RTX Capitalizes on Secular Trends to Drive Dividend Growth

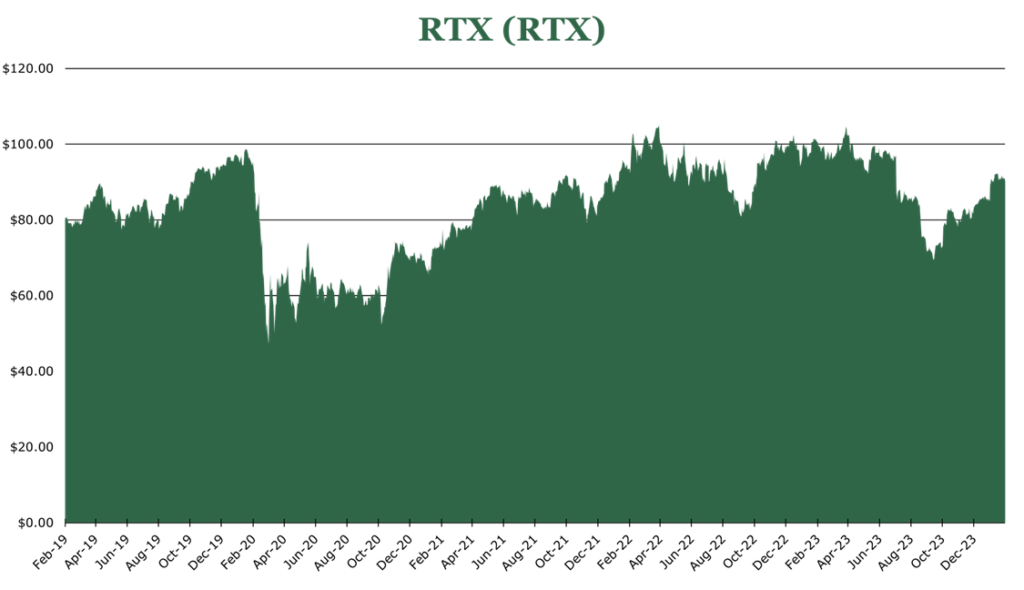

| Price $89.25 | Core Holding | February 29, 2024 |

- 2.6% Dividend Yield should grow with earnings.

- Increased military spending by the US and NATO allies, driven by geopolitical tensions, is expected to fuel sustained growth in RTX’s defense segment.

- As commercial aviation recovers and aircraft average age ticks up, RTX stands to benefit from both new equipment and overhaul services.

- $5.5 billion in free cash flow generated in 2023 and an estimated 16.7% CAGR in free cash flow to 2025 provide a solid foundation for returns and expansion.

- A 12% year-over-year growth in backlog, now at $196 billion, and a book-to-bill ratio of 1.28x for 2023 indicate strong future revenue potential across all segments.

Investment Thesis

RTX, formerly Raytheon Technologies (RTX), is an American defense contractor and aviation equipment manufacturer with a dominant footprint in both military and civilian sectors.

In the defense sector, the United States and its NATO allies are ramping up their military spending in response to geopolitical tensions and the need to modernize their armed forces for potential peer conflicts. On the commercial aviation front, the industry is recovering from the impacts of the COVID-19 pandemic, with air traffic expected to surpass pre-pandemic levels in 2026. Aging aircraft fleets and advancements in technology are driving the need for newer or overhauled aircraft, which in turn benefits both Collins Aerospace and Pratt & Whitney segments.

RTX is well-positioned to capitalize on the secular growth trends in both commercial air traffic and military budgets. The company’s strong financial position, with robust free cash flow generation and a commitment to shareholder returns, adds to its investment appeal. We believe RTX is in an excellent position for both capital appreciation and dividend growth.

Estimated Fair Value

From a financial perspective, RTX’s robust free cash flow growth projections and strengthening market make it attractive. As RTX navigates sustained inflationary hurdles, its overall valuation will be influenced by its ability to maintain its competitive edge successfully and continue to grow its market share.

