SWK Retools Production to Move Out of China

| Price $71.46 | Dividend Holding | May 20, 2025 |

- 4.64% Dividend Yield

- Management has initiated a 24-month plan to eliminate Chinese manufacturing dependency, increase USMCA compliance for Mexican operations, and implement targeted price increases.

- Strong brand recognition with DeWalt, Craftsman, Stanley, with a renewed focus on the professional sector.

- Expects over $500 million in free cash during 2025 despite tariffs.

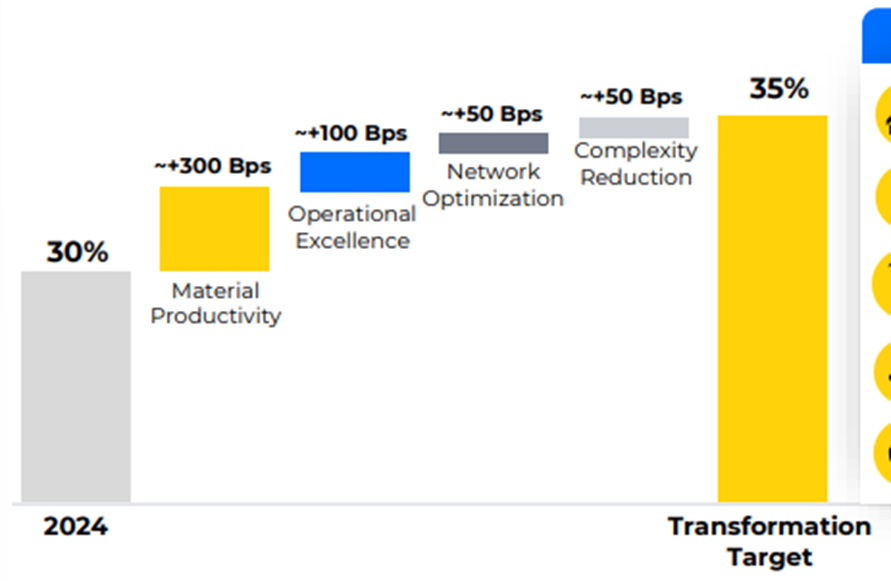

- Aggressive transformation, with a long-term target of 35% gross margin (currently 30.2%) and 16% EBITDA margin (currently 9.8%).

Investment Thesis

Stanley Black and Decker (SWK) is the largest hand-tool providers in the world, with brands such as DeWalt, Craftsman, Stanley, and Black and Decker.

On a year-to-date basis SWK has been hammered losing 10.84%, largely due to 50% of its supply chain being exposed to tariffs including 14.5% from China. Management has announced its mitigation plan, with a 24 month shift out of China and ensuring compliance with USMCA in Mexico. Overall, management expects a net effect of $0.75 per share headwind to earnings. Despite these headwinds, the long-term plan for transformation is still in place, with SWK executing $500 million in SG&A cuts and several low-margin product line disposals.

SWK still has strong fundamentals, expecting over $500 million in free cash flow generated during 2025. Thus, we believe the 4.64% dividend is safe at the present moment and allows dividend investors an attractive income while awaiting the continued transformation of the largest tool company in the world.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY27 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E27 EPS X P/E = $6.85 X 13.3x = $91.00

A P/E of 13.3x would bring SWK on improving profitability is conservative. While the 3-year moving average PE is 20.2x, this is on trough profitability.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.7 | 0.7 | 0.7 |

| Price-to-Earnings | 16.6 | 12.3 | 10.2 |

SeekingAlpha Analyst Consensus

Market Conditions

As we discussed in our Whirlpool article, due to a mixture of tariff fears, high finance rates, and a growing inventory of unsold homes homebuilder confidence has been at its lowest level since August 2012. However, despite some DIY softness management indicated that there was consistent professional demand and inventory levels are consistent with historical levels. While this may hit the income statement as a decrease in volumes, management has stated that favorable currency and SG&A savings should keep margins stable excluding the impact of tariffs.

