Pork Powerhouse Pivots to High-Margin Focus

| Price $22.98 | Dividend Holding | May 9, 2025 |

- 4.35% Dividend Yield

- SFD maintains strong financial health with a 0.7x debt-to-EBITDA ratio, $928 million cash on hand, and no major debt payments until 2027.

- The company plans $400-500 million in capex for 2025, split between maintenance and operational improvements focused on automation.

- The company has already cut 20% of its herd size since December 2024, with the goal of internally producing only 30% of needed hogs to stabilize margins across commodity cycles.

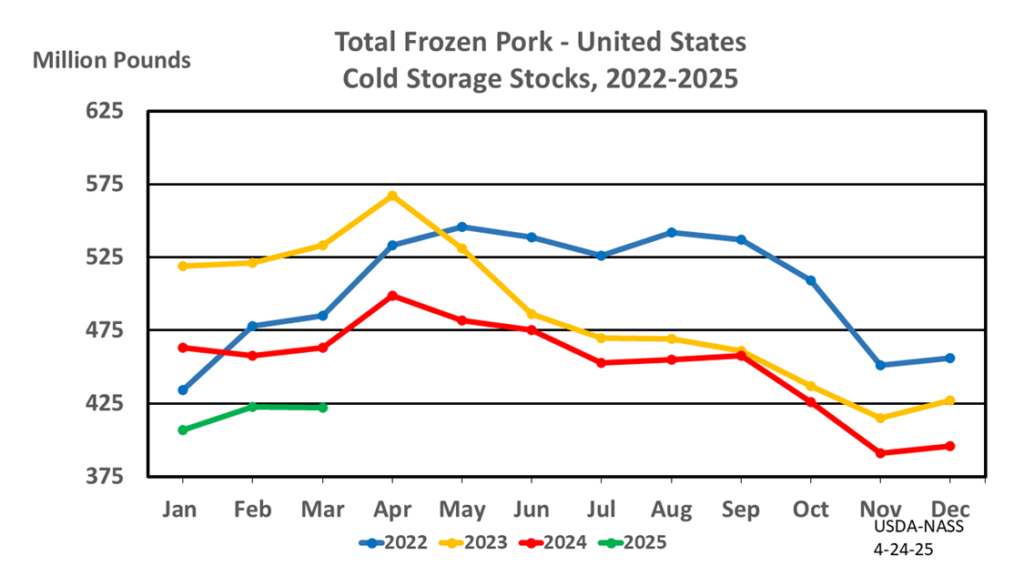

- Despite export challenges, the USDA only expects a 2% drop in overall pork trade, and low storage levels may limit pricing pressures from oversupply in the domestic market.