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $6.3 X 16.6 = $104.58

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.5 | 1.4 | 1.4 |

| Price-to-Earnings | 18.7 | 16.6 | 14.5 |

Market Conditions

On a secular basis, the United States is re-equipping for a peer conflict with China, and we expected continued modernization spending efforts across all branches. Even if there are slowdowns in the conflict in Ukraine or Israel, the US military has significantly drawn down its equipment reserves in supplying munitions and equipment to these conflicts. NATO allies in Europe are similarly re-equipping for further Russian aggression in Eastern Europe, with defense spending seeing the largest increases since the Cold War. We do not see a cooldown in this trend occurring over the short term, with the United States making up the bulk of short-term demand. As the decade progresses, other NATO militaries are likely to begin to procure new equipment as sustained spending in the military spurs expansion. RTX puts the 5-year CAGR for defense spending among addressable countries at 4%, more weighted toward international customers as the decade progresses.

Commercial aviation has still not recovered from pre-COVID-19 numbers. The Collins segment is reporting only 45% of 2019 sales for wide-body aircraft like commercial airliners, while it has reported 90% of 2019 sales for narrow-body aircraft. RTX expects by 2025, global passenger traffic will recover to above the 2019 number.

On a secular basis, the average age of aircraft before retirement has been decreasing due to advancements in technology spurring early removals and increased average flight hours per airframe over a shorter time frame. However, the fall in air traffic since the pandemic and delayed deliveries from both Boeing and Airbus have tapered retirements below the expected level. The average age of US commercial aircraft has increased by 11% since 2019 to 15.2 years. As aircraft retirements begin to move back up with deliveries of new airframes, around 20% of the current active fleet will be retired. We believe that this will provide significant additional tailwinds to both the Collins and Pratt and Whitney segments, with Collins having the additional benefit of older airframe overhauling as a service option and higher market share in newer generations of aircraft.

Breakdown by Segment

RTX operates 3 primary segments, which generally operate independently. RTX operates a multidisciplinary business with significant exposure to public and private sector clients.

| Full Year 2023 | Funded Backlog ($ Billions) | Year over Year Change |

| Collins Aerospace | 30 | 7.1% |

| Pratt & Whitney | 114 | 14.0% |

| Raytheon | 52 | 10.6% |

In contracts, particularly those with the government, a “funded backlog” refers to orders with funding set aside, even if payment has not been made yet. RTX does not make public the options for additional purchases at the original contract price, IDIQ contracts (indefinite duration, indefinite quantity), or potential long-term service agreements that are paid as needed in the backlog.

| Full Year 2023 | Revenue as a % of Total | Operating Margin |

| Collins Aerospace | 37.0% | 14.6% |

| Pratt & Whitney | 25.8% | -8.0% |

| Raytheon | 37.2% | 9.0% |

Collins Aerospace

Collins Aerospace is a leading designer and fabricator of both civilian and military aerospace components and systems. Primary products include cabin interior pieces, sensors, networking capability, spacesuits, and materials science. Growth areas for Collins include hybrid-electric aircraft engine experimentation and advanced automation and networking for both military and commercial customers.

| Subsegment | Year over Year Sales Growth |

| Commercial Aftermarket | 23% |

| Commercial Original Equipment | 17% |

| Military | 1% |

Currently, defense sales make up 37% of Collins’ total revenue, with 63% originating from the commercial market. Original equipment makes up around 58% of sales, with aftermarket representing 42%.

Overall sales in the segment were up 14% year over year. Military sales were flat year over year, but commercial aftermarket services and components were up 23%, with original equipment being up 17%.

In total, RTX estimates that Collin’s aggregate long-term contract awards for the year were $3.5 billion. Collins has been growing in market share, with RTX estimating that Collins has seen a 100% increase in penetration with new aircraft rolling off the line relative to those being retired. Collins now supplies 2.5 million components on over 70,000 aircraft, with a 10% CAGR to 2027 for new aircraft production and an 8% CAGR for aircraft rolling to out-of-warranty status.

