have legalized sports betting in some form, though only 30 states and Washington DC permit online sportsbooks.

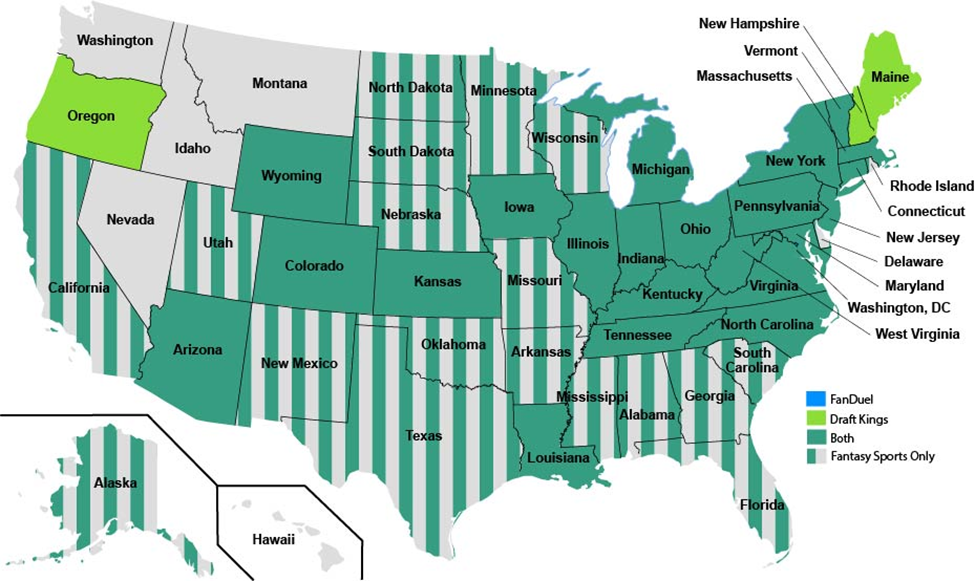

New Hampshire, Oregon, Rhode Island, Delaware, Florida, and Montana are single operator only, with no other commercial operator being permitted to operate a sportsbook within the state. In New Hampshire and Oregon, DraftKings holds the monopoly. However, as explained later, in states with enforced monopolies or without legalization, DFS (Daily Fantasy Sports) is still typically offered.

The next state to legalize sports betting is Missouri, where a ballot amendment was approved for implementation in December 2025. In early June 2025, both DraftKings and Flutter’s FanDuel have applied for licenses. The state estimates it will bring in around $28.9 million in annual tax revenue with a 10.0% tax on sportsbooks, though we believe this estimate is likely on the conservative end. A similarly populated state, Indiana, over the trailing twelve months ending May 2025 generated $539.7 million in gross gaming revenue, pulling in $51.4 million for the state treasury at a tax rate of 9.5%.

California and Texas, the largest markets where online sports betting is still illegal, are in our view unlikely to legalize it anytime soon. In 2022, a California ballot measure failed and while there is some legal proceedings regarding tribal gaming laws, tribal leaders have indicated that it is unlikely sports betting will be revisited before 2028. During the previous Texas state legislative session, the lieutenant governor repeatedly prevented the state senate from voting on legislation regarding legalizing gambling and remains a hardline opponent.

Since June 2018 when New Jersey became the first state to legalize online sports betting, states have raised $8.9 billion in tax revenue. The current largest market, New York, has raised $3.1 billion since it legalized online sports betting in 2022. We believe that the tax incentives provide substantial legislative tailwinds.

