High Dividend Yield Remains Anchored by Grocery Stability

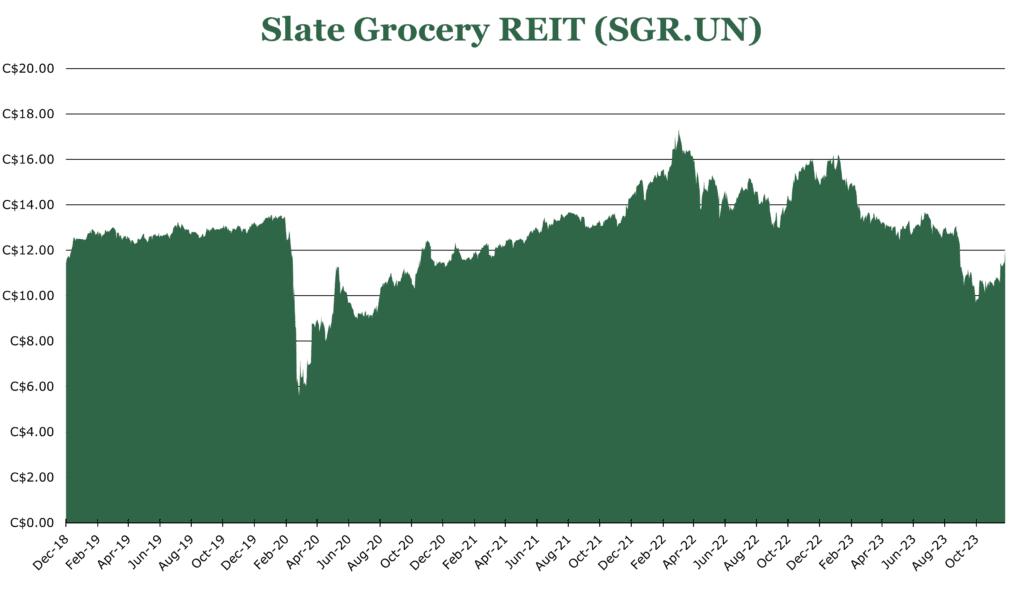

| Price CA$11.95 | Dividend Holding | December 28, 2023 |

- 9.7% distribution yield, 125% coverage from funds from operations.

- Grocery Anchors drive traffic, as 94% of grocery demand is met through physical storefronts.

- Strong occupancy rates, with a 94.1% overall rate and 99.3% in grocery space.

- 100% renewal rate on grocery-anchor spaces, 90% on connected retail locations in the last quarter.

- Average new rent is 16.4% higher than the expiring rent in the quarter.

Investment Thesis

Slate Grocery (SGR.UN:CAD and USD ADR SRRTF) is a REIT specializing in retail space anchored by grocery stores. Slate owns 117 properties across 24 states, averaging $12.37/sqft in rent across 15.3 million sqft.

Grocery-anchored retail is uniquely positioned to weather economic hardships. The necessity of grocery shopping ensures steady consumer traffic and consistent spillover into other retail outlets nearby. Slate’s stable property portfolio, geographic diversity, and superior 9.7% distribution make it a good purchase for the defensive income investor.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY24 FFO (Funds From Operations) times P/FFO (Price/FFO)

EFV = E25 FFO X P/FFO = $1.54 X 10.5 = $16.20

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 2.2 | 2.2 | 2.2 |

| Price-to-FFO | 5.8 | 5.6 | 5.3 |

Market Conditions

Grocery-anchored retail outperforms the sector during times of economic hardship. Even during times of economic hardship, consumers require food. Despite the uptick in delivery and other distribution channels, 94% of grocery demand is fulfilled by physical storefronts. Retail near grocery anchors induces significant spillover, with an estimated 49% increase in traffic to retailers within 0.1 miles of a grocery store.

Retail has been affected by the same headwinds as residential real estate, with limited new construction resulting in strong demand and high prices. Given the long leases on the grocery anchors, SGR has high occupancy rates, renewal rates, and stability in AFFO (adjusted funds from operations) across economic conditions and geographies.

