Molson-Coors Wins Beyond Domestic Beer

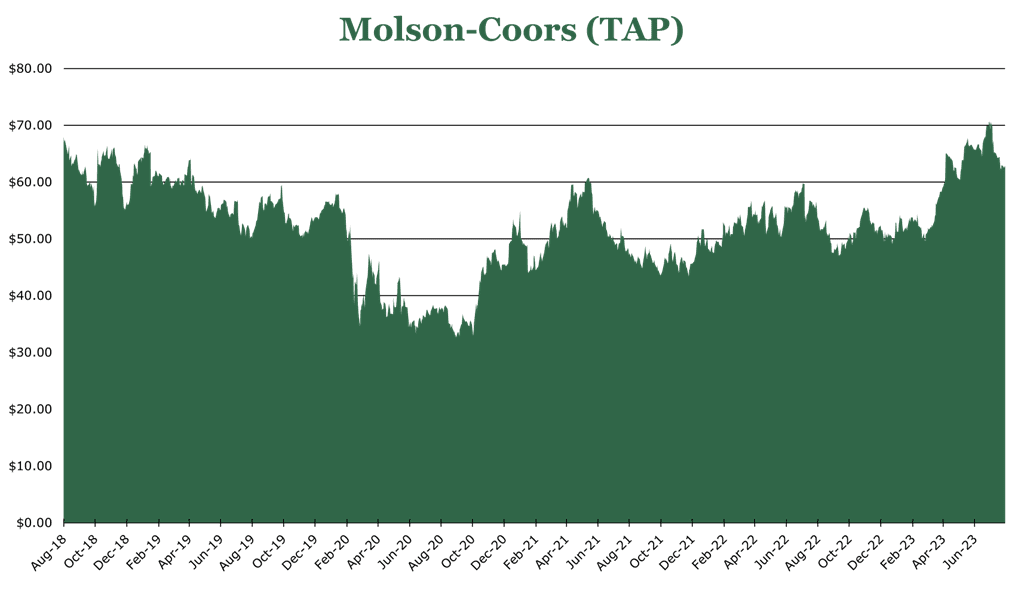

| Price $63.08 | Dividend Holding | August 30, 2023 |

- Dividend Yield 2.87%.

- Significant tailwinds in the short-term from a competitor’s blunder, a sales increase of 12.1% year over year.

- Revitalization campaign in brand identity, advertising spend, and brewery operations. Equalization of advertising dollar spend across brands has yielded excellent double-digit volume increases in Canada and the UK.

- Targeting smaller acquisitions, hoping to build a “string-of-pearls” across every segment of the alcohol market.

- Long-term partnership with Coca-Cola to market hard versions of Simply Lemonade and Peace tea.

Investment Thesis

Molson-Coors (TAP) is a multinational drink and brewery formed in 2005 through a merger between American Coors and Canadian Molson. Despite short-term tailwinds domestically from a competitor’s blunder, there are significant growth opportunities outside of Beer that Molson-Coors is taking advantage of globally.

Molson-Coors had its best quarter since its inception, benefiting from strong governance and strategic acquisitions to expand outside beer, amid shifting consumer preferences away from beer. It reduced debt levels and is making significant investments in marketing and efficiency projects, positioning it well for future global growth.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $5.10 X 18.0 = $91.80

| E2023 | E2024 | E2025 | |

| Price-to-Sales | 1.2 | 1.2 | 1.2 |

| Price-to-Earnings | 12.7 | 12.5 | 12.1 |

Market Trends

The latest Nielsen data shows a recovery in Beer consumption. However, it still lagged behind distilled spirits, which saw a 9.0% jump quarter over quarter. Additionally, prepared cocktails (also called ready-to-drink) saw a 42% growth year over year, showing a clear consumer shift away from beer and toward spirits and craft beverages. Ready-to-drink beverages have exploded and will likely increase rapidly over the next 5 years. Secularly, the ready-to-drink cocktail market is expected to have a CAGR of 14.0%, while comparatively, beer is only expected to grow by 3.68%.

To this effect, Molson-Coors is acquiring Blue Run Spirits, a bourbon and rye whisky maker for an undisclosed sum. The previously private Blue Run Spirits is constructing an additional distillery in Kentucky, currently available in 31 states. According to a Forbes article in June of 2022, Blue Run was projected to sell 50,000 cases or $15 million in sales in FY22. This “Ultra-premium” brand would be Molson-Coors’ first foray into high-end distilled spirits.

Molson-Coors reported that their Simply Spiked line was a top dollar share gainer in the United States. The alcoholic seltzer market has seen a minor slump compared to other segments. Still, Molson-Coors was the only major brewer with a significant market share in Canada and grew to the 3rd and 5th spots in the United States during 1H23. Molson-Coors has a long-term partnership with Coca-Cola to market the Simply and Peace Tea brands into the alcohol space. Simply is the second largest brand in the Coca-Cola portfolio.

Outside of Beer, customers demonstrate much less price sensitivity. Typically, Beer pricing has not kept pace with inflation, with real price decreasing over the last 50 years. Additionally, Beer consumption still has not recovered to pre-pandemic levels with those under 35s continuing to replace beer with ready-to-drink cocktails, wine and spirits.

