Google’s Search Monopoly Remains Unshakeable Despite AI Hype

| Price $178.79 | Growth Holding | June 16, 2025 |

- Increased capital expenditure to $75 billion in 2025 in order to expand Google Cloud’s infrastructure, positioning the company for continued AI and cloud growth.

- Alphabet’s proprietary Tensor Processing Units (TPU) infrastructure provides significant cost advantages over competitors who rely on expensive Nvidia chips.

- AI tools are proving complementary rather than competitive to search, with hyper-specific AI queries creating new monetization opportunities through better ad targeting.

- Antitrust remedies like Chrome divestiture are technically impractical and would be punitive rather than beneficial to consumers, making them unlikely to succeed.

- The company maintains a fortress balance sheet with $95.7 billion in cash and $72.8 billion in annual free cash flow generation.

Investment Thesis

Alphabet Inc (GOOG) is an American technology firm, most famous for Google Search. In total, Alphabet Inc encompasses more than 250 companies ranging from YouTube, Waymo, Fitbit, and AWS competitor Google Cloud.

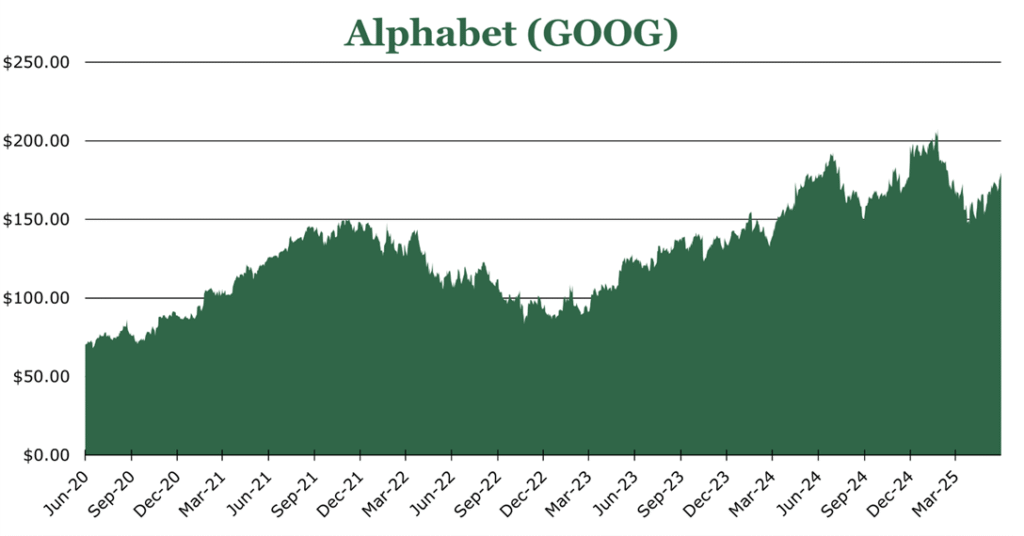

Despite being a member of the Magnificent 7, Google has only seen its stock price rise by 1.91% over the trailing twelve months and fall 5.57% YTD. Largely, the reasons behind this are investors pricing new AI competitors and subsequent loss of ad revenue.

We believe that search is far stickier than the market prices in. Even in the event where competition increases meaningfully, Alphabet’s own AI products are competitive in performance and especially on cost given the emphasis on internally developed TPUs , sidestepping Nvidia in its supply chain. Overall, we believe that Alphabet is presently undervalued.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY26 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E26 EPS X P/E = $10.14 X 26.0x = $264.00.

We believe that Alphabet deserves a P/E closer to it’s mag 7 peers, currently averaging 26.8x. While heavy capex spending in the short term may weigh on earnings growth, over the long term the added capacity will improve earnings power through scale benefits.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 5.6 | 5.1 | 4.6 |

| Price-to-Earnings | 18.8 | 17.7 | 15.6 |

SeekingAlpha Analyst Consensus

Search Is Sticky

As of the end of 2024, Google has an estimated market share of 90%, and generated $198 billion from search advertising, or 56.6% of revenue. Without a major incentive, most users simply never explore other options or are predisposed to believe alternatives are worse.

