Onshoring Brightens Canadian Solar’s Future

| Price $11.32 | Growth Holding | December 23, 2024 |

- Trading at far less than the sum of its parts, with Recurrent Energy and CSI Solar combined being worth $87.26 per CSIQ share.

- Sold 20% of utility-scale project manager to Blackrock, repositioning it to begin operating battery-storage and solar-generation to enhance recurring revenues.

- The global push toward renewable energy is secular and likely to accelerate as AI-driven datacenter demand rises.

- Onshoring more of the manufacturing base to the US will mitigate tariff risks in both batteries and solar.

- CSI Solar has shipped over 22 GW of solar components year to date, making it the #5 spot in global market share.

Investment Thesis

Canadian Solar (CSIQ) is a solar power company that designs and manufactures solar power solutions and provides utility-level project management.

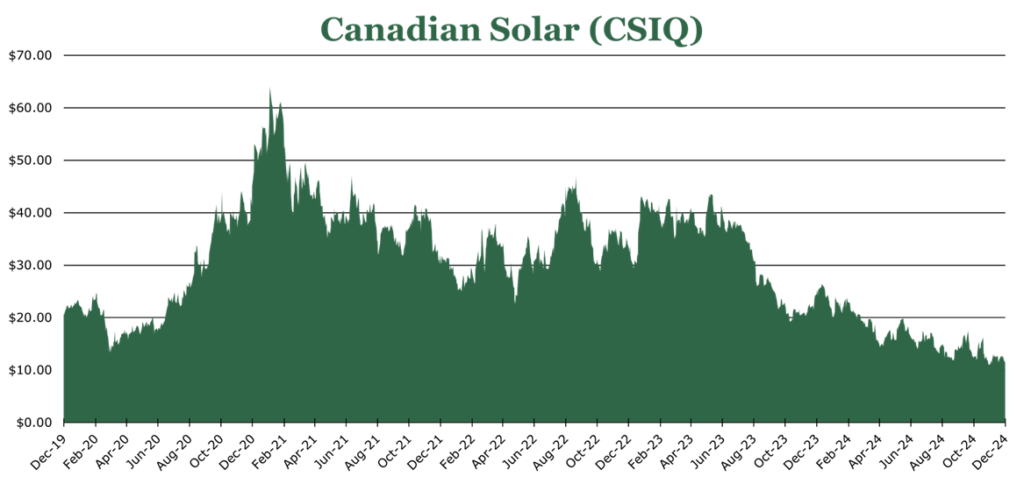

Near term political risks, tariffs, and Chinese oversupply have muted investor enthusiasm, with CSIQ seeing a sharp selloff of 30.0% YTD. Over the short term, the company will need to continue to invest heavily into US manufacturing and Recurrent Energy’s new business model, both of which will weigh on margins and cash flows until at least 2026.

However, there are secular long-term tailwinds in electrification globally and new tailwinds from AI-driven energy consumption. In the short term, we believe that the stock is unfairly discounted when compared to the sum of its parts. Over the long term we believe that strong secular tailwinds will provide a strong base growth case.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $2.5 X 24.8 = $62.19

Breaking down the asset base of CSIQ, it is trading less than the sum of its parts. As of the quarter ending September 2024, it reported a tangible book value per share of $42.43 which we calculated to be much higher at $87.26 per share.

| Segment | Detail | Implied Value (per CSIQ Share) |

| CSI Solar | $6.3 Billion USD total market cap on SSE (1 CNY = 7.3 USD), 63% CSIQ ownership. | $59.77 |

| Recurrent Energy | BlackRock invested $500 million for 20%. CSIQ ownership 80%, equaling $2 billion. | $30.12 |

| CSIQ Corporate-Level Adjustments | CSIQ has $200 million in corporate-level notes outstanding, and $25.2 million in corporate-level cash. | $-2.63 |

