MYTE Looks to Expand Luxury Offering Breadth Through YNAP Acquisition

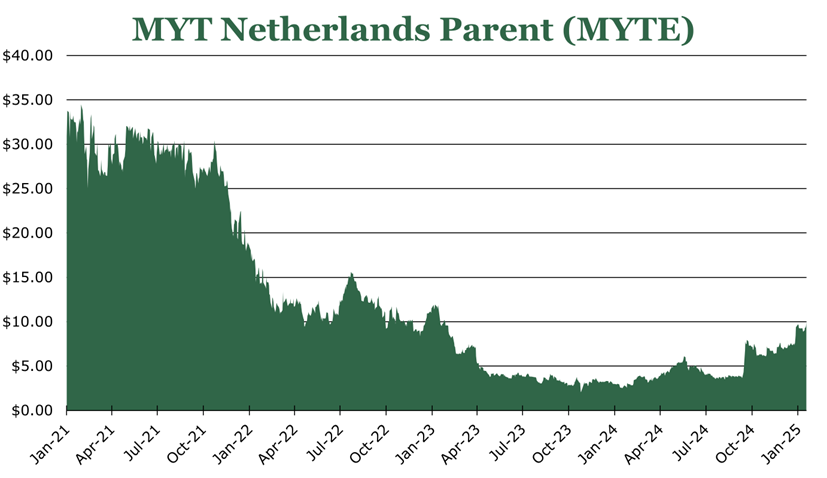

| Price $10.02 | Growth Holding | February 10, 2025 |

- MYT Netherlands Parent (MYTE), operating Mytheresa, will acquire Yoox-Net-a-Porter (YNAP) from Richemont and rebrand as LuxExperience.

- The combined entity is expected to reach $3.2 billion in gross merchandise value in 2025, with ambitions to grow into a $4 billion gross merchandise value luxury e-commerce giant by 2030.

- Richemont will provide MYTE with a $106 million working capital facility and YNAP’s $590 million in cash, while MYTE issues 43 million new shares to Richemont.

- The luxury e-commerce market is expected to double to $180 billion by 2030, with the total luxury market growing at 3-7% annually.

- YNAP generates 45% of revenue from North America, offering MYTE an opportunity to accelerate US growth.

Assumes 1 USD = 1.064 EUR

Investment Thesis

MYT Netherlands Parent (MYTE) is a luxury fashion e-commerce brand, operating the Mytheresa site. MYTE has built a strong e-commerce platform targeting high-basket size consumers while having relationships with the market’s most high-end brands.

In October 2024, MYTE announced it would be acquiring the Yoox-Net-a-Porter (YNAP) brand from Richemont (CFRHF) and changing its name to LuxExperience. The combined entity is expected to conduct around $3.2 billion in GMV (gross merchandise value) in 2025. We believe that MYTE is well equipped to deal with the YNAP turnaround, with Richemont holding most of the financial risk in the transaction. Richemont will be providing MYTE with a $106 million working capital facility along with the $590 million in cash on YNAP’s balance sheet. Overall, this is a speculative buy with the potential to grow into a $4 billion GMV luxury e-commerce giant by the end of the decade.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $0.40 X 44.5 = $17.78

At a baseline, Richemont is writing down $810 million in assets (net of cash) associated with the acquisition. On a cash-only basis, MYTE will be issuing 42.95 million shares in exchange for $590 million on YNAP’s balance sheet, or about $13.74 a share.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.8 | 0.8 | 0.7 |

