Sibanye-Stillwater Hopes to Offer a Metal Mosiac

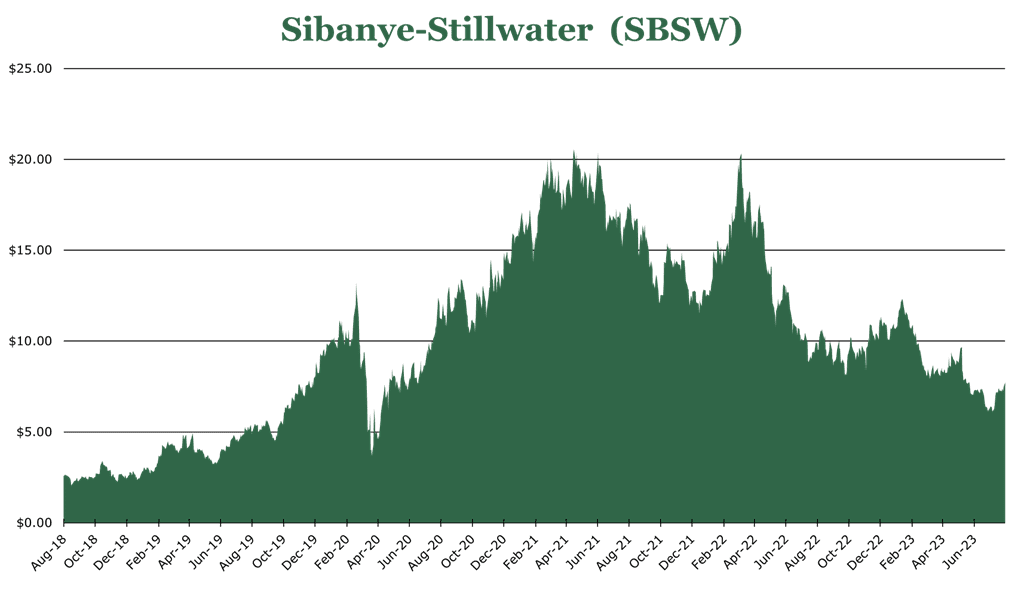

| Price $6.67 | Dividend Holding | August 2, 2023 |

- 8.54% Dividend Yield.

- Diversifying away from gold into PGMs (Platinum Group Metals) which are critical for emissions control. Electrification transformation coupled with automotive tailwinds will drive demand.

- Despite short-term challenges, SBSW’s diversified investments position it for future growth.

- A notable demand-supply gap in the Lithium and Nickel markets by 2030 highlights an emerging opportunity in the battery metals sector.

Investment Thesis

Sibanye Stillwater (SBSW) is a South African metals company with hopes of significant expansion in the next 5 years. Through investment in both recycling and production initiatives globally, SBSW hopes to become a linchpin in the global metals market.

Given its rising demand, significant investments in battery metals, especially Lithium, are critical for future growth. While electric vehicles are gaining popularity, a mix, including hybrids, will dominate the next decade, still providing tailwinds to PGM recycling and PGM mining businesses. SBSW will spend an estimated $500 million in FY23 on these expansion initiatives.

Despite the challenges faced by SBSW in the short term, the company shows promising potential for long-term growth.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $1.0 X 9.7= $9.70

