ONSemi Sweet Spot for High Growth with Fab-Light Model

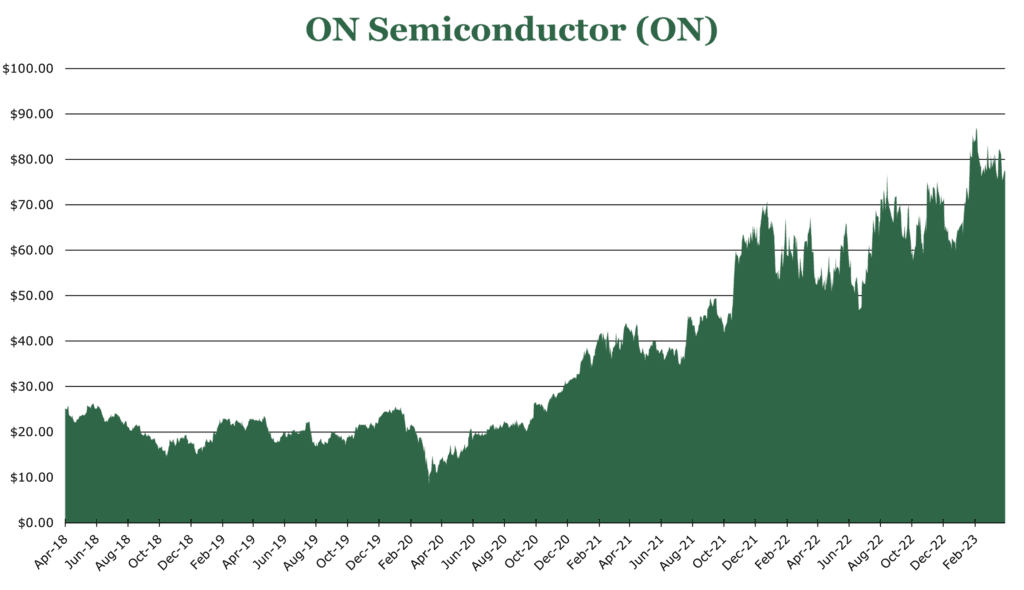

| Price $76.46 | Growth Holding Update | April 13, 2023 |

- Double Digit Secular Grower with Reasonable Valuation

- $16.6 billion in backlog, with $2.5 added in 4Q22.

- Divesting from low-margin industries and fabs, trading top line revenue for investing in high-margin products in markets with less competition.

- SiC (silicon carbide) leader, producing higher margin wafers in fewer facilities.

- Repurchasing $3 billion in shares to FY25, with $698 million in 1Q23. Targeting 50% FCF return to shareholders.

Investment Thesis

ON Semiconductor (ON) is an American semiconductor firm that began its life as a spin-off of Motorola and acquired Fairchild Semiconductor as it built itself into a leadership position in the industry. ON makes over 80,000 proprietary parts across hundreds of markets, including defense, industrial, IoT/cloud, and automotive. On average, the top 20 ON customers purchase an average of 24 product families.

ON is undergoing a mix shift, portfolio optimization, and manufacturing optimization. These changes will help bolster financial performance through more stability and a targeted gross margin expansion of 50%.

Cash flow growth will accelerate as ON targets 20-25% FCF (Free Cash Flow) revenue conversion by 2025 with a target of approximately $2 billion in FCF annually. ON is targeting 50% of this to be returned to shareholders. Despite revenue contraction in the short term, ON has a clear path forward on a fab-lite model, being a premiere provider for automotive and industrial OEMs with strong long-term gross and operating margin increases.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $5.10 X 20.0 = $102.00.

FY23 EPS should be down as macro softness couples with revenue reductions from divestitures. We expect a strong recovery in FY24and strong recovery thereafter. Its mid-teens growth rate deserves at least a 20 PE.

| E2023 | E2024 | E2025 | |

|---|---|---|---|

| Price-to-Sales | 4.2 | 3.9 | 3.5 |

| Price-to-Earnings | 17.1 | 14.7 | 12.5 |

Fab-lite model

The semiconductor shortage has gone on longer than many analysts expected. The shift for major OEMs to go fabless has only exacerbated this problem. Most semiconductor companies are migrating towards either manufacturing only (fabs) or design only (fabless). As more major OEMs move toward fabless, it has put huge burdens on the top semiconductor manufacturing firms which has only further exacerbated the supply chain issues.

While each of these has its own advantages and disadvantages, the fab-lite model has become the favorite of more niche OEMs as a way to compete for cheaper wafers with big computing giants. Fab-lite is a method by which ON manufactures lower-cost and simpler components to reserve outsourced production for higher-end products that require significantly more capex expensive high-end technology. This fab-lite approach also allows ON to manufacture common components for other manufacturers to improve cost structure and strengthen their competitive advantage.