SWK’s management maintains that it has a “industry-leading” footprint, with 43.5% of cost of sales being components originated from the United States, and 6.2% “USMCA Complaint” from Mexico. However, this does leave 14.5% from China, 12.4% from non-compliant facilities Mexico, and 23.4% from the rest of the world – or a total of 50.3% of cost of sales exposed to tariffs.

| Source | Amount ($ millions) | Tariff Assumption |

| United States | $3,000 | 0% |

| Mexico (USMCA Covered) | $429 | 0% |

| Mexico | $858 | 25% |

| Rest of World | $1,600 | 10% |

| China | $1,000 | 145%* |

Not mentioned are the 25% flat rate on Aluminum and Steel. *As of May 13th, this has been suspended for 90 days and returned to 30%.

Management’s mitigation strategy is going to be implemented over the next 12-24 months. Over the short-term, there were high single digit increases to pricing effective in April, with management evaluating if a second round is needed during the quarter ending September 2025. On the supply side, the first priority is increasing the amount of Mexican supply that is USMCA compliant. Management indicated that becoming USMCA complaint for the rest of the Mexican supply chain is not “operationally complex”, and we believe that SWK should be able to accomplish this by the end of the quarter ending April 2026.

Over the medium-term, there are several products that are dual source in nature and can have supply lines moved from China to Mexico over the next 12 months. Over the long-term, management is targeting a full elimination of China from the supply chain by the 24-month mark (April 2027).

The rest of the world will remain untouched for now, with SWK saying the cost increases can largely be absorbed by price increases passed to consumers.

Tools & Outdoor

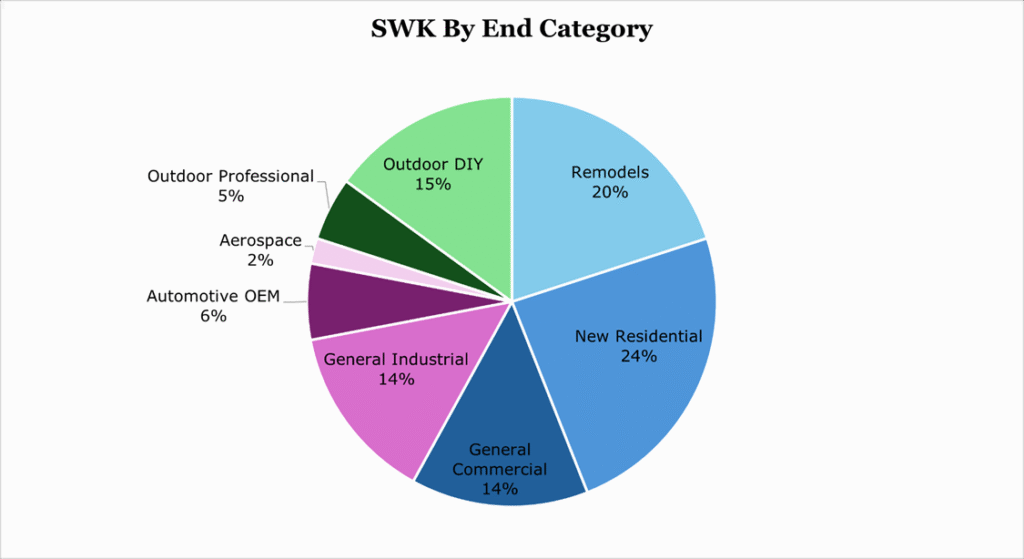

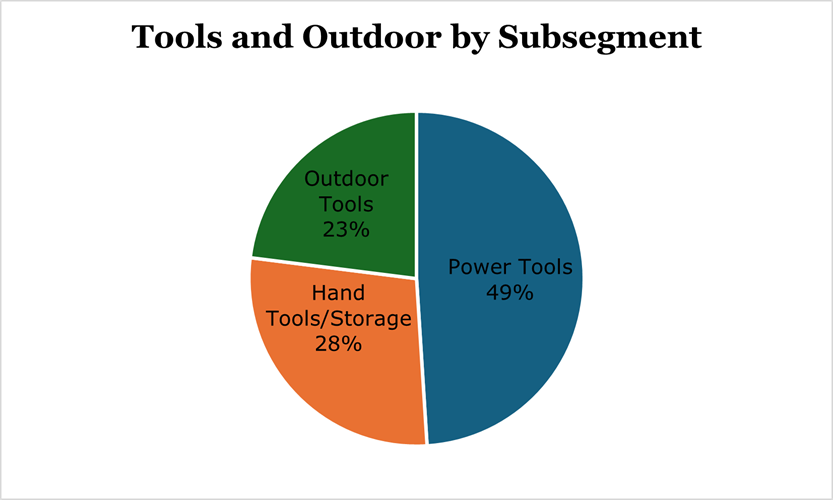

Tools and Outdoor represents 86.6% of revenues and includes all of SWK’s brands and hand tools. Most sales are linked to residential or commercial construction activity, with 63% of revenues coming from the US.