DFS (Daily Fantasy Sports) betting is generally permitted under federal and state law, provided it is peer pools with the house taking a cut rather than users betting against the house. Unlike traditional fantasy sports which run season-long contests, as the name suggests, these are usually as short as a single day.

| Structure | Betting Against | Regulatory Treatment | |

| Traditional DFS | Draft roster, leaderboard contest based on stats | Other players, house takes cut | Generally permitted as skill-based |

| Prop DFS | Draft single-stat prop bets, pick over/unders | Other players, house takes cut | Generally permitted as skill-based |

| Pick ‘Em | Same Structure as Prop DFS | Against House | enforcement varies by state, generally not permitted |

| Streak/Ladder | Similar to a parlay, but with DFS wrapping | Against House | enforcement varies by state, generally not permitted |

Only Idaho, Hawaii, Montana and Washington state have explicitly prohibited DFS betting alongside online sports betting. Only one state, Alabama, explicitly allows DFS but not sports betting. The rest of the states typically follow the opinion that skill outweighs chance in DFS, and therefore it is not regulated under existing gambling legislation. We believe that DFS, provided the players are not against the house, are at a relatively low risk for regulatory action.

The Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA) offers a test to determine if federally chartered banks are permitted to process payments related to online gambling. The three main conditions, provided online gambling is not allowed in the state, are the ‘contest’ has a public and fixed payout formula, multiple athletes from multiple teams (no prop betting), and a predominantly skilled based outcome. House-run games have run into issues, especially around skilled based outcomes. States including Massachusetts, Florida, and even New York where sports betting and Traditional DFS is legal, have sent cease and desist letters or threatened prosecution over games in which players bet against the house. Though, Flutter and DraftKings do not provide house-run games.

Nevada is a unique case. The state gaming commission classifies DFS, even peer-to-peer, as gambling and thus requires a license. So far, no major sportsbooks have applied for a license to offer DFS, which we believe indicates that the potential revenues available are small in areas where traditional sports betting is legal as indicated by the relatively small percentage of gross gaming revenues (GGR). Another potential reason is that after lobbying since 2017 that DFS is not gambling, applying for a gaming license would concede that it is gambling, which could pose legal consequences.

Sportsbooks

Combined, DraftKings and Flutter’s FanDuel have a 66.1% market share in the US. In the 30 states in which mobile sports betting is legal, both take a mobile-first approach. FanDuel generates 69.2% of its revenue from sportsbook operations, while DraftKings generates 60.9% of its revenue from its sportsbook.

In total, for the quarter ending March 2025, FanDuel reported 15% year over year increase in sportsbook revenue, driven by an 8% increase in handle and a 9% increase of total monthly players. DraftKings reported a 20.1% increase in sportsbook revenue, driven by a 15.7% boost in handle, largely due to a 10.8% increase in total monthly players.

| North American Sports Book | ||

| Stat | FLUT | DKNG |

| Annual Handle ($ million) | $50,876 | $48,061 |

| Annual Revenue ($ million) | $4,013 | $2,903 |

| Hold Rate (Full 2024) | 7.9% | 6.0% |

| Monthly Players (Mar 2025) | 3.6 million | 3.7 million** |

*FLUT publishes an “Average Monthly Players” figure, while DKNG publishes a “Monthly Unique Players”, based on the methodology, these are interchangeable metrics.

**Excludes the impact of the Jackpocket acquisition but does include the iGaming segment.

We believe that DraftKings has targeted lower-value players which has helped drive increases to monthly players to a similar level of FanDuel without the same handle. While lower-value players reduce margin, there is less variance and therefore less risk over the same volume of bets. Low-value players can provide valuable data in how groups of bettors behave, doing targeted upsells during peaks or introduction of novel offerings which may convert those players into higher-margin customers for a far lower cost than acquiring high-value customers organically. For example, more than 50% of DraftKings handle is now live-bets, up 36% year over year for the quarter ending March 2025.

| Type | Structure | House Edge |

| Moneyline/Spread | Simple bets on winner, total score, spread of odds | 4.58% |

| Prop Betting | Single-stat betting, even things like Gatorade color | Around 7% |

| Parlays | Multi-leg bets, all bets must hit to ‘win’.* | Depends on number of legs, 15% – 31% |

| Live betting | Real-time, dynamic betting based on the current play | Typically, similar to Moneyline, +-50bps |

*both FanDuel and DraftKings off “early cash out” on parlays. Theoretically, this would lower the house edge, however, both sports books discount the payout to maintain an edge.

