REPX: Sustainable Growth with Strong Free Cash Flow

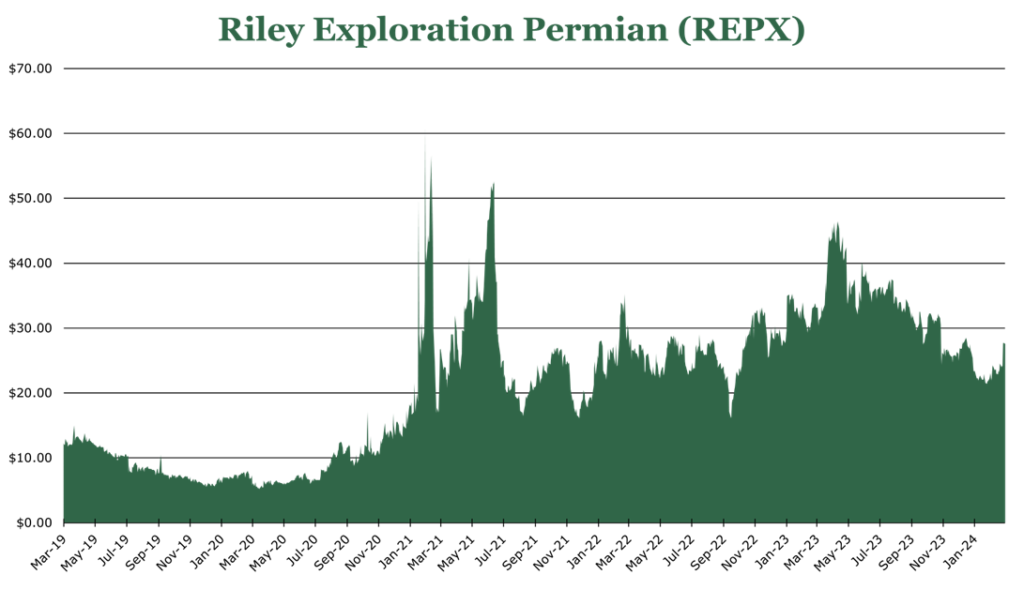

| Price $29.10 | Core Holding | March 16, 2024 |

- 5.22% dividend yield, maintained even at $40/bbl WTI.

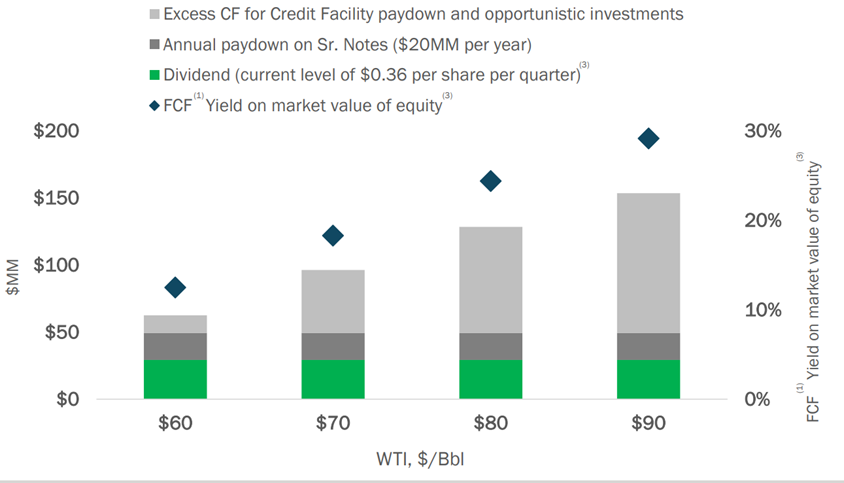

- Strong free cash flow, at $75/bbl WTI REPX expects $100 million in FCF for 2024.

- Estimated 18.3% production growth for 2024 without a meaningful increase in costs.

