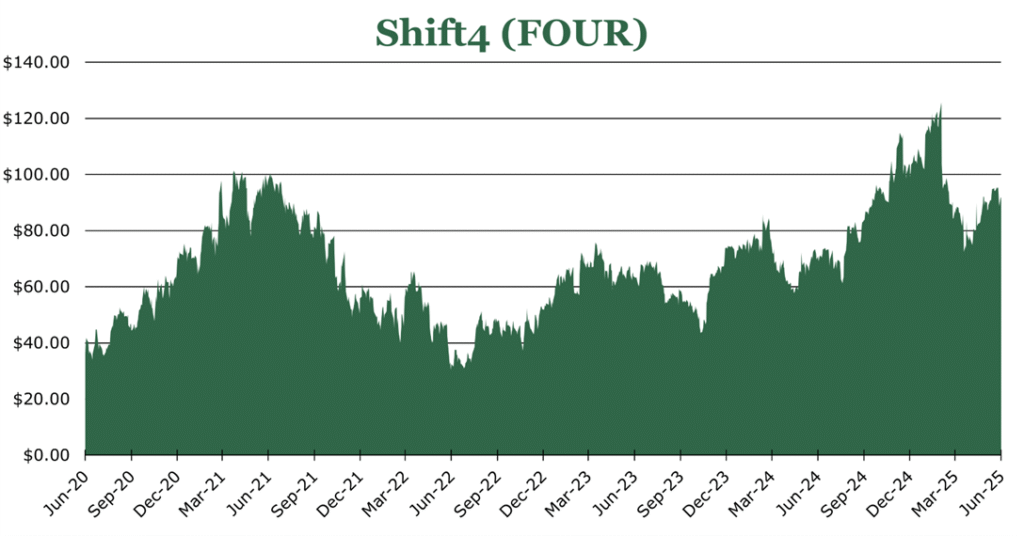

Shift4 Eyes 30% Annual Revenue Growth Through 2028 with Margin Expansion

| Price $92.03 | Growth Holding | June 25, 2025 |

- Shift4 is a fully integrated payment processor targeting underserved verticals like hospitality, restaurants and events.

- Management is guiding to >30% compound annual revenue growth to 2028 with at least 300bps of operating margin expansion.

- Shift4’s acquisition of Global Blue will accelerate European expansion and onboards a luxury-focused book of business.

- Global Blue holds a 70% market share in VAT refunds in Europe, with customers concentrated in luxury retail including LVMH and Burberry with an average customer relationship of over 20 years.

- Global Blue also holds a 20% market share in point-of-sale currency exchange in the EU, a 96.3% gross margin business.

- Shift4’s point-of-sale system maintains the highest customer satisfaction rate in the restaurant industry, with 99% restaurant retention.

Investment Thesis

Shift4 (FOUR) is an American fully integrated payment processor targeting traditionally underserved verticals such as hospitality, restaurants, and events. As of the end of 2024, Shift4’s end-to-end payment volume was $165 billion. With the acquisition of Global Blue, Shift4 believes it has the potential to expand to $1.4 trillion on current customers.

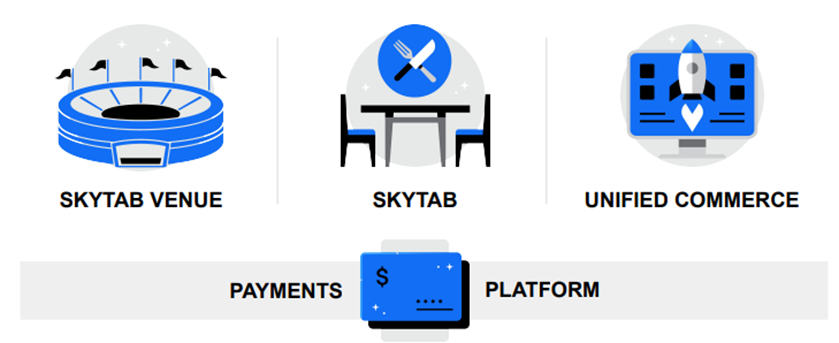

Shift4 offers two main products, SkyTab for restaurants, hospitality and venues, which is a fully integrated POS hardware and processing suite, and Unified Commerce as a payment infrastructure software offering. Both of these sit on top of the payment processing platform.

