Perrigo Outlook Healed by Repositioning

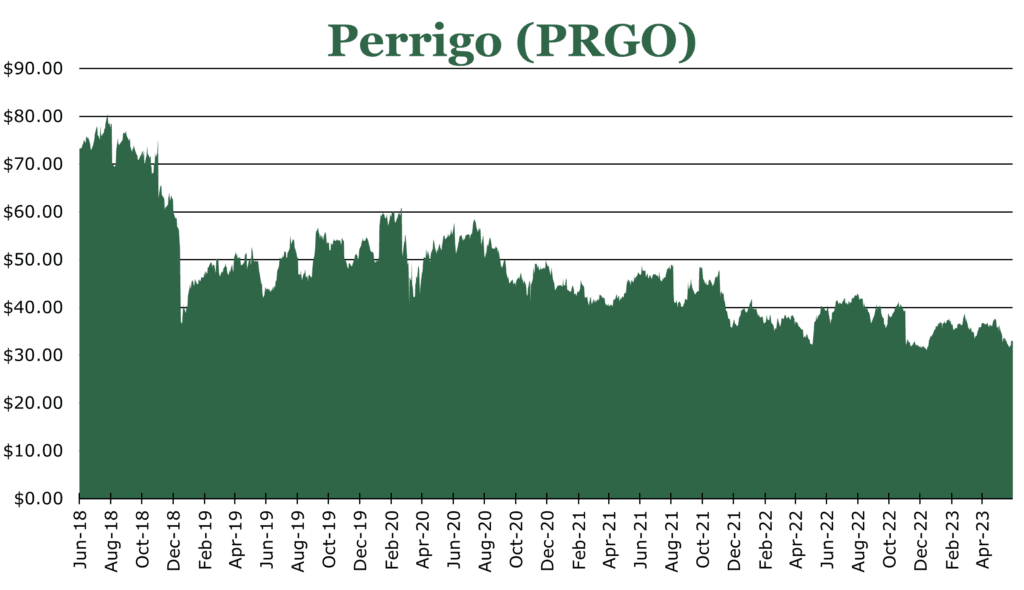

| Price $33.03 | Dividend Holding | June 6, 2023 |

- 3.3% dividend yield, 100% operating cash flow conversion and further growth in EPS expected for FY23.

- Repositioning toward consumer-facing health brand progressing with divestitures and acquisitions. Power player in consumer staples.

- Tax situation resolved, $974 million in losses mitigated.

- Potentially game-changing approval with Opill prescription birth control approved for moving to OTC (Over The Counter) usage.

- Baby formula operation is undergoing expansion to allow for an additional 100 million units in volume per year, in the face of global shortages of baby formula.

Investment Thesis

Perrigo (PRGO) is a manufacturer of private-label and contract-produced over-the-counter medications. In 2020 PRGO embarked on a program to reposition itself to be an exclusively consumer-facing OTC brand. This includes simplifying the sales process for 1000 products, extensive divestitures, and expanding the addressable market through acquisitions.

PRGO has seen an acceleration in its top line growth thanks to its efforts in streamlining and repositioning. While we have concerns about the debt level, the 3.31% dividend yield coupled with being one of the largest consumer staples manufacturers, makes PRGO attractive for a recession resistant dividend investment.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $3.05 X 16.2 = $49.41.

| E2023 | E2024 | E2025 | |

|---|---|---|---|

| Price-to-Sales | 0.9 | 0.9 | 0.9 |

| Price-to-Earnings | 12.5 | 10.6 | 9.2 |

Operations

Unlike traditional pharmaceutical companies, PRGO is repositioning to be an exclusively OTC consumer-care brand. In the United States and Europe, PRGO owns brands that treat common ailments such as allergies, colds, and flu. Additionally, PRGO operates several women’s health, baby food, and skin care brands. Often overlooked, the OTC drug market size is expected to increase by 50% in the next decade to $233 billion globally.

As part of the “Optimizing and Accelerating” program, PRGO is changing how it distributes drugs to consumers and stores utilizing a direct sales model. This initiative attempts to reduce supply chain hangs which have caused infant formula and children’s medicine shortages. This will optimize the delivery of nearly 1,000 products by FY24. This changeover will slightly decrease net results for FY23, but in the long term will increase accessibility and marketability.

Acquisitions and Approvals

PRGO utilizes Merger and Acquisitions (M&A) to expand the product portfolio or streamline existing operations. PRGO conducted 14 M&A operations from 1Q22-1Q23. M&A will remain an important part of the realignment toward being a dedicated consumer care company.

PRGO’s Opill has was submitted to the FDA’s advisory committee and, as of May 10th was recommended for approval for OTC usage. Opill was previously prescription only, and the formulation has been approved since 1960. The US contraceptive market was valued at $8.3 billion in FY22 and is expected to grow at a 6% annually over the next 5 years. Pills have had only 40% market penetration, given the barriers to entry. PRGO has increased net sales in the women’s health and contraceptive category by 95.4% in 1Q23, which could easily grow once Opill sees widespread OTC distribution.

In FY22 PRGO acquired Nestle’s infant formula plant for $170 million and an additional $60 million for modernizations and expansions. This will allow PRGO to increase production by 100 million units annually by the end of FY23. PRGO manufactures baby formula for 17 off-label brands and is a contract manufacturer for several private-label brands including Nestle. PRGO will also acquire the Canadian Good Start baby formula brand as part of the transaction.

Risk

In March of FY23, the FDA released new guidance for baby formula. The guidelines pertain to new quality control standards for infant nutrition. While PRGO does not release exact figures, management stated that the new guidelines would “significantly increase” manufacturing costs. Nonetheless, PRGO still expects to be able to undercut name brands by 40% and increase the margin of the segment through the added scale of the Nestle plant and increase in contract production demand. PRGO maintains a debt-to-EBITDA level of 5.3x, a decrease quarter over quarter. The expected bump in operating cash flow conversion will likely assist in delevering, we still have concerns about the high debt load.

Outlook

PRGO has embarked on a divestiture campaign to eliminate margin-dilutive businesses. Previously, it manufactured and marketed various generic topicals for dermatological purposes. This unit was sold off in late FY21 for $1.5 billion. In FY22, South American segments were entirely divested for an unreleased sum.

FY23 outlook is positive, with EPS expecting to land between $2.50 and $2.70 per share with net sales growth at 7-11%. Operating cash conversion is expected to increase from 32% to 100% conversion by the end of the year. Results will be weighed toward the year’s second half when most impacts of the previous year’s M&A and divestitures will be realized. The largest positive from 1Q23 was the dismissal of the Notice of Proposed Adjustment from the IRS. This eliminated $974 million in potential tax-related liabilities. Seeing a significant recovery in net margin, increasing 400bps year over year, is promising. If efficiency improvements continue to be realized, coupled with the Opill going OTC, PRGO is poised to accelerate its growth and profitability.

Competitive Comparisons

| Perrigo (PRGO) | Elanco Animal Health (ELAN) | Organon (OGN) | Johnson and Johnson (JNJ) | |

|---|---|---|---|---|

| Price-to-Earnings (FWD) | 12.5 | 11.4 | 4.7 | 14.9 |

| Price-to-Sales (TTM) | 1.0 | 1.0 | 0.8 | 4.3 |

| Price-to-Cash Flow (TTM) | 18.1 | 12.2 | 6.1 | 21.6 |

| EV-to-EBITDA (FWD) | 11.3 | 10.6 | 6.7 | 13.2 |

| Dividend Yield | 3.3% | 0.0% | 5.6% | 3.0% |