Uber: Driving Success with Network Effect and Improving Financials

| May 5, 2024 |

- Uber’s long-term strategy of focusing on scale first and profitability later is starting to pay off, as it has seen significant growth and has been added to major stock indices.

- The company’s ability to operate across multiple platforms and channels efficiently has allowed it to cross-sell effectively and capture and retain more customers.

- Uber’s recent upgrade to BB+ outlook positive and its achievement of GAAP profitability have positioned it for aggressive expansion and lower interest rates, which could further drive its growth and market dominance.

Overview

Uber has long epitomized the “scale first, profitability later” business model, which was very popular during the period of zero interest rates, but its recent strides above the competition suggest that this long-term strategy is beginning to bear substantial fruit. Added to the S&P 500 in December 2023 and the Dow Jones Transportation Index in February 2024, Uber’s ascent marks a significant validation of its business model and operational success.

As a multi-platform leader, Uber stands out for its ability to operate across multiple channels efficiently. This capability enables Uber to cross-sell effectively, with a notable portion of its delivery customers also utilizing its mobility services. Such integration has allowed Uber to capture and retain more customers while optimizing marketing expenditures. Despite some concerns about reaching the early stages of maturity, Uber’s continuous robust growth — evident in its $137 billion gross booking value increasing by 20% year over year — strongly counters this notion in our opinion, indicating that there is still significant room for expansion especially on the bottom line.

Reaching GAAP profitability has been a critical milestone for Uber, which has allowed it to generate a significant FCF (Free Cash Flow) in 2023 of $3.3 billion. Another significant development was the upgrade of Uber to BB+ outlook positive, a rating just shy of investment grade overall. If we see another upgrade in 2024, Uber could benefit from significantly lower interest rates and a wider range of buyers for its debt, which would enable it to conduct aggressive expansion while mitigating previous financial burdens. Combined with its asset-light and quick-to-respond business model, Uber is uniquely positioned as possibly the “last man standing” in the multi-product ride-hailing/delivery space. As the landscape evolves, Uber’s ability to adapt and innovate will be crucial in maintaining its growth trajectory and market dominance.

| Uber (UBER) | Lyft (LYFT) | DoorDash (DASH) | |

| Closing Price | $68.90 | $16.15 | $131.70 |

| EPS (2024E) | 1.24 | 0.62 | 2.75 |

| EPS (2025E) | 2.04 | 0.86 | 3.25 |

| EPS (2026E) | 2.87 | 1.10 | 4.57 |

| Gross Buyback Authorized (%) | 4.6% | 0.0% | 0.0% |

| Gross Buyback Authorized ($B) | $7.0 | $0.0 | $0.0 |

| Market Cap. ($B) | $154.3 | $7.3 | $54.1 |

| Dividend Yield (2024E) | 0.0% | 0.0% | 0.0% |

| Net Income Margin | 5.1% | -7.7% | -6.5% |

| EV/EBITDA | 25.5 | 19.9 | 28.8 |

| FCF ($B) | $3.36 | $(0.16) | $1.34 |

| PEG (2024E) | 0.80 | – | 0.64 |

| P/E (2024E) | 59.9 | 29.4 | 48.69 |

| P/E (2025E) | 36.3 | 21.2 | 34.78 |

| P/E (2026E) | 25.9 | 16.6 | 29.4 |

| P/S (2024E) | 3.6 | 1.4 | 5.3 |

| P/S (2025E) | 3.1 | 1.3 | 4.6 |

| P/S (2026E) | 2.7 | 1.1 | 3.4 |

Dominance by Breadth

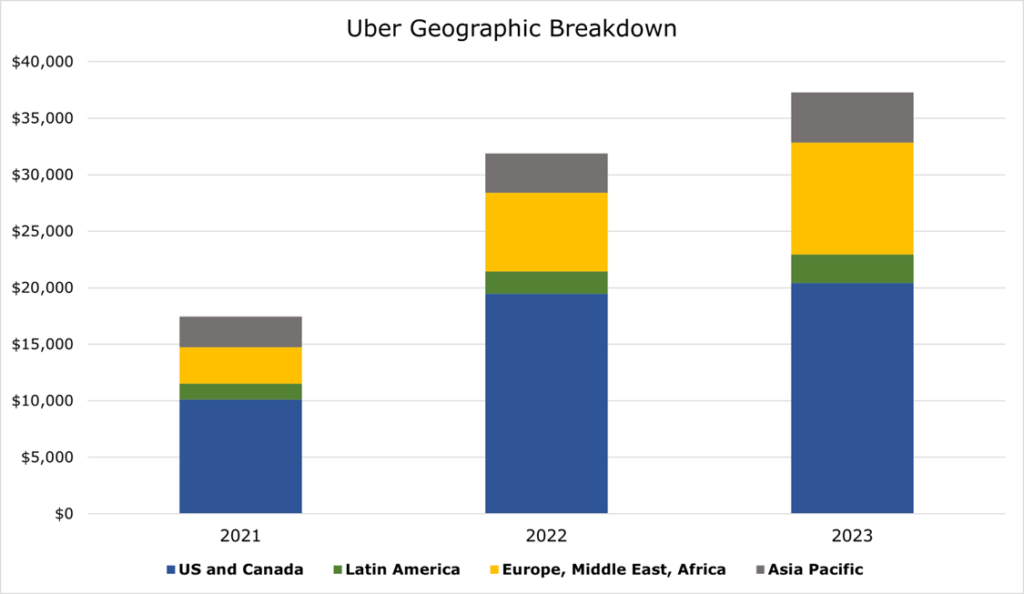

Uber’s commanding presence in the global ride-hailing and delivery market is largely due to its breadth and scale, which afford it significant economies of scale that outpace all competitors. With operations in over 70 countries and a robust portfolio of mobility and delivery options tailored to various local markets, Uber not only leads in volume but also in market innovation and adaptability. This scale has allowed cost leverage in places such as technology, focusing 75% of technology spending on areas that benefit all offerings rather than one-off features.

Buoyed By Rising Costs

We believe that tailwinds from higher prices may buoy short-term user growth. Ground transportation costs are inching higher, with insurance costs far outpacing the CPI, growing at 22.2% year over year. Large urban transit authorities like NJ Transit are instituting 15% fare increases, and NYC is implementing new congestion charges on commuters.

Uber prices, on the other hand, have grown slower than inflation. Independent analysis by YipitData confirms this, with average Uber fares growing at an estimated 17.9% year over year. According to Uber, the introduction of discount offerings like Share, Moto, and Shuttle, coupled with algorithmic navigation to reduce insurance costs (avoid unprotected lefts, monitor driver speed), have allowed it to keep prices down for consumers, which has led to continued growth in ridership despite increasing prices.

Buoyed By Rising Costs

While an Uber offering powered by AI on the front end is likely not on the cards for the near term, the company uses a significant amount of data on the back end to drive customer engagement. This allows Uber to efficiently cross-sell services, increasing the overall booking value per customer. Thus far, this has taken the form of offering coffee discounts during morning commutes or suggesting dinner options during evening returns. Uber’s focus extends to matching trips with drivers based on their preferences and availability, reducing rider and driver wait times, and improving overall network efficiency. This optimization also includes tailored fare estimates for each trip, allowing more accurate estimates of earnings for drivers and costs for customers. A data-driven approach has enabled Uber to maintain competitive pricing and grow its user base steadily despite broader economic fluctuations affecting the transportation sector.

The previous expansion strategy concentrated on growing monthly active users. At the end of 2023, monthly active customer growth has hit a 15% 3-year CAGR, or 150 million monthly active users. However, for existing customers, there has been a much smaller 6% increase in monthly trips, with over 50% of customers using Uber once or twice a month.

In our view, conversion of single-product or single-use customers will become a key part of growth on a go-forward basis, given capturing higher gross booking value per customer would convert even modest top-level growth to a significantly stronger bottom line. Multi-product customers, on average, spend 3.4x those who use a single Uber offering. Converting these single-product consumers to multi-product consumers is, on average, 50% cheaper than acquiring new customers who may only be single-product customers. At the end of 2023, 31% of first-time delivery customers ordered from the mobility app, with 22% of mobility trips coming from the delivery app. The penetration of multi-product customers has increased from 21% to 34% since the first quarter of 2021.

Core Business

The global ride-hailing market is experiencing significant growth, albeit at a slower pace than in the previous 5 years. Global revenue is projected to reach $165.60 billion by 2024 and further expand to $215.70 billion by 2028, or a CAGR of 6.83%. User engagement is also expected to rise in tandem, with global user penetration rate anticipated to increase from 22.6% in 2024 to 24.6% by 2028.