| Price-to-Earnings | 35.2 | 29.4 | 27.2 |

Analyst consensus data from SeekingAlpha

Terms of the Deal and the Market

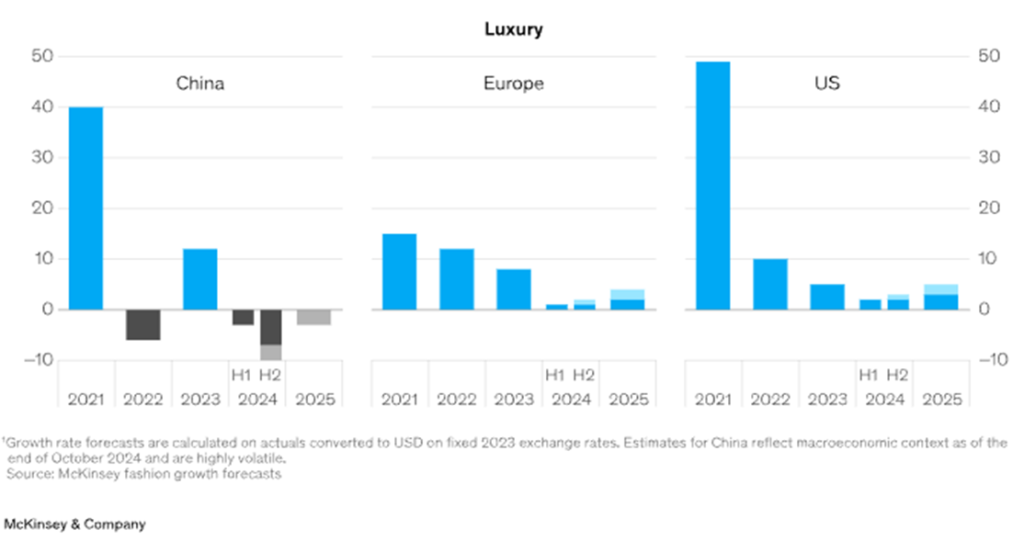

Recently, European fashion brands have struggled with slumping spending demand in China and domestic customers unwilling to ramp spending even as inflation moderates. A new push for domestic-focused consumption in the US could also throw a wrench into expansion into the still-hot consumer market there. According to McKinsey’s industry survey, 80% of firms see industry conditions worsening or staying the same in 2025.

Closing sometime in the first half of 2025, Richemont will sell its YNAP (Yoox-Net-a-porter) business to MYTE in exchange for approximately 42.95 million in newly issued MYTE shares.

YNAP contains the off-price divisions YOOX and The Outnet as well as European fashion giants Net-a-porter and Mr. Porter. In addition, Richemont will provide a $106 million working capital facility to MYTE and MYTE will inherit the $590 million in cash on YNAP’s balance sheet. The latest profitability figures for the acquired assets are not yet public, but, according to the latest Richemont filings, YNAP’s combined entity runs a narrow loss. However, MYTE has stated that Net-a-porter and Mr. Porter run a single-digit EBITDA profitability, with the Yoox and Outnet off-price outlets running losses.

| YNAP | 6 months ending September 2024 | 6 months ending September 2023 |

| Revenue | $ 911 | $ 1,076 |

| Expenses | $ 952 | $ 1,152 |

| Operating Income | $(41) | $ (76) |

| Net financial costs/income | $ 10 | $(15) |

| Taxes | $(15) | $(37) |

| Net Income | $(46) | $(128) |

Does not include asset impairments or write-downs. Richemont FY25 Interim Report.

While European fashion giants like LVMH and Richemont have posted estimate-beating results, they are still at a downcycle seeing costs increase and sales contract. Thus far, MYTE has been largely insulated, with continued sales growth and margin expansion.

Richemont, has been attempting to offload at least part of YNAP (Yoox-Net-a-porter) since 2023. Initially, it was going to sell around half its ownership to Farfetch. The deal fell through when Farfetch went under and was acquired by Coupang. Another competitor in the fashion e-commerce space, Matches, entered administration and liquidation in early 2024.

McKinsey estimates that over the course of the decade the luxury fashion market will grow between 3-7% annually with Bain & Company estimating that the e-commerce portion will double to $180 billion by the end of the decade. MYTE’s CEO stating that he believes the market will continue to grow and consolidate as competition exits.