Tailwinds for Collins include the previously mentioned aftermarket overhauling business and continued orders for new aircraft among major carriers. The aftermarket business caters to aircraft off-factory warranty, which typically lasts 4 years. The global aviation market will experience a significant rollover around 2027 as new aircraft delivered since COVID-19 begin to go off-warranty. According to RTX, it estimates that the total value from upgrades and future aircraft development will be around $40 billion by 2030.

Pratt & Whitney

Pratt and Whitney is a leading engine supplier for military and civilian aviation customers, and it provides fleet management and aftermarket overhaul services.

| Subsegment | Year over Year Sales Growth |

| Commercial Aftermarket | 18% |

| Commercial Original Equipment | 20% |

| Military | 4% |

The most substantial products for Pratt and Whitney are the PW1000 series jet turbofans utilized in more than 1700 aircraft worldwide. Additionally, Pratt and Whitney is the manufacturer of engines for the F35 program and the new B21 bomber program, which is estimated to include at least 100 new aircraft. There are simply no competitors in this area, as Pratt and Whitney are the sole providers of all 5th-generation aircraft engines to the US Military.

Overall sales were up 14%. Military sales were up 4% year over year, with commercial aftermarket up 18% and original equipment up 20%. In our view, military growth will remain in line with 4% secular growth as nations begin to modernize air forces. RTX estimates it will see roughly a 20% increase in commercial aircraft engine shipments in 2024 and a 4% increase in paid aircraft maintenance visits. As the newer PW1000s begin to mature, there will be a rollover similar to Collins, where in the latter half of the decade, Pratt and Whitney will see more aftermarket sales. RTX estimates an aftermarket profit growth of 26% CAGR in the 2022-2025 timeframe for newer components and a 6% CAGR for mature programs.

The operating margin was negative for 2023 due to the financial impacts of the contaminated powder incident. Metal powders are used in numerous components in aircraft engines to strengthen them without much weight added. However, metal powder in some PW1000G-JM engines on Airbus A320 NEO aircraft has caused some structural weakness and excessive corrosion. In the quarter ending September, RTX realized a $5.4 billion impairment to net sales, pushing operating margins for the segment down by $2.9 billion. From 2023 to 2026, RTX estimates that 3,000 engines (estimated to be in service on 600-700 Aircraft) will need to undergo a full inspection and potential rebuild, which will take the aircraft out of service for approximately 250-300 days. The financial implications of this are the previously mentioned impairment realized in the quarter ending September and a ~$1.5 billion total cash headwind per year for 2024-2026.

Raytheon

Raytheon is a leading defense contractor, developing and producing missiles, sensory equipment, and space systems. Raytheon has been the center of an internal repositioning, with many RTX defense programs being relocated within the Raytheon segment and Raytheon’s civilian programs being relocated to Collins. According to investor day materials, this will result in $200-300 million in administrative cost savings and reduce intercompany sales by $1.4 billion.

2023 was a major year for contract awards for future defense programs, with Raytheon winning several long-term contracts with undisclosed values. These include several international customers with the NATO Guidance Enhanced Missiles, US Navy Next Generation Jammer program, US Air Force Hypersonic program, and US Army Next Generation Short Range Interceptor program.

Organic sales were up 4%, with higher volumes reported in new Patriot air defense missile orders and classified programs. Currently, 26% of sales originate internationally, with 29% of sales being developmental sales for initiating new product lines.

Advantageously, 81% of Raytheon’s R&D budget is customer-funded, which significantly assists with margins. In our view, as new future defense programs begin to enter production, RTX’s R&D budget may swing back toward company funding. However, this is not necessarily a negative as 70% of these development contracts are fixed-price. Thus, the reduction in these programs and the opening of sales on previously exclusive or classified programs may improve margins. RTX says these items will incrementally improve operating margins to the 12% neighborhood in the latter part of the decade.

Risk

Future defense programs, by their nature, are classified. Determining the result or lifetime of procurement programs is difficult. On a broader level, RTX derives 46% of its revenue from the US Government. Compared to its peers, this is far lower as a percentage of total revenue. While the United States Military isn’t going anywhere, there is still intense competition among contractors and technology providers to sell the most advanced technology possible at the lowest price, which poses a risk to operating margins.