Uber is undoubtedly the global mobility market leader. Operating in more than 70 countries, it holds the top spot in mobility gross booking volume in 10 of the world’s largest economies. However, Uber still has under 20% penetration in these top markets. For example, if the US market penetration rose to that of the UK, gross booking value would increase by $13 billion.

Of existing customers, 50% of mobility users only take 1-2 trips per month. If all consumers who only take a single ride per month became 2-time users, gross booking value would increase by $4 billion. In our view, this conversion will be a key part of Uber’s push toward bottom-line growth.

Uber’s offerings started with just UberX, the core offering, and Uber Black, the luxury offering. Now, the mobility segment offers 14 different offerings depending on locality. While UberX is still the core, 30% of the mobility segment’s gross booking value comes from the differentiated offerings. Customers who use more than one of these offerings generate 3x more gross booking value compared to those who only use one offering. Localities with low-cost offerings such as Share, Moto, or Shuttle, on average, have significantly higher trips per month than other mobility products, with annual trips from low-cost offerings growing at 90% year over year, driven by the developing world. While these low-cost offerings offer less in margin, they are a significant driver of volume. Over time, as Uber’s priority shifts to increasing the mobility segment’s margins on a stand-alone basis, it is likely that Uber will either attempt to upsell heavily on these low-cost offerings or tweak price and liquidity over time.

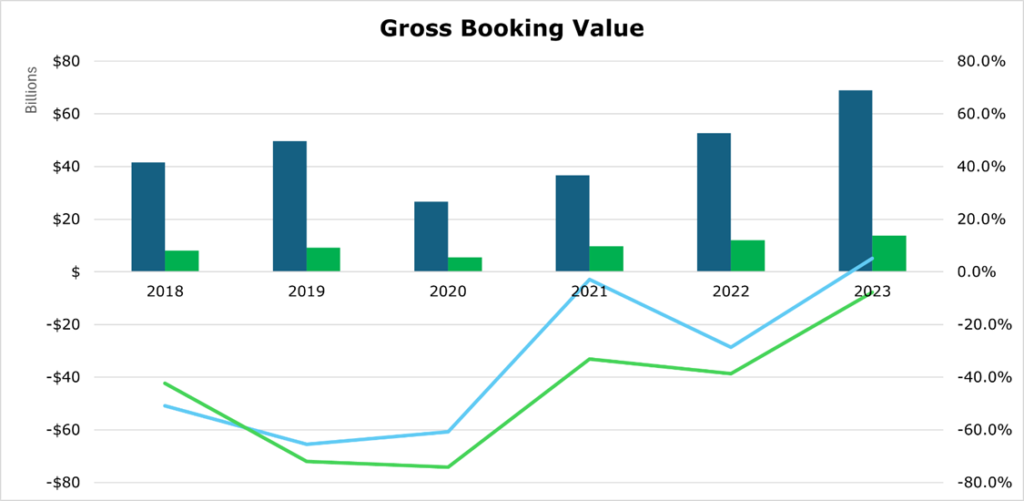

Overall mobility segment gross bookings reached $69 billion in 2023, growing 32% year over year. The overall number of drivers has increased 75% since the start of 2022, with 39% more customers and 13% more trips per customer over the same time frame.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Uber Gross Bookings (Mobility Segment) | $41,513 | $49,700 | $26,614 | $36,636 | $52,665 | $68,897 |

| Uber Net Income Margin | -50.8% | -65.4% | -60.8% | -2.8% | -28.7% | 5.1% |

| Lyft Gross Bookings | $8,054 | $9,180 | $5,456 | $9,746 | $12,060 | $13,770 |

| Lyft Net Income Margin | -42.3% | -72.0% | -74.1% | -33.1% | -38.7% | -7.7% |

Competition and Market Share

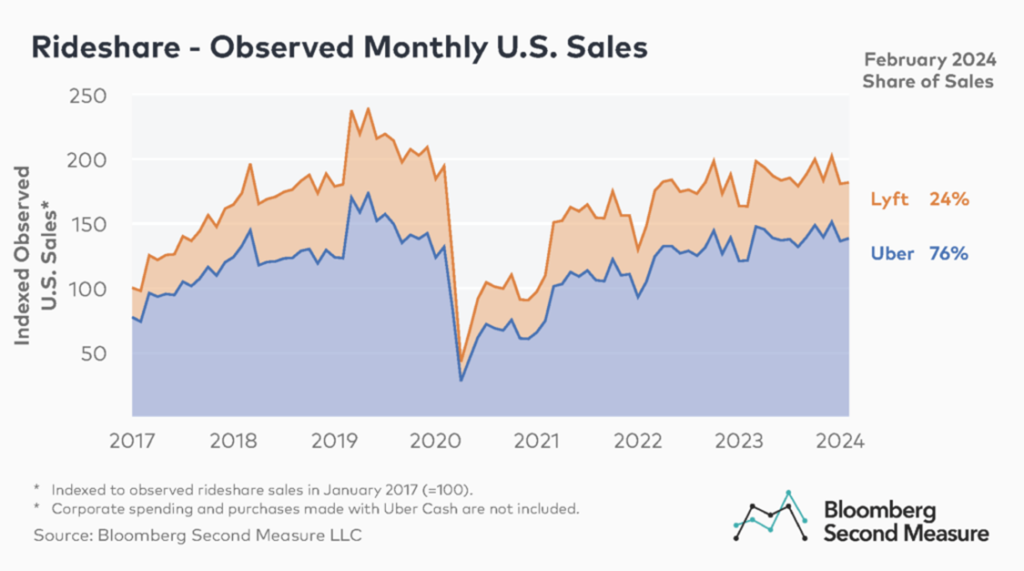

Uber’s largest competitor in the Mobility segment is Lyft. Lyft is geographically centered in the United States and Canada and positions itself as a simpler, more socially conscious alternative to Uber. Lyft expects gross booking growth in 2024 to be in the mid to high teens, driven by continued customer growth. However, Lyft has struggled with profitability since its inception and is a distant second to Uber in the ride-hailing industry.

Lyft has new management, which seeks to make broad changes to run the company as a lean, still socially conscious, cheap competitor to Uber. Part of this change was to hire David Risher, a Microsoft and Amazon veteran who has overseen numerous block-busting product launches. More attractively, his compensation is mostly options tied to performance targets. In his first action, he ordered the divestment of non-rideshare-focused offerings, saying the new direction of the company was one of a “pure player.” It remains to be seen what this pure-play strategy will look like, though in our view, it is likely they will embark on an offering breadth campaign like Uber, attempting to compete with premium Uber mobility offerings like Uber Black or Uber Reserve.

Despite Lyft’s geographic focus on North America, Uber still dominates with a 76% share of US rides.

Both companies saw a heavy decrease in traffic during the pandemic. However, Uber has already largely recovered to pre-pandemic revenue and growth levels, while Lyft is still lagging behind its pre-2020 growth. Internationally, Uber also dominates, with an estimated global market share between 25-40%. The next highest ridesharing app is likely the Chinese DiDi ride-share service, which makes up 20-30% of the global market with particular strength in China and South America. Uber owns approximately 15% of DiDi, due to divesting Uber China to DiDi in 2016. DiDi has also just recently broken into profitability in the quarter ending December 2023. In a similar transaction in 2018 Uber divested much of its South-East Asia operations to GRAB, in exchange for 27% of the company. However, since going public, GRAB has fallen 70% in value and has struggled with profitability.

Maximizing Driver “Liquidity” Through Partnerships

Previously, Uber was at odds with Taxis, but now Uber has a symbiotic relationship with Taxis in some of the highest taxi ridership localities in the world, such as NYC and Tokyo. The value proposition for Uber Taxi provides benefits to all parties: Taxi drivers see substantially higher earnings, taxi managers see substantially higher utilization rates, and Uber gains increased driver liquidity, especially during busy hours. Taxis now represent 5% of the overall active driver base, which we expect to outpace normal driver growth in the short term as onboarding is far more rapid for taxi fleets than individual drivers. As of the end of 2023, Taxis represented 20% of all first-time drivers.

In a similar vein, Uber has embraced the practice of fleet managers operating at scale. Uber’s fleet offering involves partnerships with fleet operators who own and manage multiple vehicles. These fleets may be rental car companies, driver services, or even car dealerships. This arrangement helps expand Uber’s driver base by including those who can’t or prefer not to use their own cars. Fleet operators handle vehicle acquisition, maintenance, and management, while drivers focus on providing rides. The fleet offering makes up nearly 20% of mobility supply hours and 18% of total vehicles, providing significantly more liquidity than typical independent drivers.

