Ring Energy Eyes Production Expansion Over the Medium Term

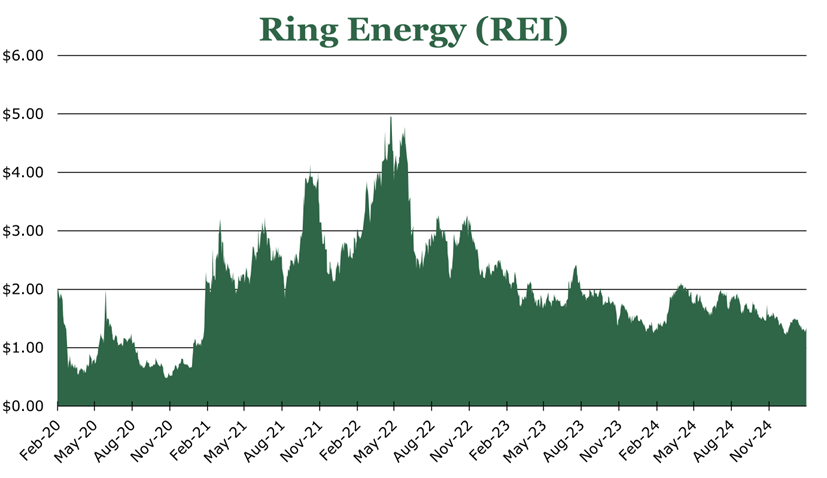

| Price $1.31 | Growth Holding | February 14, 2025 |

- Production increase of 11.5% for the first 9 months of 2024, though a lower pricing environment had sales up 8.3% over the same period.

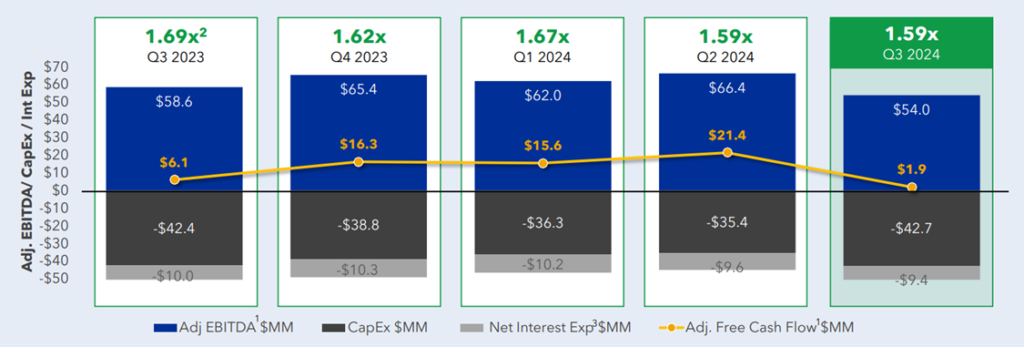

- Targeting leverage ratio of 1.0x debt to adjusted EBITDA, currently 1.59x.

- After REI reaches its target leverage, we expect management to ramp organic production or engage in another acquisition.

- Based on transactions of similar asset profiles, REI could be worth $2.44/share in private market value.

