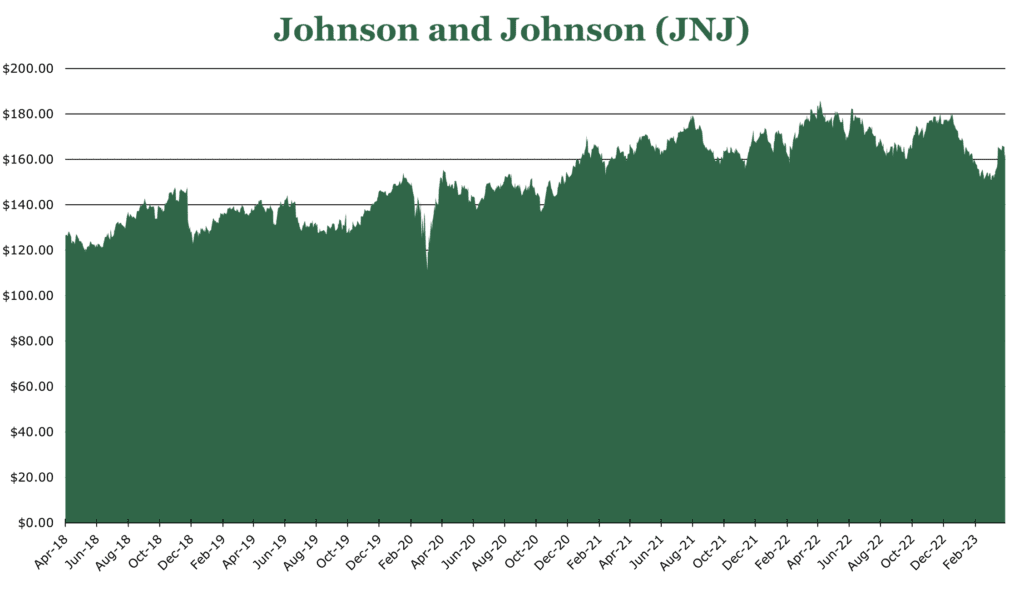

JNJ’s Reliable Dividend of 2.9% with Steady Growth

| Price $163.50 | Dividend Holding | April 24, 2023 |

- 2.9% yield with 60 consecutive years of dividend increases.

- Spending 15% of revenue on R&D, over 50 drugs in the 5-year approval pipeline. Strong blockbuster portfolio, with 3 novel therapies expected to be approved in FY23.

- Spin-off of consumer segment, repositioning primary JNJ business unit to be more pharmaceutical and medical device oriented.

- Potential settlement on the horizon for Talc lawsuit, the independent legal unit reportedly has the 75% of claimants required for bankruptcy to move forward.

Investment Thesis

Johnson and Johnson (JNJ) are a global leader in pharmaceuticals and consumer products. Despite logistical and legal headwinds in 1Q23, all segments reported strong growth. JNJ intends to spin off the consumer products segment. This will allow JNJ to focus its R&D on novel treatments and expand the medical devices segment. While the exact strategy has not been laid out by management, the spin-off of the consumer segment and the $16.6 billion acquisition of Abiomed marks an inflection point for JNJ.

1Q23 saw a worldwide operational increase in sales of 9%, with optimistic revisions to guidance. JNJ has had 60 consecutive years of dividend increases and spends $15 billion annually on R&D, making it the second-largest private R&D spender globally. Despite legal headwinds, JNJ is a strong long-term play for the dividend-minded investor.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $11.35 X 17.0 = $193.

Our 17 PE is a modest discount to the current market. However, we view this as conservative, given the quality and consistency of JNJ.

| E2023 | E2024 | E2025 | |

|---|---|---|---|

| Price-to-Sales | 4.3 | 4.2 | 4.1 |

| Price-to-Earnings | 15.3 | 14.8 | 14.2 |

Operations

JNJ operates in three primary segments. Consumer-facing health, pharmaceutical, and medical devices.

Consumer health was the strongest segment in terms of growth. Year over year, it grew 11.3% primarily driven by a large increase in OTC medications and Skincare sales. The US and Europe saw a much stronger Flu season than previous years, likely due to COVID-related restrictions being removed. Skincare had several new product launches in the Neutrogena and Aveeno brands, which was boosted by the much stronger e-commerce presence JNJ had in 1Q23. Most products in the consumer health portfolio, including beauty products, are considered recession resistant. As a result, consumers tend to spend the same amount of money or more on indulgence products during recessions.