- REPX is actively deleveraging its balance sheet, targeting 60% of free cash to debt reduction.

- Strong geographic position, operating in a lower-cost and lower-decline rate location compared to the median Permian field.

Investment Thesis

Riley Exploration Permian (REPX) is an exploration and production company operating in the Permian basin, focusing on oil development. The company’s below-average drilling costs and lower-than-average decline rates position it favorably in the competitive Permian basin. With a strategy centered on acquiring undeveloped assets with high reserves rather than pursuing short-term production increases, REPX is poised for sustainable growth over the long term.

Financially, REPX is committed to free cash flow generation, with 1/3 of its operational cash flow being converted to free cash flow. Over the short term, the company’s hedging strategy allows for $70 million in free cash flow, even at $60/bbl, and dividend maintenance at $40/bbl. Despite the challenges posed by high interest rates and stalling commodity prices, REPX’s focus on deleveraging in the short term, maintaining a healthy dividend yield, and long-term production expansion makes it a compelling choice for dividend investors seeking long-term growth.

Estimated Fair Value

REPX is a peer leader in net income margins and trades at a significant discount to peers. Over the long term, as the Permian basin reaches its peak production, REPX’s sustainable long-term growth strategy with an emphasis on shareholder return will become more valuable.

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $9.00 X 5.7 = $51.30

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.4 | 1.2 | 1.2 |

| Price-to-Earnings | 7.3 | 6.0 | 5.7 |

Production

As stated in our previous coverage, REPX has below-average drilling costs, reducing total development costs and boosting return on invested capital. Additionally, something that may become more crucial over the medium term is that REPX has a decline rate that is lower than average. The Permian basin has become one of the largest oil-producing regions in the world, with many analysts predicting a Permian production peak in 2025. Predicting a secular decline rate for shale, such as the Permian Basin, is far more complex than traditional oil, as decline rates tend to be non-linear.

| Cost per Lateral Foot ($/ft) | 5-year Decline Rate | 5-year MOIC (Multiple on Invested Capital) | 5-Year Cumulative Production per 1,000 Lateral Feet (mboe/1kft) | |

