Unlocking Growth in NSA’s Storage Landscape

| Price $31.65 | Dividend Holding | August 8, 2023 |

- Dividend yield 6.71%, REIT structure payout dictates 90% net earnings payout requirement.

- Growth potential in a highly fragmented market, with $43 billion in total addressable market owned by 31,000 different owners. NSA currently has 2% market share.

- Geographic concentration in the high margin “sunbelt” area, rising housing prices contributing to expansion in those areas.

- Targeting $300 million in acquisitions in FY23, $1.4 billion in high-value properties in the pipeline.

- Proven recession resistance, averaging 90% occupancy with 60% occupancy breakeven rates.

Investment Thesis

National Storage Affiliates (NSA) is a real estate investment trust operating within the sector of self-storage. NSA owns 1,117 self-storage locations in the United States with 72.8 million square feet of rentable space.

NSA offers potential for acquisition-driven growth. Self-storage is a fragmented and recession-resistant industry with high operating income margins. This gives an ample margin of safety for investors. With its unique participating regional operator’s program and 6.71% dividend yield, it is a strong income-oriented investment.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $2.91 X 14.2 = $41.32

| E2023 | E2024 | E2025 | |

| Price-to-Sales | 3.4 | 3.3 | 3.1 |

| Price-to-Earnings | 12.3 | 11.4 | 10.9 |

Market Opportunity

The domestic self-storage market is expected to be $43 billion in FY23, and will grow at 2.4% 5-year CAGR. Self-storage is a highly fragmented industry, with public operators only accounting for 19% of the market share. Of the 51,000 self-storage locations in the US, 79% are private, with 31,000 different owners. NSA currently has a 2% domestic market share.

COVID-19 has continued to change the dynamics of the industry, with the slow-down in commercial real estate slowing down B2B sales. However, this is offset but the increase in demand for personal self-storage. Baby boomers are downsizing and need storage space for stuff that will not fit in their smaller homes.

The fragmentation of the industry establishes a large pool to acquire from. The long-term acquisition property portfolio is 98 properties at $1.4 billion, which NSA considers highly attractive. This does not include the 185 properties and $1.6 billion to buy out partners from existing JV interests. Since its IPO in 2015, NSA has averaged $949 million per year in acquisitions, including JVs. Over the same time frame 15% of acquisitions came from the pipeline or PRO opportunities, 47% are marketed offers, and 38% are off-market offers.

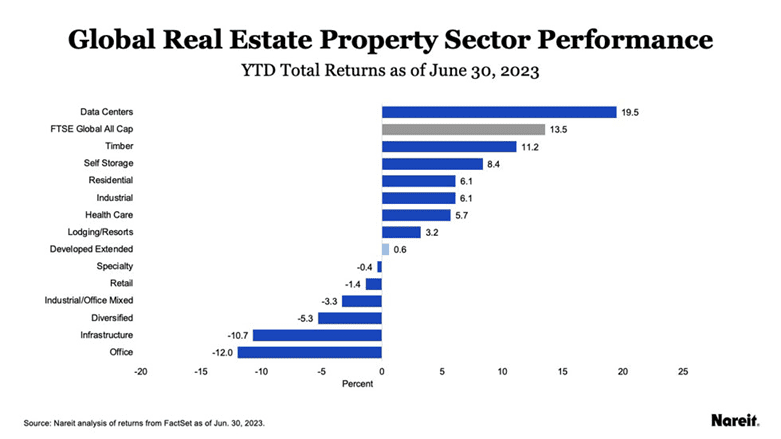

Compared to other REITs, self-storage has demonstrated lower volatility and higher mean return than other REIT structures, according to NAREIT. Self-storage is regarded as recession resistant, given its high margins and low breakeven occupancy rates.