| Total | $87.26 | |

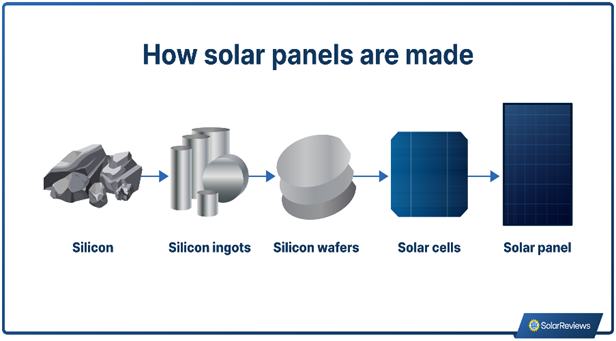

On the CSI Solar side, while a discount due to heavy Chinese manufacturing exposure is expected, the scale of the discount is hard to reconcile. CSI Solar is the 5th largest provider of solar panels, 10th largest solar cell provider, and 8th largest provider of solar wafers in the world. The global solar value chain is no small industry, worth nearly $140 billion per year, estimated to grow at a 12.5% CAGR to 2032 ending at more than $400 billion. Even excluding Recurrent Energy’s valuation, CSIQ is trading at 19.1% of its value in CSI Solar.

Recurrent Energy’s discount is more understandable, as it is not expected to generate meaningful cashflows until after 2026. However, as it is shifting its model to be utility-like, its valuation should move up as the market prices in long-term stable cash generation potential.

In addition, short interest in CSIQ has spiked to around 15.8%, implying over a trading week to cover.

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 0.1 | 0.1 | 0.1 |

| Price-to-Earnings | NM | 9.8 | 5.3 |

Power Demand

With the advent of artificial intelligence in every aspect of daily life, the expected power demands over the next decade have surged globally. The average google search uses around 0.3 watt hours of electricity, or around 2 seconds of usage for an average commercial-grade 500 watt solar panel. ChatGPT, and similar AI products, consume around 0.14 kilowatt hours per search – or approximately 17 minutes per 500 watt panel.

Globally, the continued electrification of cars and industrial uses, on top of datacenters, demand has the potential to outpace supply. The IEA (International Energy Agency) estimates that energy consumption will increase by 3% annually to 2035, 6% higher than last year’s estimates. The US is expected to increase above peer-developed nations, at 2.4%.

While highly developed economies like Europe are expected to meet growth requirements with new renewable buildout, China and other developing economies still heavily rely on old, inefficient coal power plants to meet existing shortfalls.