| REPX | $650-1,000 | 75-85% | 2.5-3.3x | 38-41 |

| Permian Shale Typical | $1,000-$1,100 | 90-95% | 1.8x-2.8x | 30-50 |

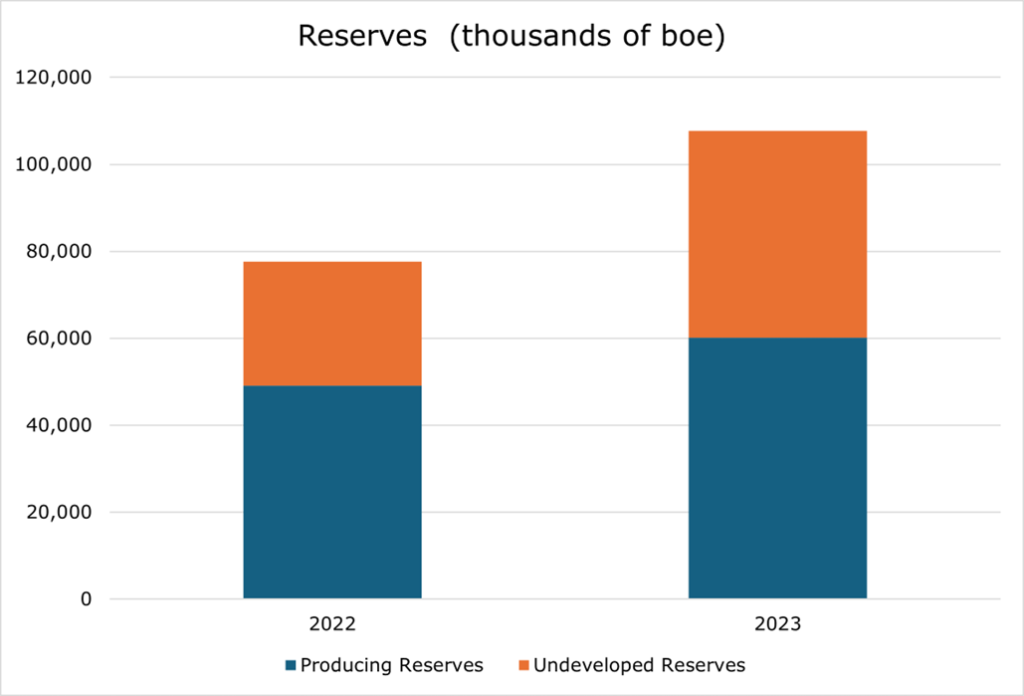

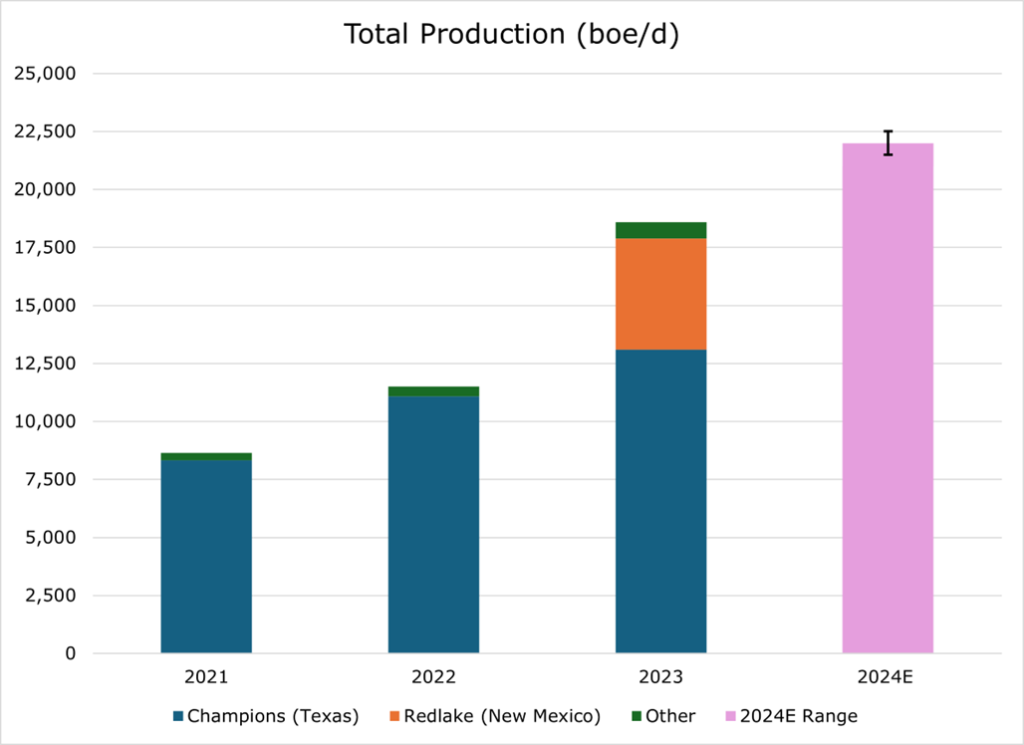

In the first half of 2023 REPX acquired land in Eddy County, New Mexico, in the same shale band as its legacy assets in Yoakum, TX. The transaction closed at $330 million, with 1/3 paid for by cash on hand and 2/3 financed. The New Mexico transaction significantly grew both the producing footprint and the number of undeveloped reserves.

For the full year 2023, REPX operated 420 wells and held a minority interest in 97 wells. Production increases amounted to 61.6% year over year, reaching 18.6 mboe/d (thousands of barrels of oil equivalent per day). Production was 71% oil, 14% natural gas, and 15% natural gas liquids. At the current production level and footprint, REPX has just under 14 years of oil production remaining.