Operations

Goals for FY23 are the continued integration of mature regional operators into its 4 in-house corporate brands. What sets NSA apart is the PROs (participating regional operators) expansion methodology. PROs make up 29% of the portfolio and have 329 properties. These are normally smaller operations that NSA does not directly run. In exchange for property ownership, NSA gives regional operators subordinated performance units in NSA and allows them to maintain branding. These subordinate performance units pay out distributions based on PROs specific performance metrics. The structure provides an alignment of incentives for property managers. After some time, the PRO is often retired and integrated into one of NSA’s 4 corporate brands though there is no specific timeline for this.

Of the 72.8 million in leasable space, NSA has a 90% occupancy rate, down around 450bps year over year, but is flat relative to the previous quarter. Typically, self-storage businesses average 90-95% occupancy rates. Breakeven rates are typically 60% or lower. With this 90% occupancy rate, NSA states that the average tenant duration is over 40 months.

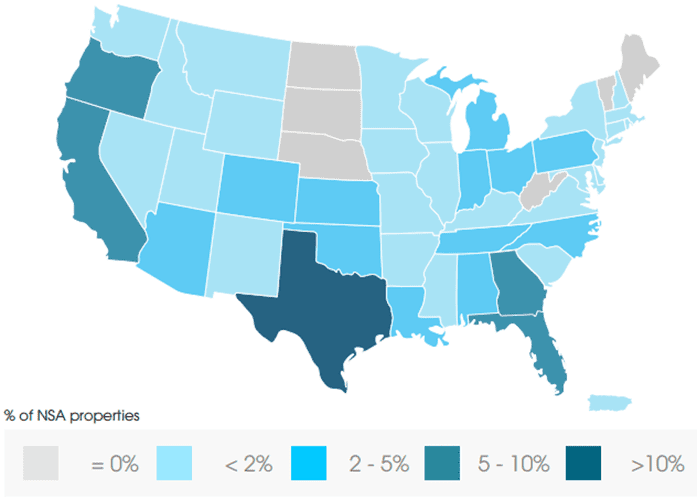

NSA targets the “sunbelt” with 66% of store count concentrated in that area and the top markets in Florida and Texas. The sunbelt has historically had much stronger results than other areas of the country, with same-store revenue growth averaging a 5-year CAGR of 7.9%, compared to the rest of the country at 6.4%. Largely, this is attributable to downsizing, increasing population and a vibrant housing market in those states