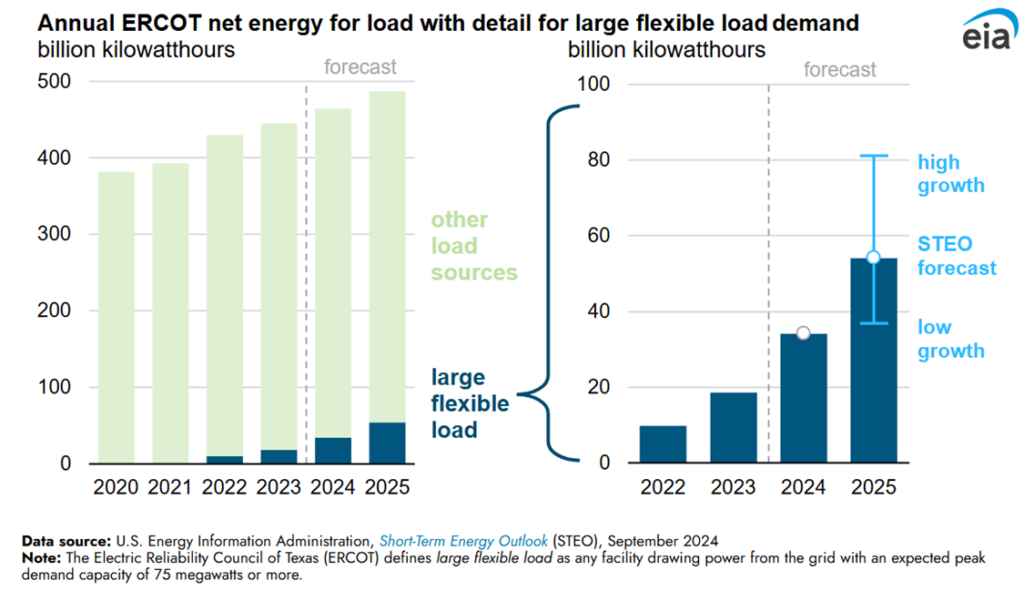

NERC (North American Electric Reliability Corporation) estimates that more than half of the US will experience at least some disruptions related to a generation shortfall within the next decade, thanks to ‘sluggish’ capacity growth mixed with previously discussed datacenter growth. The EIA (Energy Information Administration) estimates that electricity consumption across states with high-datacenter exposure will see 10% growth above the baseline. Using Texas as an example, demand from data centers alone will grow 60% year over year, consuming 10% of Texas’s total energy demand for 2025. Over the longer-term, CSIQ expects this effect to be mirrored across the US. By 2030, 11.7% of US power demand will be consumed by datacenters.

McKinsey estimates that renewables will account for around 70% of global power generation by 2050 – currently at 32%. While this projection is ambitious, if policy does prevail solar will lead the way with cost effectiveness, safety, and efficiency.

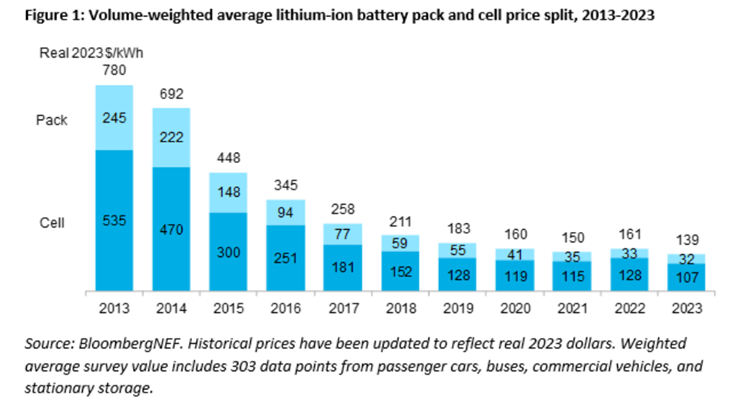

Most forms of renewable energy cannot always operate at peak capacity. Solar and wind are both limited by weather conditions. Most analysis indicates that global utility-level battery capacity will be between 600-760 GWh by 2030. Currently, global installed capacity is 163 GWh and has doubled between 2022 and 2023. Decreasing manufacturing and installation costs have driven down average costs to below $139/KWh which should continue to provide long-term tailwinds for utility-level battery storage.

Manufacturing – CSI Solar

Solar and battery component manufacturing is conducted by CSI Solar, which is owned 63% by CSIQ and is publicly listed on the Shanghai Stock Exchange. This works out to be $59.77 per CSIQ share. As of the quarter ending September 2024, CSI Solar has shipped more than 22 GW of solar components and 4.4 GWh of battery components on a YTD basis. Additionally, it holds more than 2,200 patents, more than any other competitor solar firm.

| Component | Capacity, GW |

| Ingot | 25 |

| Wafer | 31 |

| Cell | 48 |

| Module/Panel | 61 |

Image Source: SolarReviews.com, Table source: CSIQ

Currently, CSI has 61 GW of solar panel capacity, with 76% of its solar manufacturing base in China, with around 20% in Thailand, and 3% in the US. While specific geographic information is not public, management stated that it has around 25% market share in the US, and ships around 30% of its global capacity to the US per year.

CSI has expanded into manufacturing utility-scale batteries. Over the medium term, it is targeting ~10% market share and currently has 20GWh of capacity, largely based in China.

Chinese manufacturing continues to dominate due to cheap inputs and cheap labor, though China has entered into a period of oversupply in solar components. On top of oversupply, increasing tariff risks across the Asian electronic value chain and favorable tax treatment under the IRA (Inflation Reduction Act) have spurred CSI to expand manufacturing in the US.