Investment Thesis

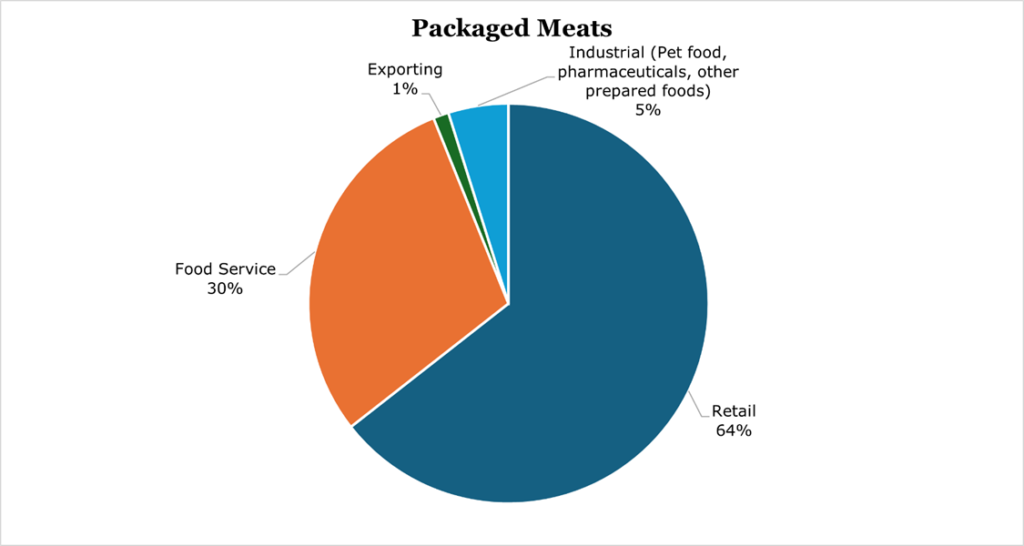

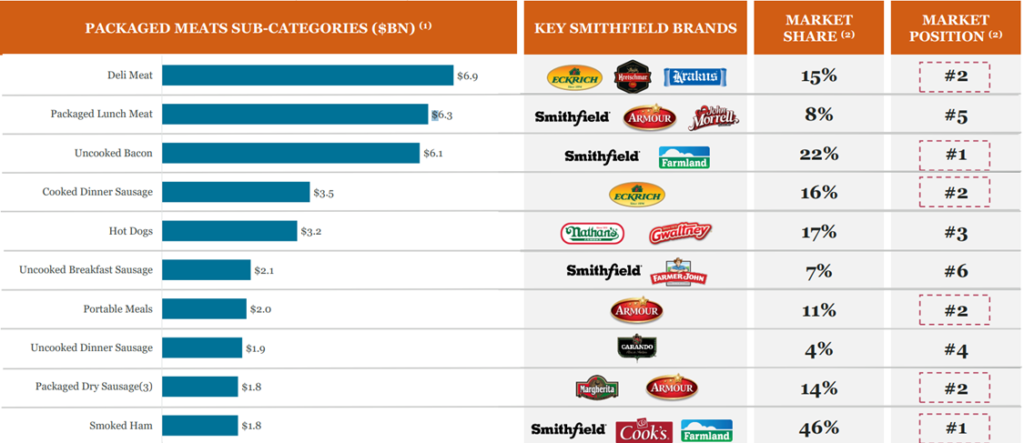

Smithfield Foods (SFD) is a producer and processor of pork, and is the largest producer of pork based products in the world. Domestically, SFD has a top market share in several prepared food categories such as deli meats, bacon, sausage, and smoked ham.

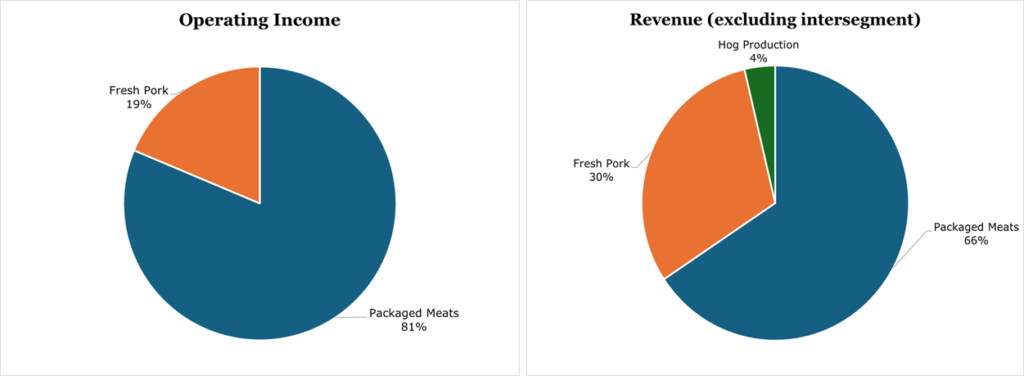

Due to the commoditized nature of pork, management has stated it is seeking to focus on the high margin packaged meats segment including limiting hog production to just 30% of needs. The attempt is to position SFD into higher margin products like dry sausage, while minimizing direct exposure to commodity cycles. While there are some short-term headwinds associated with tariffs, it has pushed management into a strategy of finding buyers for parts of the pig that are traditionally exported, such as in pharmaceuticals, dog food, and snack food.

SFD offers a 4.35% dividend yield providing solid income while maintaining strong financial health with just 0.7x debt to EBITDA and no major debt payments until 2027. SFD’s dominant market position in both branded and private label segments creates a natural floor even during economic downturns when consumers typically trade down in protein choices.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $2.35 X 14.1 = $33.13

We believe that the focus on high-margin products and insulating the company from commodity cycles will directly lead to higher earnings power over the long term. A P/E of 14.1x would bring SFD in line closer to peers like Tyson Foods.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.6 | 0.6 | 0.6 |

| Price-to-Earnings | 10.0 | 10.1 | 9.8 |

SeekingAlpha Analyst Consensus

Market

During the 2008 Financial Crisis, pre-packaged value items like SPAM saw large increases in sales as consumers sought cheap protein. Similarly, despite less seasonal summer spending on products like hot dogs, overall sales growth remained steady at 2%. During a general economic downturn, we expect similar results of flat to moderate sales growth, depending on the level of trading down consumers do. Given economic conditions are thus far holding up, SFD affirmed its current guidance of low to mid-single digit growth. Additionally, as the largest pork producer in the United States, SFD is a large provider of private label brands. In the event of an economy with high trading down, SFD likely still has a natural floor.

