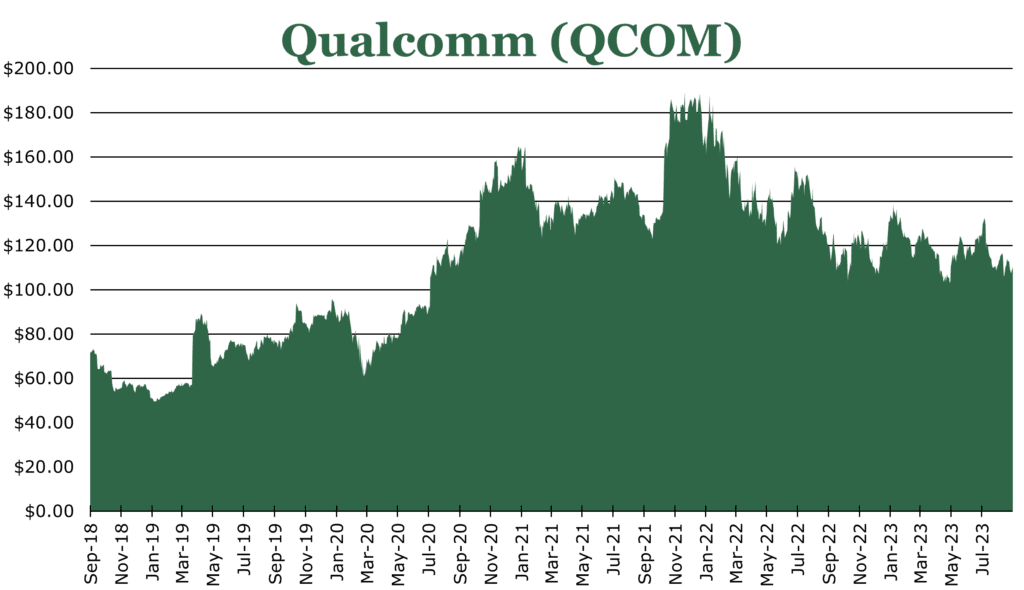

Qualcomm Drives into the Future with Apple Renewal and Auto Deals

| Price $109.72 | Core Holding | September 27, 2023 |

- 2.8% Dividend Yield, $5.5 billion in stock repurchase remaining.

- QCOM’s renewed agreement with Apple to supply 5G chips through FY26.

- The company anticipates significant growth in the Automotive sector, underscored by recent partnerships with BMW and Mercedes to supply infotainment chip systems.

- QCOM holds 140,000 patents across over 18 billion devices, an estimated 38% market share in RF IoT technology.

- Nuvia SoC ARM chipset to launch in FY24 for Windows, competing with Apple’s M1 and M2.