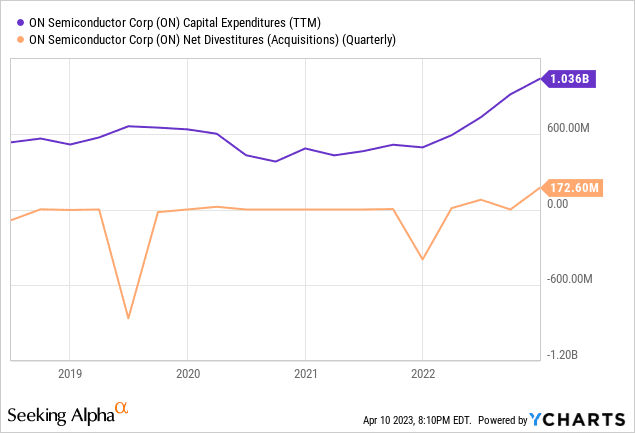

ON is exiting the smaller more inefficient fabrication sites and consolidating them into larger fabrication centers that can drive down cost per unit through economies of scale. ON estimates that this reduction in size will decrease fixed costs by $125-150 million by 2025 while also reportedly increasing capacity by 130%. This improvement is thanks to both consolidation and heavy investment in SiC.

1Q23 is expecting to divest around $75 million in additional business. The East Fishkill facility was purchased from Global Foundries for $406.3 million in FY19, and the transition is ongoing. The East Fishkill facility produces 300mm wafers. These are larger than the typical 200mm wafers utilized in most fabs and are commonly used in high-volume fabrication runs. The transition has been putting a 50-70bps headwind on gross margin which will step down until it is estimated to disappear in FY25 once ON takes full control of the facility.

This strategy will help stabilize their financial performance, which volumes have heavily influenced in years past. ON will be able to leverage existing long-term supply agreements (LTSAs) to improve long-term projections and provide greater margin stability.

Operations

ON operates primarily within the industrial and automotive spaces. By 2030, ON estimates that 62.3% of new vehicle sales will be electric or hybrid. Additionally, ON expects industrial and automotive customers to grow from 60% of revenue in FY21 to 75% in FY25. ON believes that EVs will be the area with the highest momentum in the future, announcing a long-term supply agreement to provide BMW with electric drivetrains. Despite its position as a premiere source for OEMs, the top 20 clients only make up 35% of revenue and no one customer makes up more than 10%. This provides significant breathing room especially during times of economic softness.

Power solutions group provides both industrial and automotive applications to electrification efforts. ON estimates a 5-year total addressable market CAGR of 6%, rising to $64 billion globally. In FY22 revenue from this segment grew 22.5%, primarily driven by focusing on SiC (silicon carbide) semiconductor manufacturing which provides higher yield and margin per wafer.

The industrial and cloud revenue in FY22 increased 18.4% year over year, due to better product mixes and strong market demand. ON expects to reduce the total share of revenue from this segment, focusing more on automotive sensing and power for industrial.

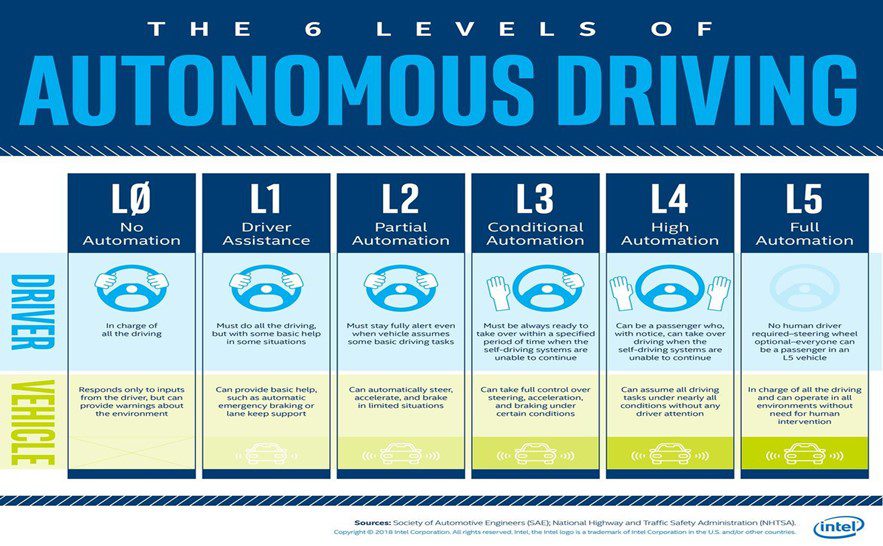

The sensing division is the forefront of ON’s growth efforts with a 5 year forward addressable market CAGR of 10%, growing to $10 billion. In FY22, the division saw a 41.7% increase in revenue year over year. ON believes they will provide between $200-1,000 per vehicle in sensing at an L2 level, and $750 of motive technology. At a full L5 level, ON believes it will provide around $1,600 in sensing per vehicle. Currently, ON provides around $200 in value per vehicle. While a weaker economy will be a drag on the auto industry over the near term, increases in total semiconductor value per vehicle will offset the reduction in deliveries of new vehicles.