Uber Reserve: Beyond Airports

Uber has identified airports as a key use case, with an estimated 15% of gross booking value deriving from intermodal travel. According to Uber, more effectively capturing the airport market would drive an estimated $10 billion in additional gross booking value. To capture this market more effectively, Uber created the Reserve product offering, which allows users to schedule a precise pickup or drop-off time. Currently, Uber estimates that 20% of all airport trips utilize the new Reserve offering. Ironically, the offering has found an unintendedly strong market in rural or suburban areas with low driver liquidity. Outside of the urban core, where Uber’s network is the strongest, the number of drivers available at any given time may be too low, driving up the price and reducing reliability. As of the end of December quarter 2023, Reserve has a higher margin than the standard UberX offering as it is positioned as a premium product offering.

Competition and Market Share

Much of Uber’s total cost of sales is made by payments to drivers. Driver pay is typically calculated based on a time and mileage multiple, which is passed through to the consumer. To avoid regulatory scrutiny and assist drivers, all major mobility and delivery platforms have introduced some form of gas reimbursement for drivers. These payments represent roughly 57% of Uber’s cost of revenue in 2023.

The other large expense for Uber is insurance, and while the passthrough rate to customers has approached 100%, it has remained a significant barrier to profitability. Uber provides liability insurance to all mobility drivers on its platform. Uber has taken steps to decrease costs over the years, including creating its own captive insurance company, which allows it to enter into more favorable reinsurance agreements and invest its own premiums. It has also attempted the standard fare of mitigation by demographics, forbidding drivers with bad driving records and disallowing drivers under 25 in certain localities. As discussed earlier, Uber has been able to drive this down further due to its ability to leverage driver data. Uber drivers navigate by utilizing the Uber app, which selects the optimal route based on traffic and time. However, a recent introduction to this system is navigating around things that may increase the risk of collision or other insurance increases. This may include avoiding unprotected lefts, areas with high levels of red-light cameras, or avoiding construction zones. While internal details of these programs are not available, in our view, this will at least partially offset headwinds related to insurance inflation.

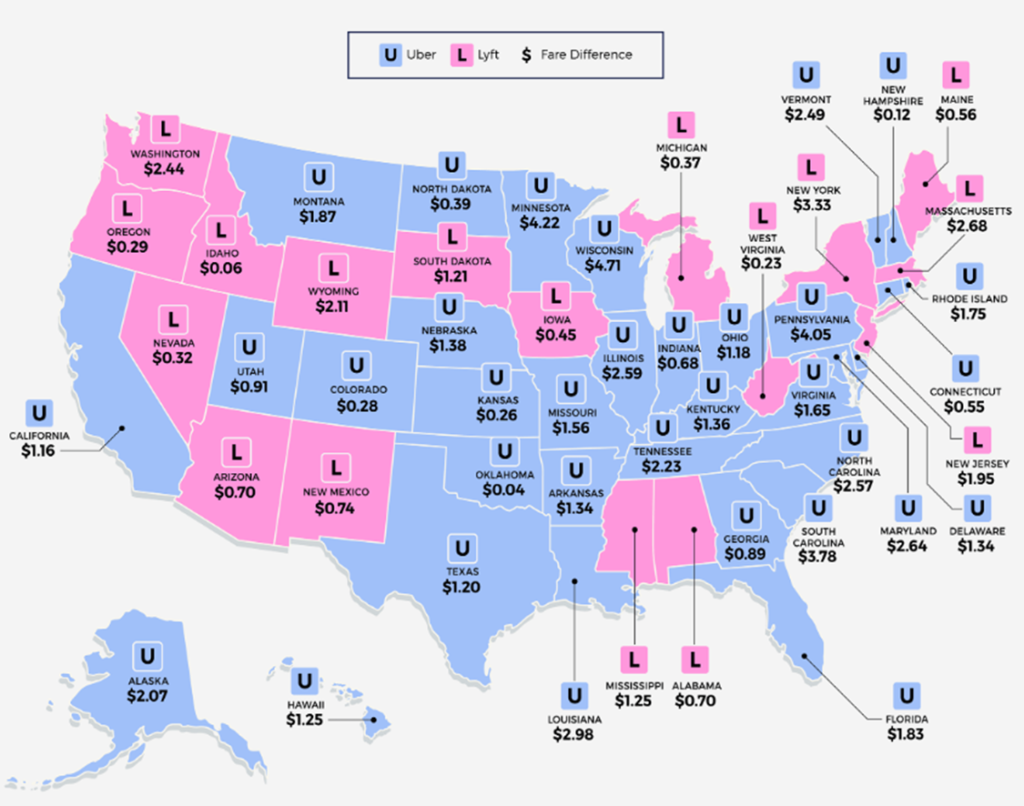

According to an independent estimate by CashNetUSA, the differences in fares between Uber and Lyft are mostly geographic. Lyft has previously telegraphed that it would attempt to be more competitive with Uber on a fare basis in order to claw back some market share. However, Lyft has also stated that it will not embark on an aggressive undercutting campaign. Uber responded by saying that it does not see a price war taking place; instead, it feels that Lyft’s reducing prices will increase competitiveness in the marketplace.

Delivery

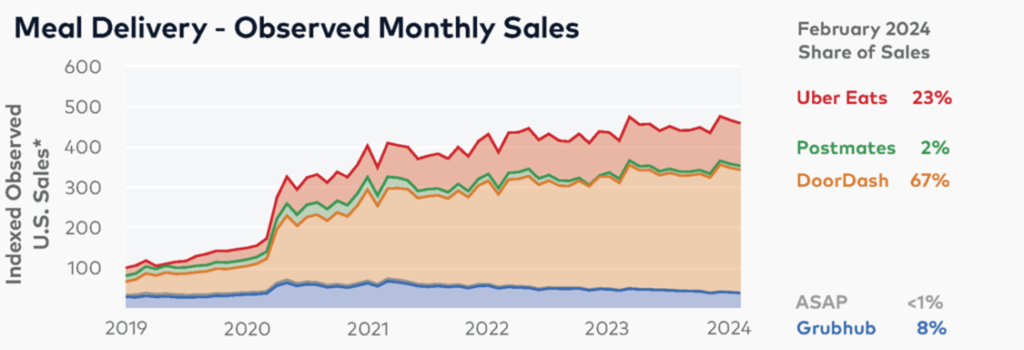

Food is one of the largest spending sectors in the world, with US food spending reaching around $2 trillion per year. Prior to the pandemic, the delivery sector was growing steadily at about 7.5% annually, mainly fueled by the younger demographic. However, the onset of COVID-19 dramatically accelerated this growth, doubling the market size within two years, with continued expansion at an estimated compound annual growth rate (CAGR) of 10%.

Despite inherently lower margins due to payouts to restaurants or stores, delivery services offer lucrative opportunities for advertising, upselling, and achieving higher gross booking values per customer. Gross booking value in the delivery segment has increased 14.2% year over year to $65 billion for the full year 2023 to $63.7 billion. The average monthly customer spend per order has increased 8% since 2021, and the average customer conducts 11% more delivery orders over the same period.

Market Share

In the United States, market share is broken down into Uber, DoorDash, and Grubhub. The most dominant player in the United States is DoorDash, a delivery pure player. Grubhub and its Dutch parent company “Just Eat Takeaway” has several localized subsidiaries that compete in many markets

Despite DoorDash leading the North American market, globally it reached $17.6 billion in gross bookings for the quarter ending December 2023. Uber was not far behind with $17 billion.

Competition has continued to heat up as the delivery market has grown, especially in Europe. DoorDash is taking a more aggressive posture toward expansion in Europe, acquiring the fast-growing Finnish delivery service Wolt in late 2022 in an effort to capture more market share in Europe. European market penetration is expected to grow from 25% in 2022 to 36.5% by 2027, which could be further accelerated by the European economic downturn bottoming out.