Finally, around 45% of YNAP revenue is generated in North America, compared to MYTE’s 20%. A larger body of high-net-worth consumers and heightened access to credit in the US have driven massive amounts of spending since the pandemic. Over the last 2 years, MYTE has made expanding operations within the US a major strategic priority, reporting sales growth of 13.6% in the US compared to 9.8% in Europe in the quarter ending September 2024.

Existing MYTE Operations

MYTE operates Mytheresa, an e-commerce high-fashion luxury store based in Germany. Mytheresa focuses on high-spend consumers and a narrow, but exclusive, series of 250 brands. Annually, Mytheresa has $971.8 million in GMV (gross merchandise value) through $952.1 million in revenues.

Mytheresa has created a wealthy but loyal customer base, with 3.7% of its customers generating 39.2% of annual revenues. On top of offering the sort of service that is usually reserved for brick-and-mortar luxury shopping experiences like personal shoppers, Mytheresa offers exclusive collections, and physical pop-ups to drive FOMO. Organically, it also utilizes browsing patterns to target would-be high-spenders, and gives them perks to drive sales automatically. The GMV for the top cohort of customers is up 16.7% year over year in the quarter ending September 2024, compared to the total GMV up 6.3% year over year.

| Metric | 2024 Actual | 2025 |

| GMV Growth | 7% | 7-13% |

| Net Sales Growth | 10% | 7-13% |

| Gross Margin | 45.7% | ‘Increase’ |

| Adjusted EBITDA margin | 3.1% | 3-5% |

| SG&A | 14% | ‘Slight decrease’ |

Adjusted EBITDA excludes transaction expenses and share-based comp.

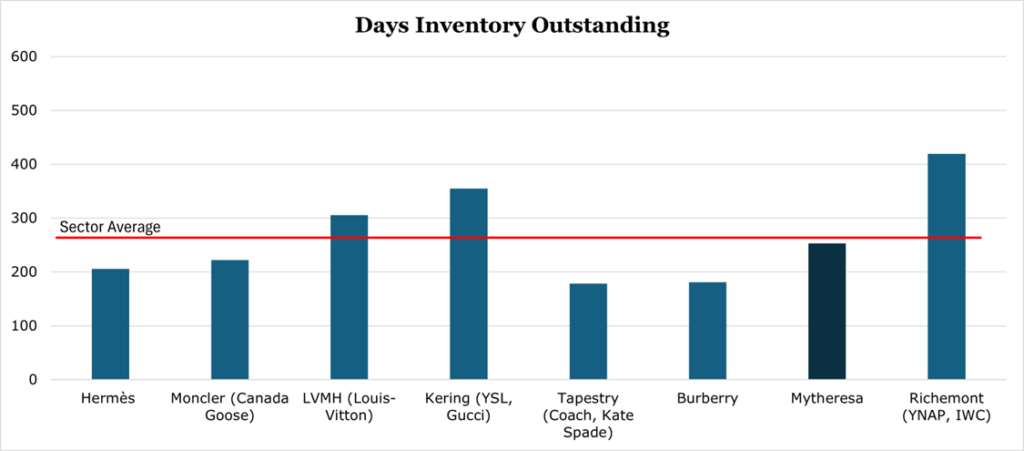

An important component of Mytheresa’s success compared to other luxury e-commerce peers has been its discipline in offerings, carrying just 250 brands of ‘true luxury’. MYTE rarely runs sales while still managing to keep DIO (days inventory outstanding) to 253 days as of the quarter ending September 2024. An industry-level bonus is that keeping inventories sale-free and exclusive endears MYTE to suppliers and industry partners.

Another inventory-based differentiator is the CPM (curated platform model). In exchange for a commission, Mytheresa lists brands and handles logistics on behalf of partners without having to buy wholesale inventory or having to change the shopping experience. Currently, 7 ‘major brands’ are under the CPM, and while not specifically broken out, earlier comments from management indicate that around 20-35% of sales come from this model which generate close to 100% gross margin.

Off-price and White label

YNAP’s white-label and off-price divisions are loss making but have a GMV (Gross merchandise value) of $957.2 million. MYTE stated that it wants to run the off-price divisions lean and distinct from the other divisions, with new infrastructure.

