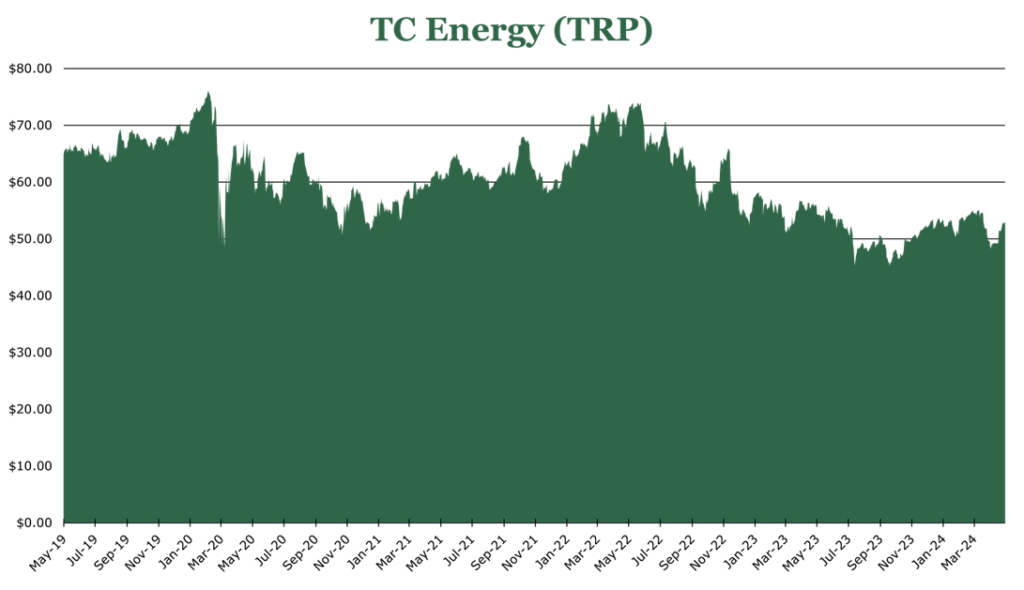

TC Energy: Running Leaner with Same Great 7% Yield

| Price $39.05 | Dividend Holding | May 17, 2024 |

- 7.19% dividend Yield.

- High returns on regulated assets, a favorable asset structure combines the stability of a utility with the opportunity of a midstream.

- Currently, 80% of its business is rate-regulated, 17% are long-term contracts, and only 3% are variable.

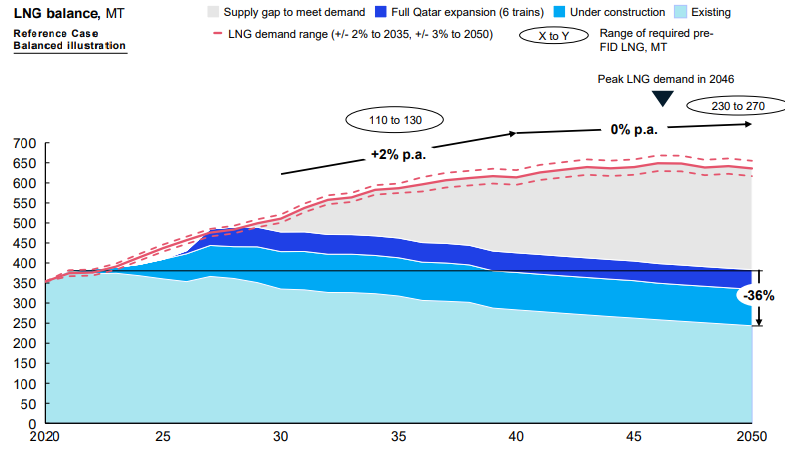

- Secular tailwinds for LNG demand globally, with Coastal GasLink expected to make its first export in 2025.

- Taking a lean operational footing, spinning off liquids segment, and divesting from assets to reduce debt burden.

Note: TC Energy is a Canadian Company, but all numbers we utilize are converted to USD.

Investment Thesis

TC Energy (TRP) is a midstream firm primarily operating in gas and petroleum liquids. TRP is a unique blend of utility and midstream firm, which puts it above its peers for risk-adjusted growth. As of the end of 2023, 80% of its business is rate-regulated, 17% is long-term contracts, and only 3% is variable and spot pricing.