A significant problem faced by all players in the delivery market is “promiscuous” customers. According to Bloomberg’s Second Measure, these are customers who frequently switch between different food delivery apps to find the best deals, driven by rising delivery prices and surcharges. To avoid the problem of commoditization, exclusivity agreements with restaurants force customers to use specific apps for certain orders, which may not match their typical consumption habits. While this certainly helps split the addressable market, the exclusivity environment encourages app hopping. To combat this, many have introduced loyalty offerings or subscriptions, although retention rates seem to fall off after promotional rates have concluded. For example, DoorDash’s Dashpass offers lower delivery fees and exclusive discounts for members but only has a retention rate of 25% after one year.

| Company | Operating Countries | Estimated US Market Share | Estimated European Market Share |

| Just Eat Takeaway | 20 | 8% | 23% |

| DoorDash | 28 | 67% | ~10% |

| Uber (Delivery Segment, Postmates) | 45 | 25% | 44% |

Direct and Connect: Nascent, Niche Offering

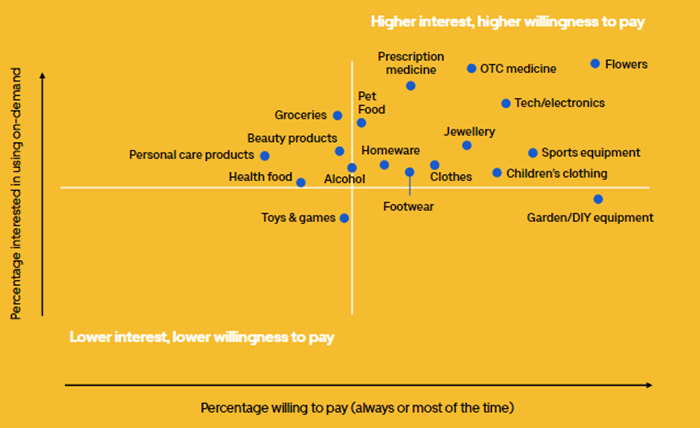

DoorDash has aggressively expanded into non-food delivery, such as through partnerships with Best Buy and CVS. In our view, DoorDash’s expansion outside the core US restaurant delivery base will be a substantial priority on a go-forward basis to remain competitive and drive profitability. Thus far, DoorDash has entered into discussions with Dick’s Sporting Goods, Sephora, and even Lowe’s.

While engaging in fewer non-restaurant partnerships than DoorDash, Uber has targeted more non-restaurants through its Uber Direct offering, a white-label delivery service. Uber Direct offers zero commissions and instead charges a flat fee, providing more favorable economics. Currently offered in 18 markets, its mix is around 40% restaurants and 60% non-restaurants. Partnerships on Uber Direct include KFC in the UK, Burger King in Germany, 7-11 and McDonald’s in Japan, and Japanese supermarket chain MaxValu.

In a similar vein, Uber Connect effectively utilizes the same infrastructure but allows Uber drivers to function as middlemen, such as picking up a package for the customer, delivering customer-to-customer, or even one-off small business deliveries. In our view, this offering likely significantly smaller than Uber Direct and likely holds similar economics present in the mobility segment.

Both remain “nascent” offerings by Uber. While not currently broken out, Uber reports that since its initial release in 2021, these businesses have grown 350%. While expansion plans are not public at this time, an Uber survey reported that 86% of consumers feel same-day delivery has become important for them. Across all age groups, 41% stated that they would be more willing to buy from retailers who offered the service. However, there is a sharp age difference among preferences. Among the youngest cohort (18-26), 69% said they’d pay a premium for same-day delivery. What is clear across all age groups is that there is a niche for a last-mile delivery service that goes beyond the typical courier service.

Maintaining Network Effect Through Business Retention

app, the better the value proposition is for the consumer; equally, the more consumers you have, the more valuable your app is for the restaurant. Since 2021, Uber has grown its total number of merchants by 20%. Uber Eats estimates it has 20% global penetration into the restaurant side of the addressable market, with about 30% in the US. Organically, Uber believes it can continue to grow restaurant offerings by around 10% per year globally.

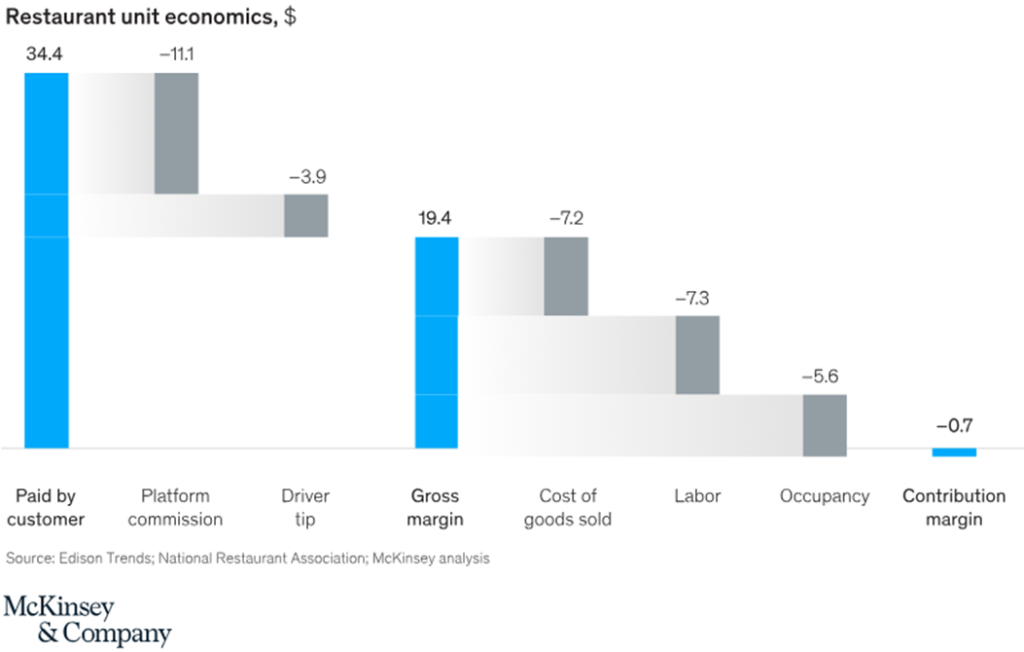

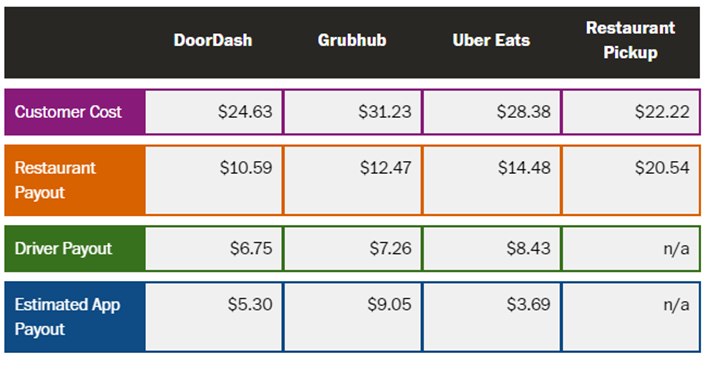

Delivery platforms like Uber Eats generate revenue through several streams: they charge restaurants commission fees typically ranging from 15% to 30% of the meal’s cost, collect delivery fees from customers ($2 to $5 per order), and add customer service fees (up to 15% extra). They also earn from in-app advertising, leveraging customer data to promote specific restaurants.

| Ordering | Delivery | Total Commission for a Typical Order | |

| Just Eat Takeaway (GrubHub) | 20% | 10% | 30% |

| Uber (Delivery segment) | 15% | 15% | 30% |

| DoorDash | Flat Monthly | 20-25% | 20-25% |

The typical restaurant has an operating margin of 7-22%, and it is generally able to enhance this by high-margin upsells like alcohol, which are unavailable for delivery. Add in the 30% commission on a typical order, and quickly, restaurant unit economics degrade. Typically, a restaurant’s attraction to offer delivery is one of visibility and utilization—offering delivery increases kitchen utilization during downtime and increases the customer base. According to McKinsey, even though most restaurants maintained or even grew revenue through the pandemic, many began to see a significant contraction in margins as most revenue originated from delivery.

To combat this, some restaurants are raising the price in-app to claw back at least some of this margin while doing delivery. However, the value proposition, even at narrower margins, is undeniable. The scale at which customer acquisition is possible through these apps is immense, even without additional spending through advertising or promotion. DoorDash has an estimated 37 million monthly active users, with Uber Eats seeing over 80 million.

Apps have begun competing on restaurant payouts, offering a service-tier model. Often, these models exchange higher commissions for better placement on the app, more promotions, and access to customers with memberships who typically spend more. In an effort to appeal to established restaurants with existing delivery infrastructure, Uber (through the Direct offering), DoorDash, and Grubhub all offer both fee negotiation and white-label ordering infrastructure, allowing point-of-sale integration and platform listing while allowing restaurants to control the delivery experience.

Ghost kitchens and virtual kitchens have stemmed from the growth in delivery, which is taking the front-of-house out of restaurants. The idea is that a ghost kitchen can house two or three restaurants on a delivery app with significantly less overhead or be bolted onto an existing restaurant to enhance volume by offering a simplified menu of high-margin items.

Grocery Delivery: Profitability Through Scale and Ads

Uber has stated that grocery is the next frontier in the delivery segment, with positioning efforts focused on capturing existing customers. Currently, around 14% of customers in the current delivery segment have utilized grocery delivery, compared to DoorDash’s 20%. However, Uber’s 14% is up from just 8% in 2022. Converting these customers from other parts of the Uber ecosystem, as previously discussed, is significantly cheaper than acquiring new customers. Early data from Uber indicates that there is roughly a 5% conversion rate for new delivery customers to grocery customers, who, on average, spend 3x as much across all Uber offerings. Grocery currently represents around $7 billion in annual gross booking value, which has been growing at over 40% year over year.

