PVH’s Undervalued Brand Renaissance at 5.6x PE

| Price $64.79 | Growth Holding | March 25, 2025 |

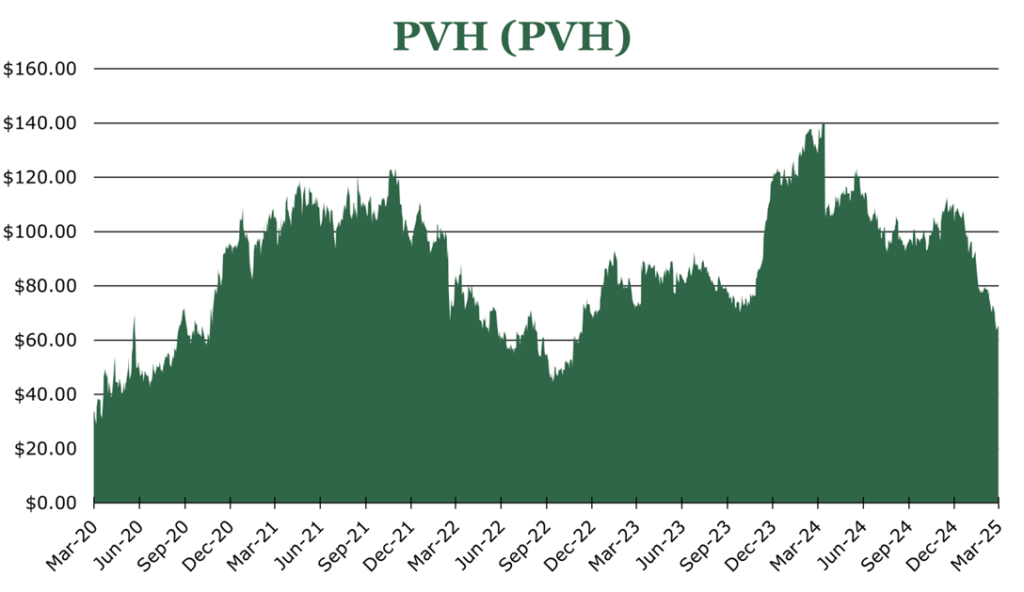

- Trading at just 5.6x PE following a 38.7% YTD decline.

- PVH’s strategic consolidation of its Tommy Hilfiger and Calvin Klein brands aims to restore pricing power and improve brand control, driving longer-term earnings power.

- Despite operational challenges, PVH maintains robust free cash flow of $715.3 million over the trailing twelve months, and a healthy balance sheet of 2.6x debt to EBITDA.

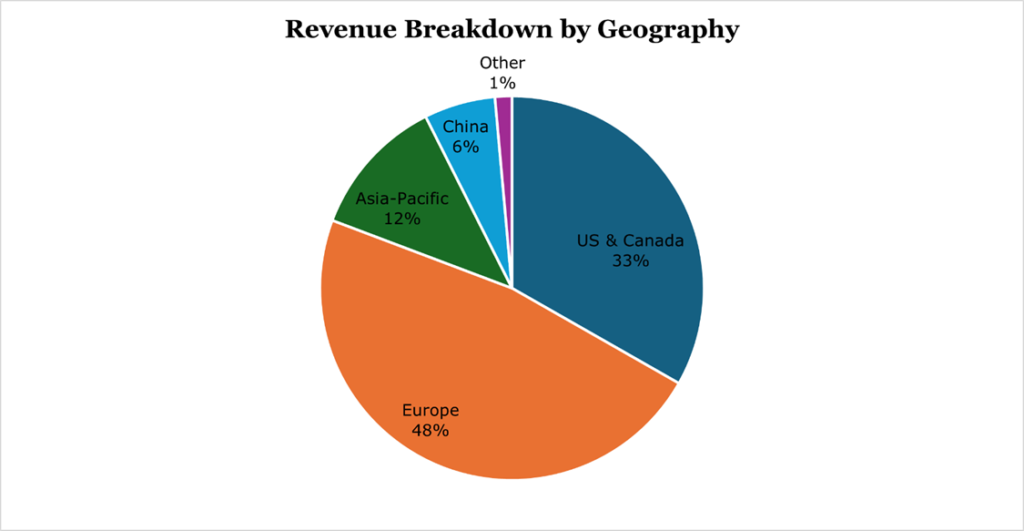

- While China represents 6% of revenue and 16% of EBT, PVH’s addition to China’s “unreliable entity list” appears to be priced in.

- PVH’s strategic initiatives including organic e-commerce growth and manufacturing consolidation position the company for potential margin improvement toward its long-term 15% operating margin target.