Investment Thesis

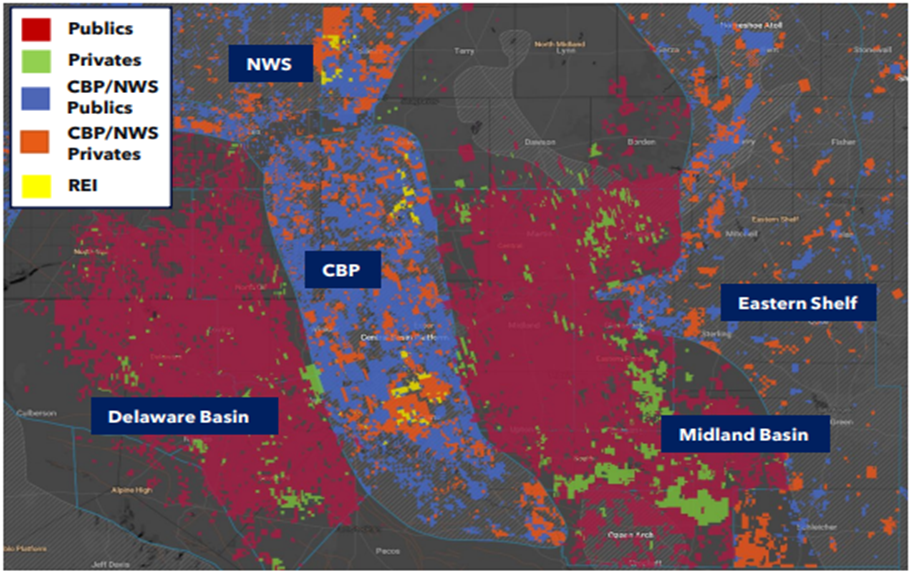

Ring Energy (REI) is a Permian exploration and production company operating in the Central (CPB) and Northwest Shelf (NWS). With 85% liquids and 66% oil mix, REI produces 20.1 kboe/d (thousand of barrels of oil equivalent per day). REI has a higher-than-peers reserve life of 18 years.

Despite an increase in production of 11.5% for the 9 months ending September 2024, sales only increased 8.3% due to decreases in NGL (natural gas liquid) and natural gas prices. However, we see these pressures alleviating with the introduction of 7 Bcf/d of natural gas transit capacity from Waha to Henry Hub by 2026.

After REI reaches its deleveraging target sometime in 2026, we expect management to expand capex to increase production or target another acquisition to expand its footprint. With a current valuation of just 3.7x earnings, we believe REI is trading at a substantial discount to its fair value. Based on acquisitions at a similar production level in the CBP area, a reasonable price for REI is closer to $2.44 a share.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $0.69 X 6.3 = $4.36

A P/E of 6.3 would still put REI on the lower end of independent peers. After it reaches its leverage target, we expect earnings power to be unlocked through increased volume even if hydrocarbon pricing stays depressed.

PDP (proven, developed, producing) divestitures in Texas provide insight into a theoretical short-term price for REI to be acquired or a more accurate fair market value. APA divested from its ‘non-core’ Permian assets, with a similar production and location to REI’s, for $950 million – or $45,238 boe/d (barrel of oil equivalent produced per day). Based on REI’s enterprise value, it has a valuation of $32,505 per boe/d. At the multiple of APA’s divestiture, REI is worth at least $2.44 per share.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.7 | 0.6 | 0.6 |

| Price-to-Earnings | 3.3 | 2.0 | 1.9 |

Analyst consensus data from SeekingAlpha

Operations

Total production was up 11.5% year over year for the 9 months ending September 2024, though sales revenues were only up 8.3% on a weaker pricing environment. REI’s production profile is 85% liquids and 68% oil, which is on the higher end of peers.