FAS (Financial Accounting Standards – GAAP) and CAS (Cost Accounting Standards used by the Department of Defense) cause different results. FAS/CAS adjustments ensure the company reports correctly to investors and the government. This can cause volatility in results due to fluctuations in pension plans, government regulation, or defense budgetary changes reducing the assessed value of a contract.

RTX has been subpoenaed by the SEC regarding contaminated metal powder in engine components that may result in more corrosion on components, which caused aircraft to be grounded for inspection. The nature of the probe is that the original figure of the number of affected engines was 1,800 short of the full 3,000 number disclosed later. While guidance on actual costs has become more stable as the situation has progressed, further unforeseen impairments would significantly degrade future financial performance in the Pratt and Whitney segment. Pratt and Whitney hold a market share of 40%, and it is growing. We believe that this matter could potentially shake the confidence in large customers like Boeing and Airbus in selecting Pratt and Whitney for future projects if the scope expands. Such a development could lead to a reevaluation of contracts and future orders, potentially affecting the company’s long-term financial performance and market position.

Outlook

Total sales were up 11%, and the company generated $5.5 billion in free cash flow. Book to bill for the whole company was 1.28x for 2023, with 12% year-over-year backlog growth, which is now at $196 billion. Company-wide book-to-bill is expected to be 1.1x or higher for 2024, with continued growth in every segment. Overall, topline growth is expected to be 7-8%, with $5.7 billion in free cash flow for 2024.

| Estimated for 2024 | 2024 Sales Growth | Operating Profit ($ millions) |

| Collins Aerospace | Mid to High Single Digits | $650-725 |

| Pratt & Whitney | Low double digits | $400-475 |

| Raytheon | Down/Flat | $100-200 |

RTX estimates that around 60% of the $78 billion defense backlog will be realized within the next 2 years as supply chain and labor situations continue to alleviate. RTX is reporting that both labor and material costs are stabilizing. However, it did report that they still experienced approximately $2.3 billion in inflationary headwinds. For 2024, it expects roughly a 26% decrease in those headwinds, which could amount to more if labor retention rates stay high and material availability continues to improve. On a broader level, as supply chains have improved, RTX has been required to hold fewer components in inventory. For 2024 and 2025, RTX expects inventory to remain flat or decrease as the backlog is cleared, which could accelerate margin improvement.

RTX has 2 important strategic programs ongoing that could affect the bottom line. The first is a significant push toward automation in its manufacturing facilities. The internal “Industry 4.0 program” intends to double the footprint of automation, which would significantly reduce the time to completion on some lines by as much as 65%. Overall, cost savings associated with automation could reach 20%. The second is, as previously mentioned, a shift in business to move defense to the Raytheon segment and move Raytheon’s civilian business to Collins. RTX estimates that this will add ~$200-300 million in administrative cost savings as it reduces intercompany transactions by around $1.4 billion per year.

Beyond 2024, RTX estimates a secular compound annual growth rate of 16.7% for free cash flow to 2025, which would bring total free cash to $7.5 billion in 2025. Volume growth will make up approximately 60% of this increase, with initiatives like automation, segment shifts, and inventory improvement accounting for the rest.

Current shareholder return is concentrated on repurchases, with a 2.6% dividend yield. RTX has stated that they are committed to around $36 billion in shareholder returns by the end of 2025, with the dividend having renewed focus to be the primary avenue for returning cash to shareholders over that time frame. For 2024, we expect a moderate dividend increase in line with earnings growth. Under the current repurchase program, RTX has $976 million remaining, which is scheduled to occur before the quarter ending September 2024.

Overall, RTX is poised for continued growth, driven by favorable secular trends in both the defense and commercial aviation markets. The company’s diversified business model, strong backlog, and growing market share position it well to capitalize on these opportunities. We find RTX an attractive option, given its solid growth prospects, diversification relative to peers, and commitment to shareholder returns.

Competitive Comparisons