Shift to Smoke-Free Sparks Steady Dividend Growth

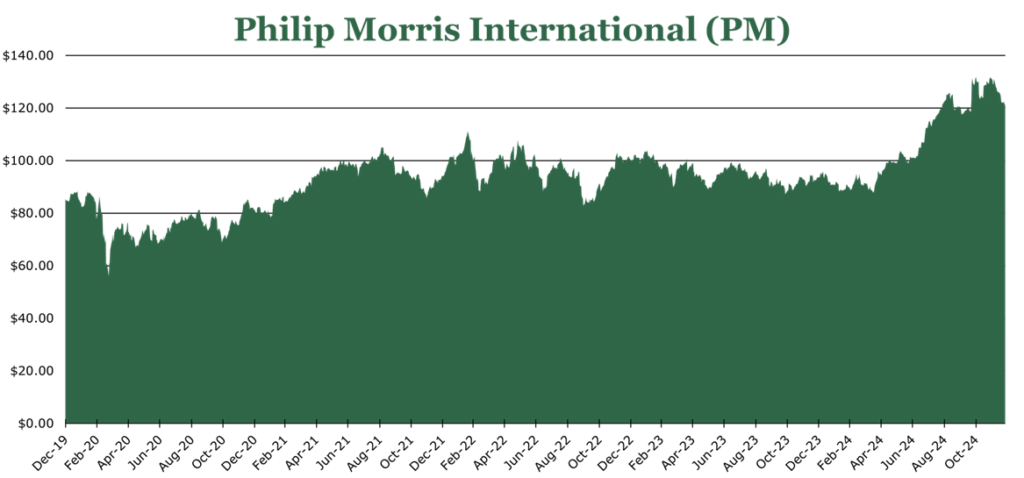

| Price $121.45 | Dividend Holding | December 31, 2024 |

- 4.5% dividend yield, 16 consecutive years of dividend growth.

- Renewed interest in the US market, bringing new IQOS products to market in the second half of 2025 and continued investment in the Zyn brand.

- Plans to re-institute share repurchase program after reaching 2.0x net debt to EBITDA target, currently 3.0x.

- Smoke-free nicotine products have 2.6x the gross margin per unit compared to cigarettes.

- Brand-loyalty in cigarettes has meant price increases have offset or even exceeded volumes.

Investment Thesis

Philip Morris International (PM) was formed in 2008 when Altria Group (MO) spun out its international segment. Since then, PM has grown to be the largest public tobacco company in the world by volume, holding 14.0% market share globally outside of China.

Since its takeover of Swedish Match in 2022 for $16 billion, PM has shifted substantial volumes toward smoke-free products. By 2030, PM is targeting 66% smoke-free revenues. Not only would this mitigate much of the current regulatory and legal risk, but it would expand the bottom line. According to PM, non-cigarette nicotine products have 2.6x gross profit on a per unit basis.

Once PM reduces its debt load to 2.0x EBITDA, currently 3.0x, management stated that buybacks are likely to be returned to the capital allocation structure. Until then, PM currently pays out 4.5% yield, growing dividends for 16 consecutive years at a CAGR (compound annual growth rate) of 7.0%. PM represents a dividend aristocrat with some potential for capital appreciation as management reinstates buybacks post-deleveraging, and as higher margin smoke-free products gain market share.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $8.00 X 19.0 = $152.00

A P/E of 19x would, in our view, more accurately price in the steady growth of IQOS availability in the United States and Zyn smoke-free nicotine pouches.