CSI currently operates 5GW of manufacturing capacity of panels to the US, planning to add 5GW of cell manufacturing capacity. Historically, US manufactured solar panels utilized imported cells, but a recent crackdown by the Department of Commerce has caused a second wave of manufacturing investment in upstream products including solar cells.

| Plant | Product | Capacity | Capex Cost (Millions) | Operating Date |

| Mesquite, TX | Modules/Panels | 5GW | $250 | 2024 |

| Jeffersonville, IN | Cells | 5GW | $800 | ~2026 |

| Shelbyville, KY | Battery Cells + Modules | 6GWh | $700 | ~Late 2025 |

CSI will also add 6GWh of battery manufacturing capacity. The new US battery manufacturing base would represent approximately 20% of CSI’s battery production by the end of 2025.

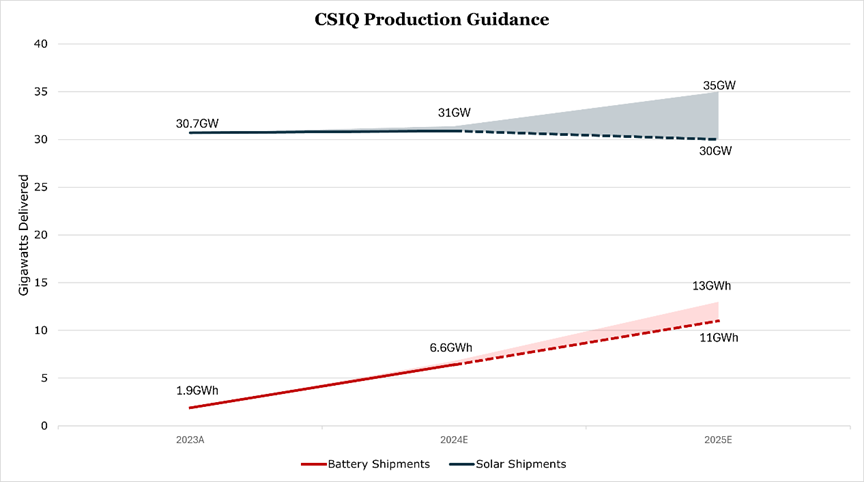

For 2025, CSI expects solar shipments to be flat at the baseline. The base 30GW assumption factors in a conservative demand outlook in the face of tariffs, reduced subsidies and low-priced fossil fuels. Management stated the final figure will depend on how quickly US production comes online, any Chinese government action regarding oversupply, and final DOC (Department of Commerce) ruling on components manufactured in Thailand – with the preliminary ruling increasing tariffs to 80%.

On the battery side, CSI expects shipments to grow by at least 66.7%, with the upper end depending on uptake in utility-scale projects.

For the 9 months ending September 2024, CSI had a gross margin of 17.9%, an increase of 160bps. This was mostly due to an increase in higher-margin battery shipments. For 2025, CSI expects gross margin to stay within the 16-18% range.

Utility-Scale – Recurrent Energy

Recurrent Energy is 80% owned by CSIQ and is a solar and battery project developer. Typically, Recurrent develops projects, secures funding, permitting, and contracting and then sells the project either at its COD (commercial operating date, once operating), or NTP (notice to proceed, as construction starts). While this limits risk, it also limits long-term recurring revenue potential.

| Solar (GWp) | Battery (GWh) | |

| Awaiting Sale | 1.7 | 1.0 |

| Under Construction | 1.7 | 3.8 |

| Backlog | 4.8 | 5.9 |

| Advanced Pipeline | 3.4 | 6.4 |

In October 2024, BlackRock invested $500 million in Recurrent Energy in exchange for 20% ownership, to support it moving forward with a repositioning plan. This values CSIQ’s ownership at $30.12 Per share. The repositioning plan would allow Recurrent Energy to own and operate facilities in the US and EU, while continuing its COD/NTP sales business in the rest of the world.