For both companies, parlays are major drivers of hold rates given their relatively high edge. In New Jersey, parlays made up 72.5% of sportsbook revenue in May 2025, and according to FanDuel 70% of all volume in NFL and NBA games are parlays. We believe the reason behind this, is the lottery-style payout on relatively small bets. There have been several viral instances of players placing multi-leg parlays for a nominal sum that paid out in excess of $100,000. Equally, we believe that new features like ‘early cash out’ both reduces theoretical risk for high-value parlays hitting, as well as drawing in lower-risk bettors. Continued emphasis on parlays as a large portion of marketing mix has increased DraftKing’s hold percentage by 30bps to 6.4% as of the quarter ending March 2025, with average revenue per monthly user increasing by 7.0%. FanDuel reported a 7.8% hold over the same time frame, citing increased penetration of parlays as a primary driver of maintaining its higher hold.

In New York, where competition is fierce and margins are low due to the states 51% taxes, DraftKings has launched a “Sportsbook Plus” subscription plan. So far, the plan only includes better parlay payouts (extra 10% per leg) for $20 per month. We believe that this is likely to drive volumes to parlay products, which the CEO has emphasized could boost hold rates. DraftKings is the first to offer any sort of service like this, though it is likely that FanDuel is working on a similar product.

In states where retail-only sports betting is legal, like Wisconsin, both DraftKings and FanDuel have agreements with legal operators to utilize branding and technology (such as odds and risk engines). However, most of these deals are limited to a percentage of total gross gaming revenue generated and an upfront licensing fee, and do not fundamentally drive customer acquisition toward the owned platforms.

Internationally, we believe both will target Alberta launches, as the provincial government moved to relax regulations. FanDuel stated it would be targeting an Alberta expansion in 2026.

Other Operations

Flutter holds a 28.7% of gross online gaming revenue market share in the United States followed by DraftKings at 24.3%. Online gaming, often called iGaming, allows players to play games of chance like slots, poker, and roulette on their phones. Flutter’s iGaming segment is 50.0% of its international revenue, compared to just 26.3% of its revenue in the United States. DraftKing’s iGaming revenue share is 31.6% of its revenues.

DraftKings iGaming revenue increased 14.5% over the quarter ending March 2025, mostly due to an increase in monthly players though it does not desegregate players by game type. Flutter’s US-based iGaming revenue increased 32.0%, driven by a 28.0% increase in monthly players on its platform, reaching 985,000.

The debate around iGaming in the United States has largely been focused on the cannibalization of in-person casino revenue and consumer health. The data surrounding the debate is, to put it frankly, often highly manipulated to serve either brick-and-mortar casino establishments seeking to preserve their dominance or in favor of iGaming providers who wish to expand to new markets typically dominated by tribal casinos or highly entrenched regional operators. The current debate in the United States is centered on Illinois, who is seeking to legalize iGaming. A much smaller cohort of states allow iGaming, just New Jersey, Delaware, West Virginia, Pennsylvania, Michigan, Connecticut and Rhode Island,

For Flutter, US-based DFS wagers make up under 4.5% of revenues and represent around 389,000 monthly players. We believe DraftKings derives a similar number of revenues from DFS, indicating it was a mid-single-digit portion of gross gaming revenue. Consistently across both companies, DFS is seen as a top of the funnel product. We believe that DFS provides a relatively cheap data collection point that has a high customer conversion ratio and low regulatory risk. Flutter has stated that players who start on DFS have “5x” the lifetime player value as single-product customers. During 2021, 44% of Flutter’s US-based sportsbook volume came from users who started in the ecosystem on DFS. That same year, DraftKings stated it was converting “60%+” of DFS customers to full betting customers within 12-18 months of legalization.

For the quarter ending March 2025, FanDuel reported a 9% decrease in revenue from DFS as players migrated to sportsbook products post-legalization, though the decrease was exceeded by new revenue. DraftKings indicated that even when sports betting becomes legal, the small revenue cannibalization that occurs tails off over time as users return to DFS.