In a recent Wharton study, with a $10 incentive to switch to Bing, only 33% of participants remained as Bing users at the conclusion of the study. The interview post-survey indicated that of those who stayed, 65% did so simply on habit rather than a specific preference for Bing.

While being the de-facto “default” across the ecosystem of browsers does provide some level of stickiness, the reason we believe Google Search will maintain its primary position is data, and decades of it. Google Search uses information from Maps, News, YouTube, decades of web-crawled information, and even browser telemetry to deliver the most relevant result to users. This creates what we believe are meaningful switching costs. Users with years of preference data built up on Google Search will be met with a worse experience on a new search engine.

Google Still has Scale

Google Search processes somewhere between 14 and 16 billion searches daily, and likely has a monthly active user count close to 4 billion. According to an independent analysis by SparkToro, the median American makes 53 unique Google searches per month.

Estimates put ChatGPT at somewhere around 1 billion messages per day, with 600 million monthly active users. Meta’s AI also had an estimated 500 million monthly active users according to Mark Zuckerberg. Gemini, Google’s AI tool, is trailing peers at 350 million monthly active users as of May 2025 but this is up exponentially from just 9 million in October 2024 thanks to the integration into search and gmail.

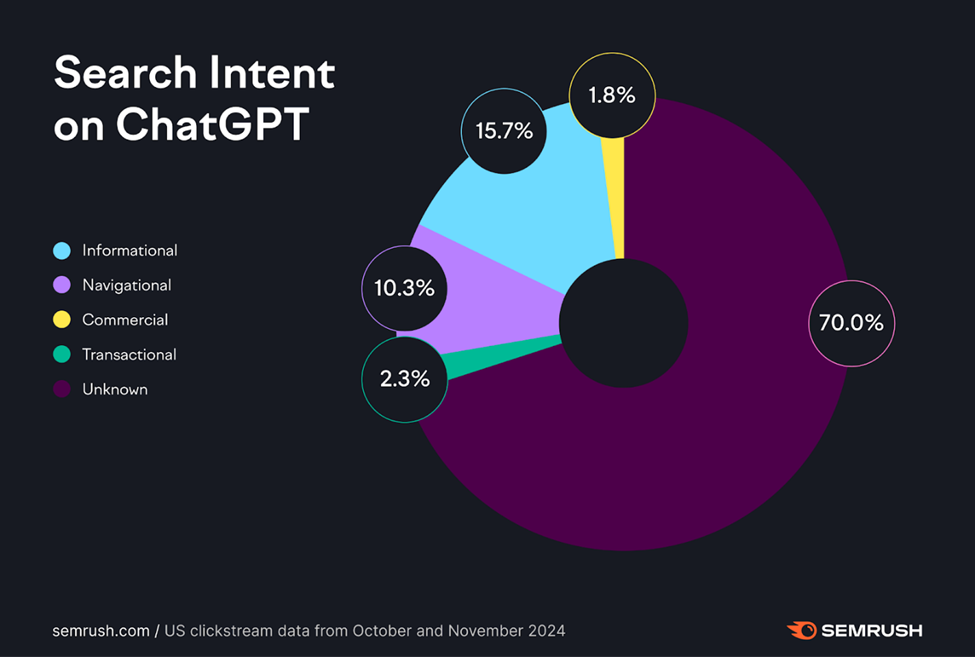

According to Semrush, 70% of ChatGPT traffic is not intended to be search queries, and just 14.4% of traffic could theoretically displace the highly monetizable Google Search categories (navigational, commercial, transactional). Another survey says despite 71.5% of individuals reporting using an AI tool in any given month, only 14% use daily and most people use AI as a tool for complex querying or creative brainstorming rather than displacing search activity.

Architectural limitations of large language models mean live information such as stock prices, latest news, location-based searches, or weather are bolted-on features typically using an API, like Google’s own. Google’s search results now include an AI summary, which we believe will contribute to retaining users who are looking for the ‘straight answer’ in the style typically given by AI agents.