According to Uber, grocery margins are still negative. In the near term, Uber will prioritize customer conversion and volume KPIs rather than making a profit. This appears to be the path that others, such as DoorDash and Instacart, are taking. In our view, Uber is likely positioning itself so that profitability will happen at scale with higher penetration with both customers and grocers. Equally, Uber could be hoping for another “last-man-standing” situation as it has in the mobility segment.

Competition in the grocery area outside of Instacart is between DoorDash and the novel GoPuff. DoorDash has significantly expanded its DashMart grocery offering, with its chief competitor, GoPuff, going public in the second half of 2024. These offerings are significantly differentiated from Uber’s. Both DashMart and GoPuff utilize a business model like that of Amazon: both normal and private-label brands are stocked in a leased warehouse, where orders are filled by employees who hand orders off to drivers to be delivered. Thus far, Uber has entered a partnership with GoPuff to list its services in parallel on the Uber Eats app and has added numerous convenience stores like BP and 7-11.

It is important to note that groceries are not passed through the topline with Uber Eats or Instacart, as they simply take a fee from the total order value, which existing grocery stores handle. Generally speaking, DoorDash is similar to most offerings, except for the DashMart offering. Both GoPuff and the DashMart offering own warehouses and maintain an inventory of groceries that are passed through the P&L.

Advertising could be the key to bringing the grocery part of the delivery segment to profitability. In our view, Uber will likely take the path of Instacart (CART) and leverage advertising impressions along with enterprise-level services to drive gross margin before scale can be reached. Uber Eats has 80 million monthly active users, with 150 million across all Uber segments, which is a massive market of engaged individuals, especially given the reported 1:8 conversion rate (every $1 spent in advertising, $8 in sales generated) for advertising dollars on Uber’s platform.

Typical grocery stores have razor-thin operating margins and charge a premium price for eye-level shelf space in practice called “slotting.” Instacart’s model has effectively done the same thing by promoting items to the top of user’s suggestions, ranking items in different ways, displaying ads, and promoting items to users. The advertising business on Instacart makes up just shy of 30% of all revenue. In our view, this is likely a large contributor to the 75% gross margin Instacart enjoys, as the advertising business has a very high gross margin. The value proposition is certainly attractive for brands, with advertised products gaining more than a 15% lift in sales, including non-barcoded items like vegetables sold by weight. On the grocer side, Instacart offers a turn-key end-to-end solution for white-label pickup and delivery options for grocers. This allows grocers an omnichannel entry point into grocery delivery or pickup and allows Instacart to capture new grocers for its platform.

Differentiators

Uber One

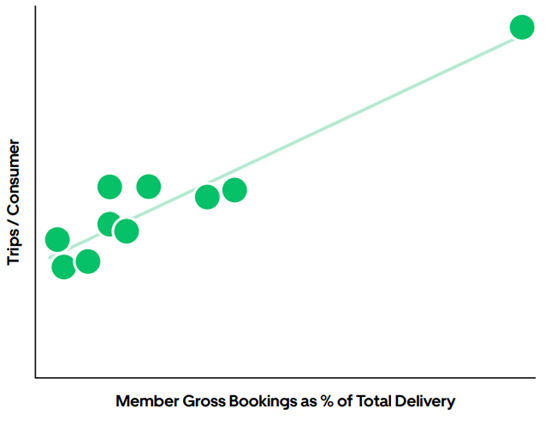

Uber One is a premium membership program in which consumers pay a fee that grants them benefits such as discounted trips, lower delivery fees, or priority service. As previously discussed, Uber feels that the best strategy on a go-forward basis is increasing the number of repeat customers to drive increases in gross booking value. Despite being less than three years old, Uber One drives 30% of gross booking value with its 19 million members across 25 countries. This penetration is more substantial in the Uber Eats area, with 45% of gross booking value coming from Uber One customers. In certain geographies, such as the United States, this penetration number is much higher and exceeds 50%. According to Uber, as membership coverage grows in a country, consumer engagement increases substantially. On a margin basis, Uber One members generate a narrower margin due to lower fees. However, the cost of acquisition of cross-platform customers is substantially reduced, and on average, Uber One members spend 3.4x more than non-members.

As previously discussed, though, retaining these premium customers can be challenging, with DoorDash reporting a nearly 75% attrition rate after just one year. Key strategies to enhance membership in delivery include upselling services where each transaction prompts non-members about the savings they could achieve with membership. On the mobility side, the Uber One membership has transitioned to a cash-back program rather than a flat discount, granting users 6% cash back, which they can use on other Uber services.

Partnerships with major brands like American Express and Disney attract new users and drive retention through additional limited-time perks like discounts or additional cash-back. Occasionally, Uber will offer “accelerators,” such as double cash back for a limited time on certain types of rides to drive cross-engagement with other products. In a similar format previously only reserved for drivers, Uber Quest presents members with a goal, and once they hit the goal, they are given an up-front discount or cash back. For example, complete 3 rides and get 75% off your next ride.

Uber Freight

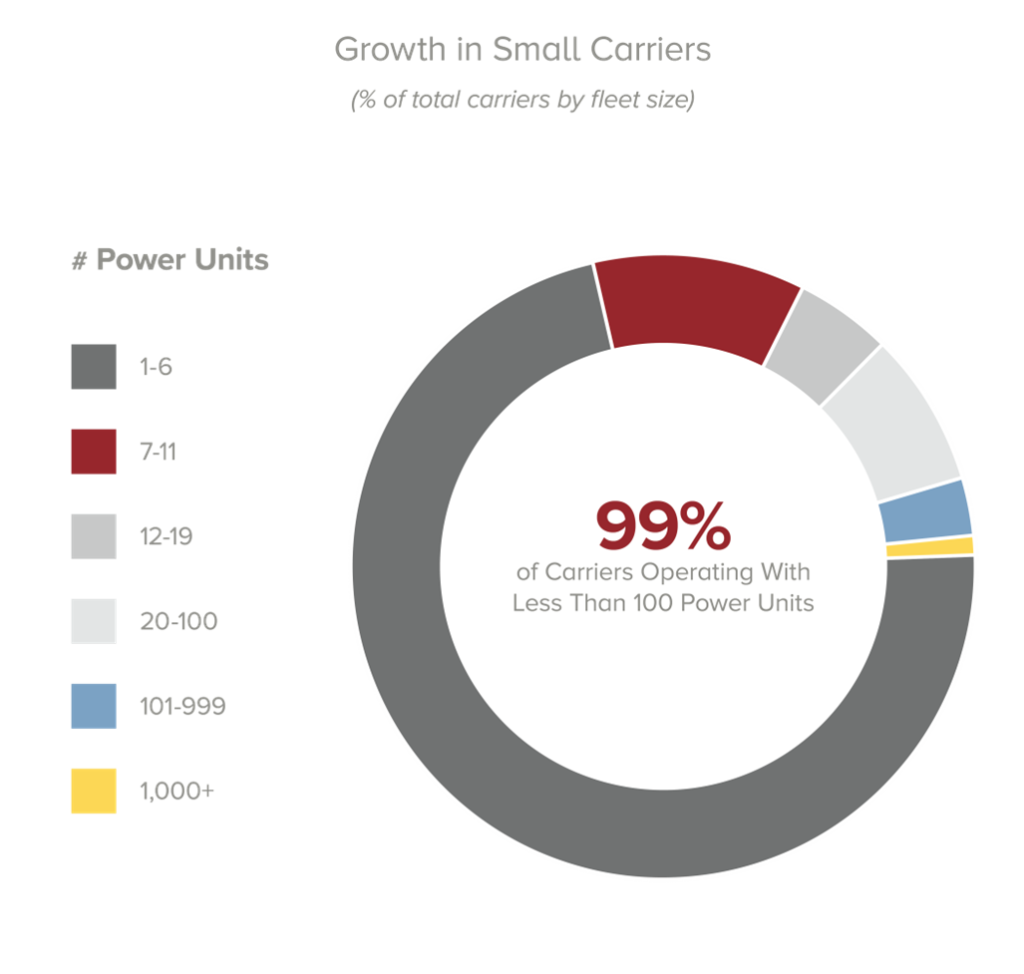

Uber Freight started its life as an autonomous business division in 2017, initially as an experiment for testing the economics of the industry. Today, the network comprises 1.7 million US truckers on its freight brokerage network and around $20 billion in US freight under management or around 2% of US market share. Freight brokers are valuable middlemen, acting as amalgamators to match shippers and carriers of all sizes. By 2026, freight broker penetration is expected to grow to 28%, a sizable increase from 22% in 2021. Internationally, Uber Freight has begun to offer both ocean and air freight and freight forwarding services. By 2028, Uber Freight hopes to achieve $2 billion in freight under management in Europe.