For the quarter ending March 2025 revenues were flat overall, with operating margin expanding by 110bps to 9.6%. The increase in margin came from continued savings in the supply chain and new product launches but were weighed down by early tariff impacts and cost of freight increases.

Across the total segment, 5 brands make up 80% of revenues, including DeWalt, Craftsman, Stanley, Black and Decker, and Cub Cadet. The top two tool and outdoor companies, SWK and an unnamed competitor, represent less than 25% of the total market, giving ample opportunity to take market share at scale. The long-term target is to have mid-single digit revenue growth primarily through a more aggressive target marketing toward professionals

As previously discussed, much of the segment is heavily linked to construction activity. Uncertainty surrounding tariffs, high interest rates, and low demand has created an oversupply of housing at current prices. While we believe this is cyclical, the up part of the cycle is difficult to determine given remodeling and DIY activity still appears robust with the segment reported 2% organic growth in the United States. Overall, we believe that given the strong brand recognition and historical resilience the fundamentals of the business remain strong.

Fastening

The Engineered Fastening (formerly called industrial) segment represents 13.4% of revenues and produces fasteners, rivets, and specialized tools. A plurality of revenue is generated in the automotive industry, with 52% coming from the US.

During the quarter ending March 2025, total revenues fell 21%, though largely this was due to the divestiture of the infrastructure business. Organic revenue fell 1% year over year, due to volume loss from softness in the automotive sector. Excluding the impact of the divestiture, segment operating margins compressed by 200bps to 10.1% largely due to the loss of high-margin volumes from the automotive sector.

| Sub Segment | % of Segment Revenue | Estimated Market share |

| Automotive | 49% | 10% |

| Aerospace | 17% | 7.5% |

| Industrial | 34% | 6.3% |

Figures provided by SWK, Year ending December 2024.

Over the short term we do expect some softness in the fastening segment, given the likely slowdown in automotive manufacturing and the 25% steel and aluminum tariffs causing broad pricing increase across the entire supply chain. Current tariffs on autos are at 25% for non-USMCA complaint, however we believe that more tariffs are likely in the pipeline for autos, especially for trucks from Canada and cars from Mexico. It is presently unclear the implementation timeline of additional tariffs, though we believe the most likely scenario is after the USMCA renewal talks in July 2026.

With that said, the long-term fundamentals of the segment are strong. The aerospace area has experienced mid-teens organic growth, with management emphasizing that despite some softness in automotive OEMs related to softening capex, the segment maintains a multi-year backlog.

Risk

While SWK has already implemented price increases, it will likely evaluate for further price increases during the quarter ending September 2025. We are unsure how much of the increased costs SWK will be able to pass on given DIY consumers will cut back on purchases due to broad inflation increases, and commercial customers will cut back as their entire supply chain comes under pressure.

Despite preliminary agreements reached with China and much of Mexican manufacturing trade falling under current USMCA tariff exemptions, we expect tariffs to continue to be a factor over the medium term. Management maintains it will be able to roll-off tariff from operations by 2027 with repositioning efforts.

Financials and Outlook

Including the impact of tariffs, organic sales growth is expected to be in the low to mid-single digits. This will be driven by a mid-single digit pricing increase, which will likely lead to low single digit volume declines. On a per segment basis, SWK expects less volume impacts in fasteners with the segment still growing in the low to mid-single digit area. Tools and outdoor is expected to lose volume due to mid-single digit price expansion, with the net effect being low single digit expansion.

As of the end of April 2025, SWK assumes headwinds of $0.75 per share to earnings due to the tariffs, representing an increase of costs of approximately $1.7 billion. Management emphasized that it does not expect this full cost to hit the company’s bottom line during 2025 due to SG&A cuts and price increases. Overall, we expect around $1-1.1 billion in tariff impacts to hit the bottom line in 2025, which is in line with management’s estimates.

The worst of the impacts will be in the quarter ending June 2024 due to LIFO (last in first out) accounting. Historically, most cash flows are weighted in the back third of the year, so there is still some time for tariff policy to shake out more firmly. Additionally, the back third weighting allows SWK to interface with customers and retailers to determine specifically how elastic their demand is as mentioned in the risk section.

