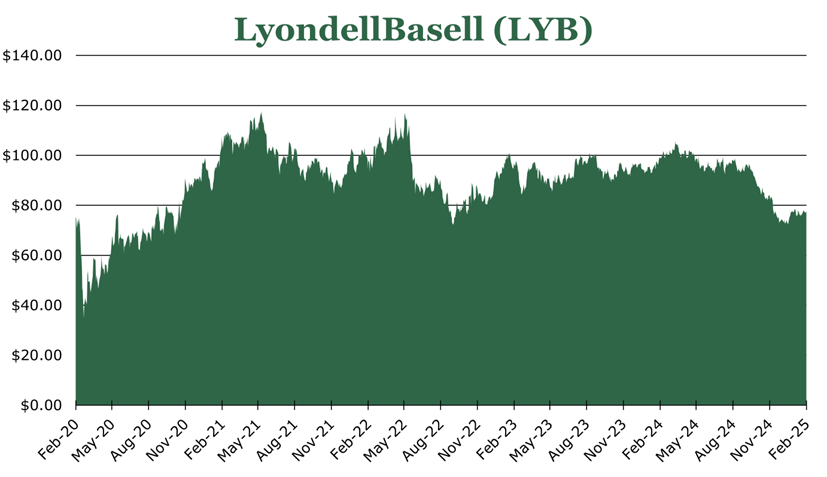

LYB Expects 2025 Recovery to Support 6.9% Yield

| Price $76.63 | Dividend Holding | February 28, 2025 |

- 6.9% Yield.

- Despite a high cash payout ratio of 106.3%, LYB intends to increase its dividend in 2025, backed by a $3.4 billion cash position.

- LYB reported growing industrial demand in North America, with high utilization rates and cost advantages from low natural gas prices.

- LYB is reviewing six underperforming assets in Europe, potentially leading to divestitures, closures, or efficiency investments.

- LYB is shutting down its Texas refinery, incurring $345 million in closing costs but freeing up $240 million in working capital.

- LYB’s net debt/EBITDA ratio of 2.1x is below the industry median of 2.4x.

Investment Thesis

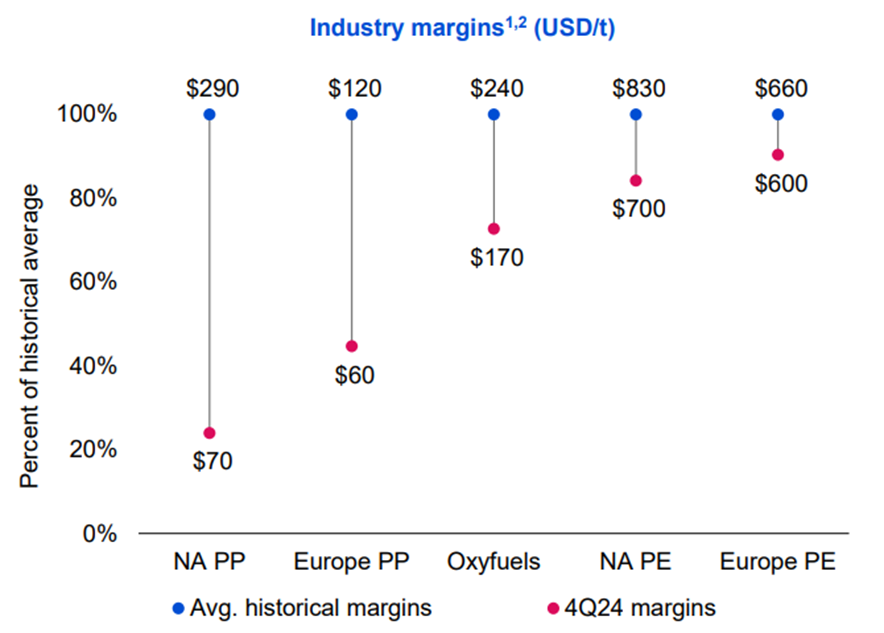

LyondellBasell (LYB) is an international manufacturer of chemicals, with more than 20% global market share in ethylene products such as plastics, polymers, and synthetic oils. Currently, global chemicals manufacturing is at a cyclical low. China and Europe de-stocked industrial inventories during 2023 and 2024, all the while global capacity in chemicals increased leading to an oversupply. As a result, LYB stated that current margins throughout the industry are only 60% of their historical averages.