Risk

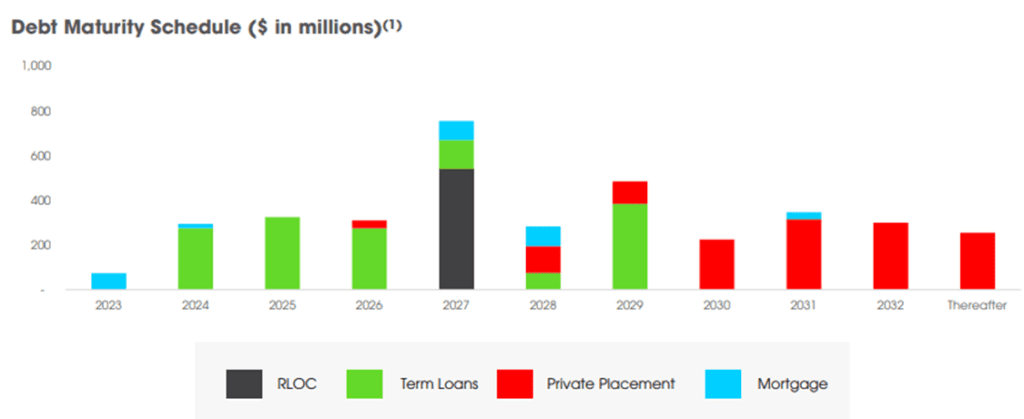

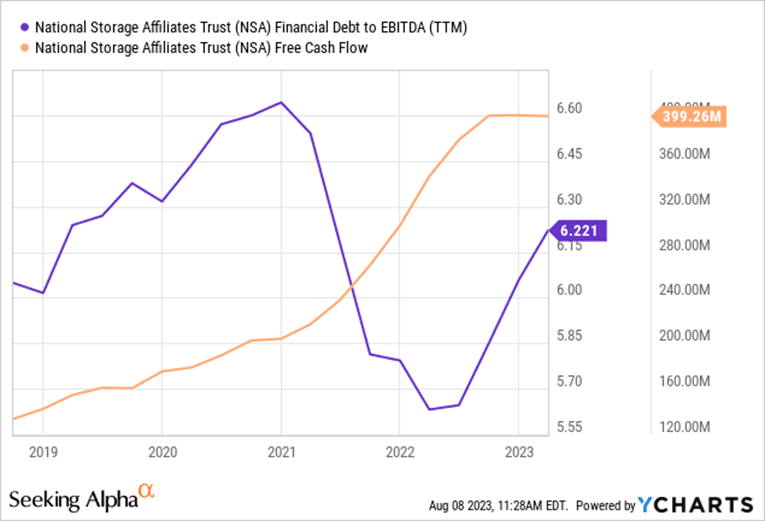

The debt profile of NSA is well-diversified, with most debt maturity not weighing toward a single year. The largest maturity block is FY27 when the RLOC (revolving line of credit) comes due and closes. This gives a weighted average maturity of 5.4 years at 4.1%. More recent debt has a higher average interest rate, with the newest notes having an effective interest rate of 5.75%. While this is unfavorable, 92% of debt is unsecured, and 84% of debt has interest swap coverage. Additionally, NSA has $112.2 million in quarterly unlevered free cash flow, and an interest expense of $39.5 million.

Due to market conditions, NSA states that there is a large bid-ask spread between existing owners and buyers. This means that NSA for FY23 will likely have fewer off-market offers and more concentrated acquisitions in the captive pipeline compared to the past.

Metrics and Outlook

NSA’s margins are high with an average net operating income margin per store of 74.4%. Same-store revenue has grown 8.8% for the top 25 properties with the remaining properties averaging 9.9%.