Portfolio Overview

The portfolio is all grocery-anchored retail and is 47% grocery leasable area. Of total leasable space, 69% is considered essential tenancy – providing goods and services that are income inelastic, meaning consumers will always demand them regardless of economic conditions. Currently, Slate has 94.1% occupancy and 99.3% grocery occupancy.

Occupancy rates have increased 90bps year over year, reaching the highest level since before the pandemic.

| Type | % of total Leasable space | Weighted average lease term (years) |

| Grocery (Anchor) | 43.8% | 5.2 |

| Retail (non-anchor) | 48.3% | 4.2 |

| Vacant | 5.9% | – |

Portfolio expansion is concentrated in the fast-growing sunbelt, making up 45% of the portfolio. Since 2021, Slate has acquired about $900 million in property. These acquisitions have a financial profile averaging $12.54/sqft in rent and 42.8% grocery space, which aligns with the existing portfolio.

Across the whole portfolio, 43.2% of leases expire in 2028 or later, which provides significant stability to operations while also allowing for some short-term increases in rent. Currently, 25% of leasable space is up for renewal in the next 3 years. This has increased the rental spread, with existing rent averaging $12.37/sqft, new leases averaging $18.76/sqft, and $12.95/sqft for renewals.

| Type | Sqft | Average Base Rent | Spread (difference between old rent, and new rent) |

| Renewal | <10,000 | $23.18 | 10.1% |

| Renewal | >10,000 | $9.63 | 8.3% |

| New Lease | <10,000 | $21.40 | 24.3% |

| New Lease | >10,000 | $13.00 | 1.0% |

Additionally, 98% of Slate’s tenants are on net leases, requiring them to pay at least part of the property’s maintenance and taxes, which significantly reduces Slate’s operating costs.

Risk

Slate has a favorable risk profile regarding tenants, with no tenant making up more than 7% of total rent. The top 15 tenants account for 45.5% of leasable space and 35.2% base rent. Given that all of the top 15 tenants are anchor grocers, it is unlikely that any single tenant will leave Slate’s locations and cause vacancies for a significant time.

The Kroger-Albertsons merger may force some former Kroger locations to become vacant. If the merger is approved, Kroger-Albertsons states they will sell off approximately 400 retail locations during the merger. Slate does not currently believe this will meaningfully affect operations, given they would be sold to other grocery retailers.

Total debt is 96.1% fixed-rate debt at 4.2% interest rate. The debt coverage ratio (interest to EBITDA) is only 2.9x. This low ratio is suboptimal for an environment with higher interest rates as debt rolls over. However, Slate has significant net income increases on the horizon as higher renewal rents improve revenues.

Outlook

Slate trades at 8.4x adjusted funds from operations, significantly lower than the sector average. Slate currently has a capitalization rate of 8.5% at the end of the quarter ending September. Compared to peers, 8.5% capitalization is very favorable, with the average US REIT sitting at around 7.3%

It has a 9.7% yield for the September quarter, distributing 80% of FFO (funds from operations) quarterly, putting it firmly at the top of its peers.

The same property’s net income has increased 2% over the previous 12 months, with the weighted average new rent being 16.4% higher than the expiring rent in the quarter ending September. We believe that same-property net income will increase faster than 2% over the next 3 years, given the expiring leases and significant leasing spread experienced thus far in 2023. Slate has a favorable 100% renewal/retention rate on its anchor tenants, giving a weighted average renewal rate of 94.1%.

| Quarter ending September | Number of Tenants | Weighted Average Rent ($/sqft) | Change |

| Renewals | 68 | $12.95 | 9.1% |

| New Leases | 31 | $18.76 | – |

| Total / Weighted Average | 99 | $13.82 | 16.4% |

In conclusion, Slate offers significant recession resistance and has secular tailwinds with limited new development, especially in non-growth markets. Slate offers a compelling investment proposition, especially for defensive income investors. Its focus on essential, grocery-anchored retail provides a buffer against economic downturns. The REIT’s strong occupancy rates, diversified portfolio, and favorable financials position it well for sustained net income growth and stability within the existing portfolio, making it an attractive choice in the real estate sector. Moreover, the combination of higher yield and lower valuation than its peers makes the current price compelling.

Competitive Comparisons