In North America, LYB reported it saw rising industrial demand, with strong utilization rates. While we do not expect a strong European recovery in 2025, LYB is undergoing a strategic review of assets in Europe which will likely result in some divestitures of non-profitable assets. We do expect to see some industrial recovery in China during the second half of 2025, thanks to aggressive stimulus policies.

We expect LYB’s strong 6.9% dividend yield and $5.36 annual payout to at least remain at its present level. Though, management has stated it intends to increase the dividend once again in 2025. While the short-term will require strong execution from management, the medium-term prospects are solid, and we believe that LYB is a strong dividend stock.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $8.18 X 12.1x = $98.77

We expect the upcycle to begin in the latter part of 2025 going into 2026. By the end of 2026, LYB should have its first recycling operation online, and European manufacturing will have begun a recovery.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 0.8 | 0.8 | 0.7 |

| Price-to-Earnings | 12.6 | 9.5 | 8.5 |

Summary of Operations

| 2024 Sales | Sales Change (year over year) | Operating Margin | |

| Olefins & Polyolefins – North America | $11,533 | 2.2% | 15.7% |

| Olefins & Polyolefins – Rest of the World | $10,867 | 3.7% | -9.3% |

| Intermediates & Derivatives | $10,424 | -6.0% | 9.1% |

| Advanced Polymers | $3,634 | -1.7% | -1.3% |

| Refining | $8,559 | -11.9% | -2.5% |

| Technology | $671 | 1.2% | 50.4% |

| Total (less eliminations) | $40,302 | -2.0% | 4.5% |

| Total (less refining and eliminations) | $31,743 | 1.1% | 6.4% |

O&P

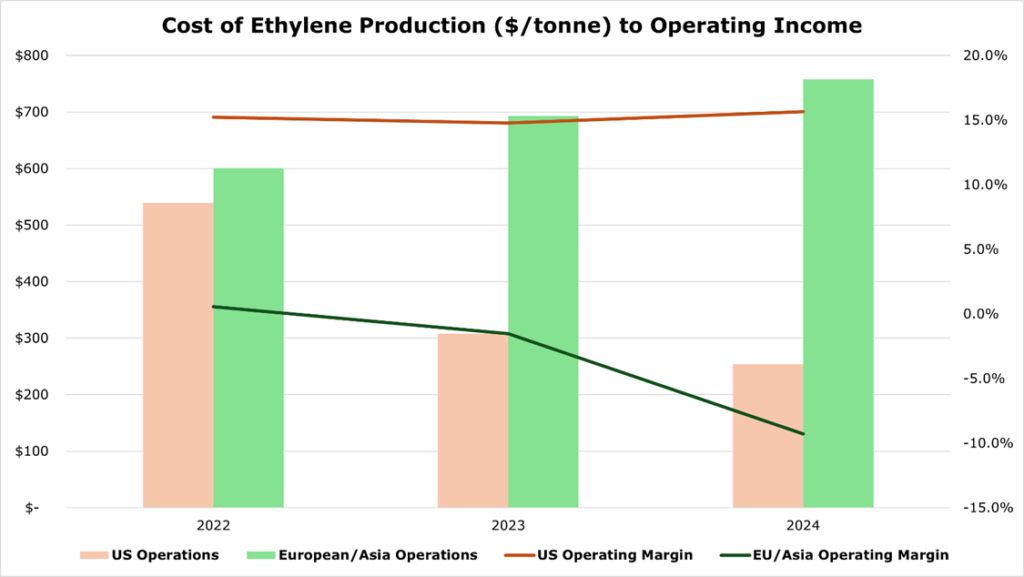

Making up 55.6% of revenues, the O&P (Olefin and Polyolefin) segment is split geographically in two between North America and Europe-Asia. Feedstocks are converted into Olefins via cracking oil-based liquids like naphtha, or from cracking ethane from natural gas. Most US-refineries use ethane, while most European