The Alphabet CEO stated that the use cases of Google Search have expanded because of AI, and that these products are complementary rather than competitors. As pointed out by a Google Search executive, hyper specific querying typically done to AI agents grants ample opportunity for creating more stickiness and better monetization.

While AI agents demonstrate an eye-watering pace of expansion, the underlying infrastructure is still highly dependent on typical search. While we do foresee a scenario in which AI agents begin to erode Google Search’s direct market share, at that point we believe that there will be ample monetization alternatives to capture more ad-spend through hyper-specific targeting that would far outpace the current keyword and demographic based approaches.

AI

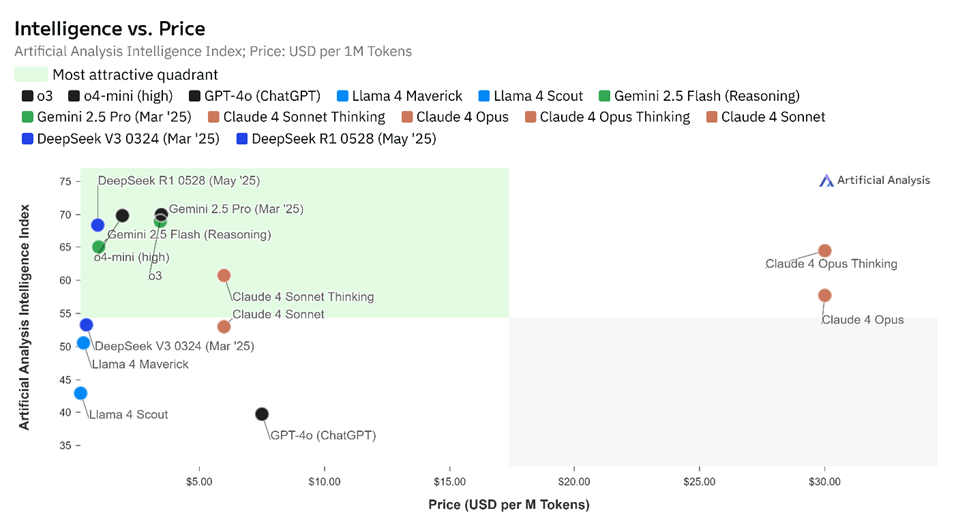

Alphabet’s own position within the AI space is one that appears to be overlooked. Alphabet’s latest Gemini model is highly competitive for both intelligence and cost of use based on aggregate scores across multiple benchmarks.

What makes Alphabet’s position particularly attractive is it deploys internally developed TPUs. Tensor Processing Units are chips specifically designed for machine learning tasks, while Nvidia’s flagship H100 and A100 AI chips are derivatives of GPUs (Graphics Processing Units) originally designed for rendering video. Over nearly a decade of R&D, Alphabet has effectively built its own proprietary ecosystem. Computing costs for major AI models is estimated at more than 50% of expenses, and all rely heavily on Nvidia A100 and H100 series chips. This creates a natural bottleneck that will eventually become a major problem if AI workloads go parabolic or as models require more data to train.

The latest internally developed Ironwood TPU is designed to boost the performance of Gemini and other Alphabet-developed AI tasks that require strong inference. As reported by Alphabet, performance data indicates it is far more efficient and powerful than anything fielded by a competitor or supplied by Nvidia. While the specific cost per unit to Alphabet is not provided, it does avoid the “Nvidia Tax” and potential supply disruptions connected to shortages of Nvidia chips.

We believe that Alphabet over the long term will be able to establish a serious cost advantage over competitors which could translate to more intelligent models as Alphabet can deploy more computing power for less cost. On an enterprise scale, it also allows for retention through favorable pricing terms as corporations begin to integrate AI into their products and workflows.

Anti-Trust Risk

There are several antitrust proceedings against Alphabet. We believe that historical precedent is on Alphabet’s side, with the judicial branch generally not forcing divestitures if they would be considered punitive. Punitive in an antitrust context means it would primarily benefit competitors rather than customers, impose disproportionate costs relative to harm, or destroy value without consumer benefit.