With the acquisition of Global Blue, Shift4 hopes to expand its market share in Europe through the luxury-weighted book of business and add new features and monetization points to its platform. We believe that Shift4 has the potential to offer a serious competitor to Adyen and Stripe with its emphasis on underserved verticals and high compatibility with existing customer systems. Over the long-term, we believe that Shift4 is a good buy for growth investors.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $6.19 X 28x = $173.00

The market still prices Shift4 like it is a payments processor, when we beleive that a multiple more aligned with Adyen or Square/Block is more appropriate given the move toward competing in traditional retail. Additionally, we believe that Shift4’s targeting of unique verticals allows for higher earnings power especially as it expands globally.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 3.8 | 3.1 | 2.9 |

| Price-to-Earnings | 17.7 | 14.7 | 14.2 |

SeekingAlpha Analyst Consensus

SkyTab and Unified Commerce

SkyTab is the brand name for the primary offering of Shift4’s business, an end-to-end payments and POS (point-of-sale) provider targeting events, hospitality, and restaurants. SkyTab includes both end-to-end payment processing as well as POS systems, business management tools, analytics, and marketing tools.

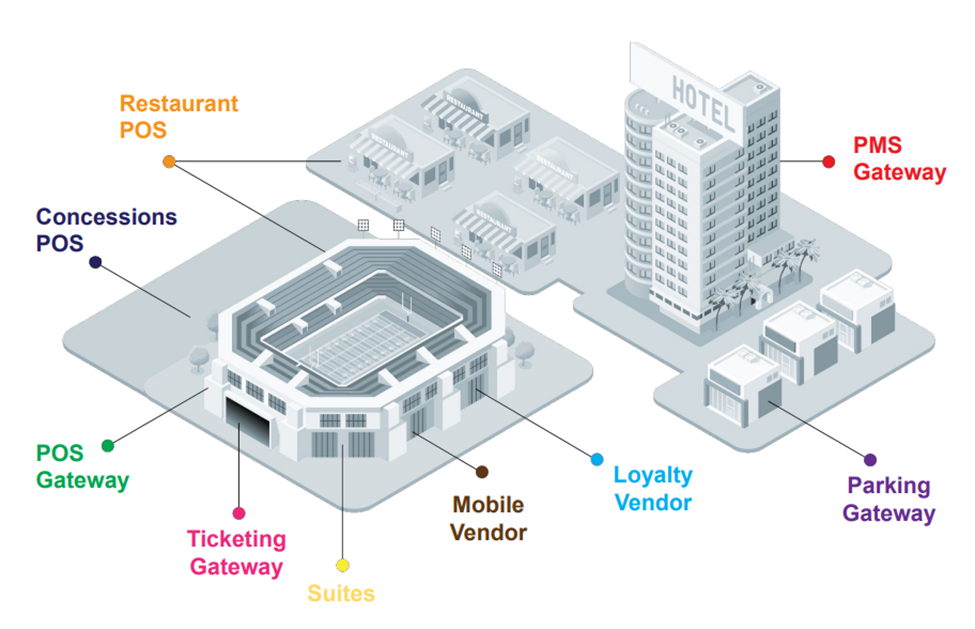

We believe that the main differentiator, is not only very low total cost of ownership but that there is very little integration friction. SkyTab has more than 500 integrations allowing customers to continue to use both software and hardware of their pre-switch stack. Some integrations include all the major delivery apps, most major hardware systems, tip pooling software, ERP (enterprise resource planning) software, and even components of competitors platforms like parts of Oracle’s hospitality management software Micros. We believe this appeals to high-complexity customers who wish to simplify the number of touchpoints that they interact with when operating.