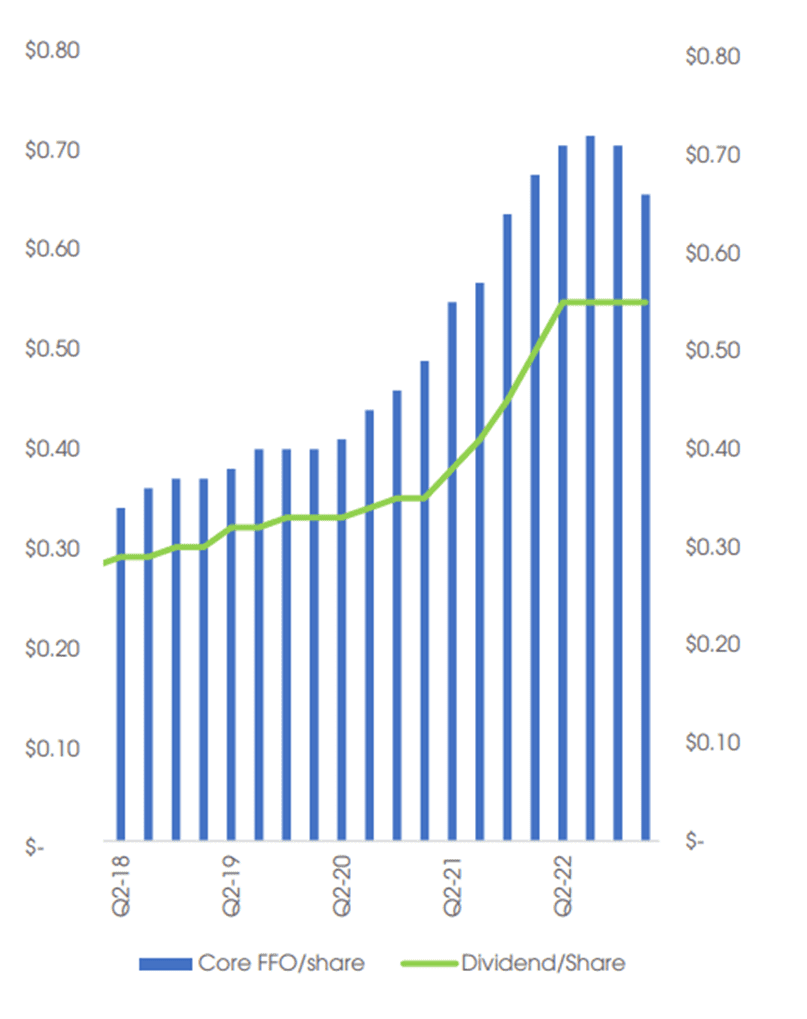

As a REIT NSA must pay out 90% of net income to investors, meaning that net income and FFO (funds from operations) are good barometers of future dividend yield. In 2Q23 net income decreased 6.1% year over year, with similar drops in FFO. This is attributed to higher interest rates and lower occupancy. NSA expects this trend to continue in FY23 until rates normalize sometime after FY24.

For FY23, NSA expects around 7.5% growth in operating expenses aside from interest, reducing net income growth to 0.25-1.75%. NSA still expects to purchase $200-300 million in additional properties in FY23. As of 1H23, they have purchased approximately $180 million. Its 3-year portfolio growth is 69.1% in net leasable square footage, far outpacing peers.

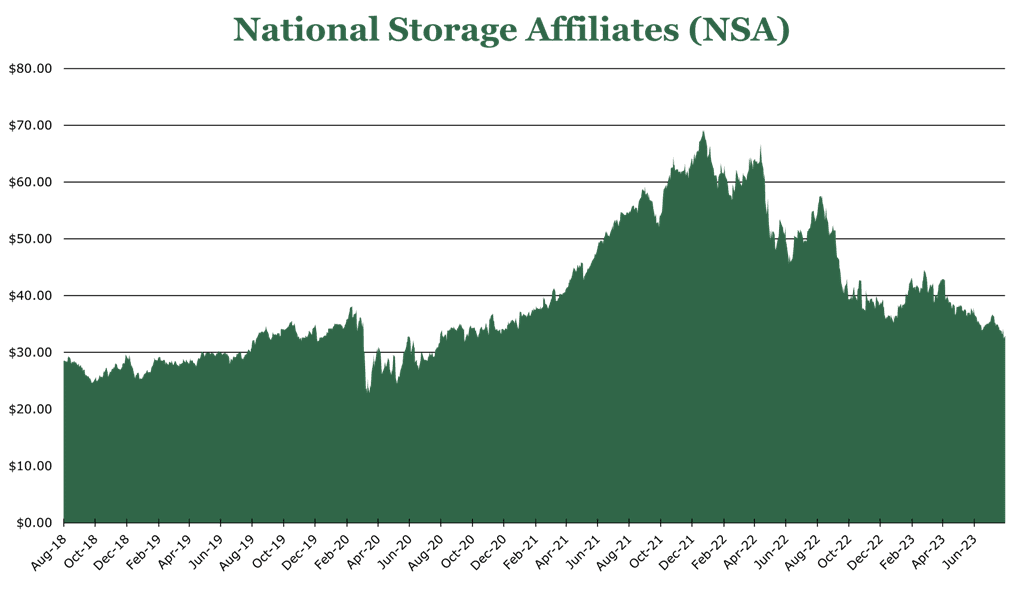

While interest rates will may slow down future acquisition based growth, NSA still generates significant cash flow, has high margins, and has 90% occupancy. For this reason, we believe that NSA is a solid recession-resistant REIT. The stock has pulled back to the low 30s from 69 at the end of 2021. It now has a higher yield and lower valuation than its peers.

Competitive Comparisons