Overall management believes they can have most of the tariff impact mitigated by 2027. Long-term targets are still unchanged at 35% gross margin and 16-19% EBITDA margin. Primarily, this will be accomplished through SG&A cuts, removing low-margin and low-volume tools, and scale benefits in manufacturing. Over the short term we expect there to be some reversal in progress, though accelerating the pace of ceasing low-margin low-volume products and the previously discussed USCMA compliance actions margins may not compress as far as feared.

Additionally, cost savings programs are underway to shave almost $500 million in SG&A expenses during 2025. To 2027, management is targeting 21.5% of revenue going toward SG&A expenses, currently at 22.5%.

| Qtr Ending March 2025 | 2024 | 2023 | 2022 | |

| Gross Margin | 30.2% | 29.7% | 26.0% | 25.9% |

| EBITDA Margin | 9.8% | 10.1% | 7.6% | 8.7% |

During the year ending December 2024, SWK generated $753 million in free cash. For the full year 2025, management is guiding toward ‘at least’ $500 million in free cash flow, though specifics of how tariffs and consumer sensitivity will impact free cash flow remains to be seen.

As of the quarter ending March 2025, SWK has $344.8 million in cash on hand. Currently, the dividend yield is $3.28 annually or 4.64%. This represents a payout ratio of approximately 72%, which we believe is safe even factoring in tariff impacts.

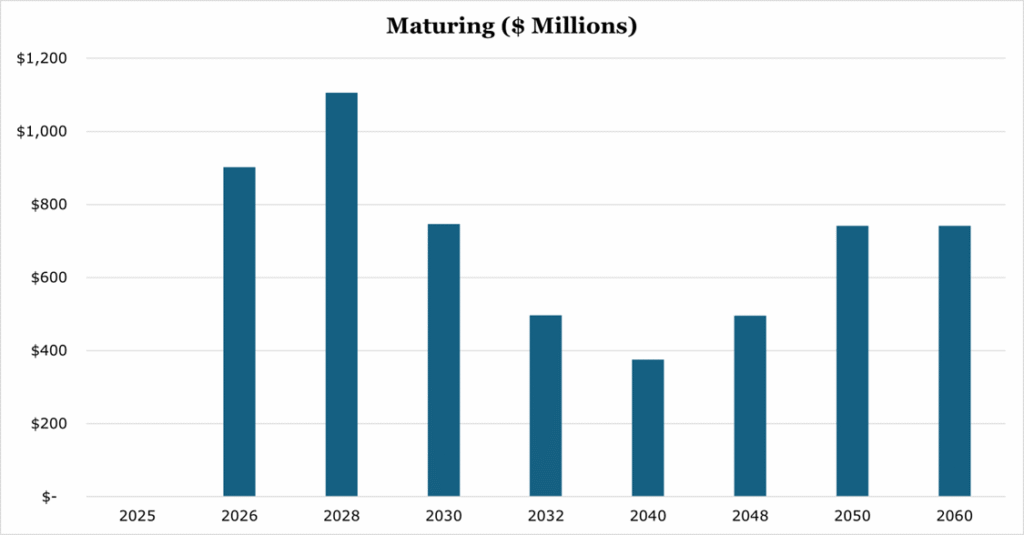

The current debt to EBITDA for the trailing twelve months is 4.4x, with the long-term target being 2.0 to 2.5x. Current debt outstanding has a weighted average interest 3.9% with an average term remaining of 13 years. Since 2021 management has been authorized to repurchase $3 billion in shares, though it has not executed on this and we do not believe it will until it reaches its leverage target.

Conclusion

While there are short-term uncertainties associated with tariff policy, management has laid out a transparent plan to address its impacts to the bottom line. By 2027, we believe that management will be able to execute its plans of removing manufacturing from China and becoming fully USMCA compliant for operations in Mexico. Given the scale in which it operates as the largest tool brand in the world, it will be able to weather any economic fallout better than peers in our opinion.

Based on the expected $500+ million in expected free cash for 2025 despite tariffs, we believe that the dividends 4.64% yield is safe. SWK has seen a price decline of 20.41% over the trailing twelve months, and thus the mixture of tariff deals appearing more likely and structural cost savings program mark an attractive entry point for dividend investors.

Peer Comparisons