Natural gas tends to be a byproduct of Permian shale production, with firms being price takers. As Permian producers have natural gas as a byproduct, the supply of natural gas often exceeds the capacity to move it to market. In some locations, this natural gas is flared off, circumstances permitting, but current regulations usually require it to be sold even if at a loss or breakeven. Additionally, due to the rural nature of the Texas operation, power was a bottleneck for the expansion of production.

To further enhance the economics of the Texas operation, REPX entered into a JV with Conduit Power to utilize excess natural gas for more reliable power generation. The terms are REPX sells the JV market price gas, and REPX pays a market rate for the output power. Entering into the initial generation in late 2023, the JV has grown to power roughly 36% of the Texas operation or about 10MW of capacity. During the first half of 2024, an added 10 MW will come online. Over the long term, this will improve both the financial and productive efficiency of the wells in the Texas operation. In our view, if this proves financially workable over the long term, it may eventually grow to cover 100% of the Texas footprint, which would have a material impact on per boe (barrel of oil equivalent) costs.

Risk

REPX currently has mixed debt holdings, with a total debt of $336 million, excluding capital leases, made up of 50% senior notes and 50% credit revolver. The revolving credit facility has a weighted average interest of 8.68% and senior notes with an effective interest rate of 13.38%. Despite having a debt-to-EBITDA of under 1.0x, the high-interest rates make this debt particularly suboptimal. Paydown on the credit revolver is linked to free cash flow, which is expected to be between $70-100 million for 2024. The senior debt has a yearly paydown of $20 million.

As previously stated, calculating the decline rate of Permian shale is difficult as it tends to be non-linear. According to some analysts, the peak production level expected to be reached in 2025 has already happened, and Permian production will begin to decline at a faster rate than expected. The EIA concurs with this view, forecasting a sharp plateau in 2024. While this would put upward pressure on oil prices, which would be good for REPX, it would significantly reduce the prospects of added expansion.

While the 2024 US Federal Budget holds steady on tax treatment, the Biden administration is seeking to remove certain tax advantages for exploration and production companies in 2025. The current tax code allows for certain independent producers, like REPX, to deduct certain drilling costs and part of exploration costs. While the current proposal is still up in the air, the removal of this could significantly erode economics on a per boe basis.