Pharmaceuticals grew 7.2% year over year in 1Q23. This was primarily driven by infectious diseases product lines, growing 26.4% year over year. Excluding the COVID-19 Vaccine, the DARZALEX and ERLEDA product line leads the pack growing 25.7% and 40.3%, respectively.

Medtech grew 11% year over year, driven primarily by the acquisition of Abiomed, which contributed 460bps. The interventional surgical solutions segment saw 41.9% growth, with Abiomed’s surgically installed implants designed to assist the heart in pumping blood. Heart disease is the leading cause of death in the United States, and heart failure represents a $35 billion per year market opportunity in the United States. In FY24 Abiomed will be EPS accretive, adding an estimated 0.05 per share, increasing thereafter. The medtech area has seen strength now that COVID-19-related hospitalizations are down and the long backlog of procedures can be tackled.

Pipeline and Notable Approvals

In 1Q23 there was a key regulatory approval in the prostate-cancer drug Akeega, being approved in the European Union. In the United States, JNJ submitted its formulation for NIRA APP (Niraparib plus Abiraterone) under the name Magnitude. JNJ holds global rights for this specific formulation, except Japan, from a collaborative project with Tesaro which was acquired by GlaxoSmithKline in 2019. Currently, GlaxoSmithKline markets the base Niraparib formulation under the brand name Zejula.

JNJ has one of the strongest pipelines in the pharmaceutical sphere, with 102 drugs in various stages of trial. Of these, 45 are in stage III testing. JNJ spends the second most on R&D compared to the sector and expects 50 novel approvals through FY25. JNJ spends approximately 15% of sales on R&D yearly — $14.6 billion in FY22.

| Drug Name | Purpose | Location |

|---|---|---|

| Niraparib plus Abiraterone | Novel treatment for treatment-resistant prostate cancer | EU Pending, US Approved |

| Talquetamab | Novel therapy for relapsed multiple myeloma | EU Pending, US Approved |

| ERLEADA | Prostate cancer | EU Pending, US Approved |

| Aprocitentan | Novel treatment for treatment-resistant hypertension | EU Approved, US pending |

| ENDURANT | Pediatric HIV | EU/US Pending |

| BALVERSA | Urothelial cancer | EU/US Pending |

| OPSUMIT | Pediatric arterial hypertension | EU Pending |

| Macitenan with Tadalafil | Pulmonary arterial hypertension | EU/US Pending |

Risk

The primary risk facing JNJ is ongoing legal proceedings relating to the talcum powder products JNJ has sold. JNJ’s talcum powder was contaminated with asbestos and pulled from shelves in FY20. This has the potential to impact the financial operations of JNJ significantly. JNJ reported a net loss of $0.03 per share in 1Q23 related to the $7 billion set aside to pay out claims. On April 20th, a judge did grant a stay for 60 days on the processing of further lawsuits. JNJ has raised its intended settlement amount to $9 billion. This would impact the company with a further $2 billion loss in whatever quarter it is realized. JNJ attempted to mitigate the legal impact on the main business unit by moving related claims to the specially formed LTL business unit and filing for bankruptcy. This maneuver requires 75% approval of existing claimants, or around 60,000 people, but may not hold water in court. JNJ maintains that the claims are baseless but does say that the protraction of the case has led to uncertainty in results.

JNJ will lose exclusivity on STELARA, a drug designed to treat Crohn’s disease with $9.7 billion in sales in FY22. This is by far the largest portion of revenue in the immunology segment. In addition, biosimilars are an increasing part of the pharmaceutical market, and litigation frequency has increased.