Investment Thesis

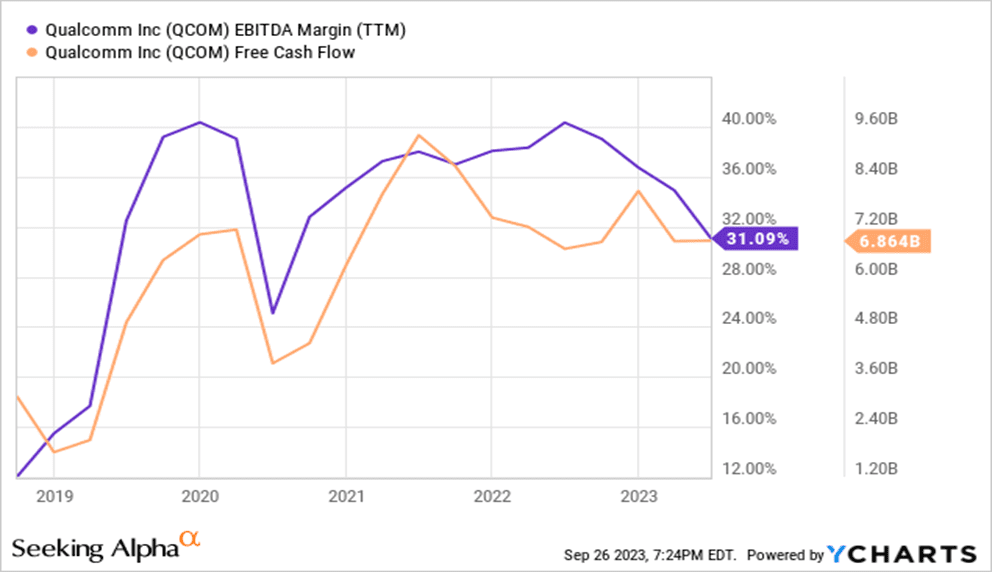

Qualcomm (QCOM) is an American semiconductor firm specializing in mobile and IoT technologies. QCOM saw a pullback in 3Q23 amid weaker-than-expected results and headwinds. Despite this, it remains a market leader, paying a 2.8% dividend yield.

The investment case has been reinforced with the renewal of the Apple supply agreement to supply QCOM 5G chips through FY26. QCOM holds 140,000 patents across over 18 billion devices. By leveraging existing relationships, QCOM stands to gain significantly in both the IoT and Automotive sectors within the decade, even as the mobile segment reaches maturity.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $9 X 18.0 = $160.0

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 3.3 | 3.1 | 2.8 |

| Price-to-Earnings | 12.0 | 11.0 | 9.4 |

Apple Deal and Mobile

After Apple acquired Intel’s cellular division in 2019, it was reported that they would try to market the iPhone 15 with internally developed 5G RF chips. According to the Wall Street Journal, Apple’s attempts failed. On September 11th, QCOM and Apple announced a renewed partnership to supply Apple with 5G RF chips through FY26. Although Apple will likely continue in-house development and possibly phase out QCOM as a supplier for RF in the longer term. QCOM concurs and assumes that it will supply around 20% of the RF chips for Apple’s 2026 flagship phone launch.

The Mobile segment makes up 73% of QCOM revenue quarterly. The segment’s primary headwind is persistent weakness in China, driving higher inventory levels than expected for OEMs. However, there will be some relief around the March Quarter of 2024 as OEMs draw down their excess inventories over the holiday season.

The cellular cycle is typically 33-39 months, with QCOM reporting the last peak was FY21. QCOM expects heavier tailwinds in the flagship season in FY24 as consumers purchase new phones at an accelerated rate.