The aggregate effect of this is the stability and limited commodity exposure of a utility without sacrificing favorable expansion opportunities awarded to midstream firms during periods of economic expansion or high commodity prices.

| Estimated 3-Year EBITDA CAGR | Natural Gas (% of total business) | EPS Payout Ratio | Rate-Regulated/Take-or-Pay | |

| TC Energy | 7% | 89% | 88% | 97% |

| Utility Peers | 6% | N/A | 68% | 91% |

| Midstream Peers | 4% | 71% | 95% | 58% |

TRP is beginning a campaign for efficiency measures that are aimed at reducing debt and running lean. This includes significant investments in LNG projects like the Coastal GasLink pipeline and the spin-off of its liquids segment. We believe that the renewed commitment to running lean coupled with the 7.19% dividend yield makes TRP an attractive income buy.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $5.60 X 10.0 = $56.00

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 3.4 | 3.2 | 3.0 |

| Price-to-Earnings | 8.2 | 10.0 | 9.6 |

Market Conditions

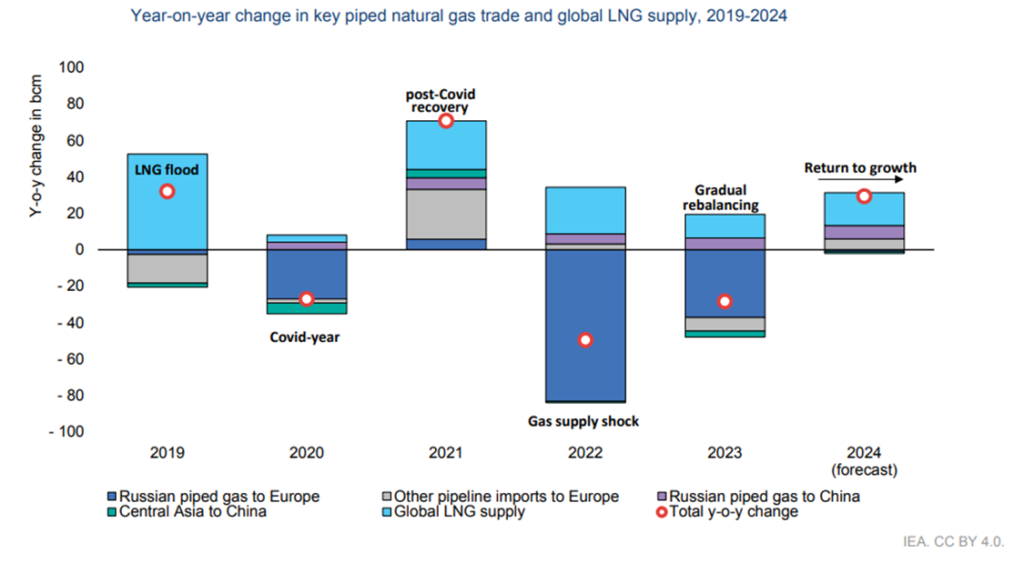

LNG demand is expected to grow substantially by 2040, with much of this growth expected to come from developing nations switching from coal to gas. According to the IEA, the global buildout of LNG capacity by 2030 will only account for 10% of Asia’s current coal consumption. Despite the projected supply glut during the 2026-2030 era, this may assist in inducing demand, as lower prices have accounted for an estimated 12% increase in Chinese demand during 2024.

In Europe, the war in Ukraine has heavily impacted the trade balance of gas imports, with the EU reducing Russian imports by 71%. Currently, the EU still imports Russian gas to cover about 15% of its demand, relying on Norway for dry gas and the US for LNG imports.

Global demand is expected to return to growth during 2024, at 2.5% year over year, with supply growing at 3.5%. Over the longer term, McKinsey expects demand to outpace supply, with the EIA expecting a price of around $3.00/MMbtu by 2025.