Investment Thesis

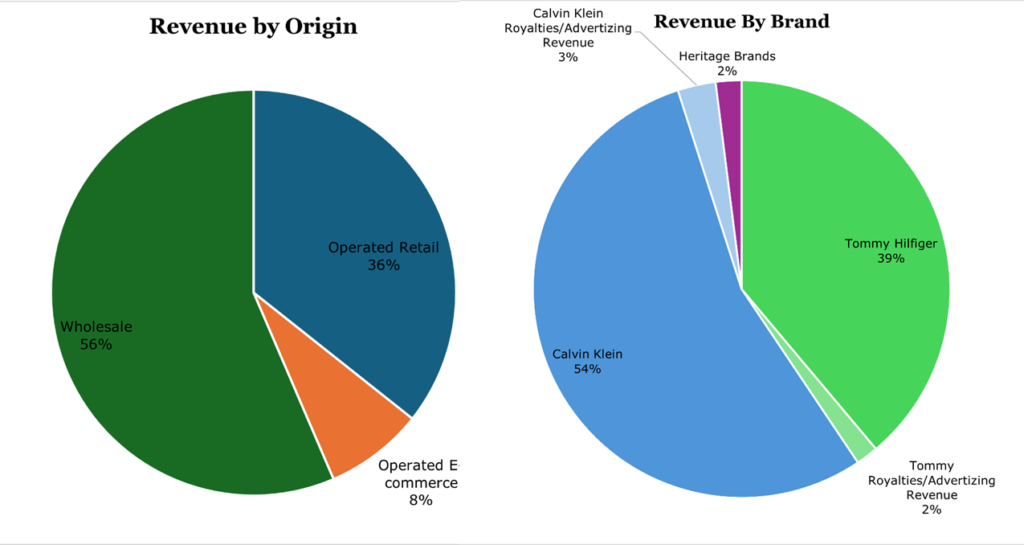

PVH Corp (PVH) is a US-based retailer and wholesaler of the Tommy Hilfiger and Calvin Klein brands. Since 2022, PVH has entered a program of cost savings, e-commerce investments, and brand consolidation to improve control over its brands to accelerate organic growth in targeted channels like e-commerce. The program has the long-term goal of restoring pricing power and brand reputation globally.

Between a weak macroeconomic environment harming sales, a weaker Euro harming the top line, risks to Chinese operations, and potential margin compression from bringing more operations in-house, the stock has collapsed 38.7% YTD. While we agree some risks are present, we also believe they are more than sufficiently priced into the stock. In our view, PVH is a long-term play, and the recent sharp downward price move at just 5.6x PE marks an attractive entry point.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E27 EPS X P/E = $13.00 X 11.3x = $147

Historically, PVH has had a P/E around 10x. However, given it is attempting to consolidate control over its brands which should provide additional pricing power, we expect earnings power to increase in tandem which should justify a P/E similar to peers like VF Corp (North Face, Vans), UnderArmor, or Kontoor Brands (Wrangler and Lee).

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.5 | 0.5 | 0.4 |

| Price-to-Earnings | 5.9 | 5.8 | 5.0 |

China Risks

In October 2024, the MOFCOM (Chinese Ministry of Commerce) announced it was launching an investigation into unfair business practices by PVH. The issue largely stems from PVH boycotting cotton suppliers sourcing from the Xinjiang province, both to comply with US sanctions and consumer boycotts stemming from allegations that several cotton enterprises in the province were utilizing slave labor. In February 2025, MOFCOM announced it had found that PVH had engaged in anti-Chinese business practices and would be added to the ‘unreliable entity list’. The list sat dormant since its creation in 2020, but renewed trade tensions between the US and China have caused its use for the first time.

PVH joins defense contractors operating in Taiwan and a biotech company on the list, making odd company. The list itself is a simple designation, but it does grant MOFCOM the ability to levy sanctions it deems to be ‘necessary’ which could include restricting operations, an outright ban, prohibitions on expansion, or fines. To be removed from the list, entities must take actions which MOFCOM deems to be ‘corrective’.

In our view, this is simple collateral damage. China sought a firm that was active in China and would have the brand recognition for it to be notable, but not so large that it would impact Chinese economic activity or Chinese consumers.

China represents only 6% of PVH’s revenue, and around 20% of its manufacturing base. While PVH doesn’t geographically break down individual countries where retail locations are located, it is likely that of the 4,000 retail stores in Asia pacific, it is likely around 1,400 are in China. While we do not expect PVH to be fully prohibited from conducting business in China, the impact of being on the list will likely dull Chinese consumer sentiment toward the brands. China is an important growth engine for PVH, growing 7% year over year in the quarter ending October 2024. Additionally, given China represents 16% of EBT (earnings before taxes) it is likely their operating costs in the area are much lower than average. While losing this business would slow growth and compress margins, we think the risk of an outright ban is unlikely, and the risk of a worst case has already been priced in.

Brands

The two primary brands of PVH are Tommy Hilfiger and Calvin Klein. While PVH has divested from its historical core brands such as Izod, Arrow and Van Heusen it licenses back some product lines reported as “heritage brands”.