Automotive and IoT

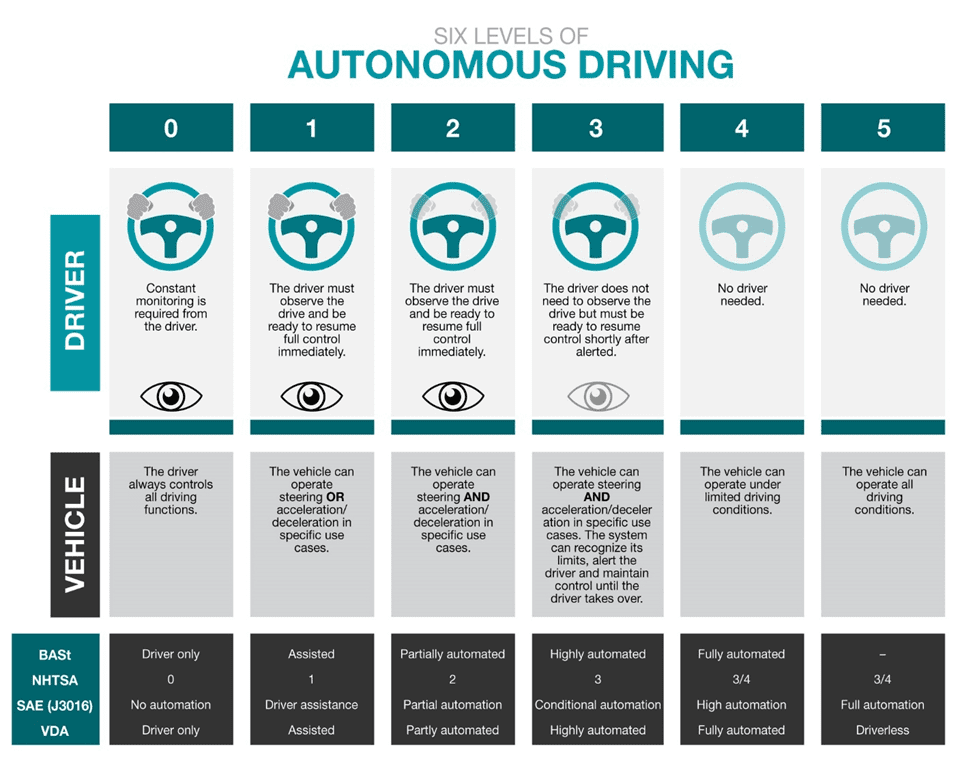

The automotive sector is still developing with the advent of more sensors, automation, and infotainment in vehicles. On September 5th, QCOM announced its partnership with BMW and Mercedes to supply infotainment chip systems.

With the FY22 acquisition of Arriver, a computer-vision company, QCOM intends to expand the Snapdragon SoC (System on Chip) into ADAS (Advanced Driver Assistance Systems). Already, QCOM has infotainment customers in BMW, Daimler-Benz, GM, and Stellantis. These existing relationships with OEMs are likely jumping-off points for ADAS system development and marketing. Currently, QCOM will focus on Tier-2 and Tier-3 ADAS, which the Snapdragon can already support. While this is short of full self-driving, QCOM believes that most of the tailwinds in the sector over the next decade will come

from this area.

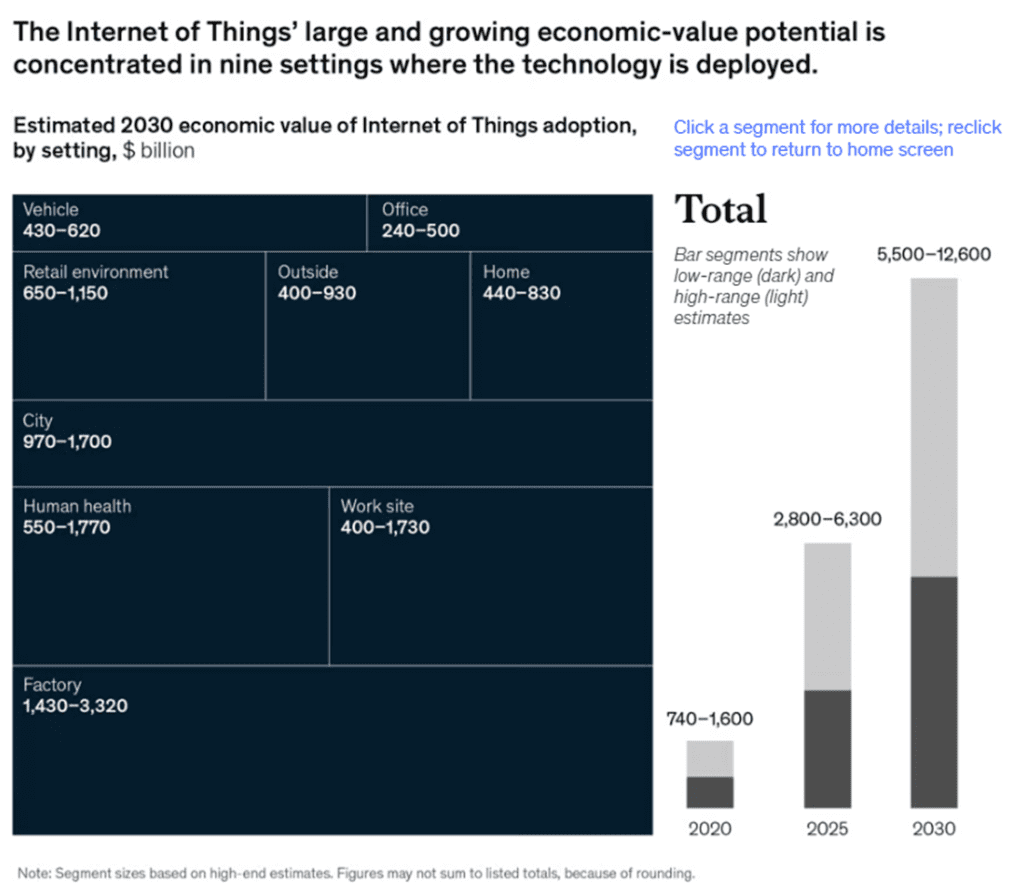

IoT still has room to grow, with the to-2030 CAGR expected to be 30.6%. IoT encompasses several still developing areas. There has been particular strength in manufacturing and traditionally low-tech industries seeking to capitalize on data insights and connectivity efficiencies.