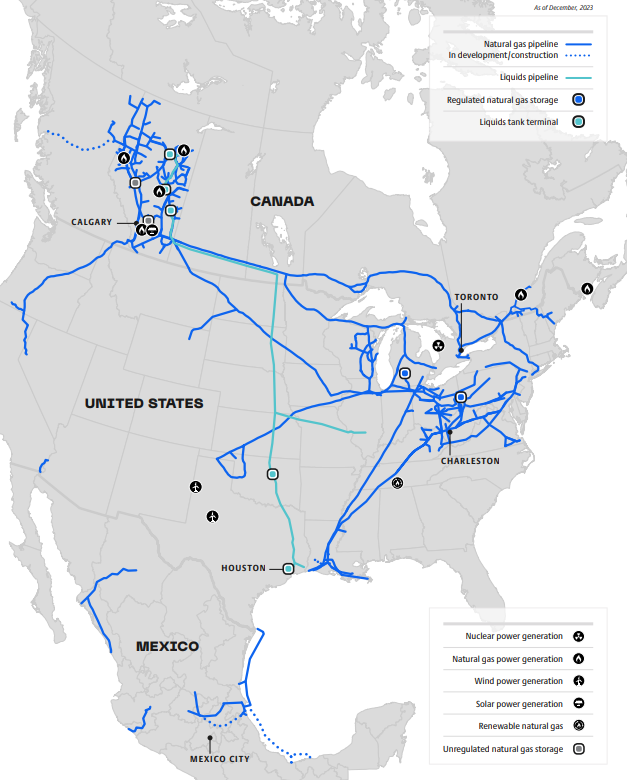

Canadian Pipelines

The Canadian pipeline business represents 39% of revenue (less the liquids segment). Generally, Canadian pipelines are regulated to charge fixed tolls, with total charge limited to give a maximum ROE of 10.1%. However, the CER (Canada Energy Regulator) calculation of equity is net of debt. As of 2023, TRP had a deemed equity ratio of 40%, allowing it to take substantially higher ROE than the regulated level.

| Pipeline | Nameplate Capacity | Length | Pricing | Return on Equity | Contract Expiry |

| Canadian Mainline | 4.6 Bcf/d | 8,750 mi | Fixed tolls, max 10.1% ROE | 15.0% | 2026 |

| NGTL System | 17.3 Bcf/d | 15,153 mi | 10.2% | 2024 |

The largest component of TRP’s Canadian network is the NGTL system, 15,153 miles of gathering and transmission lines in the WCSB (Western Canadian Sedimentary Basin). As of the quarter ending March 2024, NGTL deliveries were up by 5% to 15.3 Bcf/d, reaching a record-breaking peak of 17.3 Bcf/d in January. NGTL usage is highest in the first and last quarters of the year, which is in line with the heavy winter demand for natural gas. Expansionary efforts in the NGTL system are ongoing, with the current expansion expected to be fully in service in 2026, costing $600 million and adding 638 MMcf/d in capacity. 15-year contract extensions underpin the expansion.

The Canadian Mainline is an 8,750-mile intercontinental pipeline that runs from the exit of the NGTL system across Canada to several crossing points into the US. It ends at a planned LNG export terminal in Quebec. The Mainline represents one of Canada’s primary export lines for Natural gas into the US, with a nameplate capacity of 4.6 Bcf/d. According to the CER, the average annual throughput for all of 2023 was up 2.7% to 3.8 Bcf/d, representing an average utilization of 82%, peaking at 92% during the winter months. Combined, Canadian holdings account for roughly $560 million in recoverable maintenance capital expenditure per year.

The most substantial greenfield expansion is Coastal GasLink, a 416-mile gas line linking Montney gas fields to Canada’s newest LNG terminal in Kitimat, BC. GasLink was mechanically completed in November 2023 and is currently awaiting the commissioning of the Kitimat terminal, which is expected in early to mid-2025. TRP owns 35% of this line, which has a nameplate capacity of 2.1 Bcf/d. Over the long term, Phase 2 of Gaslink would bring nameplate capacity up to 5 Bcf/d in around 2027.

TRP expects EBITDA to grow by a CAGR of 4% by 2026. We feel that this number is likely conservative. However, growth beyond this number strongly depends on the regulator’s opinion on rate increases and third-party projects, such as the LNG terminal in Quebec.