In the US 70% of goods are on a truck at some point, with the figure being 80% in Europe. The demand for freight brokers has substantial tailwinds as the trucking industry becomes more fragmented. More than 99% of registered carriers in the US have less than 100 trucks in their fleet, meaning they do not have the scale to establish significant customer relationships. In the EU, the figure is similar, with the top 5 transporters holding less than 8% of the market share. According to a Harris-Williams survey, shippers and carriers alike are seeking end-to-end solutions to provide more efficient real-time pricing, broader geographic exposure, and higher efficiency.

Uber has continued to invest in the service, most recently hiring a former freight broker executive from C.H. Robinson and a last-mile logistics expert with tenure at Chewy and Walmart. In addition, they are expanding “drop-and-hook” offerings through Powerloop, which adds significant value to smaller carriers. “Drop and hook” logistics allow a driver to drop off a loaded trailer at a designated location and immediately hook up to another pre-loaded trailer, reducing loading and unloading wait times and increasing efficiency. Traditionally, this is reserved for only the largest of carriers who can afford the massive upfront cost required and maintain relationships with consistent customers. Since its initial inception in 2018, Powerloop has served 220,000 loads across 10,000 carriers, seeing a 30% year-over-year increase in volume in 2023 alone. Powerloop also allows carriers to “bundle” consecutive drop and hook loads quickly through a single interface, a significant step over the competition, as this feature was again typically reserved for only the largest of carriers who have massive internal dispatch networks.

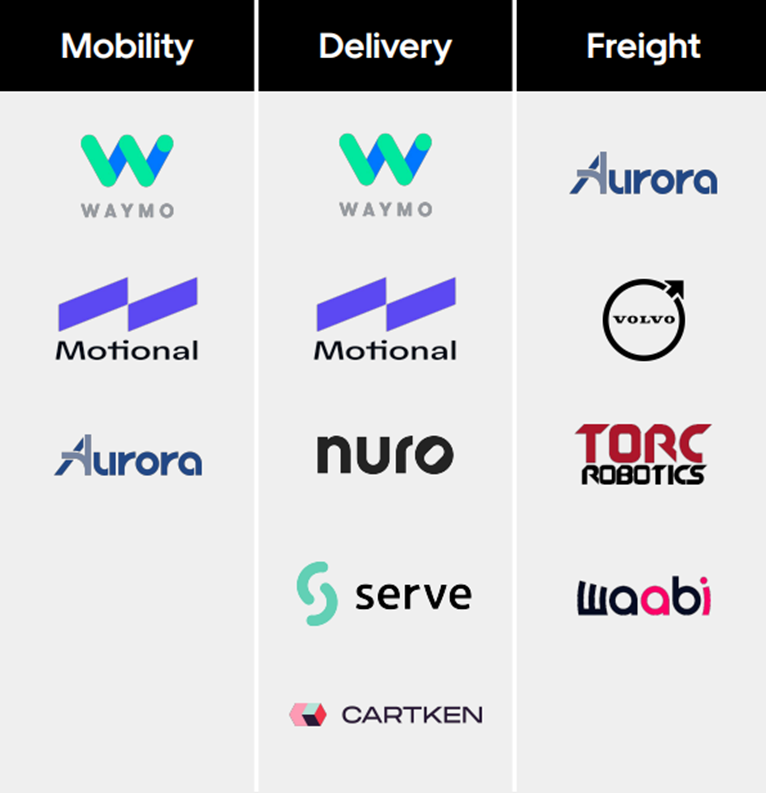

In our view, the freight segment doesn’t really fit into the core unit. However, Uber likely sees it as a logical entry point for AVs (autonomous vehicles) in the long term or for developing a more robust last-mile service. Many of Uber’s partnerships in the sector, such as Daimler’s AV arm Torc or BlackRock-Daimler-NextEra JV Greenlane’s EV program, appear to be more focused on leveraging data collected from Uber Freight to improve future offerings rather than expanding existing offerings to be that of a true freight brokerage competitor.

Advertising: Enriching Margins with Reach

Uber, Lyft, Instacart, and DoorDash all have one thing in common: a huge amount of consumer data comprising destinations, ordering history, and likely income deduced from services ordered. Combined, these firms represent more than 221 million monthly active users, a relatively captive base. Embedded advertising within products consumers already use offers a huge value proposition in converting ad spending into sales. Most promise an average of 1:4 conversion; every $1 in advertising leads to $4 in sales. Uber, however, claims an average of 1:8, which is an incredible value proposition even for small businesses that may not be able to spend at scale.

Uber’s advertising product is one of the most robust, becoming a significant growth driver for the bottom line, given advertising’s typically high margins. Uber’s ads business has grown to $650 million in revenue at the end of 2023, with a massive 80% year over year in volume of ads. For the quarter ending December 2023, this amounted to 315,000 businesses or about 25% penetration of existing businesses on Uber’s platform. By the end of 2024, Uber hopes to increase this revenue to $1 billion, which would boost the bottom line. As previously discussed, Uber likely sees the advertising business as a key driver of Grocery profitability, as Instacart has done.

On the mobility side, the advertising business could be a key to profitability for Lyft, which has grown its ad business by an estimated 400% year over year in the quarter ending September 2023. However, Lyft’s model is more traditional: displays in vehicles, on top of them, in the app, and other media ads similar to cabs. Uber has taken a more heterodox approach with offerings such as Uber Explore. Uber Explore is an attempt to be an all-in-one booking service that provides recommendations and booking options like those of an OTA. Utilizing personalized data, Uber will provide recommendations for a destination and equally provide options to book tickets or provide discounts to the ride to drive upsells. This feature has been piloted in a few major metros since 2022, though management has not indicated granular performance or when it would launch beyond its currently limited footprint.

B2B: Premium Upselling as a Service

Uber has begun tailoring offerings to corporate customers, who have made up an increasing, albeit small, portion of its volume. These offerings range from HIPPA-compliant drivers to business travel, and Uber Eats for the office.

Uber offers several key features for business, including automated travel expenses without having to submit a receipt. According to Skift, Uber rides are one of the most expensed items for businesses of all sizes. Additionally, businesses can set specific travel policies to further automate the expensing and compliance process, such as setting a price limit for Uber Eats meals, setting hours of expensing availability, and even utilizing AI to catch incorrectly expensed transactions and match receipts for enhanced record keeping.

Uber for business has higher margins out of the box, reporting almost 40% premium product penetration. Uber reported 70% of the Fortune 500 as customers, with around 200,000 organizations utilizing Uber for business globally. This represents just shy of 10% penetration of their total estimation of the addressable market. On a secular basis, it is unlikely that business travel will recover to its pre-pandemic levels in the short term, with the Global Business Travel Association stating that it does not expect equal levels of business travel to 2019 until later than 2026. However, additional growth for Uber could come from other sources, such as Airlines offering vouchers to stranded customers or even commuting incentives for back-to-office pushes occurring globally.

“The Sharing Economy”

Both Uber and Lyft have previously partnered with Hertz and Avis to allow customers and drivers to rent cars at discounted rates through their respective apps. Lyft has since shut down this initiative, but Uber continues to support Uber Fleets. On the car-sharing side, Uber Rent is still around; it is planning a shift toward car-share rather than a bolt-on car rental service. Initially piloted in Australia and now available in Boston and Toronto, the Car share program allows people to lend or borrow cars from one another for a few hours to a few days. Pricing is a flat fee plus mileage, with insurance and fuel included in the price.

This is not the first time that Uber has attempted a move into the car-sharing sector, with its San Fransisco pilot in 2018 being unceremoniously shuttered after only a few months. However, this project comes after the 2022 acquisition of startup Car Next Door which had several key investors, including Hyundai and petroleum company Ampol. While the car-sharing market is very small, only projected to reach $7.2 million by 2030, and currently dominated by Avis’s Zipcar, Uber may see itself as large enough to capture most of this addressable market and grow it with its existing reach.