During 2024, DraftKings announced it would be acquiring online lottery aggregator Jackpocket for $452.3 million in cash and $320.8 million in stock. Jackpocket allows players to order lottery tickets through an app in 17 states. During the quarter ending March 2025, DraftKing’s other segment revenue increased by 45.7% largely due to Jackpocket. DraftKings did state that Jackpocket users are typically not converted to monthly players, which may bring down the growth rate of average revenue per monthly player. However, management is guiding toward $260 – $340 million in annual revenue from Jackpocket by 2026, at 23-29% adjusted EBITDA margin (excludes one-off items and legal expenses). This would increase total annual revenue in 2026 by 4.8% based on 2025 guidance and provide a high-margin product when compared to company-wide adjusted EBITDA guidance of 13.5% for 2025.

Prediction markets are quickly becoming a novel way to place prop bets on various things, from elections to economic data. While DraftKings has not commented, it quietly withdrew its “DraftKings Predict” membership from the National Futures Association. Flutter’s CEO commented they are watching the regulatory environment closely, and once they have clarity from the CFTC they may begin to develop products. According to some gambling news outlets, FanDuel is already in discussions with Kalshi for a licensing deal. Kalshi is legal in all 50 states as it is regulated by the federal level CFTC, though it has received cease and desists from several state-level regulators.

Risk

We believe the largest risk to both companies, though more heavily weighted to DraftKings as it is mostly US-based, is escalating taxes. Illinois recently introduced a flat 25 to 50 cent fee on every bet placed, and while fees like this are easy to pass through to the customer, taxes as a percentage of gross gaming revenue are more difficult to mitigate. New Jersey’s latest budget proposal has online gambling revenue taxes increasing from 15% to 20%. Typically, the way online betting operators have dealt with this is offering worse odds to make up the difference, however this drives users back to illicit bookies.

The next largest risk is the WIRE Act. While the Murphy v. NCAA decision struck down federal restrictions on sports betting, the WIRE act prohibits the transmission of money over state lines involved in sports betting. This results in complex and expensive infrastructure, including geo-fencing, servers required in each state rather than a central processing stack, and single-state pools which makes risk transfer difficult. While the WIRE act does contain carveouts allowing information like odds to move across state lines, the overall compliance cost is still highly burdensome.

Federal legislation has been proposed to further increase the regulatory burden, including more robust KYC checks and restrictions on college sports and advertising. A bipartisan letter to the FTC urged investigation into the two giants, over both predatory practices and anti-trust concerns given their scale. Even before the Murphy v. NCAA decision, the proposed merger of Draft Kings and FanDuel was shot down, recognizing that the two constituted an effective duopoly.

A risk individually, is that promotional activity likely dictates betting volumes. There is relatively little friction between apps, with users able to switch between apps to get the best odds. This can create a ‘race to the bottom’ effect. However, due to the scale, we believe that the largest risk is to each other with new smaller entrants unlikely to be able to compete with the scale of DraftKing’s or FanDuel’s promotional activity.

Financials

DraftKing’s company-wide revenues increased 19.9% year over year for the quarter ending March 2025, due to continued sportsbook growth as previously discussed. Operating margins for the trailing twelve months ending March 2025 remain in the negative, with S&P identifying 2024’s relatively favorable sports results to the customer as a short-term headwind. However, S&P also identified that DraftKings has a structurally higher customer acquisition cost, totaling a 3-year payback period compared to Flutter’s 18 months. For 2025, DraftKing’s expects to expand its revenues by 30% — excluding Missouri — and boost its EBITDA margin (excludes one-off items and legal expenses), to 13.5% from 3.8%. Given the continuously expanding consumer base, focus on lower customer acquisition costs, and strong balance sheet we believe that the risks to continuing operations are low over the medium term and are confident it will gain profitability by 2026.