US Pipelines

The US segment makes up 47% of revenues (less the liquids segment) and has a geographically diverse footprint spanning from the Marcellus-Utica shale regions to the Pacific Northwest. Of the total US pipelines, 90% are long-term take-or-pay contracts, with a fixed base rate and penalty rates for low usage.

| Pipeline | Nameplate Capacity | Length | % Ownership | % Of US EBITDA |

| Columbia Gas | 7.4 Bcf/d – 285 Bcf Storage | 11,899 mi | 60% | 47.1% |

| Columbia Gulf | 2.3 Bcf/d | 3,340 mi | 60% | 6.4% |

| ANR | 10.0 Bcf/d – 247 Bcf Storage | 1,800 mi | 100% | 20.0% |

| GTN | 2.9 Bcf/d | 1,377 mi | 100% | 6.2% |

| Great Lakes | 2.4 Bcf/d | 2,115 mi | 100% | 5.6% |

| Portland | 0.2 Bcf/d | 295 mi | 61.7% | 3.2% |

The most substantial US asset is the Columbia pipeline network. Columbia gas contains 284 Bcf of attributable natural gas storage, with 11,899 miles of gathering lines across 30 locations in the Utica and Marcellus shale basins. Columbia Gulf operates as a branch of this gathering network, transporting gas to the US Gulf Coast. The two Columbia lines are operated by TRP and are owned at 60% equity. In the quarter ending December 2023, TRP entered into a transaction to sell 40% non-controlling equity in Columbia for $3.9 billion. The stated reason behind the sale was to free up capital to reach the debt-to-EBITDA target. In a similar layout, ANR is a vertically integrated gathering, storage, and transportation pipeline for various Midwest basins to the US Gulf Coast. In total, the existing US footprint contains $1-1.3 billion in annual maintenance programs, which TRP states are recoverable through the existing rate schedule.

Expansion in the US is underway with several smaller-scale upgrade projects, amounting to $2.4 billion in new assets estimated to be put in service through 2026. These assets will include an additional 2.4 Bcf/d in capacity, along with several reliability and compression improvements.

Across all holdings, the quarter ending March 2024 was an all-time delivery volume record, breaking an average of 30 Bcf/d. EBITDA over the same period increased 3.1% year over year, largely due to seasonal pricing. Over the long term, TRP expects the US pipeline business to grow at an EBITDA CAGR of 5%. While TRP itself does not have commodity exposure, we expect the growth rate to be muted as unfavorable natural gas prices for pure players mean less expansion and, thus, less transportation and storage demand. As previously discussed, the EIA does not expect price increases in natural gas until 2025, largely due to supply outpacing demand and excess storage.

Mexico

The Mexican natural gas business represents 6.4% of the business (less liquids) and has the strongest expected EBITDA growth of all segments. Existing operations are focused on the Sur de Texas pipeline, which provides 17% of Mexico’s yearly imports, and the TGNH gathering system.

| Pipeline | Nameplate Capacity | Length | % Ownership | % Of Mexican EBITDA |

| TGNH | ~3.4 Bcf/d | ~677 mi | 100%* | 38.9% |

| Topolobampo | 0.7 Bcf/d | 355 mi | 100% | 26.3% |

| Sur de Texas | 2.6 Bcf/d | 478 mi | 60% | 12.6% |

| Guadalajara | 0.9 Bcf/d | 194 mi | 100% | 10.2% |

| Mazatlán | 0.2 Bcf/d | 267 mi | 100% | 11.9% |

Expansion in Mexico is focused on the Southeast Gateway, which is now 70% mechanically complete. Southeast Gateway is an agreement between state-utility CFE and TRP for approximately 450 miles of additional transportation infrastructure under a single take-or-pay contract, denominated in USD, to 2055. The project is on schedule for a mid-2025 opening and on budget for $4.5 billion in total costs, with a nameplate capacity of 1.3 Bcf/d. Favorably, TRP holds a $4 billion non-recourse debt financing for the pipeline, which significantly limits downside exposure. The financing agreement also steps up CFE’s equity stake in the broader TGNH project, including Southeast Gateway, from 15% in 2025 to 35% by 2055. TRP estimates that on opening, this take-or-pay agreement will add $800 million in EBITDA annually. On opening of Southeast Gateway, TRP’s Mexico segment would increase its revenue as a percentage of the total business to around 11%.

In the quarter ending March 2024, the Mexican segment saw EBITDA increase 25.4% year over year. Much of this increase was due to the new in-service section of the Villa de Reyes in the TGNH system. In our view, the market conditions in Mexico are favorable for further bottom-line growth for TRP. Mexican natural gas demand is expected to rise by 113% to 17 Bcf/d by 2050. Natural gas as a share of the energy supply was 38.9% in 2022, with state-owned utility CFE projected to add another 12 gas-fired plants by 2030. Currently, Mexico imports 69% of its natural gas demand from the United States, with Mexican state oil company Pemex struggling to boost production, leaving importing as the only option.