QCOM currently leads the IoT pack for RF devices, with an estimated 38% market share by shipments. The IoT sector saw similar headwinds to mobile, with OEMs having excess inventory.

Research and Expansion

Through the QTL (Qualcomm Technology Licensing) segment, QCOM generates 17% of revenue. QCOM is a semiconductor patent powerhouse, with 140,000 patents across 18 billion devices.

In FY21 QCOM acquired Nuvia, a chip research firm. These chips will be QCOM’s next attempt at gaining market share in the Windows ecosystem. QCOM expects these chips to be marketable in FY24 with several OEMs. These chips are believed to target the notebook and small-laptop market. Intel, AMD, and Apple currently dominate this market. In a move away from the typical x86 architecture, Nuvia’s chipset will use ARM technology. Currently in use with Apple in the form of the M1 and M2 chips, ARM offers significant performance improvements in smaller form factors.

In August, QCOM agreed to a RISC-V (Reduced Instruction Set Computer) JV with NXP, Nordic Semiconductor, Bosch, and Infineon. While specific details are still not publicized, the JV will target automotive chipsets first with IoT and Mobile after.

Year over year, QCOM has increased R&D spending by 8%. This is a significant uptick compared to recent quarters. We believe this is a combination of Nuvia-driven development and ADAS development.

Risk

The US Government has imposed heavy export restrictions on RF technologies, forbidding selling 5G chips to Chinese OEMs like Huawei. On top of a sustained economic slump in China, this has severely limited 5G flagship uptake in China. Huawei and SMIC announced their 5nm 5G chipset launching in a flagship phone on September 12th. News outlets are reporting Huawei intends to license the chip to other manufacturers. In its first two weeks, phones with the chipset sold 300,000 units, second only to Apple.

Changes to Section 174 of the US Tax Code are now in effect for QCOM. This requires QCOM to amortize certain research costs rather than expense them. For domestic research, the time frame is 5 years. Internationally, it is 15 years. In the short term, QCOM must pay an additional $1.1 billion for FY23.

Despite the hypergrowth potential of the automotive sector, the industry has much longer product cycle times and stricter regulation than areas in which QCOM has typically worked. However, the industry-leading IoT arm and relationships with vehicle OEMs should make these growing pains less severe.

While many QCOM chipsets are designed utilizing ARM architecture, recent patent disputes and new ARM management have soured ARM’s relationship with several partners. There is a fierce legal battle between ARM and QCOM over a licensing dispute that could jeopardize the Nuvia chip launch. There is the potential that ARM wins and demands the chip not be marketed, though this is unlikely.

Outlook

A lack of demand-recovery in China and global OEMs having excess inventory pushed the June quarter results down below expectations. However, as OEMs cut down on excess inventory, QCOM expects a recovery in the March 2024 quarter.

In the mobile sector, revenue fell 25% year over year due to the previously discussed weakness and excess inventory. QCOM reports a higher price-per-chipset realized thanks to a better mix and higher selling prices. The mobile product line is maturing, which could lead to secular revenue stagnation. Even if companies begin to look inward for RF development, at least some RF revenue will be converted into the QTL segment. QCOM holds several key patents for 5G RF chipsets.

Automotive and IoT revenue can potentially be an explosive growth item for QCOM. June quarter was the 11th straight quarter of double-digit growth (13%) in the automotive area. CEO Christiano Amon said that QCOM expects automotive revenue to grow at a CAGR of 54%, reaching $9 billion in revenues by the end of the decade. QCOM expects the per-car basis to be $200-3,000 in value-added or around $30 billion in market opportunity. In the IoT world a similar 30.6% CAGR is expected, even with short-term weakness in the June quarter.

Despite short-term headwinds and a changing landscape, QCOM has the potential to grow its position as a semiconductor market leader. The sustained partnership with Apple and new partnerships in Automotive give QCOM a foot in the door for expanding into new product lines and continuing to capitalize on mature ones.

Competitive Comparisons