Risk

Semiconductors shortages created a spike in pricing, revenues and profits. This is winding down and the industry is faced with destocking over the next few quarters. In the short term, ON could face demand destruction as inventories are adjusted to end demand. In the long term, the automation and electrification of the economy will continue to bolster the total addressable market growth for ON.

While fab-lite is certainly a novel way to split the difference between fabless and owning all your fabs, it is still an unproven strategy. So far margins have reacted positively, but it is a very high-demand environment with a still lingering chip shortage.

Divesting from fabs and from non-core business will negatively impact revenue, with ON putting the figure around 10-15% being fully realized in FY24. However, these divestitures are from non-core competencies and are from low-margin businesses in highly competitive markets.

Outlook

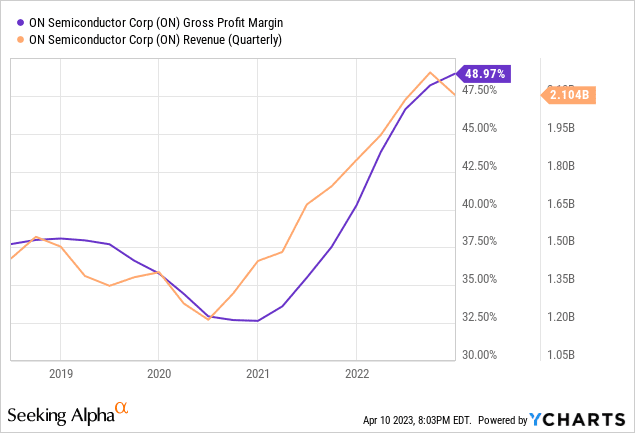

ON has expanded gross margins to 48.4%, a 320bps increase year over year. Approximately 73% of ON’s revenue comes from the industrial and automotive sectors. ON has increased revenue across the company year over year by 24%. The leading sector was automotive which grew by 54% year over year. Both of these sectors are hypergrowth, but especially automotive. FY22 saw a record EPS at $5.33, far outpacing expectations.

As previously discussed, ON is investing heavily in SiC (silicon carbide) semiconductor manufacturing. SiC has advantages over traditional silicon, but it is more expensive in terms of startup costs and quality control. ON will be investing $160 million annually over 3 years. This has caused headwinds of100-200 bps in gross margins. However, in the future, 300mm SiC could double capacity per factory.

Utilization is around 74% companywide, which ON expects to fall marginally or stay flat. Over the long term, SiC investments are expected to increase utilization especially when the macroeconomic softening lets up and assisted driving system demand increases in FY24.

Despite all the improvements across financial metrics, there is still room for improvement according to the FY25 strategic plan. To FY25, ON expects 7-9% revenue CAGR, with EPS growing slightly faster given the $3 billion buyback program. The gross margin is already at the 49-50% target, finishing the year with 49.2%. Capex is expected to grow at 9%, in line with revenue. FCF Conversion is expected to be between 20-25% in FY25, currently at 19.6% — another record high. ON targets 50% of FCF returned to shareholders as part of the FY25 strategic plan.

1Q23 is expected to see the gross margin stay the same. However, revenue will decrease by about 9%. ON is erring on the cautious side for 1Q23 with a seemingly imminent consumer recession and impacts from divesting from certain areas. The long-term supply agreement backlog is still strong, reaching $16.6 billion with $2.5 billion added in 4Q22. Of this, $5 billion in revenue is expected to be realized in FY23.

During 1Q23, ON is expected to repurchase $698 million in shares as part of the FY25 $3 billion repurchase plan.

Competitive Comparisons

| ON Semiconductor (ON) | Global Foundries (GFS) | NXP Semiconductors (NXPI) | Qualcomm (QCOM) | Intel (INTC) | |

|---|---|---|---|---|---|

| Price-to-Earnings (FY24) | 15.03 | 20.62 | 11.98 | 10.79 | 17.06 |

| Price-to-Sales (TTM) | 3.09 | 19.85 | 8.25 | 9.69 | 6.64 |

| EV to EBITDA (FWD) | 11.58 | 11.62 | 10.93 | 10.29 | 14.65 |

| Return on Total Capital | 19.78% | 6.87% | 12.84% | 28.96% | 1.05% |

| Gross Margin | 48.97% | 27.61% | 56.90% | 57.22% | 42.61% |

| Price to Cash Flow (TTM) | 12.66 | 14.06 | 11.46 | 13.6 | 8.67 |