Bruce Power and Other

| Ownership | % Of Other EBITDA | |

| Bruce Power | 48.3% | 56.6% |

| Other Canadian | 100% | 25.3% |

| Other | 100% | 18.1% |

The Bruce Power and Other segment primarily includes the Bruce Nuclear Power Station in Ontario, in which TRP owns a 48.3% stake. The segment also includes several smaller energy solutions, such as unregulated natural gas storage or other small power plants. Collectively, these make up 7.7% of TRP’s total revenue (less the liquids segment).

Through 2028, TRP has several face-lift projects for Bruce Nuclear Power Station, which are expected to be around $1 billion in capex in 2024. However, Pumped Hydro Storage projects in Ontario and Alberta may increase incremental EBITDA. Pumped storage uses cheap off-peak power to move water to higher-elevation reservoirs to release it back into the grid during peak hours. TRP has plans for a 1GW plant in Ontario, which has come under regulatory scrutiny recently and has had its final approval delayed. In Alberta, a much smaller 75 MW plant is currently under construction. If both of these projects come online successfully, TRP estimates EBITDA will improve by nearly $500 million by 2030.

During the quarter ending March 2024, EBITDA increased 12% year over year. This was largely due to contract price increases at Bruce and more favorable pricing for WCSB natural gas storage. At its current trajectory, we expect this segment to remain flat, aside from government-approved rate increases at the Bruce Power Station. TRP has made efforts to expand the segment’s diversity, acquiring several wind and solar generation assets during 2023.

Liquids Spin-off – South Bow

South Bow Corporation will encompass the TRP petroleum liquids business, which includes midstream and storage assets. As of 2023, the liquids business represents 16.7% of TRP’s revenue. If accepted, the spin-off vote will be held in mid-2024 and completed by early 2025. According to TRP, it does not expect any dis-synergies with either company, as they have been run de facto independently for some time now.

| Pipeline | Nameplate Capacity | Length | % Ownership | % Of Liquids EBITDA |

| Keystone-MarketLink | 830 Mbbl/d | 2,151 mi | 100% | 391 |

The crude midstream business will contain the Keystone pipeline, Marketlink pipeline, and several WCSB liquid terminals. Keystone and Marketlink are the shortest and most direct routes to both Cushing (PADD2 region) and Houston terminals (PADD3 region), making it one of the most competitively priced corridors in North America. These pipelines connect crude and petroleum liquids from the WCSB to 14 MMbbl/d of refinery capacity across the PADD2 and 3 regions.

S&P estimates that PADD3 exports are expected to increase by 43% by 2030, which we feel will likely be the peak of domestic US refinery demand. However, even as oil demand tapers off on a secular basis going into 2050, PADD2 and 3 refineries will likely begin to grow their market share from 79% to 91% as supply from WCSB is projected to remain at or above 4 MMbbl/d well into the 2050s.

Among peers, South Bow will maintain TRP’s contract positions. South Bow will derive 88% of cash flows from contracts, with a weighted average term of 8 years. This is far above the peer average of 54% contracted cash flow at a weighted average length of 6.5 years. In our view, the longer-term growth prospects of the spin-off are less than TRP’s, and the ill-fated Keystone XL likely soured any plans for substantial liquids expansion. However, the liquids midstream business has minimal commodity exposure, which could prove to be beneficial if global oil demand declines faster than expected.

According to TRP, it expects the South Bow spin-off entity will grow EBITDA at around 3% CAGR to 2026. We feel this number is fair, given the expected production peak of WCSB around the same time. Financially, South Bow will start at 5.0x debt to EBITDA, which will taper down to 4.5-4.75x by 2027. The deal will grant TRP shareholders 1 new TRP share and 0.2 South Bow shares. At this time, TRP has stated that the separate entities combined will pay out the same dividend, with 86% coming from TRP and 14% coming from South Bow.

Risk

TRP operates with high leverage, which is advantageous in certain regulatory environments like Canada. However, TRP was downgraded to BBB+ during the quarter ending March 2023. This is what spurred the extensive deleveraging plan that TRP is embarking on. In recent weeks, peers have been downgraded further on weak pricing momentum through a mild winter. While TRP has yet to be downgraded again, and the latest outlook is stable, a downgrade could force TRP to sacrifice expansion or shareholder return for deleveraging.