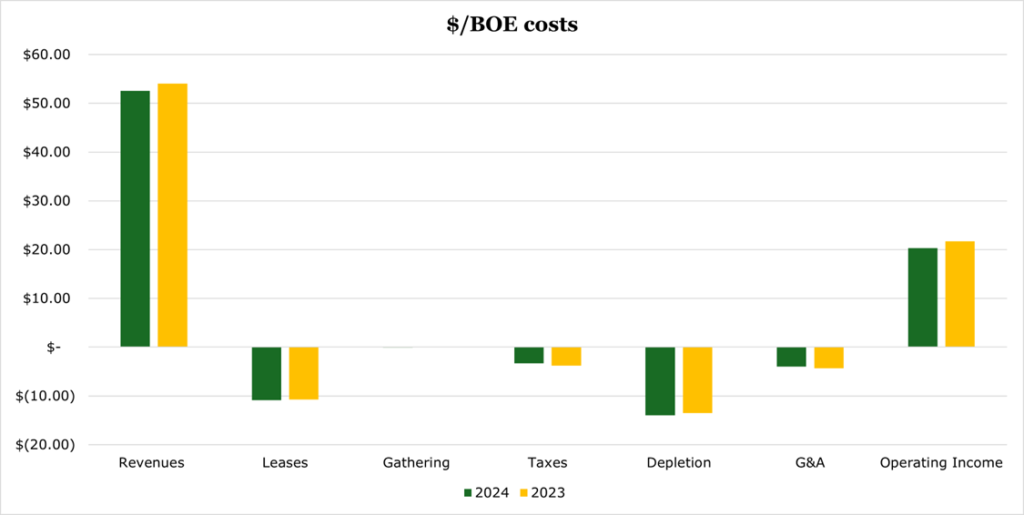

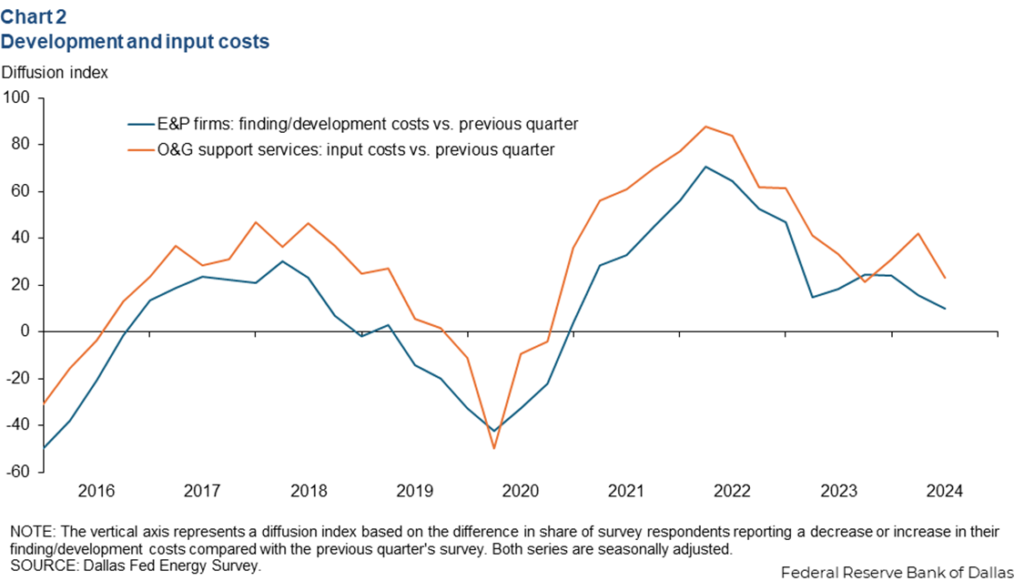

Total operating expenses on a per BOE basis (barrel of oil equivalent) were flat year over year for the 9 months ending September 2024. Operating income per boe declined by 6.5% year over year primarily due to a 3.0% decrease in sales price, concentrated in natural gas.

REI is in the top of the peer group for reserve life and decline rate, with around 18 years at current production levels compared to the median of 11 years. Decline rates are equally on the lower end of peers, with a rate of 25% compared to the median of 34%.