Investment and Expansion

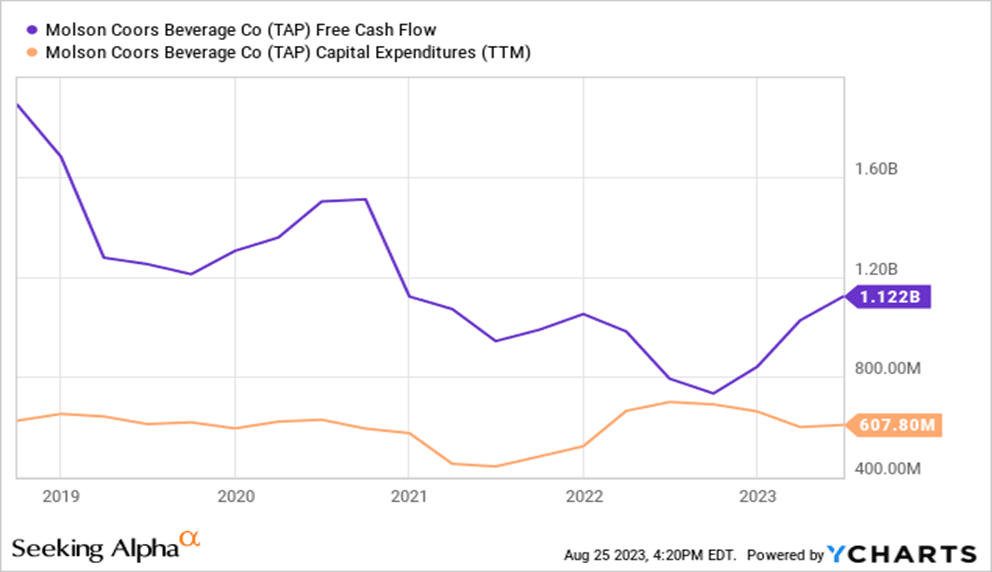

Free Cash flow was $570 million in 1H23, a 98.3% year-over-year increase, largely due to record sales and far lower capex spending. Capex was $335 million for 1H23 and went toward modernization projects for sustainability and efficiency improvements. Capex is expected to be $700 million for FY23. We feel it is likely that because of the surge in free cash flow, the previously mentioned Blue Run Spirits acquisition will be cash funded. Future M&A will likely stay in the sub $1 billion range, as management has stated their intended strategy is a “string of pearls” rather than a huge one-and-done acquisition to expansion.

Given the strong free cash flow improvement, Molson-Coors has significantly reduced the debt to EBITDA 2.5x. This puts it at almost record lows and much lower than the sector. Molson-Coors states that it will continue to reduce its net debt, though a new long-term leverage reduction target has not yet been released.

Molson-Coors will increase underlying spending on advertising and existing brand reach across the global market. In addition to new title sponsorships for events, a new shift toward heavier investment in digital advertising is underway. With heavy competition in the Beer market, even from very small craft breweries, Molson-Coors will also “premiumize” some of its brands.

This demonstrates an equalization of push internationally. Typically, Molson-Coors has spent the lion’s share of its advertising dollars in the United States. But, for the first time “in many years,” Molson-Coors is spending money on Carling, the #1 brand in the UK. Additionally, Molson-Coors is revamping the Molson Canadian brand to be more aligned with the typical Coors brand in the US with new options and a campaign of premiumization. This has directly led to growth in the Molson Canadian brand for the first time “in a very long time.” In the past, this equalization strategy has worked. The Ožujsko beer typically marketed in Central and Eastern Europe had demonstrated long-term decline and consumer attrition until a similar campaign was undertaken, increasing its market share to over 50% in a short time period.

Risk

Based on Nielsen data, it is unlikely that beer will ever return to pre-pandemic consumption levels as a percentage of total consumption. This does allow premiumizing brands to recover some lost dollars. Despite the tailwinds, sales volume across the entire portfolio was up only 5% year over year, though pricing actions increased revenue by 12.1%.

Likely, Beer sales will secularly decline over the decade, but Molson-Coors will likely experience a reduction in volume toward the end of the year. On top of Summer seasonality, boycotts of easily substituted goods like beer typically cause a short-term price shock but dissipate over the 1-year horizon.

Outlook

FY23 guidance has been raised significantly with a stronger than anticipated 1H23, with EBITDA expected to increase by 23-26%, with free cash for the year expected to be $1.2 billion. Molson-Coors brands grew to dominate the American domestic market due to AB InBev’s marketing blunder, but the market growth trend was repeated globally. Molson Canadian and Carling (UK) saw secular volume growth for the first time in many years.

While Molson-Coors was helped by its main competitor’s volume loss, the revitalization campaign in both manufacturing and marketing has begun to show significant results. Revenue increased by 12.1%, with cost savings leading to EBITDA growth of 122% year over year. With the help of short-term tailwinds domestically, Molson-Coors is taking advantage of significant growth opportunities globally.

Competitive Comparisons