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 5.0 | 4.8 | 4.4 |

| Price-to-Earnings | 18.7 | 17.0 | 15.4 |

Combustible Tobacco Products

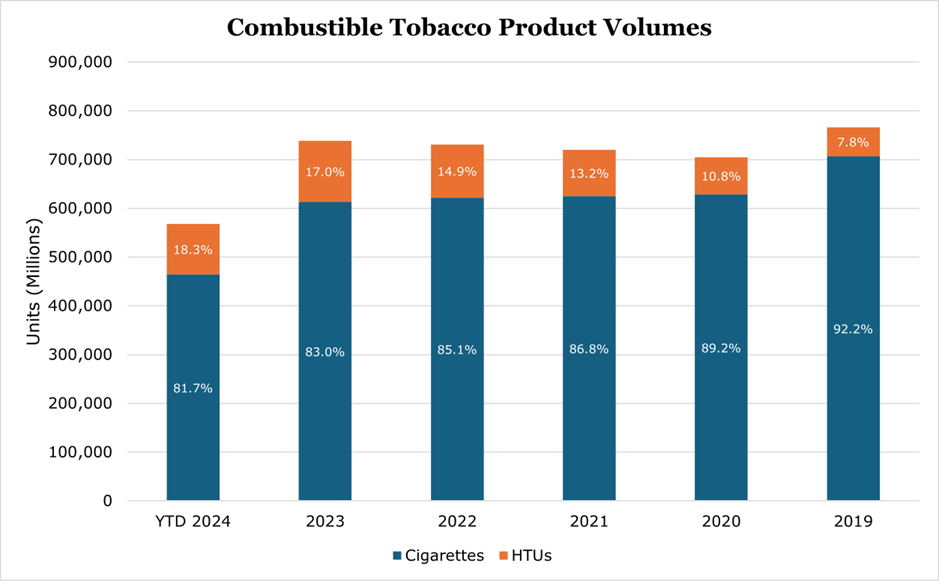

PM has committed to being 66% smoke-free by 2030, though it will likely maintain a strong base of cigarette users given the addictive nature of the product and the high regulatory barriers for new entrants.

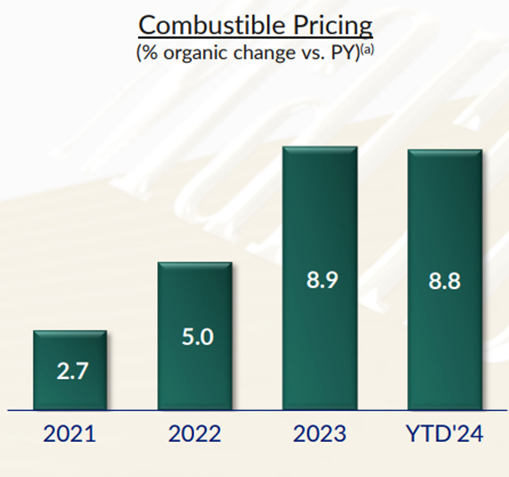

Brand loyalty in the developed world has meant that price increases have consistently offset or even outpaced volume. For the quarter ending September 2024, PM reported price increases of 9.7%, with cigarette volumes up 1.3%, beating out the industry average of 0.5%.

Outside of the developed world, 80% of the world’s smokers now live in developing nations. Tobacco products in low-income countries tend to have lower pricing power than developed ones due to the weaker brand loyalty caused by higher price sensitivity. However, we see no reason why brand loyalty and associated pricing power wouldn’t establish itself organically as local incomes increase, which should increase the tail of the cigarette market.

For the quarter ending September 2024, the total market share of PM cigarette brands was 25.3% with PM controlling 5 of the top 15 global brands, excluding the US and China. As part of the Altria Group spin-off in 2008, Altria kept control of marketing and brand-management for tobacco products, like Marlboro, the US market. In China, it licenses sales and production to CNTC (China National Tobacco Corporation), the state-owned monopoly of tobacco products sold in China.

PM’s latest tobacco product is the HTU (heated tobacco unit), marketed most prominently under the brand IQOS. HTUs heat tobacco to high temperatures, but not enough to burn it. According to PM, this makes it safer, and the FDA has granted it the ‘modified risk’ tobacco product status, meaning it is allowed a wider breadth in marketing compared to cigarettes. Outside of the US and China, IQOS has become a strong cigarette alternative in markets that have been resistant to smoke-free nicotine products like Japan and Central Europe. For the first 9 months of 2024, PM shipped 104 billion HTU units. This is on pace to beat the 125 billion shipped for the full year 2023, with volumes up 14.8% in the quarter ending September 2024. By 2026, PM is targeting at least 180 billion units shipped annually.

In our view this figure is now achievable with the re-acquisition of US IQOS sales and marketing rights from Altria for $2.8 billion. While the HTU market in the US is small at just $24.1 billion in 2023, the market has strong potential for double digit growth as developed-market consumers move away from cigarettes.

Regaining marketing rights will allow PM to boost product awareness, which is currently low at just 15% of US Adults having heard of any brand of HTUs. Uptake and product awareness in the US has been sluggish because of the approval process. Since their first introduction in 1994 the FDA has only approved two HTUs, with IQOS being approved in 2019. PM expects acceleration in the HTU market with the approval of newer models of IQOS expected in the second half of 2025, provided PMTA (premarket tobacco product application) timelines match their historical 2-year average.