Lyft has no peer offering and appears to be exiting the “sharing economy” altogether. In 2018, both Uber and Lyft sought to increase intermodal offerings outside of the automotive space, with Uber purchasing Jump Bikes for $200 million and piloting e-scooter offerings with Lime. Fearing being outpaced in yet another segment, Lyft purchased Motivate for $251 million in late 2018. By 2020, Uber divested Jump Bikes to Lime, and as of 2023, Lyft still struggles to bring Motivate to profitability. As previously discussed, the new CEO seeks to become a ride-share pure player and has stated that Motivate’s scooter and bike offerings do not do enough to drive people into the Lyft ecosystem. Lyft attributed just 7% of its revenue to bikes, scooters, and car rentals. While Lyft does not break out individual costs, it did attribute 62.8% of the $108.2 million increase in cost of revenue in 2023 to rental, bike, and scooter-related items. In 2023, these offerings reported just under 1.5% in topline growth.

Self-Driving

Uber previously had an extensive in-house development arm dedicated to AVs (autonomous vehicles). However, due to a spat with regulators, nearly $500 million per year in expenses, and an ever-extending timeline before the first production, the internal arm was divested in December 2020.

Since then, Uber has entered into 10 partnerships worldwide with AV manufacturers and designers. The largest of these partnerships is with Alphabet’s Waymo. Waymo has announced its intention to increase ridership by 10x by the summer of 2024. Waymo seeks to utilize Uber as a vector for customer growth and as a tester for alternative arrangements, including delivery with Uber Eats. Uber has a best-in-class platform for AV providers to test, with a relatively turn-key solution for customer acquisition and high fleet utilization.

It is easy to see why Uber and other ride-hailing companies would so heavily covet AVs. Drivers are the largest cost for ride-hailing and delivery services. In our view, Uber would be able to reduce its cost of goods sold by approximately 50% if a large portion of its fleet was replaced with AVs. If Uber were to pass on these savings to customers, it could rapidly increase gross booking value.

However, the timeline for AVs is still in limbo. Uber was unable to estimate when just 10% of the fleet would be replaced with AVs, with McKinsey estimating AV penetration of 4-20% by 2030. More importantly, there are still no domestic US standards for AVs, and only 5 states allow for fully autonomous driving without a safety driver. Internationally, the EU and China are both friendly to fully autonomous driving without a safety driver, though laws do depend heavily on locality.

Risks

Over time, governments have become more unfriendly to ride-hailing and delivery apps. Stricter regulations regarding gig economy workers and food delivery services can influence how Uber operates, particularly in terms of driver and courier rights, benefits, and working conditions.

These regulations typically take the form of wage floors at the minimum for “engaged time.” Normally, this involves drivers being guaranteed minimum wage for the time they spend driving or delivering for the app, which takes the form of an earnings adjustment if active drivers fall below that level on an hourly basis. Typically, these are not meaningful adjustments for the cost of revenues.

However, there has been an introduction of more extreme measures, such as in the Minneapolis metropolitan area, where new rules would guarantee a minimum floor of $1.40 per mile and $0.51 per minute, excluding tips. While initially pioneered as an alternative to earnings adjustments, an independent analysis by the Minnesota Department of Labor found that a far lower $0.89 per mile and $0.49 per minute would reach the state’s minimum wage of $15.57. Uber and Lyft announced intentions to leave based on the current plan but have said they would accept the Department of Labor numbers if the plan were revised. The city council, which initially passed the ordinance, has put a hold on it for at least two months, pending further review, which has delayed the initial July 1st leave date.

Some localities have gone so far as to classify Uber’s contractor model as an “employee-like relationship”, which would be unfavorable as a classification for Uber, as they would be required to withhold taxes, provide certain benefits, or other labor restrictions. These are ongoing in Brazil, Australia, and several US states. Tighter regulations typically lead to higher prices passed to the consumer, which could hurt the top line.

In other locations, Uber’s business model is not legal because carrying passengers for a fare is a taxi-licensed operation, such as in Japan or other places with strong Taxi unions. However, Uber has made headway, as Japan is undergoing a critical labor shortage in the transport economy. Uber Japan largely hails Taxis only, but some large localities like Tokyo and Kyoto now allow independent, not taxi-licensed drivers to carry passengers during peak hours.

On the delivery side, restaurant commission fees have been particularly contentious, leading to regulatory caps during the pandemic. There are ongoing debates about making these caps permanent as platforms grow in scale and influence restaurant’s operations. In Canada, the province of British Columbia instituted a hard 15% cap on commission, with some localities in the US, like San Fransisco and Chicago, implementing similar temporary measures during the pandemic. According to McKinsey, due to the unfavorable unit economics of delivery experienced by restaurants, a greater share of delivery volume is likely to go to ghost kitchens. In contrast, some traditional restaurants may consider not playing in the delivery space at all or going white-label.

Financials

For the first time, Uber broke into GAAP profitability for the full year 2023, ending the year with a net income margin of 5.1% and posting $1.8 billion in net income. Overall gross booking value grew at 23.5%, with revenue growing at 17.0% year over year. Uber is expected to grow EPS by 42.4% for the full year 2024, driven by its rapidly expanding bottom line and an “inaugural” share repurchase program.

We expect topline revenue growth to stay in the 15% range over the medium term due to increased customer growth, albeit with less emphasis than growing the bottom line. For the quarter ending March 2024, Uber expects gross booking value to remain flat. While busy seasons vary by locality, the first quarter of the year is generally the weakest for booking value. We expect gross bookings to slow from over 20% year-over-year growth to mid to high teens. In our view, the marginally lower expected gross booking growth is primarily due to shifting efforts toward converting customers into cross-platform and multi-frequency users rather than raw monthly active user growth. Additionally, as previously discussed, Uber could see sustained momentum from increasing travel costs for commuters and those without a personal vehicle. This could effectively offset a slowdown in gross booking value if prices stay elevated.

Bottom Line

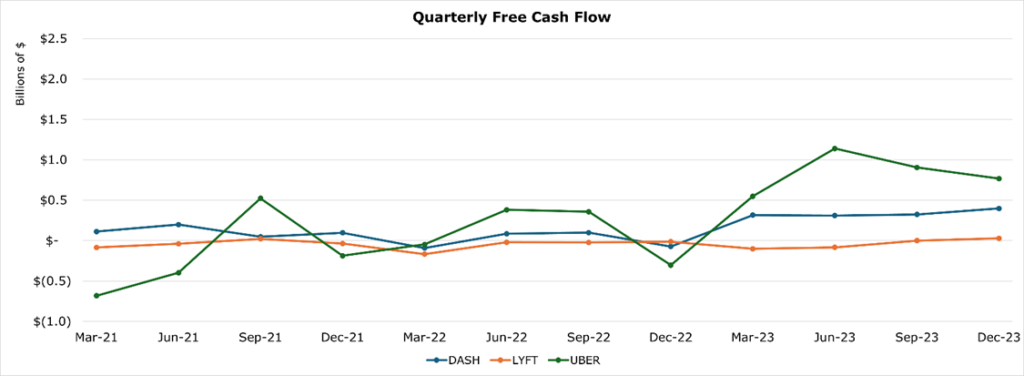

Compared to its peers, Uber has begun to consistently generate free cash. For the year-end 2023, total free cash flow was $3.3 billion, a 762% increase since 2022. Over the 3-year period 2021-2023, Uber averaged a 60% EBITDA to FCF conversion. Management expects this number to climb to 90% EBITDA conversion, primarily driven by expected EBITDA growth in the ~40% 3-year CAGR range. We feel this is a realistic assumption given the investments in cost reduction, conversion rates, improving delivery margins, and the consumer upcycle. Uber increased its EBITDA by 137% year over year to $4.0 billion at the end of 2023, led by a 173% increase in delivery EBITDA and a 50% increase in mobility EBITDA.

Freight

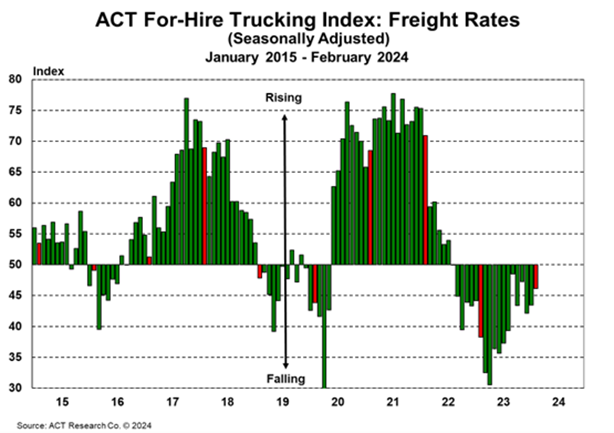

The current freight market, despite tailwinds from fragmentation, is still in a state of oversupply. Carriers significantly built out capacity during the COVID-19 supply chain crunch. As consumer demand has rolled over, the demand for shipping services has also declined, leaving spot prices far lower than typical levels. The freight market does tend to be cyclical, and it is likely that as excess capacity bleeds off and truck orders begin to decline, rates will see recovery. C.H. Robinson estimates a return to the long-term trend by 2025.