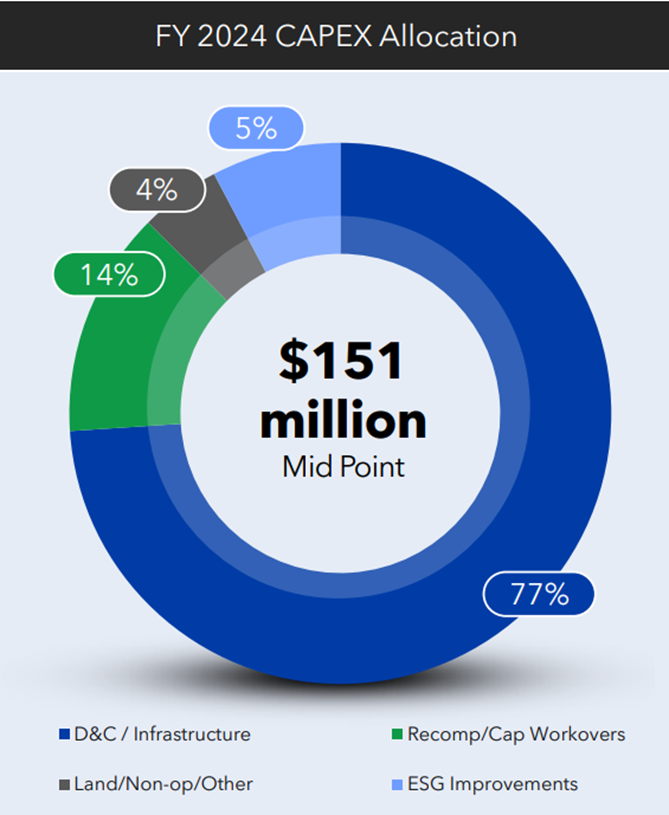

Capex for the full year 2024 is concentrated 77% on completion costs for wells, with 14% going toward improving performance of existing wells.

Costs are in line with peers, with a total completion cost for horizontals being in the $2.3-3.7 million range and verticals in the $1-1.9 million range. For the quarter ending September 2024 REI drilled 7 horizontals and 6 verticals.

The current drilling program emphasizes maintaining the current pace of operations, though we expect marginal low-single digit increase in volumes during the last quarter of 2024 as new assets are brought online. Production curves usually peak during the first 6 months of well operation before tapering into a decline over a 24-month period. Once REI reduces its leverage ratio to below 1.0x, we expect there to be more substantial moves to expand organic production capacity.

Natural Gas Pressures Alleviating

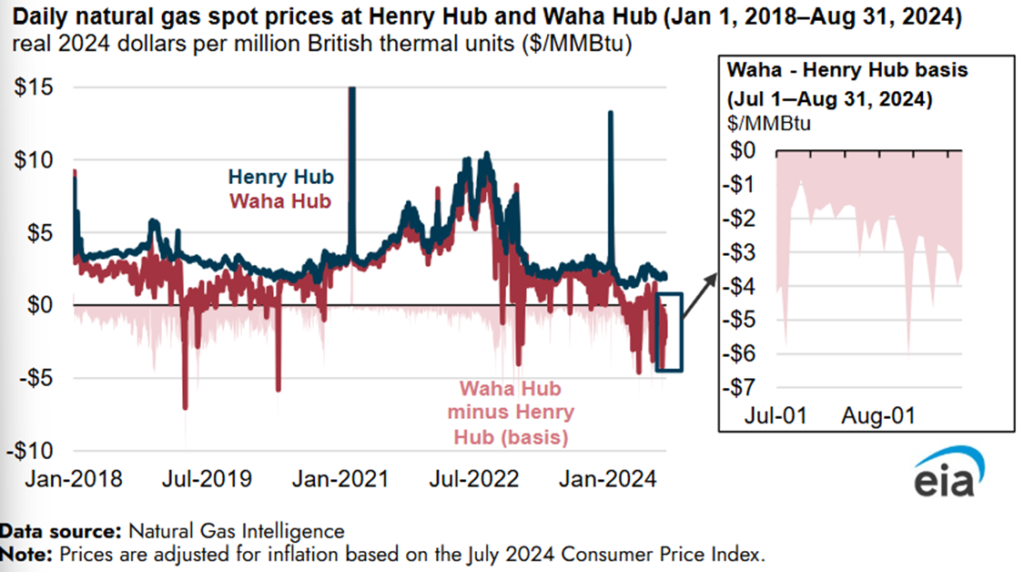

As natural gas is a byproduct of oil production and environmental regulations prohibit flaring, many producers in the Permian are loss-taking in natural gas. However, NGL (natural gas liquids) pricing has been more resilient, allowing REI to offset the loss in natural gas. For the 9 months ending September 2024, REI’s non-oil sales narrowed to $866k from $9.1 million due to a $2.68/bbl (barrel) fall in NGL pricing and a $1.72/Mcf (thousands of cubic feet) fall in natural gas pricing.