and Asian producers utilize naphtha. Naphtha is a refinery byproduct, and there is an inverse relationship to the grade of the oil and naphtha content. As refiners have tapered down output of fuels and heavier inputs, naphtha output has decreased which has raised input prices. Meanwhile, the explosion of US shale drilling has driven down the price of ethane to very low levels.

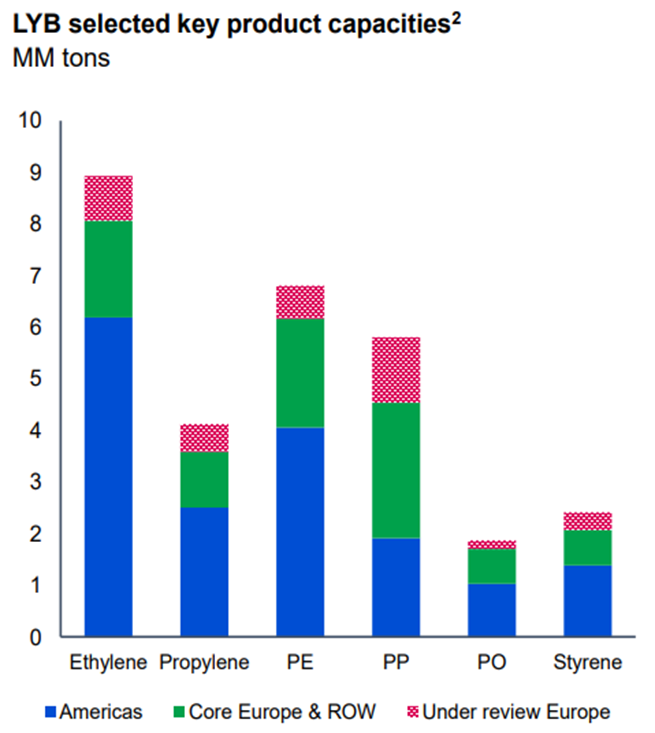

The Olefins are then further refined into Polyolefins, such as PP (polypropylene), which LYB is the second largest global producer of, or PE (polyethylene). PE is the most common plastic in the world, utilized in flexible synthetics like plastic bags, bottles or insulation. PP is more rigid and is used in car components, bottle caps, or any other hard synthetic.

| % of O&P segment1 | |

| Olefins and Co-Products | 9% |

| PE | 18% |

| PP | 14% |

LYB reported that for the full year 2024, North American industrial demand for PE rose 8%, and PP rose 3%. S&P reported US manufacturing PMI (purchasing manager index) had risen to 51.6, indicating a continued expansion of manufacturing activity which should provide some demand tailwinds. Utilization during the final quarter of 2024 was 98%, with typical utilization being 93-98%. For the quarter ending March 2025, LYB expects planned downtime, which will reduce utilization to 80%.

In North America, 100% of feed stock comes from natural gas. For the full year 2024, favorable natural gas pricing drove down input costs by 11.1%, with most of LYB’s facilities getting gas from HSC (Houston-ship channel) which trades at a slight discount to Henry Hub. Cheap inputs, on top of competitor downtime giving some pricing tailwinds, had operating margins expand by 120bps to 15.7%. Over the long term, we expect the pricing advantage from HSC to slowly degrade due to expanding LNG export capacity and global LNG demand projected to increase over the decade. However, this may be offset by increased pipeline capacity from Waha hub, as discussed in our Ring Energy article.