Smoke-Free

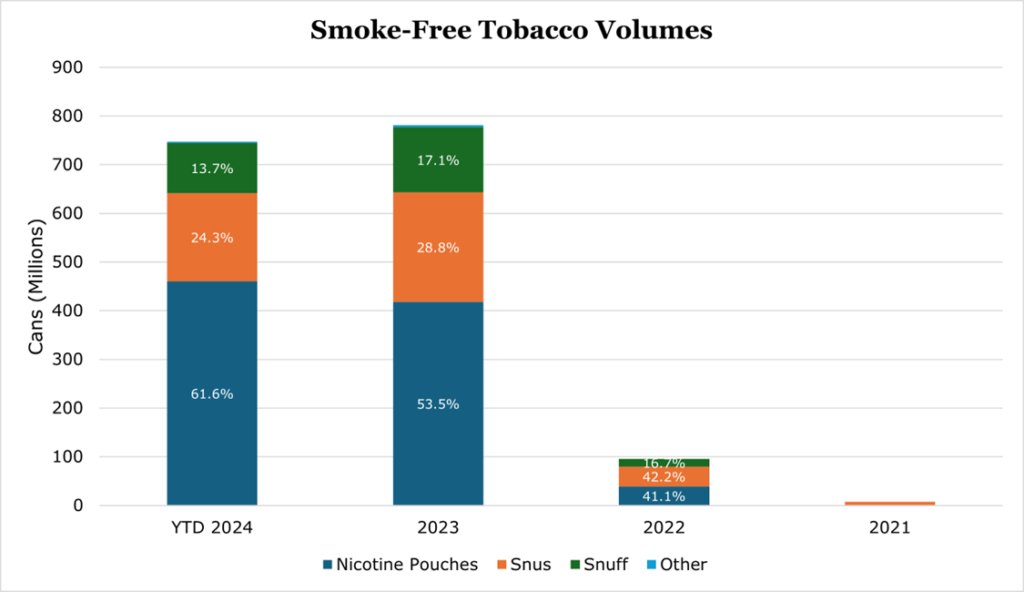

The economics of smoke-free products outpace traditional products. In per unit profit, PM reported that the profit per smoke-free unit was 2.6x that of a typical cigarette.

Compared to the combustible area, PM has a strong focus on smoke-free US market development. PM estimates that the US smoke-free market is the largest and most mature in the world, with more than 300-billion addressable unit-size and 45 million active users. The US tobacco market is around 40% smoke-free, with vapor and pouch nicotine products consistently seeing double digit market share growth. From 2020-2023, nicotine pouches and vapes saw 55% and 37% CAGR respectively in the United States.

PM’s main effort in smoke-free products began with the $16 billion takeover of Swedish Match. PM maintains an internal product development arm, focused on the VEEV line of vapor e-cigarettes.

At the time of the acquisition, Swedish Match held the #3 US market share in moist snuff (more commonly called dipping tobacco), around 10%, and a mature position in Scandinavia where snuff has historically been more popular than smoking. What made the deal more attractive at the time was it had the #1 spot in the US, 64.9% market share, in the nascent tobaccoless nicotine pouch market. Zyn was the first tobaccoless nicotine pouch brand marketed in the US, first introduced in 2016. Since then, it has remained the top brand and even expanded market share to 65.5% as of the quarter ending September 2024. Zyn has an atypical market dynamic for tobacco products, with a high percentage of young high-income college graduate consumers. What is similar is consumption volumes, with the average user consuming 3 cans per week.

While tobaccoless nicotine pouches are more discrete and socially acceptable in public than vaping, which could provide an organic tailwind, the large differentiator of Zyn is advertising. Since Zyn contains no tobacco, it is not as tightly regulated as other smoke-free tobacco products. Zyn has had incredible advertising power among young people. It is unclear the level of advertising PM pays for through unofficial channels like podcasts or social media personalities, though it is likely that this guerrilla-style marketing has contributed to the success and explosive growth of the brand among educated young people.

For the full year 2023, PM shipped 421 million cans of tobaccoless nicotine pouches. Already in the first 9 months of 2024, PM has outpaced this, selling 460.2 million cans. A total increase of 41.4% in the US and ‘close to’ 70% internationally. According to management, this increase puts it on pace to sell 575 million cans by the end of 2024. By 2026, PM is targeting at least 800 million cans, with production capacity of 900 million. This target is ambitious given its already high market share in the US and comparatively lower uptake in other developed nations outside of Scandinavia. However, competitor British-American Tobacco estimated that the market size for nicotine pouches will grow 500% by 2026, with particular strength in Central Europe, the US, and the UK.