| E2023 | E2024 | E2025 | |

| Price-to-Sales | 0.8 | 0.7 | 0.7 |

| Price-to-Earnings | 6.4 | 6.2 | 3.3 |

PGM Operations

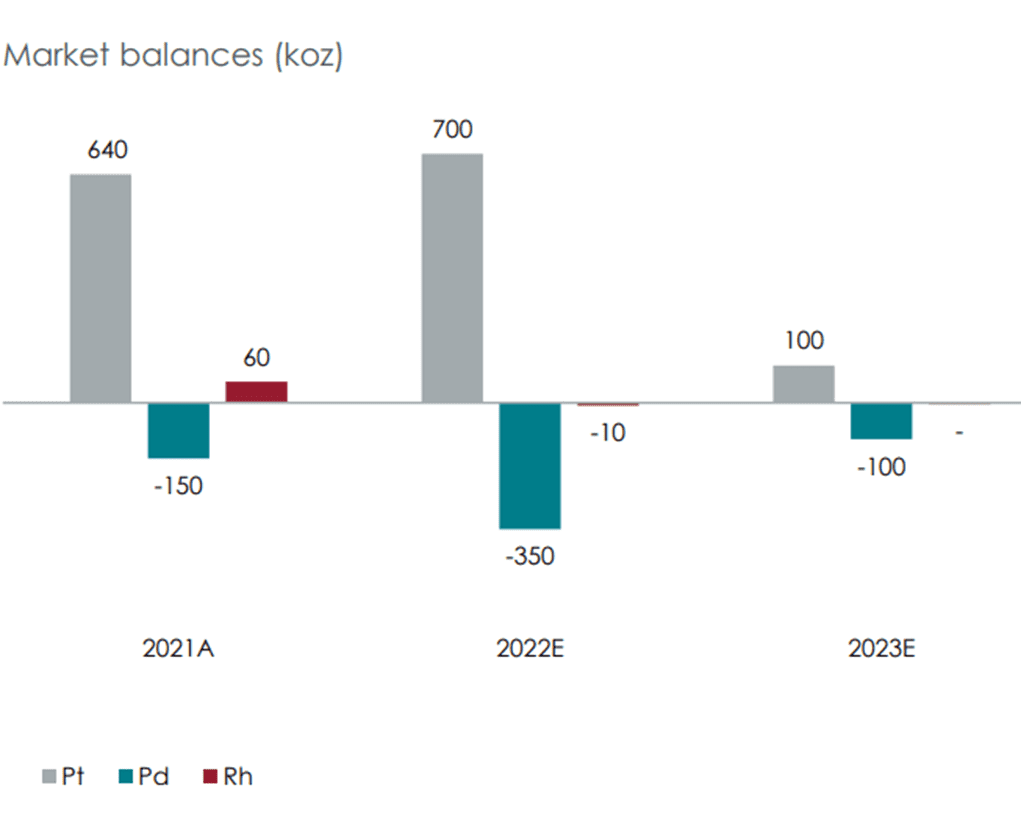

PGMs are typically grouped into 3 classifications: 2E PGM, containing Pt (Platinum) and Pd (Palladium), 3PGM contains Pt (Platinum) Pd (Palladium) and Rhodium (Rd). 3E is 2E plus gold. 4E is 3PGM plus gold.

PGMs are not rare-earth metals, but are critical in numerous industrial components, particularly in the hydrogen and emissions management space. While fully-electric battery EVs receive the most attention, a mix of EVs, including hybrids are needed to fulfil demand within the next decade. Light vehicle production climbs to 82.5 million units per year in FY23. The PGM market is expected to see significant demand recovery linked with the Chinese auto sales rebound expected in FY23.

28% of global PGMs still originate from Russia, and there is still some uncertainty about Russia’s place in the global economy. While much of Russia’s PGM capacity remains unsanctioned, that could change and further affect the supply and demand dynamics of the market.

| Location | Mineral | All-in Sustaining Costs | FY23 Estimated Total Production (koz) | Realized price (average for 1Q23) |