The Outnet offers past-season high-fashion brands, likely sourced from Mr. Porter and Net-a-porter. At its core, The Outnet operates as a liquidation outlet for old high-end inventory and is thus more limited in what it sells. Over time YNAP has attempted to position The Outnet as a strange mixture of resale site for individuals, a short-lived white-label division, and even a direct-to-consumer platform where brands can offload their past-season inventory for a commission. Yoox on the other hand operates like a brick-and-mortar off-price outlet, buying wholesale inventory from partners of a wide range of categories and brands.

While typically not the customer base MYTE targets, lower income ‘aspirational’ customers who drive off-price sales make up 50% of total luxury spend. Even as Eurozone inflation eases, consumers are still spending weakly, and largely still prefer to spend in-person rather than online. Targeting aspirational customers can be challenging as off-price fashion consumers are less likely to demonstrate brand loyalty.

According to McKinsey “socialite” and “status seekers” represent 63% of the aspirational luxury wallet share and are plugged into influencers who dominate their view on trends. They are likely to have made at least one online purchase for a luxury good in the last year and spend between $3,700-5,700 per year on fashion – representing $172.3 billion in global spend on fashion per year.

While retaining and building a parallel infrastructure for the off-price segments will offer challenges and cost, we are confident that running lean and ceasing non-core services should provide tailwinds and bring the off-price offerings to narrow profitability over the medium-term.

Mr. Porter and Net-a-porter

Mr. Porter and Net-a-porter have a combined GMV of $1,276 million, and list more than 1,000 luxury brands. The Porter brands have a wide selection of offerings from clothing to home goods and accessories. Mr. Porter’s white-label offer will not be a part of the transaction, with Richemont opting to shutter the division before finalization. According to MYTE, the brands run a narrow single-digit EBITDA profitability, and it will continue to keep them distinct of existing MYTE storefront Mytheresa.

We do not expect the struggles Richemont has had with the Porter brands will remain with MYTE. There are clear organizational challenges within the Porter brands, which we believe MYTE is well-equipped to handle. Speaking to WWD, chairman of luxury-industry services firm Interluxe Holdings stated “[Working with Net-a-porter is] very challenging. There’s no one, centralized payable department. The disorganization at the various divisions of Net-a-porter has created more and more work for small brands.” MYTE has stated that the first order of business is to swap the Porter brands to use the MYTE technology platform which has helped drive so much of its success among high spenders.

Outside of business fundamentals, to drive customers back to Porter brands, MYTE CEO stated that it wants to rebuild Porter magazine and other editorial content. With influencers dominating the consumption trends of the youngest cohort of consumers a strong editorial presence, especially online, could provide a sales driver.

Risk

Brands in the high-fashion space tightly control where their products are listed and how they are advertised. We do not expect there to be any reputation risk associated with the transaction, and broad fashion-industry reception has been positive to the acquisition.

It took Richemont nearly 3 years to sell the YNAP brand since beginning its search. There may not be an exit for MYTE other than a full write-down if the integration process is messy and more capital intensive than is tolerable. However, we are confident in management’s ability to execute given its history and strong industry-relationships. Additionally, Richemont bears much of the financial risk of the transaction with shares in lockup for at least 1 year and the $106 million credit facility.

MYTE has run a $40.4 million loss over the trailing twelve months and has not been accounting profitable since 2020. While much of this is due to share-based compensation, transaction costs, and impairments, a capital-intensive acquisition will put more pressure on the bottom line. As a luxury retailer, its cash conversion cycle is long, though in the same neighborhood as peers.

Conclusion

We are confident in the ability for MYTE to execute. Much of the transaction risk falls on Richemont, with MYTE being able to focus exclusively on turning around the acquired brands.

While this is a speculative buy with low volumes, it has the potential to grow into a retail giant over the decade with an expected $4 billion in GMV and mid-single-digit EBITDA margins.

Peer Comparisons