Asian demand is still uninspiring with manufacturing PMI aggregate barely positive at 50.7, with PMI above 50 indicating growth. S&P expects China to begin an industrial capacity rebuild in the latter part of 2025, though aggressive tariffs from the US could take the steam out of the limited economic growth there. LYB is confident that Chinese sales will at least have some recovery in 2025. According to S&P, European manufacturing PMI came in at 47.3. In Europe, the down industrial market has resulted in a downturn in chemicals and refining, which has put pressure on O&P producers to consolidate. Over the long term, this will provide a tailwind to European operations.

In Europe and Asia, 40% of LYB’s feedstocks come from non-naphtha products, with 60% coming from naphtha. Operating margins contracted 780bps driven by lower volumes due to unplanned downtime in Europe, resulting in the Europe-Asia segment ending the year with 53% utilization. For the first quarter of 2025, LYB expects results to recover back to near break-even levels with utilization returning to the 75% neighborhood.

Derivatives and Polymers

The I&D (intermediates and derivatives) segment makes up 25.9% of revenues and is the second largest producer of PO (propylene oxide) in the world, and the second largest Oxyfuel producer in the world. PO and its co-products are derived from Olefins and are usually utilized in cleaning products, synthetic rubber, pesticides, cosmetics, and almost all synthetic materials. An estimated 20% of PO is further refined to make PG (propylene glycol), a common food and medicine additive. Oxyfuels are derived from byproducts of naphtha cracking to make Olefins and are typically used for doping octane levels in gasoline, and in synthetic lubricants.

Globally, much of the inputs for the I&D segment are internally sourced from the O&P segment, which allows for a high level of operating leverage. Operating margins compressed by 300 bps primarily because of low gasoline demand impacting Oxyfuel sales. However, as previously mentioned, management noted that global industrial demand did boost PO sales. LYB’s newest asset, a $2.4 billion PO and Oxyfuel plant in Texas, continues its production ramp after its 2023 commissioning. For the full year 2024, the plant operated above target at 78% utilization. On a go-forward basis, management stated it will operate at over 90% utilization. However, due to the previously mentioned scheduled maintenance in the O&P segment, management expects the I&D segment to also average 80% utilization for the first quarter of 2025.

The AP (advanced polymer) segment makes up 9.0% of revenues and produces engineered plastics, dyes, and composites using inputs mostly internally sourced. The segment focuses on molded end-uses, with a large portion of the customer base being automotive or industrial molding firms.

Overall, 2024 saw a slight decline in revenues due to unfavorable pricing, with volumes flat. We expect AP volumes to decline during 2025 with tariff risks and rising new automotive inventories. Operating margins expanded by 590bps due to a change-up in sales strategy focusing on gaining market share through repeat customers and better mix.

Technology

The technology segment is 1.7% of revenues, earned primarily through licensing chemical process patents and selling catalyst supply agreements to licensees. Licensing has consistent high-margin revenues which more than offset the seasonality of catalyst sales. Management stated that it expects a moderate slowdown in new licensing agreements, especially in Europe, due to ongoing market consolidation.

To push toward sustainability, LYB has entered several green projects. The largest of these is MoReTec recycling, with the first facility currently under construction in Germany. The project is designed to break down previously unrecyclable plastic waste into feedstocks for Olefin production. First production is expected in 2026 and expected to generate around $30 million in annual EBITDA. If the project is successful, LYB has stated it could add MoReTec facilities to its existing operations, including Texas O&P facilities. While we are skeptical of the economics in the short-term, LYB estimates that there is a large supply gap for recycled feedstocks of around 4 million tons by the end of the decade as firms seek to hit green-targets. By that point, LYB has estimated that recycled or renewable-sourced polymers could add $1 billion in annual EBITDA to the O&P segment.

Divestitures and Strategic Review

LYB has begun the process of shuttering its only fuel refinery. The Texas facility is one of the largest refineries in the US, with just short of 300 kbbl/d in capacity, and it is one of the oldest continuously operating refineries in the world, first opened in 1918.