According to CSIQ, this plan would enhance the ‘funded growth’ model, where recurring cashflows from operated plants on top of COD/NTP sales would reduce the need for outside capital. In our view this would favorably change cyclical dynamics within CSIQ and allow Recurrent Energy to operate like a utility rather than a services company.

Currently, the plan is to introduce 2-3 GW of operated capacity to see how much PPA demand materializes. Thus far, Recurrent has announced a 10-year 300 MW Solar PPA with an unnamed tech company, and a 20-year 150 MW Solar PPA and 1.8GWh of storage with Arizona Public Service. Both projects are expected to be operational by 2026.

Recurrent Energy had gross margin contract to 38.1%, a 310bps decrease for the 9 months ending September 2024, with operating margin moving into the negatives. The contraction is due to the new direction, which incurs higher direct operating costs. The process to get projects approved can take 2-5 years depending on locality, not including the 18 month-long construction time frame. Operating margins for Recurrent Energy are likely to stay negative until more PPA projects come online in 2026. Over the long-term, the shift toward operating PPAs would realize more consistent revenues and operating income, even if average margins decrease.

Risk

The market has begun to price in the removal of favorable tax treatment under the IRA (Inflation Reduction Act). The risk repricing is understandable, as the killing of IRA subsidies for manufacturing could push the economics of major projects into the red. However, the risk of all subsidies being cut is not our base case, and we do not expect the sweeping elimination of manufacturing credits. The IRA has resulted in $206 billion in private investment, largely in manufacturing, which has seen 335,000 new jobs created. The preservation of at least part of the IRA would allow President Trump to follow-through on his campaign promise of returning manufacturing to the US.

While there has been some Congressional push to repeal the IRA, 78% of the $206 billion in investment has gone toward Republican-held districts. So, while Republicans have a majority in Congress and would be able to eliminate the IRA, politically there is little to be gained in removing these programs in their entirety.

| Plant | Product | Base Credit | Current Estimated Tax Benefit |

| Mesquite, TX | Modules/Panels | $0.07/W | $350 million |

| Jeffersonville, IN | Solar Cells | $0.04/W | $200 million |

| Shelbyville, KY | Battery Cells + Modules | $35/KWh + $10/KWh | $270 million |

Financials

For the first 9 months of 2024, combined company revenues saw a 24.3% decrease, with gross margin decreasing by 50bps to 17.5% and net income margin decreasing to 1.3%. A weak pricing environment from solar oversupply and cheap fossil fuels hit volumes and realized prices. Mixed with higher capex, R&D expenses and high tariff rates there was also downward pressure on margins.

The weaker pricing environment in Chinese manufacturing will likely continue into 2025 unless the government steps in, though utility-level fossil fuel pricing is likely to increase somewhat which could reduce renewables switching-cost. With CSI growing production in the US it could see stronger margins and realized price from tariff mitigation in the second half of 2025, as more than 85% of the global solar supply chain is Chinese-based.

Full company capex has grown to 14.7% of revenue, compared to the long-term average of around 8.5%. Overlapping growth trajectories in Recurrent Energy and CSI will keep capex at an elevated level through 2025.

We expect the debt level to increase from here, currently at $3.2 billion in net debt. Management stated that debt typically covers around 17% of capex with the remaining being a mix of supplier prepayments, outside investment, and equity. The trailing twelve months net debt to EBITDA is 6.6x, and the interest coverage ratio is only 1.4x which will make additional debt difficult until profitability returns. However, CSIQ holds approximately $2.2 billion in cash on hand which should allow for continued investment in growth projects.

Conclusion

The secular push for renewables coupled with long-term energy demand should provide attractive growth. Electricity is essential for AI datacenters and could accelerate the renewable buildout. On a company level, our view is that CSI Solar’s onshoring of manufacturing to the US will reduce most of the worst-case scenarios that are currently priced into the stock, with Recurrent Energy’s switch to a utility-like model providing more stable cashflows. Despite short-term pressures from Chinese oversupply, policy-related uncertainty in the US and a large ramp in capex spending increasing the debt load, there is a compelling long-term investment case for CSIQ.

Peer Comparisons