| Drug | FY22 Sales ($ Billions) | Patent Expiry |

|---|---|---|

| Immunology | ||

| REMICADE | 2.34 | Expired |

| SIMPONI | 2.18 | 2024 |

| STELARA | 9.72 | 2023 |

| TREMFYA | 2.67 | 2026 |

| Infectious Disease | ||

| COIVD-19 Vaccine | 5.45 | N/A |

| EDURANT | 1.01 | 2025 |

| PREZISTA | 1.94 | 2026 |

| Neuroscience | ||

| INVEGA SUSTENNA | 4.14 | 2031, Under Litigation |

| RISPERDAL | 0.49 | Expired |

| Oncology | ||

| DARZALEX | 7.98 | 2035 |

| ERLEADA | 1.88 | 2033 |

| IMBRUVICA | 3.78 | 2036 |

| ZYTIGA | 1.77 | 2027 |

| Pulmonary Hypertension | ||

| OPSUMIT | 1.78 | 2029 |

| UPTRAVI | 1.32 | Expired |

| Other | ||

| XARELTO | 2.47 | 2024 |

The FDA approval process begins once a biologics license (BLA) or new drug (NDA) is filed. The FDA has massive power in deciding if – and when – a drug will become available for sale. There are 5 program designations. Fast track, breakthrough, accelerated approval, priority review, and standard (drugs can hold more than one designation). The most important difference is between priority review and standards review, as the difference between priority and standard is 4 months. The other designations can allow firms to continuously update documents during the submission process rather than having to re-file or provide certain exemptions to documentation.

Outlook

Planned for FY23 is the spin-off of the consumer product arm into a new company called Kenvue. Kenvue will take control of every product in consumer health, including Listerine, Band-aid, Tylenol, and Neutrogena. The products that will make up Kenvue’s portfolio generated $15 billion in revenue for FY22 across 100 countries of operation. Kenvue’s spin-off will include an IPO.

1Q23 saw an overall increase in sales of 9%, with operating margin expanding 60bps in 1Q23. Management is more optimistic after 1Q23 than in 4Q22, revising guidance upward after revenues reached $1.2 billion above the consensus. For 2023, JNJ now expects 6% higher sales, or approximately $97 billion. JNJ Yields 2.93% and pays out $4.76 per share per year in dividends. JNJ has had 60 years of dividend growth, increasing the dividend by 6.6% year over year.

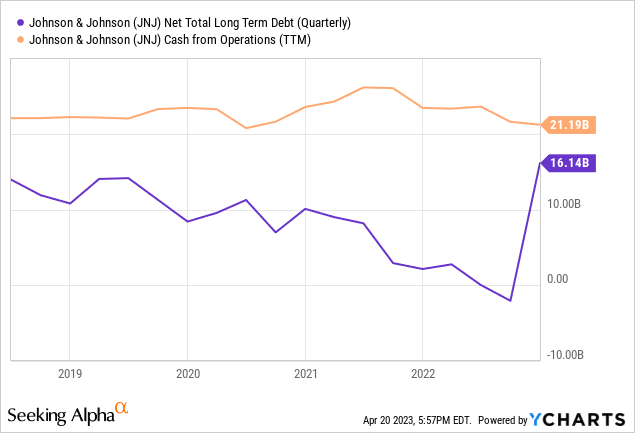

JNJ is undoubtedly a financially robust company, with only $16.1 billion in debt, compared to its massive $187 billion balance sheet and patent base. Additionally, it has a strong operating cash flow, generating $21.2 billion in the trailing twelve months.

Talc lawsuit concerns aside, 1Q23 was an excellent quarter for JNJ. It announced a dividend increase, a guidance raise, and earnings coming in stronger than expected. In the short term, the Talc lawsuit will continue to be a problematic element. Still, for a long-term focused investor, the JNJ price slump is an excellent opportunity in our opinion.

Competitive Comparisons

| Johnson and Johnson (JNJ) | Novo Nordisk (NVO) | Eli Lilly (LLY) | Merck & Co. (MRK) | Pfizer (PFE) | |

|---|---|---|---|---|---|

| Price-to-Earnings (FWD) | 15.26 | 30.99 | 43.97 | 16.48 | 11.81 |

| Price-to-Sales (TTM) | 4.41 | 14.67 | 11.7 | 4.87 | 2.25 |

| Price-to-Cash Flow (TTM) | 20.04 | 32.66 | 47.16 | 15.17 | 7.76 |

| EV-to-EBITDA (FWD) | 12.42 | 24.81 | 34.38 | 13.02 | 9.54 |

| Dividend Yield | 2.93% | 1.43% | 1.22% | 2.56% | 4.08% |