| United States | 2E | $1,861/oz | 470 | $1,426 |

| United States (Recycling) | 3E | N/A | 475 | $2,972 |

| South Africa | 4E | $1,129/oz | 1,750 | $2,051 |

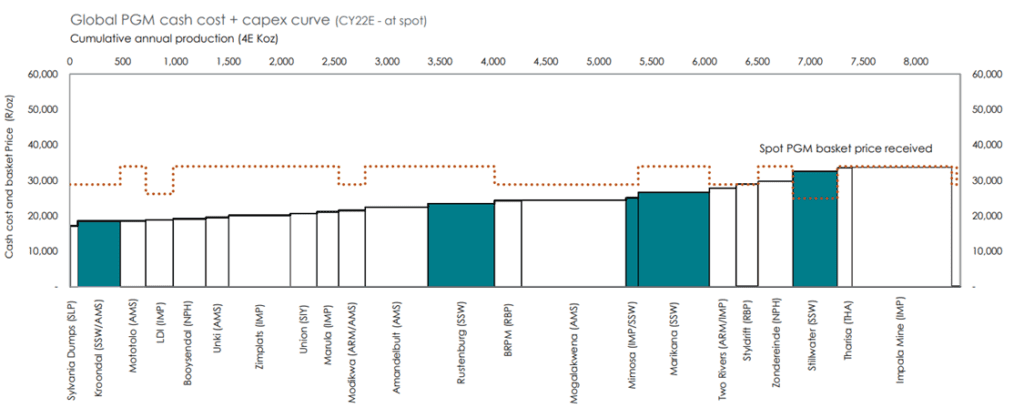

American PGM operations are still ramping up, with SBSW ramping production to 700koz of 2E PGM by 2027. Short-term sustaining costs have surged amid regional flooding and a shaft collapse which caused a work stoppage, which will resume in 2H23. SBSW states this is temporary and expects leveling off of AISC by FY26 of under $990/oz. SBSW expects the American PGM segment to return to full profitability in late FY23 or in FY24 when all in sustaining costs return to normalized levels.

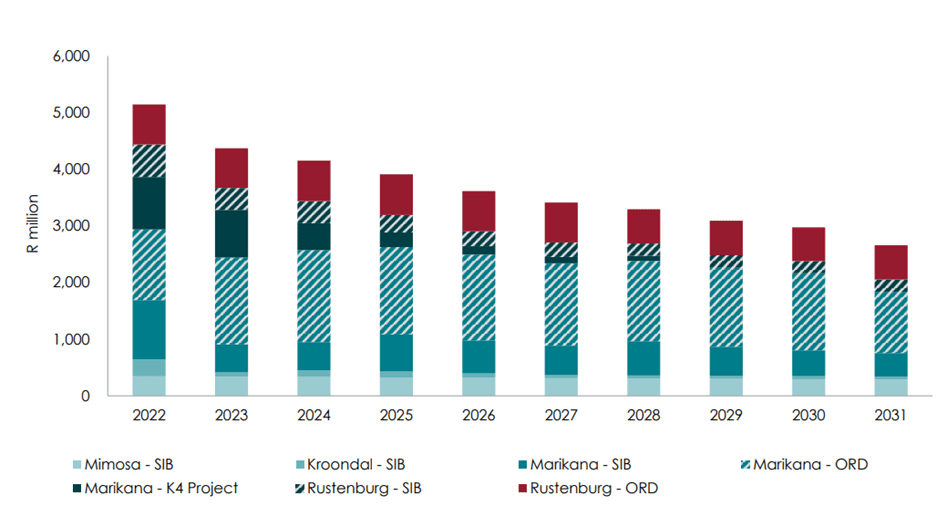

The South African PGM operation is the largest segment by revenue and is considered mature. Currently, the segment has 4 active mines and 3 exploration operations. Expansion in this segment includes the K4 expansion to Marikana, South Africa facility. This new will add 50 years of output, at an estimated 250koz per year, once full capacity is reached in FY29.

Gold

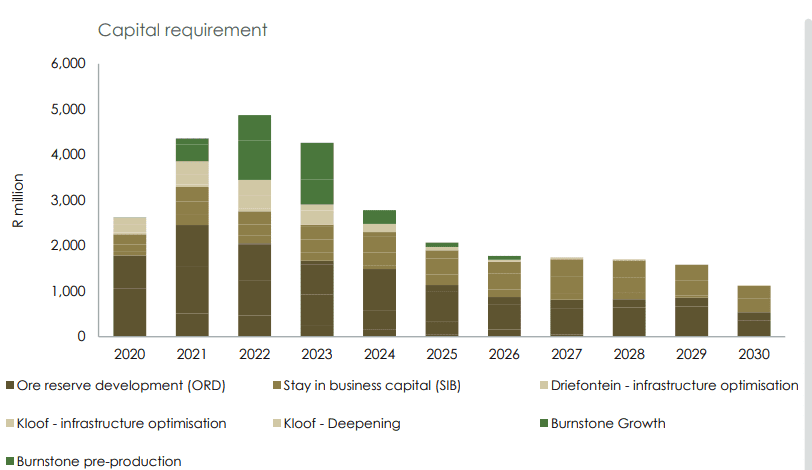

Before the acquisition of Stillwater, Sibanye was an exclusive gold producer. SBSW still seeks to streamline its operations in this area, acquiring a controlling stake in DRDGOLD – a tailings management company. SBSW will close underperforming mines to reduce capital costs and make room for new greenfield expansion. After FY23, SBSW expects the capital requirements to significantly decrease for the Gold segment, amounting to $54.7 million annually in savings due to these streamlining actions.