In real economic terms, much of the production of SFD has exposure to both sides of the economy. During periods of expansion people are likely to eat out or go to events in which they purchase food away from home, and during downturns they choose to eat at home. Generally speaking, branded and pre-packaged products have a high margin buffer that would allow SFD to absorb at least some of the cost of production through price increases, packaging changes, or product mix. According to the USDA Foreign Agricultural Service, around 30% of total domestic US pork production is exported primarily to Mexico, China, and Japan. During 2018, China levied 55% tariffs on US pork in retaliation for other US duties which depressed market prices into loss-taking territory.

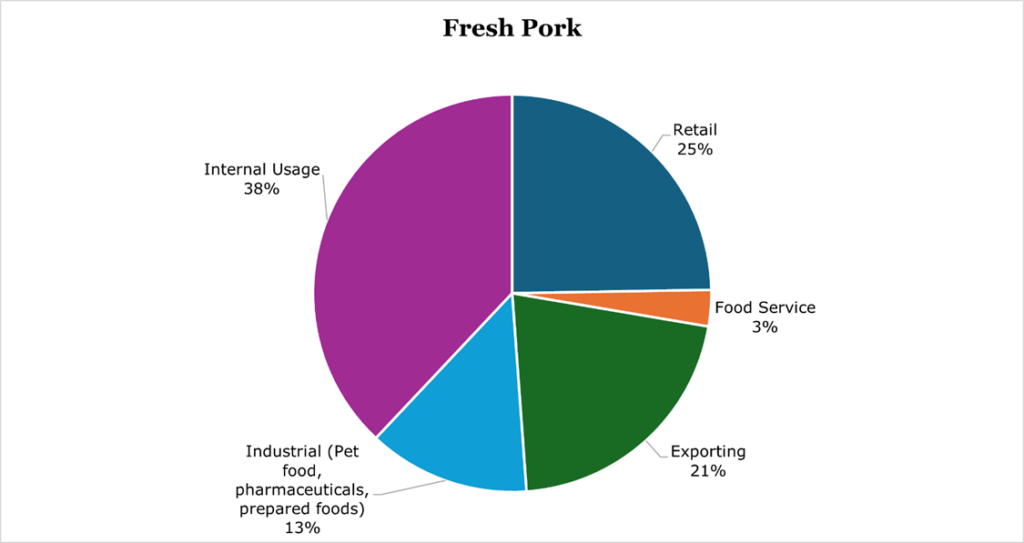

With China now levying 125% tariffs on all US goods including pork, SFD has effectively been cut from China leaving about 3% of revenues potentially at risk. Management has stated that it plans to ‘pivot’ to other exporters, though with many countries planning to retaliate on US tariffs we believe that pork will likely see prices fall domestically during 2025 with the resulting over-supply. Around 13% of SFD’s 2024 revenues were derived from exporting. However, the Chinese and US Governments have announced a preliminary pause on tariffs for the next 90 days, which may bring tariff levels down enough it is viable to export to China again.

The largest impact in our view is export products that US consumers traditionally do not eat, such as tails, feet, and heads.