Financial Outlook

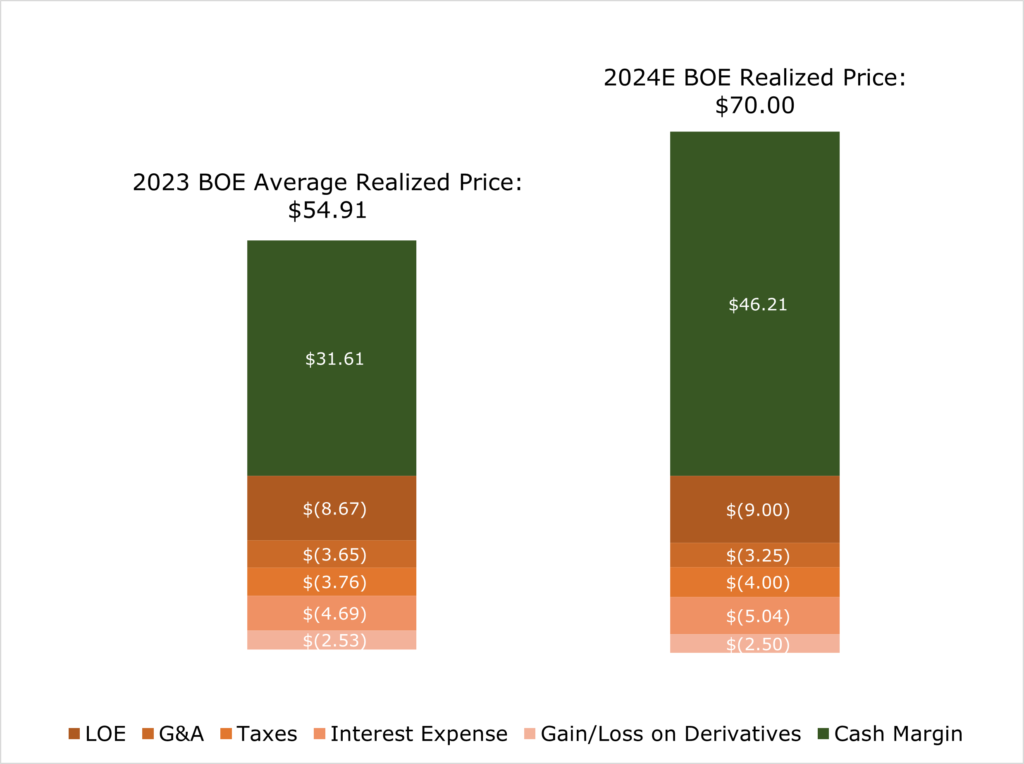

| Cash Margin per BOE | ||

| 2023 | 2024E | |

| Realized Price | $54.91 | $70.00 |

| ◆LOE | $(8.67) | $(9.00) |

| ◆G&A | $(3.65) | $(3.25) |

| ◆Taxes | $(3.76) | $(4.00) |

| ◆Interest Expense | $(4.69) | $(5.04) |

| ◆Gain/Loss on Derivatives | $(2.53) | $(2.50) |

| Total Cash Cost | $(23.30) | $(23.79) |

| ◆Cash Margin | $31.61 | $46.21 |

LOE (lease operating expenses) are costs needed for the direct operation and maintenance of the drilling operation. Lease operating expenses scale linearly with expansion. REPX estimates that LOE costs on a year-over-year basis for 2024 will be flat, and we believe that over the medium term, they will decline with the Power JV and steadying labor costs.

REPX expects taxes to be around 6-8% of topline revenue, which for the full year 2023 amounted to around $3.76/boe, or 6.7% of revenues. We expect this to be similar for 2024, falling within the $3.50/boe and $5.00/boe range.