Gold production for FY23 is expected to produce 756-788koz at an all-in sustaining cost of $1826/oz. The average realized price for 2Q23 for gold was $1864/oz.

Expansion in this area is the Burnstone project, believed to be able to output 141koz per year at full capacity in FY25. Existing local infrastructure significantly reduces startup costs, with the first production output expected in 2H23. DRDGOLD is a tailings management company recovering residue metals from waste from the mine. It has a far lower sustaining cost of $1,528/oz with an annual output of 179koz. This portfolio addition could increase cash flow by $55 million per year at full production capacity in FY25.

Battery Metals

The battery metals segment encompasses Nickel, Copper, and Lithium operations. SBSW seeks to create a raw materials presence closest to regional United States and Europe ecosystems.

In Finland, a concentrated 7 mine facility has been approved for mining and broke ground in March of FY23. SBSW has a 79% controlling interest in the operation and hopes to achieve 15,000 metric tons annually in FY25. The current price assumption for the 15-year life of the mine is $26,034 per ton, with an average operating cost of $7,423 per metric ton in all in sustaining costs. Total capital expenditure, less sustaining capital, is expected to be $650 million. This has the chance to be a highly profitable venture in a strategic area close to numerous battery factories in Europe.

The Sandouville Nickel Refinery was acquired with 100% controlling interest in FY22. The facility is designed to produce 16,000 tons of nickel and 600 tons of Cobalt. This location is strategically close to a site set to be France’s first gigafactory, built and operated by Verkor in a partnership with Renault. SBSW invested $27.5 million in the gigafactory as well.

Rhyolite Ridge in the United States is a lithium-boron project in Nevada. The project has a nameplate capacity of 22,000 tons annually, assuming an average price of $13,000 per ton for Lithium and $710/ton for Boron. SBSW has pledged to contribute funding in exchange for 50% interest conditional to permitting approval. The permitting environment for lithium exploration has become more favorable in the wake of the Inflation Reduction Act, with the Department of Energy offering a loan of $700 million. The project has attracted large names, including the Toyota and Panasonic JV, Ford, and South Korean battery maker Eco Pro. Ford has committed to take 35% of production from FY25-FY30.

Risk

The top two risks facing SBSW in the short term are labor disputes and South African power infrastructure.

Numerous disruptions in FY22 caused by South African workers protesting poor working conditions and low wages. While these have settled, SBSW could be at risk of disruption again once the contract expires in FY25.

The South African power company ESKOM has been plagued with fuel supply problems, sabotage, and aging components. This has caused them to embark on a program of “load shedding,” turning off power after peak hours. Mining, smelting, and refining consume roughly 30% of ESKOM’s net power output. Thus, ESKOM, on top of load shedding, has increased power prices by 20%. In the medium term, ESKOM will remain a primary power supplier to the SA Mining segments. ESKOM expects load shedding to ramp up through FY23, which could result in 15% production losses. At the end of FY24, SBSW expects enough private-sector electricity generation to eliminate load shedding for the mining industry. To this effect, SBSW has acquired the largest solar farm in South Africa, set to enter initial production in FY25 with 89MW in nameplate capacity.

Underpinning these is ongoing political instability in South Africa. While SBSW is quickly diversifying out of South Africa, it is still a South African company. We will likely see some form of price action after the 2024 election in South Africa comes out.

Outlook

Lithium demand will grow by 30% CAGR to 2030. There will be a 55% gap between supply and demand for Lithium at the current global capacity. The story is similar but not as grim for nickel, with an 8% gap between supply and demand. This fact will put upward pressure on the prices of nickel and Lithium as the decade continues. Additionally, PGM metals in use with existing non-battery EVs and traditional ICE vehicles will continue to put upward pressure on prices. Even at an aggressive growth assumption, EVs of all types are not expected to pass 40% market share until after 2030.

Despite lower-than-expected output in FY22 and 1H23, the foundations for significant long-term growth are in place. SBSW has a very strong balance sheet, with only 0.14x debt to EBITDA and around $630 million in free cash flow. Additionally, it pays out a sector high 8.54% yield targeting 35% of earnings paid out to shareholders. SBSW is undergoing a transformative effort to broaden global holdings and cut stalling operations. For this reason, we think it is attractive at its current price for the dividend investors.

Competitive Comparisons