SkyTab Venue is the only top-down provider specifically targeting events and venue customers. We believe a key differentiator for retention is that 100% of customer acquisitions, venue installations, and support are handled by Shift4 in-house, rather than contractors or consultants. This direct relationship makes Shift4 stickier. Shift4 has grown its footprint to include “more than 50%” of major league venues. While Shift4 does not publish retention metrics for this segment, we believe that given the high-complexity nature of events and venues, switching costs are likely to be high.

SkyTab Hospitality primarily competes with legacy providers like Oracle’s Micros, who do not offer payment processing and primarily focus on property management. Like Venue, the main differentiator to customers is the low friction and simplicity of SkyTab, allowing users to continue using the parts of Micros or other vendors they need while switching to SkyTab for others. This highly modular approach to customer acquisition has paid off, with half of the Las Vegas Strip using SkyTab and 40% of the US hospitality market utilizing Shift4’s payments architecture.

SkyTab Restaurant operates in a more competitive space, but according to a survey commissioned by Evercore ISI, SkyTab Restaurant has the highest customer satisfaction in the industry, beating out Toast, Clover, and Square. To encourage switching, SkyTab does not charge up front for hardware, leasing it instead, which it says reduces total cost of ownership by over 60%.

While Shift4 does not publish its take rate, the commonly cited figure for restaurant owners online is approximately 0.35% of transaction amount plus a flat 10 cents to Shift4, and interchange fees passed through to the customer. While on paper this is slightly higher than Stripe’s 0.30% transaction amount, a full blended take rate that includes software subscriptions and upfront hardware costs would likely bring competitors to a similar take rate.

Unified Commerce is Shift4’s software-focused payments platform, intended to directly compete with Adyen and Stripe, which we covered here. What sets Shift4’s Unified Commerce apart is the intent to be maximally compatible, mounted to any POS system or existing backend. Unified Commerce does offer hardware targeted at retailers including mobile card readers or a SkyTab POS system, but it is not required and is primarily a software offering. The documentation for Unified Commerce indicates that the architecture can be integrated with a single line of code, and full self-service to begin accepting payments globally through e-commerce and in-person.

Global Blue Acquisition

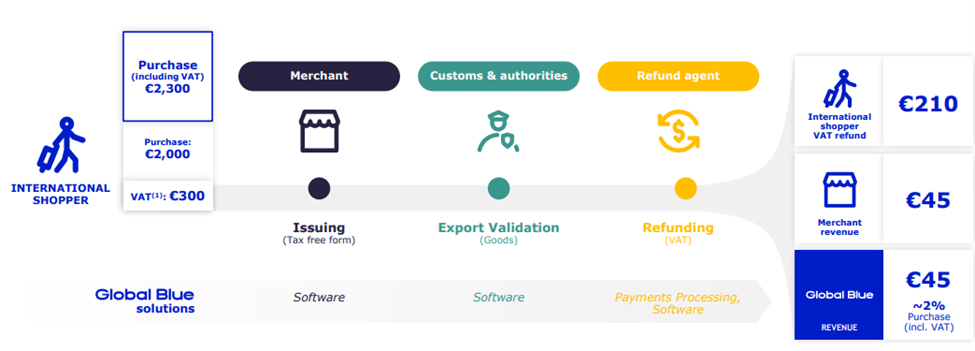

In February 2025, Shift4 announced it would be acquiring Global Blue for $2.5 billion in cash. Global Blue is a specialist payment acquiror, targeting tax-free shopping (VAT refunds) and instant currency conversion.

In countries with a VAT (value added tax), if you are not a resident, you may claim a refund for the VAT taxes you paid on items you are taking out of the country. For example, a strong selling point for luxury retailers in Europe is the up to 30% VAT refund that tourists claim. Global Blue offers both sides of the transaction, an app for tourists to help track their accumulated VAT and retailers to facilitate the refund.