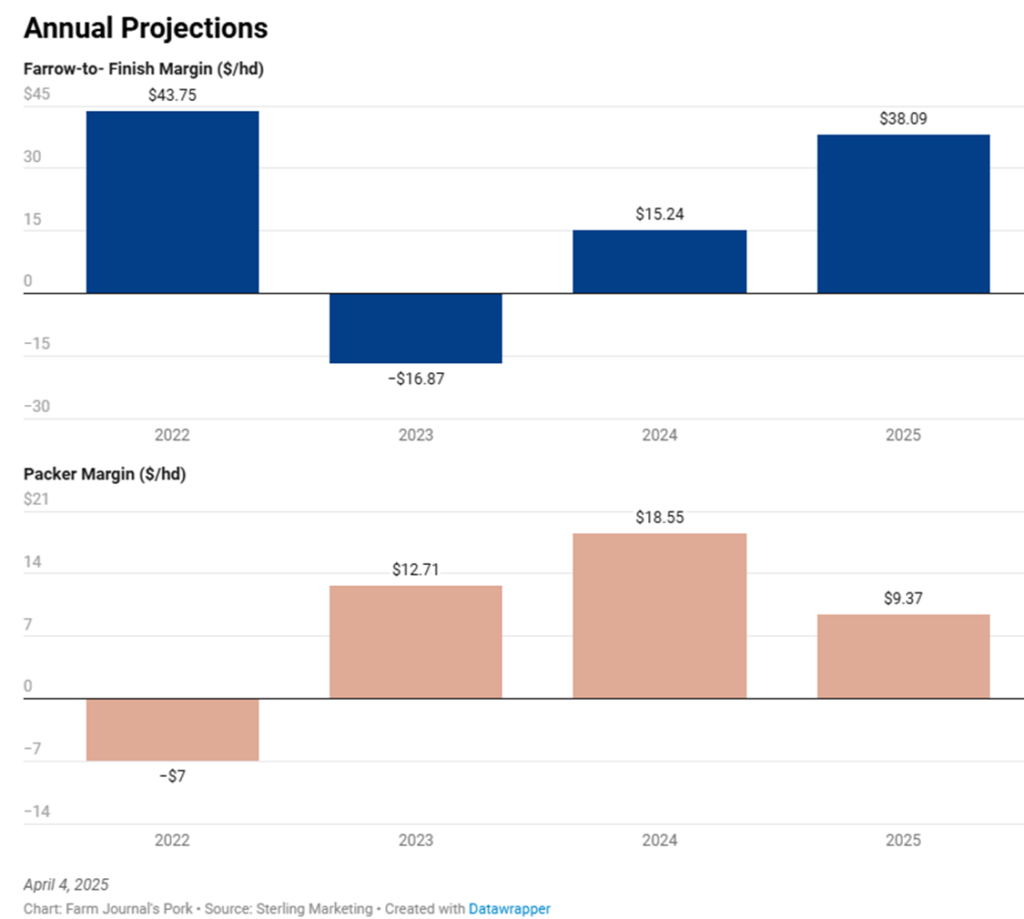

Overall, the USDA only expects a 2% drop in pork trade as a result of the tariffs, and storage levels are at cyclical lows so pricing pressures may be more limited than initially expected. The metric to keep an eye on upstream is the farrow-to-finish margin, effectively translating the cost of raising a pig to slaughter. Downstream, it is the packing margin.

Operations

SFD operates three segments, representing each stage of the production process. For hog production across any given year, SFD utilizes approximately 80% of hogs internally, around 15 million, with the remaining 2.5 million being sold externally. The hogs from around 500 owned farms in the US are slaughtered and processed at 8 processing plants capable of butchering 108,000 hogs daily. From there, outputs are sent to 31 different packaged meat plants. Typically, only the fresh pork and packaged meat segments are profitable.

| Segment | Revenue (year over year) | Price | Volume |

| Packaged Meats | 1.2% | 5.7% | -4.2% |

| Fresh Pork | 4.9% | 4.8% | ~flat |

| Hog Sales | 32% | Not tracked | Not tracked |

| Company Wide | 9.5% |

For the quarter ending March 2025

Hog sales grew 32% year over year in the quarter ending March 2025 primarily due to downsizing operations and favorable realizations, with adjusted operating margins coming in at 0.1% during the typically seasonally low first quarter. For the full year 2025, SFD expects hog production operating margins to be between -3% and 3%, which even on the low side would be at least a 120bps of improvement. Largely, this is due to strategic downsizing of the number of hogs held by SFD directly and much more favorable supply and demand dynamics.

Typically, the hog production segment runs at a slight loss as it must not only maintain farms with high fixed costs, but also must process and produce feed which represent nearly 60% of variable costs exposing the segment to both sides of the commodity cycle. However, since its public listing, SFD has been open about its plans to substantially cut its herd sizes and focus more heavily on packaged foods rather than raw hogs. Since December 2024, SFD has cut approximately 20% of its herd size, with the end goal of holding only 30% of needs as internally produced. Over the long term, the intended effect is stabilizing margins and decoupled earnings from commodity cycles. On the packing-weighted model SFD will lose upside when markets are booming, such as 2022, but will be in a much better position during downsides like in 2023.

The fresh pork segment grew sales 4.9% year over year during the quarter ending March 2025, driven by steady demand despite marginally down supply. Fresh pork operating margins contracted by 170bps due to increases in hog costs, with around 50% of hogs sourced internally and 50% sourced from agreements with partners. Management expects total hogs supplied internally to the segment to fall to 40% during 2025. For the full year 2025, management expects the segment to remain profitable, though the uncertainties surrounding tariffs have potentially more downside, expecting between a 33% drop in operating income and an 11% gain.