While refining made up 21.2% of 2024 revenues, the downcycle in refining and low oil prices in the second half of 2024 pushed operating margins into the negatives. The refining industry traditionally has high operating leverage due to high fixed costs, making it sensitive to input prices.

As we touched on briefly in our TTE research, a combination of lower-than-expected oil demand and a record high refinery availability has pushed the industry into an extended downcycle. Management estimated it would cost a little over $1 billion to provide the necessary upgrades to keep the facility operating or bring it into sellable condition. Instead, it elected to close the facility, ending final production in early February 2025 with 400 layoffs expected in mid-April 2025. Closing cash costs are expected to be $345 million, which will be partially offset by $240 million in working capital released.

With European manufacturing weak, LYB has placed 6 assets under strategic review, 5 in the O&P segment and 1 in the I&D segment. The possible outcomes are improving profitability through efficiency initiatives, selling the assets off, or ‘rationalization’ which may include closing certain operations. It expects to announce findings sometime during the quarter ending June 2025

Risk

The largest risk facing LYB is a full global recession or a more localized US recession. While we believe the current market is near its bottom, if demand conditions deteriorate further LYB would be forced to cut the dividend and accelerate closures and divestitures of assets.

As most inputs are sourced internally, the O&P segment’s inputs of naphtha and natural gas determine margins across the entire business. Henry Hub spot prices for natural gas have hit their highest level since 2022, though RBN energy estimates the elevated costs are due to after-effects of winter storm Enzo. On a global scale, Chinese manufacturers have begun to compete for ethane and non-naphtha inputs to increase their margins amid low domestic demand. If Chinese demand does not recover later in 2025, it would not only put downward pressure on demand for LYB’s products but also upward pressure on its inputs.

Financials

For the full year 2024, LYB spent $1.8 billion on PPE (property, plant, equipment) capex. Given the requirements for the refinery closure, management’s projected 2025 figure of $1.9 billion feels appropriate. At this time, LYB will retain the previously discussed Houston refinery site. Management has floated the idea of turning it into a recycling facility or a hydrogen facility. Both potential markets are not yet economically viable and would require substantial expenditure to begin operating.

LYB has a net debt/EBITDA ratio of 2.1x which is slightly below the peer median of 2.4x. At this time, we do not expect LYB to engage in M&A or aggressive expansions that would increase the debt load. Of the $1.9 billion of planned 2025 capex, 36.8% is allocated toward growth projects with the remainder being sustaining or maintenance.

A concern among shareholders has been the dividend safety of LYB, given the down market coupled with the high fixed costs required in chemicals. Currently, LYB yields 6.9%, $5.36 annually, which is a cash payout ratio of 106.3%. LYB has 14 consecutive years of dividend increases, a cut or hold would damage institutional sentiment, which is already on shaky ground given concerns over weakness in the global economy and the high capex spend on the horizon for green projects. Management has explicitly stated its intent to continue increasing in 2025, though we could foresee LYB holding the dividend steady if a demand recovery does not materialize. Unless a global or US recession emerges, LYB’s dividend appears safe in the short term. Management expects a slight recovery in 2025 which should reduce the payout ratio. In a non-recession worst case, the dividend is backed by a $3.4 billion cash position, compared to $1.9 billion in shareholder returns during 2024, which included $200 million in share repurchases.

Conclusion

Overall, we believe that LYB’s strong North American operations will be able to offset the continued slump in the European market. Equally, Chinese industrial demand is expected to begin a recovery in the second half of 2025.

Maintaining its 14-year streak of dividend increases will require good execution by management in the short term, which we are confident they will be able to do. Short of a global recession, we expect the worst case to be a hold at the present payout. Over the medium-term, LYB has a leadership position in several key industrial chemicals which should provide it with good long-term prospects.

Peer Comparisons