For the full year 2023, the freight segment saw a 25% decrease in revenue year over year, which is all attributable to the cyclical downturn in the trucking market. Despite this significant volume decrease, the freight segment only reported a $64 million loss on an EBITDA basis, compared to breaking even in 2022. In our view, the freight market has likely bottomed out and will enter the upcycle in 2024, which should bring the segment back to at least breakeven.

Balance Sheet

A drastic shift occurred internally during the COVID-19 pandemic, with Uber becoming cost-conscious of the balance sheet and a desire to run asset-light. At the time, Uber had substantial holdings in AVs and bike/scooter-sharing services, which increased capital expenditure requirements and decreased flexibility for cost-cutting during the pandemic-driven downturn. Since 2020, Uber’s fixed assets have stayed steady, largely in computer systems and buildings.

On the insurance side of the businesses, having a captive insurance company substantially increases the required insurance reserves. However, in the current market, this is favorable as insurance reserves can be invested. Short-term reserves are currently $1.2 billion, with a total of $6.7 billion, and the risk policy is fairly conservative, utilizing high-grade fixed income only. Uber reported $484 million in investment income for 2023.

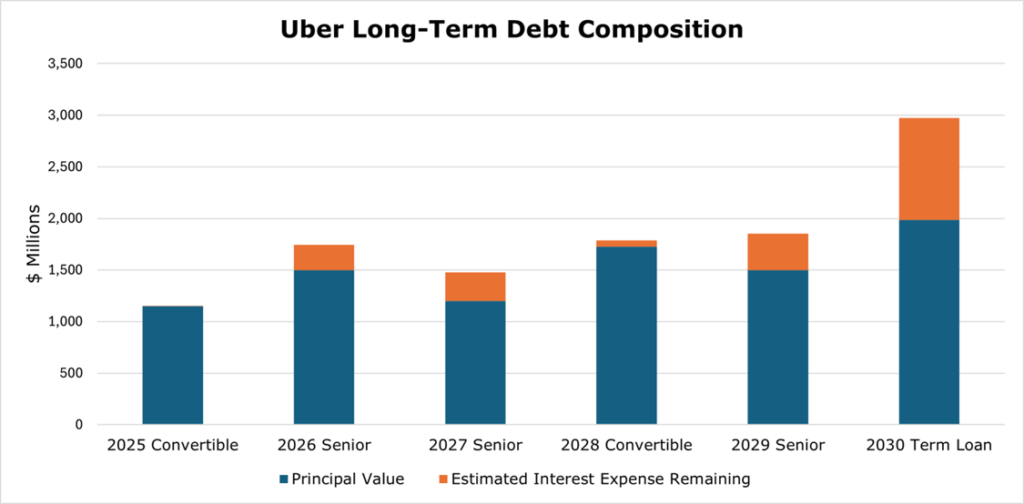

Most recently, Uber was upgraded from BB- to BB+, a full two jumps by S&P. At the same time, it upgraded its secured debt from BB to BBB-. The stated reason was a breakthrough in profitability and growth in free cash flow, allowing Uber to pay down more debt quickly. The upgrade allows Uber more flexibility in its financial operations. The company can more easily make strategic decisions involving large investments, expansions, or acquisitions without being overly constrained by high-cost debt. In addition, future interest expenses will likely be substantially lower for the same amount of debt held on the balance sheet.

The largest current exposure on Uber’s balance sheet is 2030 Term loans, recently refinanced at an effective interest rate of 8.3%. This likely makes up a substantial portion of Uber’s $633 million in annual interest payments. As of the end of December 2023, Uber’s debt-to-EBITDA sat at 2.1x, with S&P expecting it to trend down substantially in 2024 to 1.2x by the end of the year. In our view, Uber will likely take an aggressive repayment stance now that it has positive cash flow.

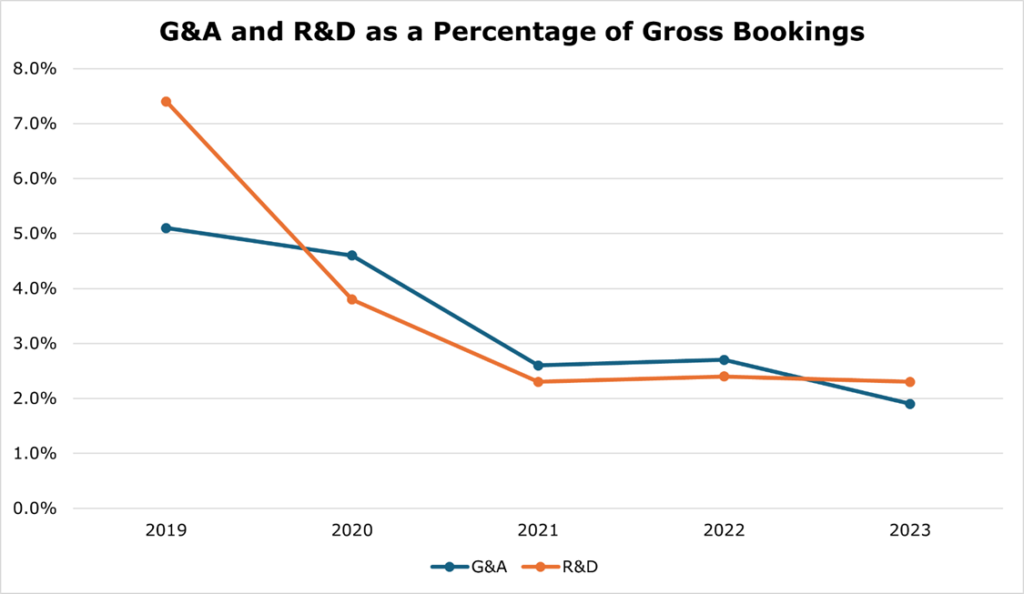

Core Spending

Uber’s core unit handles the administrative functions for all its business segments, contributing to significant cost efficiencies. By centralizing these roles, Uber saves about $5 billion in EBITDA annually. Since 2022, the company has begun a campaign of cost discipline to maintain financial sustainability and profitability. This strategy and cost discipline extends to technology spending, with an estimated 75% of development spending applied across all of Uber’s platforms. This includes investments in universal features or algorithms, which enhance the performance of various services like ridesharing, food delivery, and freight operations.

Other cost discipline measures include increased automation, utilizing least-cost routing for payments, and fraud prevention. Since 2021, Uber estimates these programs have saved 360bps in costs as a percentage of gross bookings. In our view, Uber has hit critical mass on the segment-agnostic spending side. It has the efficiency at scale to continue to experience some minor leverage on these items.

Uber’s cost efficiencies are clear compared to those of its peers. Lyft recently implemented a headcount cut of nearly 26%, and in 2022, DoorDash cut the workforce by 14.5%. Uber has thus far avoided large-scale layoffs of its competitors, stating that it sees no reason to do so and has generally grown its headcount at a modest 3% per year.

Generative AI is a hot product for many companies at the moment, and they are all eager to leverage customer insights into new products. Generative AI models are rapidly improving in speed and cost-effectiveness, though current customer-geared offerings tend to have higher latency than the current customer experience. For example, Uber Eats has developed a model to aid user discovery, such as the user being able to query “the most authentic Chinese food near me,” we view these virtual assistant features as less impactful financially compared to the broader productivity gains anticipated from generative AI. Management has stated it has been able to cut down on the number of customer service agents and improve the workflow of developers, which are expected to convert to bottom line growth in the 3-5 year horizon.

Repurchase Program

With the break into profitability, Uber has announced an “inaugural” share repurchase agreement of $7 billion, or about 4.6% of outstanding shares. Favorably, management signaled that repurchases would become consistent over time and, in our view, will likely target antidilution in the short term, growing into a more mature offering in the long term.

Conclusion

In summary, Uber’s unique position as the only multi-platform, multi-channel player at scale enables it to efficiently capture and convert a significant customer base while minimizing advertising expenditures. With 30% of new delivery customers and 22% of first-time mobility customers cross-utilizing its services, Uber not only has the conversion but the scale. Uber has a fast-improving balance sheet, with a solid likelihood of further credit upgrades, which could drastically change the dynamics of how it receives expansionary funding. Despite already impressive growth — a $137 billion business expanding at 20% annually — and substantial stock performance with a 103.21% increase year-over-year, Uber’s potential for sustained expansion in both top-line and bottom-line may still be underestimated by the market. Coupled with its recent inclusion in the S&P 500 and the Dow Jones Transportation Index, Uber presents a compelling opportunity. The strategic moves and financial milestones achieved indicate that Uber is not just riding the wave of current consumer services growth, but may have begun snowballing into an earnings explosion.