A plurality of PVH revenue comes from wholesale with retail partners such as Macy’s. Operated retails includes the 1,400 corporate operated stores, 1,450 store-in-store locations and approximately 1,800 franchised locations. A small but growing component comes from operated e-commerce channels, namely the flagship websites for each brand. Management has stated that e-commerce is a channel they are targeting for organic growth, as e-commerce tends to have fewer promotional pressures given the high control over inventory and product availability.

Both Calvin Klein and Tommy Hilfiger have struggled with brand consistency due to their heavily licensed histories. For example, in the annual report for 2015, PVH reported 27 major licensing partners across its brands, sometimes overlapping with one another in supply areas and geographies. As of the end of 2023, PVH had cut down the list of its major licensing partners to just 12.

During 2022, PVH added several industry veterans to its brand teams, including several from Zara at Calvin Klein, and a Global Brand President from H&M at Tommy Hilfiger. While unlikely to mirror H&M and Zara exactly, we believe that this is the beginning of an effort to consolidate and bring major lines of procurement in-house, like H&M, while still maintaining fast-fashion flexibility.

In November 2022, PVH announced it would terminate its long-term relationship with G-III. Most roll offs would begin in 2025 and end in 2027. G-III has historically been a major North American partner of PVH, being the primary supplier and wholesaler of outerwear, activewear, and 20% of the women’s wholesale portfolio including formalwear. During 2025, PVH expects to execute on the North American side of the women’s wholesale portfolio. Over time, we expect PVH to execute on other lines where G-III is a primary licensee, such as activewear, and eventually transition out the remaining apparel licenses.

In the non-clothing area, given PVH lacks the execution experience, we do not see a reason for them to bring things like leather goods, accessories, or fragrances in-house and will likely continue to be a license-only business.

Risk

One of the largest uncertainties surrounding PVH is currency effect. With US tariffs being implemented slowly, the US dollar has strengthened against most global currencies, including the Euro where PVH realizes most of its revenues. However, the balance could shift the other way. In mid-March, weaker than expected retail sales in the US, uncertainty about the Fed’s policymaking, and a German mega-spending program sent the euro to five-month highs. For the year ending January 2025, PVH expects currency effect to weigh down earnings only by around 2%, though the revenue effect will likely be more pronounced.

PVH’s “PVH+” plan released in 2022 outlined ambitious 2025 goals including $12.5 billion in revenue, 15% operating margins and $1+ billion in free cash flow. While falling short of their lofty goals in the short term, over the trailing twelve months posting $8.7 billion in revenue, 9.2% operating margin and $715.3 million in free cash, PVH is making steady progress along a backdrop of sluggish global economic growth. While consumption is expected to continue to make up an above-the-norm component of economic growth globally, we do expect there to be a slowdown in domestic US consumption, at least partially offset by a Chinese recovery in the latter part of the year. As previously discussed though, PVH may not be able to take part in a Chinese recovery if MOFCOM implements the harshest penalties available.

Financials and Outlook

For the year ending January 2024, PVH expects to report a revenue decrease of 6-7%, with 5% due to currency effect and having a 53rd week in their 2023 financial year. PVH issued a down-revision on its EPS (earnings per share) guidance by a similar 6% to $10.63 at the midpoint. The declines expected for the full year 2024, outside of currency and 53rd week effect, are due to increased promotional activity in the US and China amid a hard macro environment. During the quarter ending October 2024, management commented that inventories were up 9% year over year due to the holiday season beginning earlier than normal in the US.

| Brand | Revenue Growth | EBT Margin | EBT Margin Expansion (contraction) |

| Tommy Hilfiger | -4.8% | 8.9% | -110bps |

| Calvin Klein | -1.4% | 13.2% | +100bps |

| Heritage Brands | -59.8% | 20.5% | +1510bps |

| Company Wide | -6.6% | 8.9% | +40bps |

9 Months ending October 2024

We expect the final quarter of 2024 to report compressed margins amid the higher promotional activity. During 2025, we expect a small compression of operating margins due to the movement of another large component of operations to internal control. Depending on macroeconomic conditions playing out during 2025, promotional activity may again see a large spike during the last quarter of the year and holiday season which could weigh down full year margins.

We feel that excluding elevated inventory levels, the balance sheet is healthy. Over the trailing twelve months PVH has a net debt to EBITDA of 2.6x, which is within the range of its peers. Over the trailing twelve months PVH generated $715.3 million in free cash flow, which is ahead of peers, and maintains a strong cash position of $560 million.

The dividend yield is a token $0.15 annually, or 0.23% yield. However, PVH has authorization to repurchase 53% of its shares through 2028, and repurchased approximately $400 million through the end of 2024 or 10.5% of outstanding shares. Given the stock declined 38.7% YTD, we expect the volume of share repurchases to increase during the year if macroeconomic conditions hold up.

Conclusion

Overall, PVH has laid a solid foundation for brand control, which should restore pricing power. Additionally, continued growth of e-commerce, which traditionally has lower promotional pressure, will also add to unlocking earnings potential. While there are some risks present around China and currency translation, the 5.6x PE is an attractive entry point in our view.

Peer Comparisons