Over the long term the fresh pork segment is also engaging in a shift toward high-value-added products. SFD management stated it will continue to focus on areas it is dominant in, such as its #1 40% market share in pre-marinated pork products. Additionally, it emphasized its focus on ‘increasing realizable value of hogs’, which we interpret as focusing less on exporting parts traditionally unused domestically and will instead find new markets such as selling skins for snack products, other parts for pet food, and pharmaceutical uses. Largely we believe this decision was made independently of tariffs though the tariffs have likely sped up the implementation.

Packaged meat is the largest and most profitable segment and includes brands such as Nathan’s Famous. During the quarter ending March 2025 sales grew 1.2%. Operating margins decreased 120bps due to both a loss in volume on branded products due to trade-down dynamics and increases in input costs. During 2024, 80% of inputs were sourced from the fresh pork segment. For 2025, management expects operating income to be roughly flat year over year, though as with the other segments, tariffs introduce uncertainty that have a potential operating income downside of around -7.1%.

On the retail strategy side, several brands like the dry sausage brands Carando and Margherita only have 40% penetration in stores compared to the Smithfield brand’s 93%. We expect elevated promotional spend over the medium term to boost consumer spend on these brands as they build footprint. On the production side SFD will be dedicating less capacity for low-repeat and low-margin seasonal items and instead trying to capture customers who purchase more frequently. While this will likely decrease aggregate weight sold, it will increase margins. Since 2019, net weight of products sold has decreased by 3% while the number of units sold has increased 22%.

Risk

As previously mentioned, during economic downturn consumers tend to trade down. Historically, downturns are a time in which there can be a ‘race-to-the-bottom’ effect as producers attempt to take market share over the short-term through promotional activity. SFD stated that they do not see this as an immediate risk, and that it will not be engaging in aggressive price cutting to take share. We believe that SFD will choose instead to weather out economic conditions aside from previously mentioned promotion spend increases to increase penetration. Given SFD is one of the largest providers of private label products in the United States, we believe this provides them with a stable floor, albeit a lower margin one.

Despite a large divestment to facilitate the IPO, SFD is still roughly 93% owned by Chinese meatpacking giant WH Group and has secured continuation of the existing board until at least 2028. In the past, Chinese ownership of SFD has not had many benefits, with SFD not exempted from Chinese tariffs on US goods and it obviously has not provided political favorability domestically.

SFD has a reputation of utilizing contract labor, which has historically included a large percentage of undocumented immigrants and even children. It should be noted that SFD is not unique in this aspect, with much of the meatpacking industry in the US operating similarly. Management has stated it is taking better control of the hiring in its plants.

Financials and Outlook

SFD ended the quarter ending March 2025 with $928 million in cash on hand due to the first quarter traditionally being a high working capital period. Over the trailing twelve months ending March 2025 SFD generated $785 million in free cash flow.

For 2025, SFD expects to pay out $1.00 per share or a yield of 4.35%. Currently, there are no active share repurchase programs. We expect free cash during 2025 to be marginally down due to the increase in capex spending and headwinds associated with tariffs. However, SFD has a debt to EBITDA of only 0.7x and no major debt payments until 2027.

For 2025, management expects to spend between $400 and $500 million in capex, with around half being maintenance and the other half going toward improvements.

In the hog production segment, as previously discussed, efficiency improvements are largely going to be reducing the number of company-owned hogs which we expect to prop up the segment’s bottom line into breakeven over the short term. Management indicated it is on the tail end of its plan to introduce more favorable proprietary genetics to its herds. The specifics are not clarified in filings, though management indicated that the metrics they are focusing most on are PMSY (pigs marketed per sow per year) and nutritional savings. On the positive side, selecting these traits translates to larger litter and faster time to maturity using less food. However, an important tradeoff they have noted is that herd health has been a headwind.

In the packaged meats and fresh pork retail section, capex investments are going to be focused on automation to reduce fixed costs. As previously discussed management is focusing effort on the repeat customer packaged area, which will likely mean a continued reduction in SKUs. While this may impact volumes, we believe it will translate to stronger margins.

Conclusion

Overall, we believe that over the short term SFD is relatively insulated from tariffs given its strong financial position and dominant market share. Over the long-term we are confident in management ability to execute its focus on high-margin packaged meats.

Peer Comparisons