Risk

The regulatory environment toward traditional tobacco products has become harsher in developed nations. While US regulation remains less harsh than peer nations, the PMTA (premarket tobacco product application) backlog is over 2 years long. The harshest regulatory environment in the world, New Zealand, rolled back a full-ban on cigarette sales after an increase in organized crime and a loss of tax revenue. Thus, we feel that if PM can reposition itself to being 2/3 smoke free as planned, most of the risk from the reemergence of harsh measures would be minimal.

In Canada, PM and its peers have been involved in a decade of litigation. In October of 2024 the government of Canada announced that it had proposed a preliminary settlement deal between PM and 2 peers of a combined $23.5 billion, with $8.7 billion upfront and the remaining payable through 85% (stepping down to 70% after 5 years until paid off) of the after-tax income generated from the sales of tobacco products in Canada. Fitch estimates that the final agreement will be implemented in the middle of 2025, though it is unclear how much PM would pay.

As previously discussed, a large part of Zyn’s success in an atypical demographic has been official and unofficial social media advertising. Internationally, PM implemented a similar strategy with IQOS, and faced some scrutiny, though minimal regulatory penalty. Nicotine pouch usage among underage youth is only 1.8%, which is lower than vapes (5.9%), but still higher than cigarettes (1.4%). If this dynamic were to increase it is likely that the FDA would impose harsh regulatory sanction on Zyn and related products as it did with JUUL and other vapes in 2018.

Newer tobacco-free products like vapes and nicotine-pouches are often inconsistently taxed. Tax laws in the US and EU are written based on tobacco content rather than nicotine content. Therefore, at the present time most tobacco-free products are exempt under current ad-valorem and excise tax laws. Over the short term it is likely that state-level governments will begin to introduce laws that put tobacco-free products into the existing regulatory frameworks. Over the medium to long-term it is likely that there will be tax homogenization between tobacco and tobacco-free products. However, given the addictive nature of the products, we do not expect there to be a substantial change in volumes or pricing power as a result.

Financials

For the 9 months ending September 2024, revenue was up 7.8% year over year. Operating margins expanded to 36.0%, by 300bps, thanks to favorable mix. As the mix shifts further toward smoke-free, we expect the bottom line to expand further which should provide favorable tailwinds to earnings. As of the quarter ending September 2024, smoke-free items now make up 38.2% of revenues, up 270bps compared to last year.

Management stated that it was having some capacity constraints in the US due to higher-than-expected IQOS and Zyn volumes which should be alleviated by the end of the calendar year.

With the takeover of Swedish Match in 2022 and the acquisition of marketing rights for IQOS in the US from Altria Group, PM’s net debt to EBITDA is elevated at 3.0x. Management has stated that it expects to end 2024 at around 2.7x and be at the long-term target of 2.0x by 2026. After it reaches this leverage target, management stated that buybacks are likely to be reinstated.

Fitch rates PM at an A, with most debt having an interest rate below 5%. According to investor materials, 75% of future capex will go toward smoke-free products and PM expects to spend around $1.2 billion annually on capex to 2026. With the elevated debt levels, the upfront component of the Canadian litigation settlement, and elevated capex from building out the base in the US, there will likely be some pressure on free cash flow for 2024 and 2025. However, the headwinds are short-term and will not impact the dividend.

PM yields 4.5% and has a payout ratio of 82.6%. PM has paid out a dividend for 16 consecutive years with a CAGR of 7%. Future dividend increases could be above this level especially if volume momentum in the US stays near present levels and global revenues shift toward high-margin smoke-free products.

Peer Comparisons

| Philip Morris (PM) | Altria Group (MO) | British American Tobacco (BTI) | Japan Tobacco (JAPAY) | Imperial Brands (IMBBY) | |

| Price-to-Earnings | 18.67 | 10.21 | 7.85 | – | 10.16 |

| Price-to-Sales (TTM) | 5.07 | 4.47 | 2.45 | 2.15 | 1.13 |

| EV-to-EBITDA (FWD) | 14.77 | 9.18 | 7.49 | 8.15 | 6.93 |

| Net Income Margin | 26.42% | 50.51% | -52.84% | 15.69% | 14.14% |

| Dividend Yield | 4.45% | 7.79% | 8.25% | 5.05% | 6.02% |