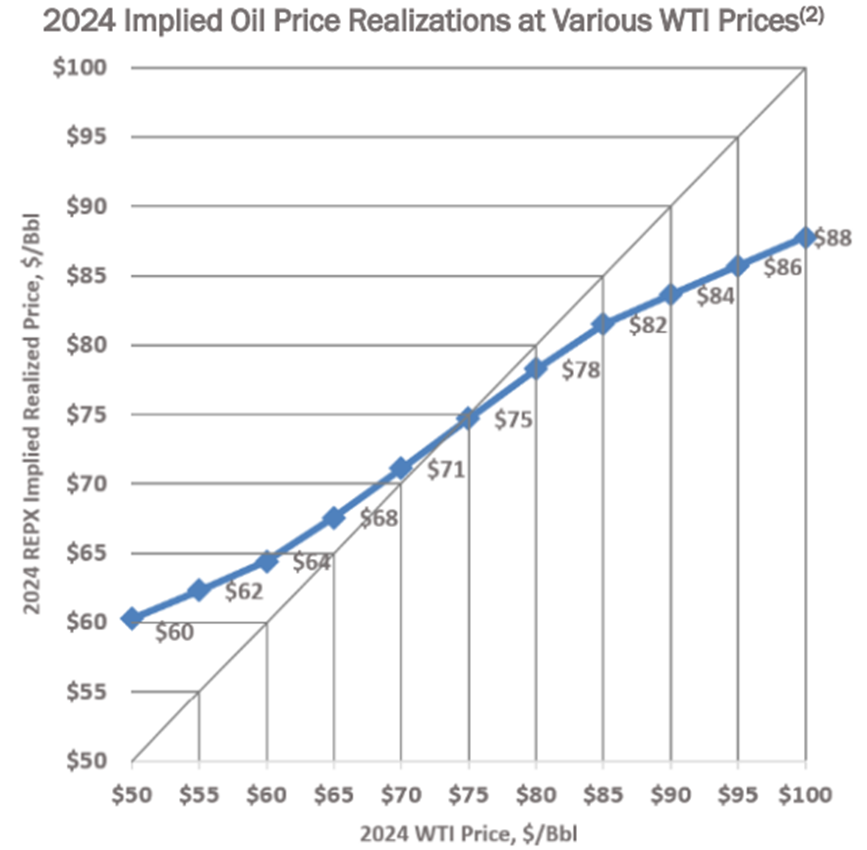

Full 2024 production is roughly 54% hedged for oil, giving a weighted average price floor of $66/bbl and a ceiling of $80/bbl for hedged production. According to the EIA, oil prices will likely stay around their current price for the year, with pricing tailwinds due to volatility in the Middle East and OPEC+ target cuts and headwinds due to rising global

inventories.

Natural gas prices are expected to inch back up toward the $4/mmbtu neighborhood by the end of 2024, with REPX having a weighted average price floor of $3.2/mmbtu for the year.

Capex is expected to be $120 million for the year, or around a 10% cut, with around 80% of Capex allocated toward drilling. REPX does not have any active acquisitions in mind, though management did state that they are open to small acquisitions like purchasing a full interest in the Power JV. Beyond that, REPX states that it does not intend to become a PDP (proven developed producing) acquirer but rather targets undeveloped assets with high reserves. This strategy allows for more sustainable long-term increases in production rather than short-term incremental gains.

FCF for the full year 2023 grew at 26% year over year to $70 million. If oil prices average $75 for 2024, cash flow would grow to be in excess of $100 million. Even in a dismal situation for oil prices, in which WTI is in the low $60s for much of 2024, REPX will still hold free cash flow constant at $70 million. Dividend coverage is supported even down to $40/bbl, though the speed at which debt is repaid would be significantly slower at these prices.

Deleveraging will be a top priority for 2024, with the interest expense growing to just over $5/boe. For 2023, the allocation of 61% of free cash flow went to paying down debt, with the remainder going toward the dividend. If oil prices meaningfully increase, REPX will likely be in a position to aggressively pay down debt before increasing the allocation toward the dividend. While there is not a specific debt target released, management states that the ideal area is 25-30% debt to capital, currently at 45%.

The dividend yield is projected at 5.22% for 2024, or around $1.44/share, which could grow larger if oil prices stay in the $75/bbl range and REPX keeps a similar free cash allocation to 2023. At the present moment, REPX has no plans for a repurchase plan for shares. However, with debt paid down in the future, management stated that other forms of shareholder return beyond the dividend could be on the cards.

Production Outlook

Despite an expected 10% cut to capex, REPX expects production growth in the area of 22 mboe/d or an 18.3% year-over-year increase. We feel this is more than practical, given that without the New Mexico acquisition, REPX still grew production 22% year-over-year.

REPX expects to have 21-26 drilling completions through the year, or about a 5% increase in the total operated well count. We expect this to be on the upper end of guidance as REPX has been able to experience lightning-fast drilling times, increasing the number of feet drilled per day by 58%. The time from the first drill to production has also substantially decreased, now coming in at just under 5 days.

Additionally, REPX will invest in infrastructure that improves the volume of natural gas that can be sold from extraction, which could increase revenue. More impactfully, it will improve the cash margin per well. By increasing the takeaway capacity, REPX can reduce bottlenecks, leading to more efficient transportation, which in turn leads to higher realized prices.

In conclusion, REPX is poised for robust future growth, with a strategic focus on sustainable development and operational efficiency. With plans to increase production by 18.3% year-over-year without meaningful increases in cost, we believe that REPX is a good choice for the dividend investor looking for a growing dividend coupled with some capital appreciation.

Competitive Comparisons