Flutter’s global revenue increased 8% year over year for the quarter ending March 2025, with monthly company-wide players increasing 8%. For the trailing twelve months ending March 2025, operating income margins expanded 419bps to 6.8%. The driver behind both the margin expansion and revenue increase was US Markets, with double-digit increases in sportsbook customers as previously discussed and gaining more operating leverage. For 2025 Flutter expects total revenues to increase 22%, lead by 28% US growth excluding Missouri. Global adjusted EBITDA margin (excluding one-off items and legal expenses) is expected to increase to 18.6% from 16.8%. US-specific adjusted EBITDA margin is expected to increase to 15.2% from 8.7%, largely due to a return to form after 2024’s customer-favorable sports results, growth in high margin products like parlays, and continued increases in operating leverage.

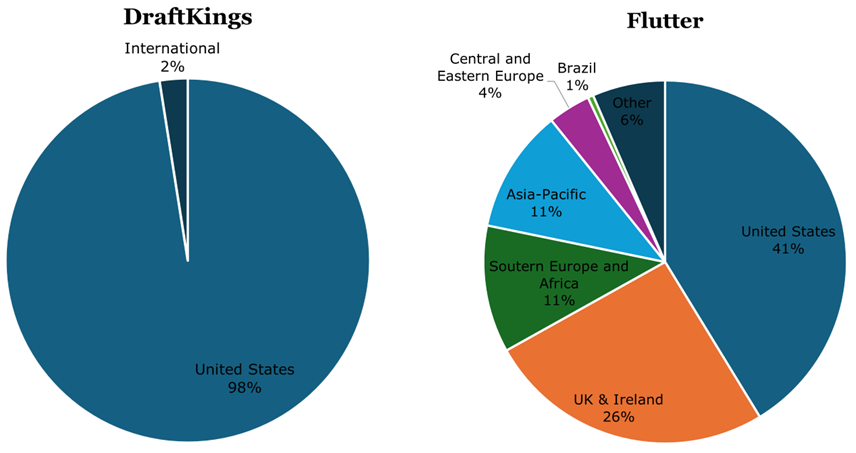

Both companies operate outside of the United States, though DraftKing’s international footprint is smaller operating in Ontario since 2022 and exiting the United Kingdom’s DFS market in 2024. Flutter’s international footprint is much more substantial, gaining 58.7% of company-wide revenues from international customers. While we believe that the higher international exposure of Flutter makes it more stable, international markets are more mature leading to lower growth. During the quarter ending March 2025, total international revenues only increased 1.0%, due to an 8.0% increase in monthly players.

Both companies have solid balance sheets, with DraftKings having $1.1 billion in cash on hand, with a net debt to adjusted EBTIDA of 4.0x which S&P project to decrease below 1.5x by the end of 2025 given the strong projected adjusted EBITDA growth. Given the strong expansion of revenues and projected EBITDA, it is possible that DraftKings will turn free cash positive during 2025 depending on the scale of acquisition activity and the cost of launching in Missouri.

Flutter has a net debt to adjusted EBITDA of 1.4x, and $3.5 billion in cash on hand. For the trailing twelve months ending March 2025, Flutter had free cash flow of $801 million, weighted down by around $500 million in acquisitions.

Currently, DraftKings has $809.7 million in share repurchases available or 3.8% of shares. Flutter has $5 billion in authorized repurchases, and expects to purchase $1 billion during the year, or 2.1% of outstanding shares.

Conclusion

There are favorable long-term expansionary tailwinds in the United States due to fiscal incentives on behalf of states. Despite compliance costs being high, both companies have demonstrated that they are able to monetize millions of customers monthly at consistent handle hold rates.

We believe that over the short-to-medium term, DraftKings will turn profitable as it executes on lowering its customer acquisition cost and incentivizing players toward high-hold offerings like parlays. We believe that Flutter, despite its relatively mature international position, still has substantial room to grow given its strong operating leverage and consistent growth in the United States.

Overall, we believe that both represent solid picks for growth-oriented investors to enter a still-growing market.

Peer Comparisons