According to Global Blue’s December 2024 investor materials, it has a 70% market share in this space and is the only firm to offer its software in more than 40 countries. It has a strong portfolio of blue-chip luxury customers including LVMH, Capri Holdings, Tiffany, and Burberry Group, with 80% of its volume linked to luxury and an average customer relationship duration of over 20 years.

Chinese giants Ant (Alipay) and Tencent (WeChat Pay) are both shareholders in Global Blue, integrating its solutions into their payment platforms. According to Shift4, the working relationship will continue post-acquisition and will move effort into developing the Unified Commerce platform.

Global Blue’s second largest offering is instant currency conversion, allowing retailers to accept payments from a wide variety of cards and currencies from different countries. Typically, when a customer pays with a card that is denominated in a foreign currency the card-issuer conducts the conversion, which is usually a wholesale rate with a markup. However, with Global Blue converting at the point of sale, it is typically a spot rate plus a markup. As a bonus to customers, Global Blue shares the markup with the merchant. This business has 96.3% gross margin, with Global Blue having a 20% market share for foreign exchange at European retailers. We believe that this will be a key feature implemented into SkyTab and Unified Commerce, as it would provide a high-margin monetization opportunity and kickback incentive to customers.

While Global Blue will meaningfully increase the feature set offered by Shift4, we believe the main impetus behind the acquisition is the massive number of relationships that Global Blue has built over its more than 20 years in the industry. Shift4 estimates that the pipeline is more than $500 billion in volumes that could potentially be converted to Shift4’s payment processing stack.

We believe that this will be key in the land-and-expand strategy for Shift4. If it can maintain the relationships while also offering a low-friction switch to its Unified Commerce or SkyTab platforms, it has the potential to rapidly expand its market share in Europe.

Risk

We believe the biggest risk to the business in the short term is macroeconomic. While Shift4 does not break out revenue by source, given their target customer base we believe most of their revenue is linked to volume from hospitality and restaurants. While we believe the worst-case scenario is a slowdown in the high-twenties growth rate, at the close of the Global Blue acquisition S&P forecasts debt to EBITDA to reach 6.7x. This degree of leverage requires precise execution and solid growth. Achievable but not without risk.

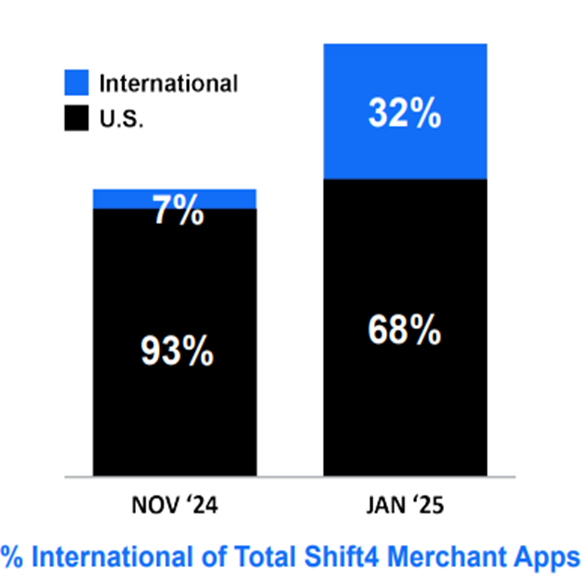

Current expansion efforts are focused on Europe, and while Shift4 does retain most of its acquired talent to bolster local expertise, it is still a new player which has inherent compatibility risk. As of January 2025, the number of international merchants on its platform has already grown to 32% compared to just 7% in November, thus we believe there is momentum and an addressable market to secure. Global Blue is already profitable in Europe with long-standing customer relationships. Therefore, we believe the worst case is features such as foreign exchange bolster Shift4’s proposition in the US, with Global Blue remaining dominant in its niche.