The Waha hub, where most Permian products are aggregated, typically trades at a small discount to the Henry Hub price where most products are exported from. The discount offsets the cost of transit and storage. Since 2018, the volume of natural gas produced in the Permian has doubled, and transit capacity to export has not kept pace. In 2024, there was a record 164 days of negative Waha gas prices, including a record low of -$7/MMBtu (millions of British thermal units) just before Labor Day weekend.

Management noted that there has been an increase in third party uptake capacity with the Matterhorn Express pipeline adding an additional 2.5 Bcf/d (billions of cubic feet per day) in capacity. For the week ending February 5th, 2025 the EIA reported Waha prices had increased to $1.86/MMBtu, representing a much narrower $1.36 discount to Henry Hub compared to 2024’s $2.20 average. The IEA also noted that there are another 4.5 Bcf/d coming online by 2026, which should continue to narrow the spread between Henry Hub and Waha.

A Wave of Divestitures on the Way

Management believes that there are going to be opportunities for acquisition in the area with a ‘wave of conventional targets’ from oil majors and large Permian producers. Speaking to Ion Analytics, the managing director for Houlihan Lokey stated that 18-24 months after a wave of M&A follows asset-level divestitures as firms look to maximize value. Since November 2024 in the Permian, Exxon, Permian Resources, ConocoPhillips and APA have divested a combined $3.7 billion in Permian assets deemed ‘non-core’.

We expect management to target an acquisition over the medium term, though it will likely wait until its leverage is closer to the 1.0x target, currently at 1.59x. As for size, the most recent acquisition by REI, Founders, was completed for $100 million in cash when REI’s leverage was 1.4x. We expect a marginally higher transaction size, though the EBITDA acquisition multiple will likely be higher than the 2.3x paid for Founders, with more recent deals in the area having multiples ranging from 2.5-4.0x.

Risk

As of the quarter ending September 2024, REI had no cash on its balance sheet and negative working capital. While it does have a revolver for liquidity with a $200 million undrawn component, its adjusted free cash flow has shrunk to $1.9 million quarterly, from its typical $15-20 million level due to a poor pricing environment.

While we do not expect oil prices to meaningfully decline below REI’s breakeven of approximately $35/boe, a further degradation of the hydrocarbon pricing environment would increase the expected timeframe for REI to hit its 1.0x deleveraging target and likely hamper expansion plans.

Financials

Despite the lower pricing environment, REI leads peers in net income margins, posting 39.8% during the quarter ending September 2024. Cost inflation for drilling across the United States has moderated with fewer than 20% of firms reporting cost increases during the quarter ending September 2024. REI’s costs, as previously discussed, have remained flat.

anagement has said that it is ‘more focused on debt reduction than trying to grow the company’ now. Over the trailing twelve months, its debt to adjusted EBITDA (adding back share comp and non-cash retirement costs) is at 1.59x. The current target ratio before it begins expansionary efforts again is 1.0x. At the current pace of repayments, $15 million quarterly, it will be at the target in the middle of 2026. The current weighted average interest on the revolver component of the debt is 9.3%, with total quarterly interest cost being $10.8 million or around 12.5% of revenues.

It is possible that repayments increase with a more aggressive offloading of assets operating at higher than target production costs, or a more favorable oil pricing environment. During the quarter ending September 2024 REI sold some ‘non-core’ rigs for $5.5 million in cash.

Conclusion

Though REI does have a higher debt load than peers, it has put itself on the path for hitting its deleveraging target by the middle of 2026. If hydrocarbon prices begin to climb in the latter half of 2025, it could also provide a much-needed boost to free cash for faster repayment. By that point we expect divestiture activity by majors and independents in the Permian to reach its peak, which should give REI the opportunity to purchase more PDP assets at a good price or invest in organically expanding production.

Despite a clear path to higher production and earnings, the stock has remained flat over the trailing twelve months and trades at just 3.7x earnings. Similar assets have divested for substantially higher prices, and thus we believe REI is undervalued at its current price.

Peer Comparisons