The most recent of these is the US Department of Justice challenging Alphabet’s annual $26.3 billion in payments to browsers to make Google the default search engine. The largest of these agreements is Safari, with Alphabet paying Apple 36% of all its ad revenue generated on Apple devices, around $20 billion annually.

While the judge ruled that these agreements are anticompetitive, the actual remedy is likely to be more harmful to those Alphabet pays, than the other way around. Apple makes over $20 billion annually in pure profit from this agreement, previously expressing if it chose to develop its own search engine it would cost them $12 billion in revenue over the first 5 years once the exclusivity ended. Internal Alphabet estimates from 2020 estimate that it would likely cost Apple $20 billion to build the technical infrastructure, and a further $6-8 billion in annual maintenance costs.

While the DOJ has requested a review of the divestiture of Chrome as a potential solution, we believe that this is highly unlikely. Chrome is deeply connected to the Google account architecture, and a decoupling would be highly technically difficult. Google also maintains the open-source architecture system Chromium which Chrome, Edge, Opera, and Brave utilize. Another barrier we think is far more insurmountable is who would acquire Chrome? Microsoft, whose Edge browser runs on Chromium, would instantly face the same antitrust issue. Foreign ownership would raise national security questions, and we do not believe that any private entity (or Chrome as a standalone business) would have the technical or financial resources required to maintain the product without degradation of user experience.

In our view, the most likely scenario is that when a user installs a new browser, a screen prompts the user to choose their default search engine. This is the agreed upon solution with the Android antitrust case in Europe regarding Chrome. Despite this legally required screen listing competitors, Google has continued to retain its market share.

Another case is the proposed breakup of Alphabet’s AdX business. We believe that this runs into the same problems as the proposed separation of Chrome. In ad tech, we believe the most likely solution is that Google will be required to be more transparent about the way it prices advertising, and the elimination of minimum pricing. The AdX business maintains components of advertising technology independent of its own products in a similar way to Chromium. A forced divestiture would be similarly be technically burdensome, and would benefit competitors in the space like Amazon, which we believe will be interpreted as punitive.

Financials

For trailing twelve months ended March 2025, Alphabet grew its revenues by 13.1% and had an operating margin of 32.6%, a 169bps increase compared to 2023. The largest increase in margin came from the Google Cloud business, mostly due to scale from 30.4% revenue growth.

| Revenue Growth (TTM) | Operating Margin | Margin Change | |

| Google Search | 12.1% | ||

| YouTube | 12.4% | ||

| Ad Tech | -3.3% | not individually disclosed | |

| Subscriptions and Devices | 16.6% | ||

| Google Services | 11.0% | 40.4% | +412bps |

| Google Cloud | 30.4% | 16.1% | +921bps |

| Other Bets | -7.6% | Neg | |

| Aggregate | 13.1% | 32.62% | +169bps |

Google has a fortress balance sheet, with $95.7 billion in cash against just $10.9 billion in debt. During 2024 Alphabet generated $72.8 billion in free cash flow, paying out a dividend of 0.47%. During 2024 Alphabet repurchased $62.0 billion if its own shares, or 1.2% of class A voting shares (GOOGL) and 5.4% of class C non-voting shares (GOOG). There is currently $44.7 billion remaining on its repurchase authorization combined, and we expect the repurchase authorization to be refilled to allow for a continuation of the $62.0 billion in annual repurchases conducted in 2023 and 2024. Capital expenditure guidance for 2025 has increased by 42.8% to $75 billion. Primarily, this will be a continued expansion of Google Cloud’s physical footprint. This high level of capex will likely put some pressure on accounting margins as physical buildout will increase depreciation costs. Overall Alphabet expects most new capacity to come online toward the end of the year, which will likely boost growth rates in the second half of 2025.

Conclusion

On the antitrust side, Alphabet still has a lengthy appeals process before any action is taken, and we believe that the more radical actions like being forced to divest Chrome are unlikely. In the AI space, we believe that the competitive threat is far overstated and is unlikely to meaningfully impact the top line in the short term. Over the long-term, we believe that even in the event in which Google Search’s market share begins to erode due to AI, its own AI products will be highly competitive, and AI will enable better monetization through more specific targeting.

Peer Comparisons