Net Revenue Retention

An important metric in software sales is NRR (net revenue retention). Net revenue retention is a percentage of revenue retained from existing customers, plus new upsells, less lost revenue from churn or volume decreases. A revenue retention above 100% indicates that the company is not only retaining customers, but those customers are being upsold on services, or in the case of a payment processor, pushing more volume through.

| Company | Net Revenue Retention | Classification |

| Shift4 – Restaurants | 99.0% | Vertical Payment Processing |

| Shift4 – Hospitality | 115.0% | Vertical Payment Processing |

| Shift4 – Unified Commerce | 103.0% | Payment Infrastructure |

| Global Blue – VAT | 102.8% | VAT Refunds |

| Global Blue – FX | 104.7% | Foreign Exchange |

| Toast | 118.0% | Vertical Payment Processing |

| Lightspeed POS | 110.0% | Vertical Payment Processing |

| Block/Square | “Over 100%” | Vertical Payment Processing |

| Flywire | 124.0% | Foreign Exchange |

| Olo | 111.0% | Restaurant SaaS |

Before 2022, customer acquisition traditionally came from VARs (value-added resellers) such as consultants, or ISVs (independent software vendors) such as Oracle. As of the end of 2024, around half of hospitality customers are now direct sales, and a third of restaurant customers are direct sales. Venue is fully direct sales only. Overall, partners are paid around 11.8% of GRLNF (gross revenue less network fees) as a commission, we believe that direct sales are targeting much higher-value customers and leaving smaller acquisition to VARs and ISVs.

Given that the shift away from ISVs and VARs toward its own direct sales channels, we believe that Shift4 is prioritizing new customer acquisition rather than NRR especially in segments that were previously 100% ISV/VAR driven like restaurants. While direct sales have longer cycles, we believe they have higher long-term run rate potential.

Financials

As of the trailing twelve months ending March 2025, Revenues grew 27.4% year over year thanks to continued growth in large merchant acquisitions. Over the same time frame, 89.0% of revenue came from payments-based fees and 11.0% came from software and related services.

Management stated that volume will begin to outpace revenue as larger merchants are charged lower rates than existing customers. For the quarter ending March 2025, payment volume has increased by 34.7%, with Shift4 targeting $200-220 billion (21-33% growth) for the full year including the impact of the Global Blue acquisition. For the full year 2025, this volume will translate to $1.6 to $1.7 billion in gross revenue less network fees, or 23-28% growth.

Operating margins for the trailing twelve months ending March 2025 were 6.5%, down 40 bps, mostly due to an increase in headcount, advertising and network fees related to higher volumes.

Longer term guidance provided at the February 2025 investor day has a baseline operating margin expansion of 300bps, with revenue less network fees CAGR to 2028 being in the high teens. The target for revenue less network fees is >30% annual growth through 2028, with the Global Blue acquisition estimated to represent a little under half of this growth.

Shift4 currently has a debt rating of BB-, and after the closing of the Global Blue acquisition it will grow its leverage to 6.7x in 2025, including the convertible debt. However, we believe that the resulting growth will allow a quick deleveraging with S&P estimating 4.3x by the end of 2026. We believe that once Shift4 sufficiently deleverages, it will likely engage in further acquisition activity.

Currently there is $291.2 million in available repurchase authorization, or 3.6% of outstanding shares. Given the scale of the Global Blue acquisition, we expect a smaller repurchase pace than 2024 which saw Shift4 purchase $178.7 million.

Conclusion

We believe that the Global Blue acquisition will increase the value proposition of Shift4 to its existing customer base and should help drive further growth into its payment processing business. Additionally, the acquired licenses and local expertise will help spearhead the further expansion of SkyTab to Europe, which will also meaningfully increase payments volume.

Over the medium term, we believe that Shift4 has a strong value proposition in more specialized verticals like events and hospitality, while the Global Blue acquisition allows it direct access to high-tier luxury customers as potential selling points for its newer Unified Commerce offering.

Peer Comparisons