While the midstream business does not have direct commodity exposure, periods of low commodity prices can put downward pressure on utilization. This can equally limit the expansion of gas pure players, which limits the demand for midstream services.

Financial Outlook

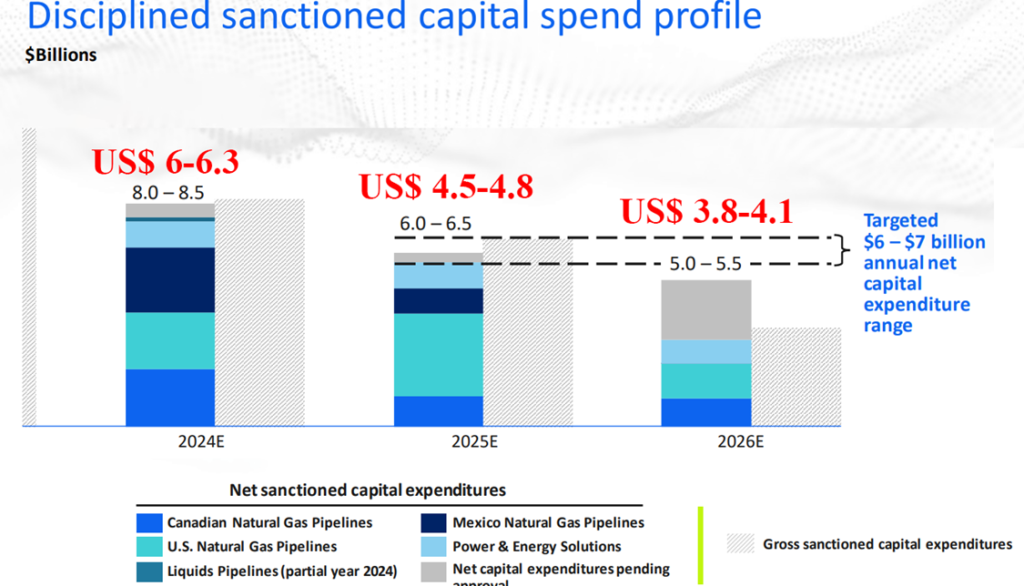

TRP is maintaining an expected capital spending budget of $6-6.3 billion for 2024. Over the longer term, TRP intends to substantially reduce the Capex budget, setting aside an estimated $3 billion annually for modernizing and improving systems, with the remaining ~$1 billion available for expansion or repurchasing shares. TRP has stated that it is determined to remain on the lower end of its capex guidance well into the future, so we feel that it is likely taking a more mature footing regarding its assets.

The overall leverage goal is to achieve 4.75x debt-to-EBITDA by the end of 2024, up from 5.3x currently. To accomplish this, TRP will conduct a further $2.25 billion in smaller divestitures during 2024, including CFE’s purchase of 15% of the Mexican TGNH line. At present, despite the high leverage, the weighted average term on debt is 17 years at fixed interest rates, just above 5%. Thus, we feel that deleveraging beyond 4.75x is unnecessary, especially if TRP takes a more mature footing.

TRP has maintained its annual dividend growth rate of 3-5%, which is in line with the expected 3-year EBITDA CAGR of 7% and EPS growth of 3-5%, excluding the liquids segment, which we feel is reasonable. The current dividend yield is a very favorable 7.19%, paying out $2.8/share per year.

Conclusion

TC Energy’s (TRP) commitment to introducing a leaner operating model, coupled with its substantial dividend yield of 7.19%, makes it a compelling income play. In addition, despite a slowdown in expected capital expenditures, TRP is well-positioned to deliver modest growth from increasing global LNG demand and several projects nearing completion.

Competitive Comparisons

| TC Energy (TRP) | Kinder Morgan (KMI) | Williams Companies (WMB) | Enbridge (ENB) | |

| Price-to-Earnings | 12.71 | 16.16 | 22.21 | 17.34 |

| Price-to-Book (TTM) | 1.98 | 1.43 | 3.97 | 1.85 |

| EV-to-EBITDA (FWD) | 11.19 | 9.47 | 11.13 | 11.31 |

| Net Income Margin | 17.31% | 16.08% | 28.40% | 13.81% |

| Dividend Yield | 7.19% | 5.87% | 4.64% | 7.26% |